Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue reading2025 LeadingAge SE

HJ Sims is proud to be attending, sponsoring, and exhibiting at the 2025 LeadingAge Southeast.

Come see us at booth 302!

Attendees

James Rester

Executive Vice President

214.252.8223

[email protected]

2024 Year in Review

2024 Year in Review

2025 Late Winter Conference Recap

Check out our 2025 Late Winter Conference Recap below:

Save the Date

The 23rd Annual HJ Sims Annual Conference will be held February 24th-26th, 2026 at the Marriott Sanibel Harbour Resort & Spa in Fort Myers, FL. Stay tuned for more information soon. We can’t wait to see you there!

For more information, please contact Kat Dymond.

2025 LeadingAge Ohio Annual Conference & Trade Show

HJ Sims is proud to be attending, sponsoring, exhibiting and speaking at the 2025 LeadingAge Ohio Annual Conference & Trade Show.

Come see us at booth 85.

Speaking Details:

Lynn Daly, Executive Vice President

August 28, 2025 – 8:30am – 9:45am

Topic:

Understanding Baby Boomers: A Tapestry of Needs, Aspirations and Resources.

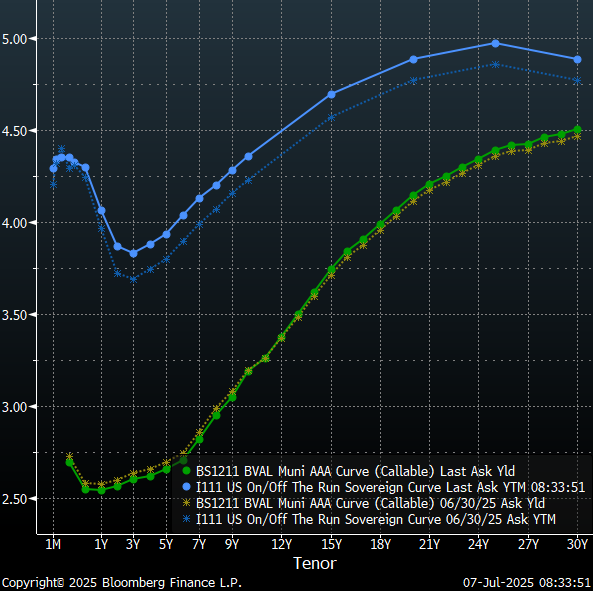

Curve Commentary: July 7, 2025

Overview

Last week, the President signed into law his “Big Beautiful Bill,” which reportedly contains roughly $4.5 trillion in tax cuts, and protects the tax exemption for municipal bonds and private activity bonds. The Bill also creates a new category of private activity bonds for “spaceports” and includes a few additional bond-related provisions. The preservation of the tax-exemption is of critical importance to the municipal bond market.

Strategy and Insights

Muni and Treasury yields moved slightly higher over this past week with the long end of the Treasury curve remaining notable steep. The municipal yield curve steepened with yields dropping roughly 3 basis points per year on the short/short-intermediate potion of the yield curve and climbing by the same magnitude on the long-end with yields pivoting around the 10-year mark. Thursday’s jobs data, released by the Bureau of Labor Statistics, dashed the markets hopes of a July rate cut with nonfarm payroll employment increasing by 147,000 jobs in June, beating the census forecast of 110,000 jobs from economists polled by Dow Jones. Furthermore, the unemployment rate fell slightly from 4.2% to 4.1%. As a result, Treasury yields generally climbed throughout the curve over the past week, with an almost parallel shift upward of 13 to 16-basis points.

This week, municipal issuers are expected to sell more than $12.7 billion of bonds, following last week’s truncated holiday calendar. This supply will likely be met with strong demand following last week’s infusion of $958.89 million to municipal bond mutual funds, as reported by LSEG Lipper Global Fund Flows. In addition, $24.2 billion in municipal bonds are expected to mature in the next 30-days and $4.2 billion in calls have been announced over the next 30-days. Overall, technical conditions in the municipal bond market have been supportive of new issues and we expect this trend to continue.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

2025 LeadingAge SE

Attendees

Sponsor Tier 1

Sponsor Tier 2

Sponsor Tier 3

2024 Year in Review

Check out our 2024 Year in Review below:

2025 Late Winter Conference Recap

Check out our 2025 Late Winter Conference Recap below:

Save the Date

The 23rd Annual HJ Sims Annual Conference will be held February 24th-26th, 2026 at the Marriott Sanibel Harbour Resort & Spa in Fort Myers, FL. Stay tuned for more information soon. We can’t wait to see you there!

For more information, please contact Kat Dymond.

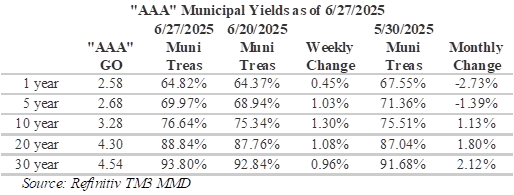

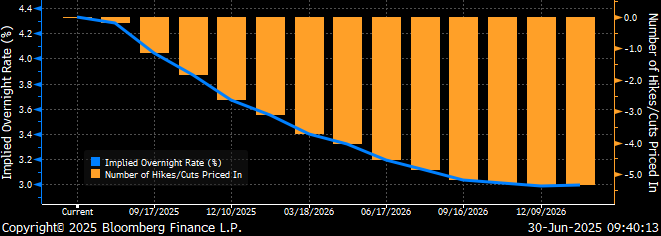

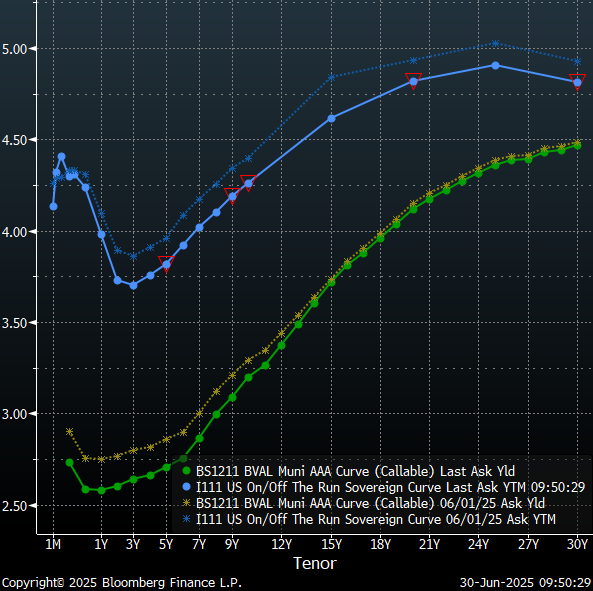

Curve Commentary: June 30, 2025

Overview

Treasury and municipal market yields rallied over this past week as the market fixated on the potential for the Fed to cut rates earlier than previously forecast. Sentiment was driven by dovish Fedspeak from Fed governors Bowman and Waller, first quarter GDP revisions to -0.5% and a benign May PCE report, all of which bolstered rate cut expectations. The futures market is now anticipating the Fed could cut rates as soon as September. However, Fed Chair Powell’s comments made last week to the House Financial Services Committee were clear, that the Fed is well positioned to wait citing elevated inflation and intensifying price pressures. Powell also commented that signs of weakness in the labor market would change the Fed’s stance. As a result, we may see some volatility in the capital markets following this week’s employment data releases on Tuesday and Thursday.

Ratios and Strategy

Over the past month, Treasury yields have rallied roughly 15-basis points from 2 to 10-years with a steeper dip of 23 basis points around the 15-year mark. While municipal yields held relatively steady, with declines of approximately 10 to 15-basis points from 2 to 10-years and 1 to 2 basis points for maturities past 15-years. As a result, muni/Treasury ratios have generally become more attractive with ratios enticing investors to extend portfolio durations with significantly higher ratios on longer maturities. Currently, 10-year munis are yielding over 76% of equivalent Treasuries and 30-year munis are yielding over 93% of equivalent Treasuries. The slope of the municipal yield curve is also rewarding extension with multiple spans along the yield curve in excess of 10 basis points per year. The steepest slopes have formed around the 10-year maturity, with an overall slope of 45 basis points from 9 to 11-years. Further out the municipal yield curve, slopes remain steep from 15 to 18-years, with an overall slope of 45 basis points. Slopes after this point taper off dramatically to just a basis point or two on the extreme long-end. The flattening on the longer-end of the yield curve allows investors to buy 17-year maturities with yields that are 90% of the 30-year municipal maturity.

Although municipal bond mutual fund flows have been steadily weakening, supply/demand technical conditions remain strong with nine consecutive weeks of positive fund flows and investors anticipating $45 billion of interest payments, maturing and called principal this week. LSEG Lipper Global Fund Flows reported municipal bond mutual funds saw an additional $76.9 million from investors. The majority of the inflows were directed to high-yield funds, which registered an additional $45.4 million compared to the previous week’s $57.7 million. This week, the calendar has contracted to $5.78 billion, which is relatively heavy for a holiday week with an early close. This past June is anticipated to be the largest June on-record for issuance and year-to-date, municipal issuance has already reached $277.8 billion, which is 17.8% ahead of last -year at this time.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Market Commentary: The Hammer Drops

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingCurve Commentary: June 23, 2025

Overview

Although last week was a holiday week, there was a steady stream of potentially impactful headlines ranging from escalating tensions in the Middle East to an FOMC meeting. Although Fed officials left interest rates unchanged at last week’s meeting, the conflict in the middle east has disrupted air traffic, rattled global markets, and raised concerns of oil prices and inflation. However, Treasury bond yields generally slid last week amid elevated recession concerns following a disappointing release of data by the Census Bureau indicating retail sales dropped by 0.9% in May, significantly below the 0.6% contraction previously estimated by economists surveyed by Dow Jones.

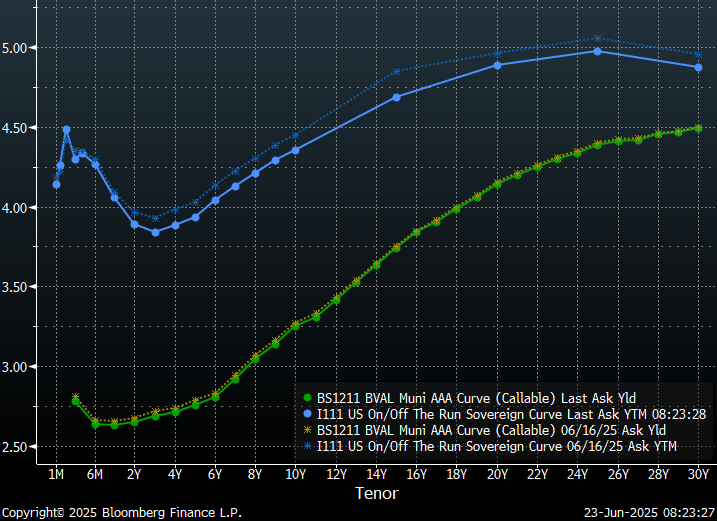

Ratios and Strategy

Over the past week, Treasury yields slid roughly 10-basis points from 5 to 30-years with a steeper dip of 20 basis points around the 15-year mark. While municipal yields held relatively steady with declines of approximately 3 basis points for maturities within 10-years and only a basis point a year on longer tenors. As a result, muni/Treasury ratios have generally become more attractive with ratios enticing investors to extend portfolio durations with significantly higher ratios on longer maturities. Currently, 10-year munis are yielding over 75% of equivalent Treasuries and 30-year munis are yielding almost 93% of equivalent Treasuries. The slope of the municipal yield curve is also rewarding extension with multiple spans along the yield curve in excess of 10 basis points per year. The steepest slopes have formed around the 10-year maturity, with an overall slope of 43 basis points from 9 to 11-years. Further out the municipal yield curve, slopes remain steep from 15 to 18-years, with an overall slope of 45 basis points. Slopes after this point taper off dramatically to just a basis point or two on the extreme long-end. The flattening on the longer-end of the yield curve allows investors to buy 17-year maturities with yields that are 90% of 30-year maturities.

Secondary trading volumes slowed last week as attentions were divided by the short week. However, municipal market technicals remain accommodative, with last week’s approximately $6 billion municipal calendar was taken down with relative ease amid $32 billion in bonds maturing over the next 30-days and an additional $7.5 billion in announced bond calls. LSEG Lipper Global Fund Flows reported municipal bond mutual funds experienced their eighth consecutive week of inflows, albeit with a modest $110.5 million being added to the asset class. High-yield funds saw an additional $57.7 million compared to the previous week’s $138 million. This week, the calendar has expanded to $11.8 billion in new issues to close-out June as one of the highest supply months seen in recent years. Year-to-date, municipal issuance has reached $265 billion, which is 19.4% ahead of last -year at this time.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Market Commentary: Secret Spaces

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingCurve Commentary: June 16, 2025

Overview

From the perspective of the trade desk, last week was another challenging week with attentions focused on new deals rather than the secondary market. Both municipal and Treasury markets responded to last week’s reports of slower growth and lower inflation with yields dropping approximately three to six basis points across both curves. However, this week escalating overseas tensions in Israel and Iran are placing upward pressure on yields. Not surprisingly, both Brent and West Texas Intermediate crude oil prices have risen above $70 per barrel sparking concerns of inflation among traders and placing additional upward pressure on long-term yields. These concerns are in addition to the existing inflationary concerns related to the trade wars, spiraling U.S. debt concerns and traders demanding a higher premium for the risk of lending to governments following Moody’s downgrade of the United States credit rating to ‘Aa1.’ Overall, the yield gap between 10 and 30-year Treasuries has reached the widest levels we have seen since 2021.

Over the past week, attentions on the trade desk have been more focused on the short-end of the curve as accounts look for safety amid global conflict, economic and policy uncertainties. The municipal curve has responded with steeper slopes in the longer-intermediate tenors with extension risk being rewarded from 2034 all the way out to 2043 with a collective 116 basis points of slope over the 10-year period. The 2036 maturity now offers over 75% of the 30-year municipal maturity and over 75% of equivalent Treasury yields. Going out an additional 6 years to 2042 nets an additional 64 basis points of yield, or 90% of the 30-year municipal maturity, and 83% of equivalent Treasury yields. Slopes on the long-end of the municipal curve taper significantly past 20-years with only a basis point or two of slope on the long-end.

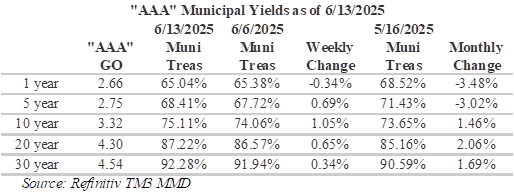

Ratios and Strategy

Muni/Treasury ratios have been relatively balanced over the past week declining on the short-end and increasing on the long-end with the largest changes in the intermediate portion of the curve around 10-years. Long-term ratios remain appealing, with 20-year munis yielding 87.22% of Treasuries and 30-year munis yielding 92.28% of Treasuries. Over the past week, we have seen ratios drop down to 65% in the 1-year tenor as investors migrate toward the safety afforded by the shorter end of the yield curve.

Ahead of the upcoming FOMC meeting and the Juneteenth holiday, the municipal market is anticipating a slower week as issuers are scheduled to bring $5.73 billion in new deals to market versus $17 billion last week. Market technicals remain receptive to strong issuance with LSEG Lipper Global Fund Flows reporting municipal bond mutual funds saw a seventh consecutive week of inflows with $523 million being added to the asset class following $426 million of inflows the prior week. Long-term muni funds added $72 million while high-yield funds saw an additional $138 million and intermediate funds added $35 million. In addition, $35.4 billion in municipal bonds are maturing over the next 30-days and an additional $7.8 billion of bond calls has been announced.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Market Commentary: The Daily Soaps

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingCurve Commentary: June 9, 2025

Overview

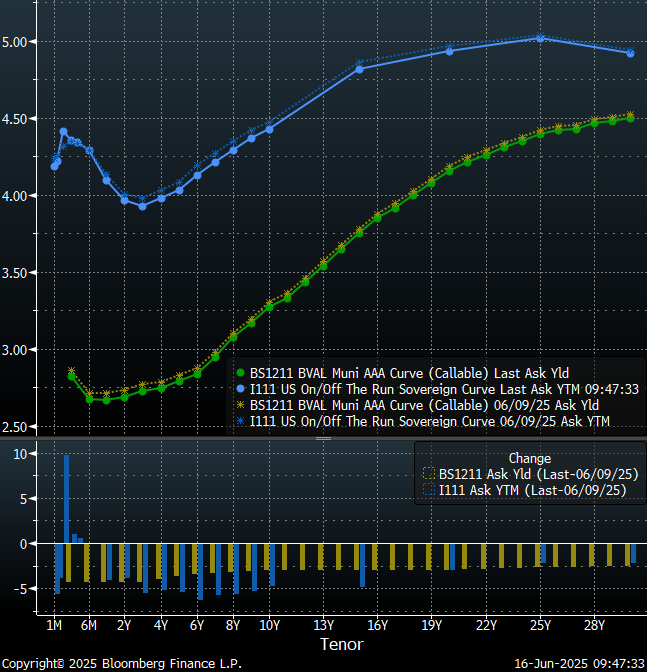

Last week, the municipal market was flooded by issuance as state and local governments unloaded $20 billion in new deals, marking the largest issuance volume in almost eight years. The municipal market is anticipating another big week with issuers currently scheduled to bring $17 billion in new deals to market ahead of the upcoming FOMC meeting and the Juneteenth holiday. However, despite the challenging volume of deals being processed by the market, municipal yields have held steady, even outperforming Treasuries, with a rally of two to three basis points in tenors under ten years and a minor sell-off of one to one and a half basis points out long. As a result, the MMD municipal yield curve has modestly steepened by about 11 basis points over the past week. In contrast, Treasuries have flattened from two to 30-years with tenors under ten years selling-off as much as ten basis points as the Treasury market responded to a stronger than expected jobs report and continued policy uncertainties.

From the perspective of the trade desk, this has been another challenging week with attentions focused on new deals rather than the secondary market. Not surprisingly, secondary trading volumes have progressively slowed as new issue volume has accelerated. Inquiries have been more focused on the short-end of the curve with investors seeking asylum amid economic and policy uncertainties. The municipal curve has responded with steeper slopes in the longer-intermediate tenors with 41 basis points of slope from 2034 to 2036, with the 2036 maturity now offering approximately 75% of Treasury yields. In addition, slopes remain steep from 2040 to 2043, rewarding investors that travel further out the curve with approximately 85% of Treasury yields in 2043. Slopes on the long-end of the municipal curve taper significantly past 20-years, with a basis point or two of slope on the long-end. Currently, 20-year munis offer 95% of 30-year yield.

Ratios and Strategy

Muni/Treasury ratios have responded with mixed results over the past week, declining by over two percent on the short-end and remaining practically unchanged on the long -end. However, long-term ratios remain appealing, with 20-year munis yielding 86.57% of Treasuries and 30-year munis yielding 91.94% of Treasuries. Over the past week, we have seen ratios dip below 70% to 67.72% in the 5-year tenor, primarily due to the notable sell-off in Treasuries in that part of the curve over the past week.

Year-to-date, long-term municipal issuance is $240.5 billion, which is up 17.8% versus the same time period last year. Fortunately, market technicals remain receptive to strong issuance with $34.7 billion in bonds maturing over the next 30-days and an additional $12.5 billion in announced bond calls. In addition, LSEG Lipper Global Fund Flows reported municipal bond mutual funds saw a sixth consecutive week of inflows with $426 million being added to the asset class following $526 million of inflows the prior week. Long-term muni funds gained $45 million while high-yield funds added $281 million and intermediate funds added $110 million.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

2025 National Charter School Conference

Attendees

Sponsor Tier 1

Sponsor Tier 2

Sponsor Tier 3

2024 Year in Review

Check out our 2024 Year in Review below:

2025 Late Winter Conference Recap

Check out our 2025 Late Winter Conference Recap below:

Save the Date

The 23rd Annual HJ Sims Annual Conference will be held February 24th-26th, 2026 at the Marriott Sanibel Harbour Resort & Spa in Fort Myers, FL. Stay tuned for more information soon. We can’t wait to see you there!

For more information, please contact Kat Dymond.

Market Commentary: Bright College Years

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingGrace Inspired Living Case Study (May 2025)

HJ Sims Successfully Completes

Tax-Exempt Financing

Enabling Affiliation

Integration and Funding

Continuing Campus Growth

FOREST HILLS OF DC (May 2025)

Forest Hills of DC

Enhances Long-Term

Position by Affiliating

with Goodwin Living

Case Study (May 2025)

HJ Sims Provides $4.3 Million

Mezzanine Loan for Skilled Nursing

Acquisition

Curve Commentary: June 2, 2025

Overview

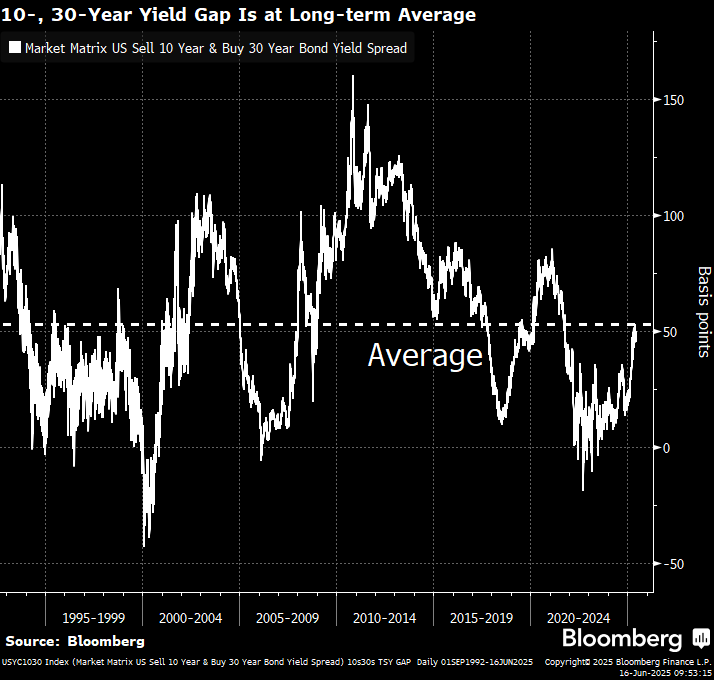

Long-term US Treasury yields have recently popped-up to their highest level in over a year, driven by the passage of the budget by the US House of Representatives and widespread concerns of escalating deficits. The biggest deficit driver is the proposed extension of the Tax Cuts and Jobs Act of 2017, which is estimated to add $3.5 to $4.0 trillion to the current deficit, likely requiring the issuance of additional Treasury securities. However, demand for Treasuries is waning as countries like China and Japan have been decreasing their holdings due to trade tensions and a stronger US dollar. Yields on 2, 5 and 10-year notes, by comparison, have fallen resulting in a widening gap between the 10-year and the 30-year bond. Although this gap is widening, it is still within long-term historical averages.

Looking at shorter tenors, the slope of the municipal 2s10s curve has reached 53 bps, the steepest level observed since 2022. This marks a complete reversal from the minus 50 bps seen last year at about this time, in April 2024, as yield relationships along the curve continue to normalize. Similarly, the US Treasury 2s10s curve has a slope of 52 bps, which is far more approachable than the minus 108 bps seen in mid-2023. With steeper slopes shorter on the curve, investors can capture a substantial percentage of 30-year rates over significantly shorter duration exposures. Currently, 10-year munis are yielding approximately 75% of the 30-year maturity and 18-year munis are yielding approximately 93% of the 30-year maturity.

Ratios and Strategy

Recent yield shifts have resulted in muni/Treasury ratios declining by almost a percent on the short-end and increasing by 1.4% on the long -end. Although long-term ratios remain appealing, the yield differentials between municipals and Treasuries have tightened over the past month with 5-year ratios declining from over 75% down to 71% as investors move to the shorter end of the curve amid rate volatility. At the long-end, municipal continue to yield over 90% of equivalent Treasury bonds, which continues to be appealing to investors. However, as mentioned earlier, compelling values are available at shorter durations with 20-year munis yielding 87% of Treasuries. Nevertheless, as discussed below, ratios are likely to be range bound as municipals head into the more technically driven portion of the year.

Technical Factors

Year-to-date long-term municipal issuance is $220.5 billion, which is up 17.3% versus the same time period last year. Issuance is expected to pick-up this week with US state and local governments slated to sell more than $19.1 billion of bonds, which is the highest weekly total this year and one of the largest weekly calendars on record and is expected to accelerate over the next month. On this week’s calendar, there are multiple billion dollar issues scheduled lead by Indiana University Health is with its $1.5 billion issue and the Commonwealth of Pennsylvania with a $1.17 billion issue.

Last week, LSEG Lipper Global Fund Flows reported municipal bond mutual funds saw a fifth consecutive week of inflows with $526 million being added to the asset class following $768 million of inflows the prior week. Long-term municipal funds gained $203 million while high-yield funds added $150 million and intermediate funds added $79 million. However, despite the inflows, trading volumes fell to the lowest level seen in 2025 last week amid healthy but cooling demand.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Market Commentary: No Place Like Home

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingCurve Commentary: May 27, 2025

Overview

In the period following the announced tariffs on April 2nd, Municipal bonds have fared better than Treasury bonds, with 30-year Treasury bonds selling-off by 44 basis points while similar municipals sold-off by only 32 basis points. However, it is in the 15-year portion of the Treasury curve where investors are most unsettled as the Treasury bond market backed-up 54 basis points versus only 23 basis points in municipals. The result is flattening on the longer end of the Treasury curve with a slope of only 7 basis points from 15 to 30-years. Treasury bonds are responding to the long-term inflation outlook, national debt concerns and consumer anticipation of steeper price pressures with uncertainty leading to flattening on the long-end. The municipal curve has evolved to become more consistently sloped with longer duration municipals responding more to technical factors such as new issuance and fund flows.

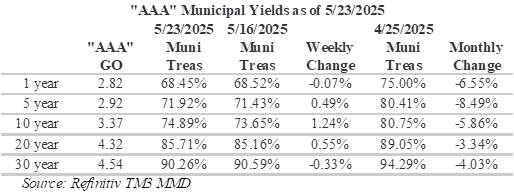

Ratios and Strategy

Over the past week we have seen some steepening on the longer-end of the intermediate portion of the municipal curve with slopes increasing 34 basis points from 9 to 11 years. The 15 to 18 year tenor of the municipal curve also continues to offer investors reward for extension, with yields climbing 45 basis points from 2040 to 2043. This portion of the curve offers a combination of relatively steep slope and meaningful yield, allowing investors to lock-in over 93% of the yield on the 30-year municipal maturity and approximately 85% of equivalent Treasury yields.

Although long-term ratios remain appealing, the yield differentials between municipals and Treasuries has tightened over the past month, with 5-year ratios declining from over 80% to just over 70%, as investors migrate to the shorter end of the curve amid rate volatility. Over the past week, ratios have tightened on both the extreme long-end and the short-end with widening in the middle with the largest moves around the 10-year mark. At the long-end, municipal bonds are still yielding over 90% of Treasury bonds, which is continues to be appealing to investors.

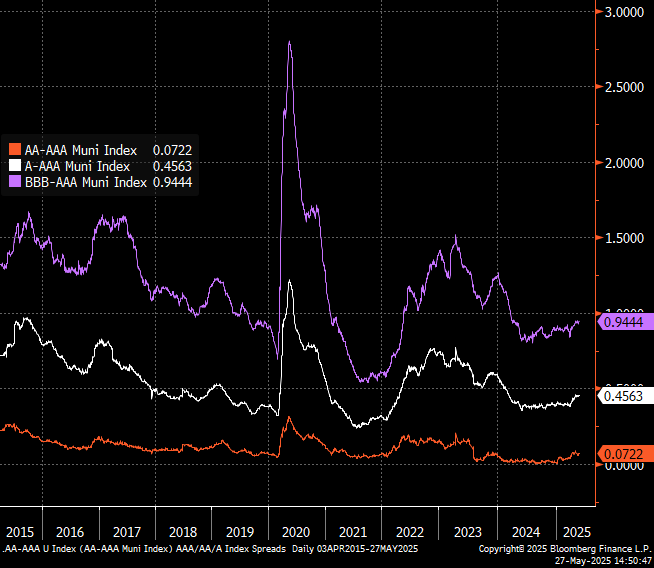

Municipal credit spreads remain relatively stable with modest widening as recession fears have been rekindled amidst day-to-day tariff and economic uncertainty and the downgrade of U.S. sovereign credit. Credit spreads measure the difference in basis points between credit ratings. This spread reflects the additional return investors demand for the credit risk associated with investing in lower rated bonds. Of the investment grade ratings, ‘BBB’ spreads have widened the most, post Liberation Day, by approximately 10 basis points while ‘A’ credit spreads have widened by 7 basis points and ‘AA’ credit spreads have widened by 3 basis points. Although credit spreads continue to reward risk, they are noticeably tighter than they were at the end of 2023, when ‘BBB’ credit spreads were 125 basis points versus their current 94 basis points.

Technical Factors

Last week LSEG Lipper Global Fund Flows reported municipal bond mutual funds saw $768 million of inflows following $769 million of inflows the prior week. The new issue calendar is a little lighter this week, due to the holiday, with an estimated $9.5 billion versus $15 billion last week. New Jersey Turnpike Authority has $1.75 billion in revenue bonds on the calendar and Omaha Public Power District is scheduled to sell $503 million in electric system revenue bonds. Year-to-date, municipal issuers have sold $210 billion, which is up 14.8% from last year at this time. However, there is speculation that issuance may slow this summer due decreased likelihood of the elimination of the tax-exemption on municipal bonds following the passage of the “Big Beautiful Bill” by the House Budget Committee last week.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.