HJ Sims Secures Financing for Start-Up Assisted Living and Memory Care Community in Unique For-Profit/Not-for-Profit Collaboration

“I’ve worked with the Sims team for the past 25 years and have had nothing but great service from the organization over the years. Sims has always stayed true to doing what’s in the best interest of its clients – across the board. The Sims representatives who worked on the MRC Manalapan financing, Jim Bodine and Siamac Afshar, continues the exemplify the Sims values…even in the year 2020, where these business values don’t seem as important to some today as it once was. They were great representatives of the firm and we are thankful that we had the good fortune of having them in the lead for us. I honestly believe we might not have made it without them.

This transaction, in particular, was very challenging for a number of reasons. For me, it now ranks among the best of several transactions with the Sims firm over the years. I would not consider another company on any of my projects going forward. Sims is simply the best of the best out there.”

– Gary Puma, Principal, MRC Manalapan/LV Development LLC

Partnered Right®

MRC Manalapan (“MRC”) is a newly formed for-profit senior living developer, consisting of two principals, including LV Development. The owner of LV Development is the retired CEO of a major regional non-profit senior living provider, following a nearly forty year career which included extensive work in development, operations and management.

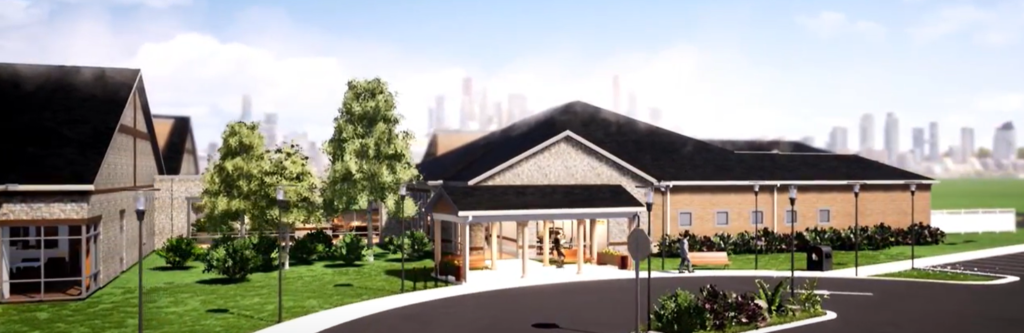

MRC is constructing a new 80 bed Assisted Living and Memory Care facility in Manalapan Township, Monmouth County, NJ, a growing region of north central New Jersey bridging the NJ Turnpike/I-95 corridor and Jersey shore communities along with Metropolitan New York. Upon completion, the community will be comprised of free-standing, single-story buildings with three “neighborhoods” of 20 semi-private and 40 private rooms configured with two courtyards for resident use.

MRC as developer/owner is partnering with Springpoint Senior Living (“Springpoint”) as tenant/operator under a long-term triple-net lease. Springpoint, a multi-site not-for-profit senior living organization, based in Wall Township, New Jersey, operates eight full-service Continuing Care Retirement Communities, consisting of Independent Living, Assisted Living, Memory Care and Skilled Nursing Facilities, a stand-alone 120-bed SNF facility and a portfolio of affordable seniors housing communities across New Jersey.

HJ Sims worked with MRC over a multi-year planning process, assisting in assessment of project and financial feasibility and evaluating various financing options. With project plans complete in early 2019, MRC engaged Sims to assess and pursue and implement financing, focused on commercial bank financing.

Structured Right®

The development and ownership-operator relationship between MRC and Springpoint is formalized in a development agreement and long-term lease, respectively. The triple net lease includes extension options along with a purchase option. The collaboration is further evidenced through equity contributions from each party – in the case of MRC, to supplement required external debt financing and for Springpoint, to fund initial start-up investment and working capital/operating expense requirements during fill-up. Finally, this is supplemented by guarantees from both MRC and Springpoint, as outlined below.

Following HJ Sims’s engagement, the financing process unfolded quickly with the goal of completing financing and commencing construction in fall 2019, following anticipated receipt of final project-related approvals and GMP construction contract. To start, Sims led a comprehensive commercial bank financing solicitation, seeking up to $15 million in a combination of construction and permanent financing, to be complemented by approximately $5.5 million of owners’ equity. Peoples United Bank was ultimately selected to provide the debt financing based on competitive loan pricing (interest rate and fees) and covenant/security package – this attractive pricing/terms reflected the favorable reputation, combined experience and significant financial commitment from both MRC principals and Springpoint, coupled with a well-balanced capital structure, combining significant equity and senior debt.

Primary financing security includes a revenue pledge (lease revenue) and mortgage. Supplemental security includes a combination of guarantees: from MRC principals, from financing closing through project completion and receipt of certificate of occupancy, followed by a limited tenant guaranty from Springpoint which reduces with the passage of time and/or achieving a minimum lease service coverage ratio and is ultimately eliminated.

Executed Right®

Following the HJ Sims-led solicitation, Peoples United Bank was selected to provide $14.3 million of taxable senior debt financing, incorporating a construction/mini-perm structure with a five-year balloon maturity – an interest only period is followed by monthly principal amortization through the maturity date. The loan includes tiered-interest rate pricing with reductions in loan credit spread following progression from construction, opening and stabilization. With interest rates at historic lows and expectations for continued low rates, the loan currently carries an unhedged variable interest rate with MRC retaining the ability to fix the rate via a balance sheet-based fixed rate or floating-to-fixed interest rate swap. At maturity, the financing may be refinanced with Peoples (or another commercial bank), refinanced on a longer-term basis via HUD/FHA mortgage financing or taxable/tax-exempt bonds or repaid via a sale of community.

Following the selection of Peoples United Bank as lender, Sims coordinated financing implementation, working with MRC, Peoples United and respective legal counsel as well as Springpoint. This included direct participation in and monitoring the completion of the conditions precedent to financing such as appraisal and bank credit approval, financing documentation including final negotiation of financing and related terms with Peoples United and Springpoint, as tenant/operator and finalizing the financing composition and structure.

Financed Right®

Completing a start-up project financing in these unique times required a collaborative and concerted effort by the entire financing team. Added challenges to timing included unforeseen delays in the municipal approval process followed by the uncertainty and market volatility associated with the Covid-19 outbreak. HJ Sims, working with MRC, Peoples United and the full financing team, successfully navigated these conditions to secure final approvals and successful closing in mid-May 2020. With financing in place, construction commenced, beginning the next chapter for Springpoint at Manalapan, a distinctive assisted living-memory care community, in a unique organizational collaboration effort.