by Gayl Mileszko

Our homes have been our anchors, true ports in the storm of this past year, our refuge from all the uncertainty outside. They have evolved as we have, morphing into classrooms and workstations, gyms and bistros, chapels and clinics. It is said that there is no place like home, the place where our stories begin and unfold. Home is the starting place of love, hope and dreams, the place where we can go just as we are, feel safest and always belong. In these and other ways, our homes are priceless. The physical structures themselves, however, have values that can be pinpointed quite precisely and unemotionally. Let us take a look at some of the latest price tags and trends for housing because these structures, our primary residences, in most cases represent the largest percentage of all assets that we hold.

Despite all that we have been through in this past year, it is astonishing that the U.S. housing market has remained sizzling hot with prices surging at the fastest pace in 15 years. Sales just recently cooled off as new home construction has lagged behind demand and many homeowners have elected to hold onto their houses longer. But buyers in search of better space in which to live, study and work during this pandemic have been in fierce competition for what has become a record-low supply of homes. The residential real estate market has never been tighter. Housing inventory remains at a record low of 1.03 million units, having dropped by 29.5% year-over-year. That amounts to a 1.9-month supply, well below the level said to be needed in a balanced market at six months. Properties are typically selling in 20 days, another record low. As a result, existing home sales fell 6.6% in February and pending home sales also fell after eight consecutive months of year-over-year gains, according to the National Association of Realtors. Entry-level homes in particular remain in short supply. Median existing home prices, meanwhile, rose to $313,000, 15.8% above the comparable 2020 level, with all regions of America posting double-digit gains. First-time buyers have been responsible for about 31% of sales, and a new Zillow survey finds that these buyers are increasingly comfortable buying online.

CoreLogic forecasts that home prices will increase by an average of 3.3% by January 2022, with only a few metro areas including Houston, Las Vegas and Miami seeing declines. The Case-Schiller 20-city index shows that Phoenix has had the fastest home-price growth in the country for the 20th straight month, at 15.8%, followed by Seattle at 14.3%. The average commitment rate for a 30-year conventional fixed rate mortgage is about 2.81%, still well below the 2020 average of 3.11%. Rates, which dropped below 3% in July for the first time ever, are expected to remain below 3.5% this year. As they rise along with prices, however, affordability becomes a key and continuing concern for many. As it is, about one in five renters is behind on rent payments and 2.8 million are in mortgage forbearance. But in the four weeks ended March 21, 39% of homes that went under contract sold for more than their list price, up from 23.9% a year earlier according to Redfin Corp. As a result, 76% of nonhomeowners in the U.S. say they have no plans to purchase a home in the next six months due not only to affordability constraints but fear that the market will turn and leave them owing more on their mortgage than their home will be worth. In the fourth quarter, some 410,000 U.S. residential properties with combined mortgage debt of $280.2 billion were underwater. Real estate data firm Black Knight reports that at least one of every 14 residential mortgages in Connecticut was delinquent or in foreclosure.

Homes with a mortgage account for about 62% of all U.S. properties and the home equity for these properties surged to more than $1.5 trillion last year, an increase of 16.2% from a year earlier. Homeowners aged 62 years and older saw their housing wealth grow by a net of 3%, or $234 billion, in the fourth quarter of 2020, according to new data from the National Reverse Mortgage Lenders Association. The increase brings senior housing wealth to a record $8.05 trillion. During the pandemic, some seniors have turned to reverse mortgages to assist with expenses, including in-home care, while others have refinanced their homes or taken out home equity lines of credit. Total cash-out refi’s surged 42% year over year in 2020 averaging $50,000 per borrower and adding up to $152.7 billion in total according to Freddie Mac. Home equity line of credit volume more than doubled to $74.9 billion in 2020 from a year earlier. Many seniors are looking in shock at area home sale prices and wondering if this is the ideal time to sell the family home and move to something smaller or perhaps better located. Prices could certainly rise further — but how much more? The market looks ripe for a correction. At some point, who will be able to pay these high prices for existing homes plus all the necessary repairs, remodeling, and refurnishing costs? The average American family in 2020 consisted of only 3.15 people. So how much interest will there be in a four-bedroom home? Maybe it is better to seize the moment and sell rather than wait until there may be no real choice. We are not getting any younger, after all. The 65-and-older population has grown by 34.2% or 13.7 million during the past decade. And more and more of us are living alone. That includes 27% of adults ages 60 and older. Do we want to be home alone for the next decade (or more) cooking and cleaning for ourselves and waiting for visitors and the occasional offer of help?

For some who have struggled in isolation during this pandemic, the thought of a safe, caring, well-managed senior living community has become very appealing. Thousands of folks in their 60’s, 70’s and 80’s are researching options on line and taking virtual tours of neighborhoods with similarly aged and active people, organized social activities, high quality dining, cleaning services, concierges, and higher levels of service when needed. Life plan communities present countless options and configurations for garden homes, cottages, and high-rise apartments, assisted living, memory care, rehabilitation and nursing facilities. At Bailey Station in Collierville, Tennessee they offer seniors a “Return on Life”. At Ingleside at Rock Creek in Washington, D.C, they attract residents with “Truly Engaged Living”. At Broadview at Purchase College in New York, they promote “Think Wide Open Lifelong Learning”. At Sinai Residences in Boca Raton, they say “No One Does Livable Luxury Like This.” At The Homestead at Anoka in Minnesota, they assure “It’s your life. We’re Here to Help You Live It.”

Throughout the COVID-19 crisis, life plan communities have evolved with new safety procedures, technology, and services. Many have continued with expansion and renovation plans, uninterrupted or only slightly delayed for labor or material-related reasons. Several have come to the bond markets for financing projects on a tax-exempt basis. In the past few weeks, this included Plymouth Place in La Grange Park, Illinois (“The Time and Place For You”) which sold $23.9 million of BB+ rated bonds structured with 5% coupons due in 2056 to yield 3.61%. In the secondary market, bonds issued for Ralston Creek at Arvada in Colorado traded at $89.95 to yield 6.552% (19648FCK8). Arizona’s Great Lakes Senior Living Communities’ 5.125% bonds traded at $85 to yield 6.20%. 04052TBV6 The Shelby County, Tennessee’s Farms at Bailey Station 5.75% bonds due in 2049 traded at $100.332 to yield 5.70%. 82170 KAE7 Roanoke County’s Richfield Living 5.375% bonds due in 2054 traded at par. 76982TAE8.

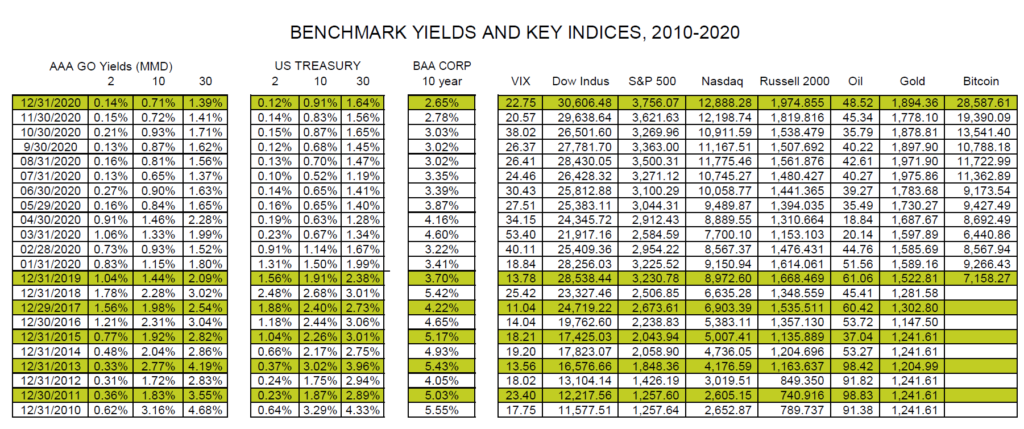

Unlike the corporate bond market which has seen record high yield issuance this past year, the municipal market has not seen much in the way of high yield financings and this is vexing many investment strategies. Demand for yield in this low rate environment has been insatiable. Individuals, funds, insurers, banks, and foreign buyers cannot find enough to meet their investment needs. Prices remain extremely elevated. Among the few higher yielding deals of late, a Georgia issuer brought $439.5 million of BBB-minus rated hotel and convention center bonds to market with a final maturity in 2054 that priced with a 4% coupon to yield 2.95%. The Public Finance Authority sold $135.9 million of Ba2 rated taxable bonds for Noorda College of Osteopathic Medicine due in 2050 priced at 5.625% to yield 5.75%. The Latrobe Industrial Development Authority in Pennsylvania had a $42 million BBB-minus rated transaction featuring 2051 term bonds priced at 4.00% to yield 3.30%. The California CSCDA Community Improvement Authority brought a $112.9 million non-rated social bond issue for Moda at Monrovia Station due in 2046 that priced at par to yield 3.40%. The Pennsylvania Economic Development Authority brought a rare $75 million Caa1/CCC rated solid waste disposal financing for CONSOL Energy that was subject to the alternative minimum tax; it had a sole term bond in 2051 priced at par to yield 9.00%. The Capital Trust Agency in Florida issued $17.2 million of non-rated bonds for St. John’s Classical Academy structured with a 2056 maturity that came with a 4% coupon priced to yield 4.075%. The 2-year AAA rated general obligation bond benchmark yield currently stands at 0.15%, the 10-year is at 1.11%, and the 30-year is at 1.73%.

As we begin the second quarter of the year, technical factors continue to buoy the municipal market. Cash continues to flow into bond funds and ETFs, buying activity is at the highest levels since 2009, issuance is below average, bids in the secondary market for many bonds are strong as the gusher of federal funds is making many credits appear stronger and not much product is available. In addition, the tax chatter in Washington and several state capitals is getting louder, muni/Treasury ratios have dropped below historic averages. Economic data reports also appear to reflect a solidly recovering economy. New orders, employment, business activity, and prices all increased last month. High yield muni performance has been good: returns on the S&P High Yield Muni Index in the first quarter were +1.77%; the ICE BoAML High Yield Muni Index was up 2.1% . However, investment grade tax-exempts posted negative returns (-0.26% for S&P, -0.4% for ICE BoAML). The best performing sectors so far this year have been airport and transportation. Away from munis, markets have been volatile due to surging inflation expectations. U.S Treasuries lost 4.61% in the first quarter, and corporate bonds were down 4.49% while the Dow gained 8.2%, the S&P 500 6.1% and the Nasdaq 2.95%. Oil prices have dropped in recent days but are still up26% on the year. Gold and silver prices have fallen. Bitcoin is up more than 100%.

HJ Sims has an 86-year history of guiding our individual and institutional clients through changing markets. In addition, we have either financed, advised on, or followed the progress of continuing care communities in every major U.S. market area. So, whether you are seeking assistance with executing your investment plan, in need of a trained eye to review the credits in your bond portfolio, searching for higher yielding bonds to boost your income, looking for specific advice on how best to meet your community’s financial and capital needs, or researching suitable senior living or care communities for a friend or family member, we encourage you to contact your HJ Sims representative. We aim for amazing.