by Gayl Mileszko

There is only a week to go until the Inauguration of our 46th President. The weather forecast for January 20 is for a partly cloudy day with temperatures in the mid-40s. But other conditions are not so favorable for this time of year and for these traditional American quadrennial ceremonies in which we all ask for God to bless America. The pandemic has already nixed most of the festivities that have accompanied the swearing-in since 1805, including celebratory inaugural balls and parades. But now in the wake of the storming of the U.S. Capitol on January 6, law enforcement is on the highest possible alert. The FBI is warning about armed protests at all 50 state capitals in the days leading up to the recitation of the oath of office by the Chief Justice. Fifteen thousand National Guard troops are being deployed to the historic grounds that lay between Independence and Constitution Avenues, the People’s House.

Two hundred thirty miles away on Wall Street, markets have barely flinched over these events. Many months ago, markets baked in assumptions of a peaceful transition of power. Investors and traders, as good at counting votes as any party whip, were unfazed when the House of Representatives approved articles of impeachment against the 45th President on December 18, 2019. They are again unfazed by this Wednesday’s vote in the south end of the Capitol. Dozens of major U.S. companies have responded with pronouncements that they are suspending political donations to some or all Members in the upper and lower chambers. Insiders understand that these bans are largely toothless as no one is fundraising at this part in the cycle with more than 660 days to go to the next election. Time and time again, we find that a lot not only can but does change in two years.

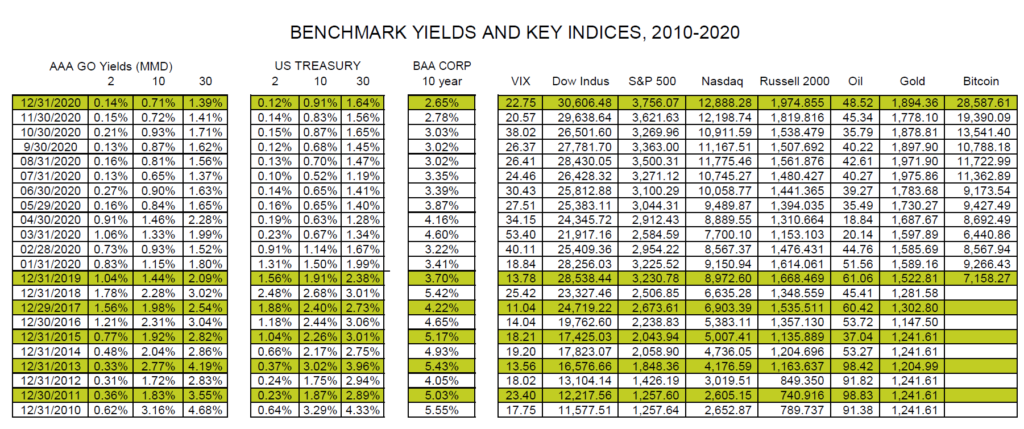

Since the start of the year, not a lot has changed in the financial markets. Prices on most assets are still extremely elevated, and rallies continue across most sectors on the expectation that additional fiscal stimulus will speed up our economic recovery. Although bonds have slightly weakened since the Georgia elections turned Washington “light blue”, as pundits label the razor thin Democrat majority in D.C., yields remain in historically low ranges. With expectations for even heavier federal spending. additional borrowing, and higher taxes, intermediate and long U.S. Treasury yields have jumped by about 24 basis points. This moved the 10-year past a 1% touchstone, but bear in mind that this yield exceeded 3.80% ten years ago. The 10-year yield is at 1.14% and the 30-year at 1.88%. The 2-year is relatively unchanged at 0.14% so far in 2021. It goes without saying that all these yields are producing negative real returns for investors.

The prices of all bonds are linked in some manner to Treasuries. So as government prices have dipped, BAA Corporate 10-year benchmark yields have risen by about 17 basis points to 2.82%. These rates nevertheless remain at historic lows, so corporate borrowers are still lining up for market entry. And both investment grade and high yield corporate bond issues cannot come fast enough to satisfy domestic and foreign demand. High yield sales total $13.2 billion so far this month with orders exceeding offers by more than three times, while investment grade issuance is already at $55.6 billion with recent trades more than 2.4 times covered. Corporates have clearly been buoyed by stock prices. At this writing, the Dow, S&P 500, and Nasdaq indices are each up about 1.2% this year while the Russell 200 is up nearly 6%. Oil is up more than 7%, but gold prices have fallen more than 2% and silver prices are off by nearly 5%. Among digital currencies, Bitcoin has been extremely volatile but is up nearly 15% in 2021.

Municipal bond yields have also inched higher since the start of the year, but Bloomberg is reporting that valuations are currently at record highs. The ratio of top-rated tax-exempt yields to U.S. Treasuries at 67% is the lowest since 2001, a huge drop from where it stood ten months ago at 215%. The 2-year AAA rated general obligation bond MMD benchmark at 0.15% is largely unchanged from last month. The 10-year and 30-year benchmarks have added 7 basis points and stand at 0.78% and 1.46%, respectively. Imagine that: top rated borrowers are still getting rates of under 1.50% for maturities in 2050! These are fantasy conditions still prevailing for most non-profit borrowers. For lower-rated and non-rated sectors, there are few deals so far this year to help us gauge the market. The Illinois Finance Authority brought a $26.6 million non-rated deal for the McKinley Foundation with a single 35-year maturity priced at par to yield 5.125%. The Wisconsin Public Finance Authority sold $6 million of non-rated bonds for St. Francis College in Brooklyn at par to yield 5.50% in 2024.

Investors cannot source enough tax-exempt product as many state, local and non-profit borrowers are taking advantage of low rates prevailing in the taxable and corporate bond markets to refinance higher coupon bonds. The 115th Congress removed the ability of tax-exempt borrowers to refund most long-term debt at tax-exempt rates, but many in the muni market hope that the 116th Congress will appreciate the urgent pleas from non-profits who are lobbying to restore the authorization and allow them to refinance outstanding debt at these extremely low rates. Record levels of taxable issuance would likely decline if, as some predict, tax reform legislation is enacted later this year or next with a provision restoring the exemption. This would significantly increase the supply of traditional munis for those looking to offset potentially higher individual tax rates.

We at HJ Sims are looking forward to this new year and cheer those states with the safest, most rapid and successful vaccine rollouts for health care workers, long term care residents and those greatest at risk of contracting the coronavirus. Along with our investors, we simultaneously root for those entrepreneurs and manufacturers of cost-effective air and surface cleaning and filtration technologies. While we share the concerns of millions over the civil unrest, the key but often controversial role of social media, the prospect of inflation, the status of mortgage, rent, student loan and other delinquencies, our growing federal and state debts and deficits, and the unprecedented year-long financial stress on most every non-profit and for-profit enterprise, we pause to count our many blessings and pledge to make our voices heard even louder this year.

For more than 85 years, we have worked with colleagues in our industry to improve market access for our borrowers, market intelligence for our investors, and public understanding of the key role that the municipal market has in facilitating essential purpose project financings. We are proud of our role in helping to originate the quintessential social good bonds and encourage our readers to join us in working collaboratively to provide and protect the safest living and learning options for our seniors, our disabled, and our young going forward. Please contact your HJ Sims representative to share your thoughts on how we can collectively enhance our advocacy on behalf of our country’s greatest needs in 2021.