RSVP for the HJ Sims Women’s Brunch 2023

HJ Sims 2023 Women's Brunch

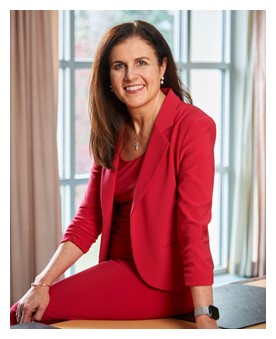

Featuring Susan DiMickele, President and Chief Executive Officer of National Church Residences

Date & Time: Sunday, November 5, 10:30am – 12:30pm

Location: Level 33 at Marriott Marquis

We look forward to hosting you at our annual Women’s Brunch. Hear from other successful women leaders in the senior living community and share your experience. Join us as we cultivate a space for women leaders to come together and produce thought leadership that supports your professional and personal endeavors.

Registration is by invite only and required to obtain access to the event. Please RSVP below by November 1st as space is limited.

Meet Our Speaker

Susan DiMickele is the President and Chief Executive Officer of National Church Residences, the nation’s largest nonprofit provider of affordable senior housing and the largest manager of service coordinators with more than 360 communities across the United States. Prior to being named President & CEO in June of 2023, DiMickele served as Senior Vice President of Senior Living and Senior Services and was responsible for overseeing the day-to-day operations and management of the organizations’ senior living communities that provide housing and services for independent living, assisted living, skilled nursing, memory care, as well as the operation and management of the organization’s home health and hospice services.

Prior to joining National Church Residences, DiMickele was a Partner with the Squire Patton Boggs law firm where she co-led the global Labor and Employment Practice Group.

A trial lawyer with over 20 years of experience in employment discrimination, breach of contract and fraud cases, DiMickele has advocated for employers in matters involving wrongful termination, employee benefits, trade secrets, unfair labor practices and personal injury.

In her previous role, DiMickele led in-house training for employees, including EEO and diversity, project management and risk management training, and represented employers in successful union-free campaigns. She also led the firm in employing new processes, tools and creative approaches to maximize the value of services and regularly spoke on efforts in project management, business process development and knowledge management.

DiMickele is an author of many national publications as well as a personal memoir. Her honors include being regularly named an Ohio Super Lawyer, being recognized as a leader in the field of labor and employment by Chambers USA, and being listed in The Best Lawyers in America since 2007.

RSVP for the HJ Sims Women’s Brunch 2022

HJ Sims Women's Brunch to Kick Off the LeadingAge Annual Conference

Date & Time: Sunday, October 16, 10:30am – 12:30pm

Location: Sundeck at The Denver Athletic Club

We look forward to hosting you at the Women’s Brunch and sharing stories among successful women leaders in the senior living community. Registration is by invite only and required to obtain access to the event. Please RSVP below by October 1st, space is limited.

Our Panelists & Moderator

If you would like more information about our participation in LeadingAge National, please visit our event webpage.

Please complete this form to register for the Women’s Brunch.

Special Market Update

As we continue to experience daily fluctuations in our capital markets, HJ Sims is committed to keeping our employees, our clients and our business partners informed. We are diligently tracking the key indices and data that drive our sectors’ interest rates and access to capital. We have developed a set of straightforward charts that capture these trends and are updating them regularly. Please download PDF below.

We will update this page adding information as frequently as needed.

HJ Sims Capabilities Video – Charter Schools

Testimonials may not be representative of the experience of other clients and are not indictive of future performance or success.

Sims Mortgage Funding is a wholly owned subsidiary of HJ Sims.

Find the Right Structure for Your Unique Capital Needs

Advisory Services to Face Challenges or Opportunities

HJ Sims Who We Are Video

Testimonials may not be representative of the experience of other clients and are not indictive of future performance or success.

Sims Mortgage Funding is a wholly owned subsidiary of HJ Sims.

Find the Right Structure for Your Unique Capital Needs

Advisory Services to Face Challenges or Opportunities

An Exclusive Investment Opportunity: Broadview at Purchase College

**This financing has been successfully closed. Please contact you advisor for any potential secondary market opportunities.**

Exclusively for Charter Members

Please join us for a special luncheon event to learn about investing in Broadview at Purchase College. Meet members of the project team and learn more about the tax-exempt municipal bonds for Broadview at Purchase College, offered exclusively by HJ Sims.

When: Thursday, October 14th; 11:00am-1:00pm

Where: Broadview Marketing Office: 6 International Dr., Suite 120, Rye Brook, NY 10573

RSVP below

Registration Form to pre-register to attend the seminar regarding information on the Broadview at Purchase College Revenue Bonds.

$392,245,000*

WESTCHESTER COUNTY LOCAL DEVELOPMENT CORPORATION

Revenue Bonds

Purchase Senior Learning Community, Inc. Project

Series 2021

Series 2021A Bonds $213,805,000*

Series 2021B Entrance Fee Principal Redemption Bonds $23,520,000*

Series 2021C Entrance Fee Principal Redemption Bonds $58,730,000*

Series 2021D Entrance Fee Principal Redemption Bonds $89,525,000*

Series 2021E Taxable Entrance Fee Principal Redemption Bonds $6,665,000*

HJ Sims is pleased to serve as sole underwriter for Broadview at Purchase College, a planned senior living community consisting of 174 independent living apartments and 46 villas, 36 assisted living beds and 32 memory care beds on the campus of Purchase College in Purchase, Westchester County, New York.

Purchase College is approximately five miles from White Plains, NY and 25 miles from midtown Manhattan. It was founded in 1967 and one of the 13 comprehensive colleges of the State of New York (SUNY) system.

In 2011 legislation was passed in New York to permit SUNY to enter into a 75-year ground lease for development of Broadview, finding “provision of a senior learning community upon the grounds…is appropriate to further the objectives and purposes of [SUNY].” The legislation mandates that 100% of any rent Purchase College receives from the lease shall be used by the college for student financial aid and full-time teaching positions.

In addition to a wide variety of amenities and commons spaces, the community will include a Learning Commons consisting of classrooms, studios, a dining venue, gathering spaces, and performance spaces for use by Broadview residents and the College community and will be a place where residents, students and faculty can come together for lectures, seminars, performances, mentoring, tutoring and other educational purposes. Arts and cultural opportunities on the Purchase College campus also include the Neuberger Museum of Art, the Richard and Dolly Maass Gallery, and the Performing Arts Center, all a short walk from the Community.

Reach out and connect with Broadview.

This stunning new community will mix a vibrant college environment with senior living premium services and amenities. There will be unique opportunities for intergenerational learning & mentoring.

Broadview residents will become part of a senior living community embedded on the Purchase College campus. The Purchase College tagline ‘Think Wide Open’ will be the guiding principle for Broadview, offering opportunities to cross borders between generations, break down stereotypes and form mutually beneficial and lasting friendships.

Broadview will feature the Learning Commons (pictured above) which will be the fulcrum where students of all ages converge. Classrooms, galleries, studios, a coffeehouse and more will be housed within its expansive premises as Broadview’s hub. Meet, dine, take courses and attend lectures — each day here will present an open invitation to mingle with other residents, students and faculty in life-expanding relationships.

Market response to the new community has been strong with 83% of the independent living units reserved as of September 30, 2021.

In 2014 HJ Sims was selected as investment banker and has been actively involved in the development of the community and structuring this financing throughout the past seven years. In 2018 we raised $15 million in Bond Anticipation Notes for the initial development costs which supplemented a $5 million grant received by the Purchase College Foundation Housing Corporation. For more information about the 2018 financing, please read the full case study.

About the Bonds

- Series 2021A Bonds $213,805,000*

- Interest is exempt from Federal Income Tax, State of New York Income Tax and New York City Income Tax

- Minimum investment of $100,000 with $5,000 increments thereafter Qualified Institutional Buyers and accredited investors only

- Interest will be payable on January 1 and July 1 of each year, commencing July 1, 2022

- First principal payment: July 1, 2027

- Final maturity: July 1, 2056 (multiple maturities offered)

- Series 2021B Entrance Fee Principal Redemption Bonds $23,520,000*

- Interest is exempt from Federal Income Tax, State of New York Income Tax and New York City Income Tax

- Minimum investment of $100,000 with $5,000 increments thereafter Qualified Institutional Buyers and accredited investors only

- Interest will be payable on January 1 and July 1 of each year, commencing July 1, 2022

- Sized to 85% of Entrance Fee pool

- Anticipated to be redeemed July 1, 2025

- Series 2021C Entrance Fee Principal Redemption Bonds $58,730,000*

- Interest is exempt from Federal Income Tax, State of New York Income Tax and New York City Income Tax

- Minimum investment of $100,000 with $5,000 increments thereafter Qualified Institutional Buyers and accredited investors only

- Interest will be payable on January 1 and July 1 of each year, commencing July 1, 2022

- Sized to 75% of Entrance Fee pool

- Anticipated to be redeemed July 1, 2025

- Series 2021D Entrance Fee Principal Redemption Bonds $89,525,000*

- Interest is exempt from Federal Income Tax, State of New York Income Tax and New York City Income Tax

- Minimum investment of $100,000 with $5,000 increments thereafter Qualified Institutional Buyers and accredited investors only

- Interest will be payable on January 1 and July 1 of each year, commencing July 1, 2022

- Sized to 50% of Entrance Fee pool

- Anticipated to be redeemed July 1, 2024

- Series 2021E Taxable Entrance Fee Principal Redemption Bonds $6,665,000*

- Interest is NOT exempt from Federal Income Tax, State of New York Income Tax and New York City Income Tax

- Minimum investment of $100,000 with $5,000 increments thereafter Qualified Institutional Buyers and accredited investors only

- Interest will be payable on January 1 and July 1 of each year, commencing July 1, 2022

- Sized to 12% of Entrance Fee pool

- Anticipated to be redeemed October 1, 2023

Use of Bond Proceeds

Project

- Construction of the community

- Working Capital to fund pre-opening and opening expenses

- Debt Service Reserve Funds

- Capitalized Interest during construction

- Financing costs

Security

- Secured by a sub-leasehold mortgage on the property

- Secured by a gross revenue pledge

- Secured by debt service reserve funds

- Secured by an assignment of project documents

- Secured by a $10 million liquidity support fund

Key Financial Covenants

- 1.20x Debt Service Coverage Ratio; tested annually following stabilization

- 175 Days Cash on Hand/Liquidity Covenant; tested semi-annually following stabilization

- Marketing Covenant requiring quarterly step ups beginning with 78% at 12/31/21 rising to 90% by 6/30/24 or approximately 12 months after opening

- Occupancy Covenant requiring quarterly step ups beginning one full quarter after opening and rising to 90% in 4 years

- Cumulative Cash Loss Covenant: testing to begin the full fiscal quarter following the issuance of the Certificate of Occupancy and ending the first full fiscal quarter following stabilization.

We are currently accepting indications of interest for these tax-exempt bonds with an expected pricing the week of October 25, 2021, and anticipated settlement during early November. For more information including risks, please read the Preliminary Official Statement in its entirety. If you have interest in purchasing these bonds, please contact your HJ Sims financial professional as soon as possible.

*Subject to change

No dealer, broker, salesperson, or other person has been authorized to give any information or to make any representation other than those contained in the Preliminary Official Statement and, if given or made, such other information or representation should not be relied upon as having been authorized by the Issuer, the Borrower, or the Underwriters. The information set forth herein has been obtained from the Issuer, Borrower, and other sources that are believed to be reliable, but is not guaranteed as to accuracy or completeness by, and is not construed as a representation of, the Underwriters. The information contained herein is subject to change without notice. Under no circumstances shall this constitute an offer to sell or solicitation of an offer to buy, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Any offering or solicitation will be made only to investors pursuant to the Preliminary Official Statement, which should be read in its entirety. Investments involve risk including the possible loss of principal. HJ Sims is a member of FINRA and SIPC, and is not affiliated with Purchase Senior Learning Community, Inc.

An Exclusive Investment Opportunity: Broadview at Purchase College

**This financing has been successfully closed. Please contact you advisor for any potential secondary market opportunities.**

$392,245,000*

WESTCHESTER COUNTY LOCAL DEVELOPMENT CORPORATION

Revenue Bonds

Purchase Senior Learning Community, Inc. Project

Series 2021

Series 2021A Bonds $213,805,000*

Series 2021B Entrance Fee Principal Redemption Bonds $23,520,000*

Series 2021C Entrance Fee Principal Redemption Bonds $58,730,000*

Series 2021D Entrance Fee Principal Redemption Bonds $89,525,000*

Series 2021E Taxable Entrance Fee Principal Redemption Bonds $6,665,000*

HJ Sims is pleased to serve as sole underwriter for Broadview at Purchase College, a planned senior living community consisting of 174 independent living apartments and 46 villas, 36 assisted living beds and 32 memory care beds on the campus of Purchase College in Purchase, Westchester County, New York.

Purchase College is approximately five miles from White Plains, NY and 25 miles from midtown Manhattan. It was founded in 1967 and one of the 13 comprehensive colleges of the State of New York (SUNY) system.

In 2011 legislation was passed in New York to permit SUNY to enter into a 75-year ground lease for development of Broadview, finding “provision of a senior learning community upon the grounds…is appropriate to further the objectives and purposes of [SUNY].” The legislation mandates that 100% of any rent Purchase College receives from the lease shall be used by the college for student financial aid and full-time teaching positions.

In addition to a wide variety of amenities and commons spaces, the community will include a Learning Commons consisting of classrooms, studios, a dining venue, gathering spaces, and performance spaces for use by Broadview residents and the College community and will be a place where residents, students and faculty can come together for lectures, seminars, performances, mentoring, tutoring and other educational purposes. Arts and cultural opportunities on the Purchase College campus also include the Neuberger Museum of Art, the Richard and Dolly Maass Gallery, and the Performing Arts Center, all a short walk from the Community.

Reach out and connect with Broadview.

This stunning new community will mix a vibrant college environment with senior living premium services and amenities. There will be unique opportunities for intergenerational learning & mentoring.

Broadview residents will become part of a senior living community embedded on the Purchase College campus. The Purchase College tagline ‘Think Wide Open’ will be the guiding principle for Broadview, offering opportunities to cross borders between generations, break down stereotypes and form mutually beneficial and lasting friendships.

Broadview will feature the Learning Commons (pictured above) which will be the fulcrum where students of all ages converge. Classrooms, galleries, studios, a coffeehouse and more will be housed within its expansive premises as Broadview’s hub. Meet, dine, take courses and attend lectures — each day here will present an open invitation to mingle with other residents, students and faculty in life-expanding relationships.

Market response to the new community has been strong with 83% of the independent living units reserved as of September 30, 2021.

In 2014 HJ Sims was selected as investment banker and has been actively involved in the development of the community and structuring this financing throughout the past seven years. In 2018 we raised $15 million in Bond Anticipation Notes for the initial development costs which supplemented a $5 million grant received by the Purchase College Foundation Housing Corporation. For more information about the 2018 financing, please read the full case study.

About the Bonds

- Series 2021A Bonds $213,805,000*

- Interest is exempt from Federal Income Tax, State of New York Income Tax and New York City Income Tax

- Minimum investment of $100,000 with $5,000 increments thereafter Qualified Institutional Buyers and accredited investors only

- Interest will be payable on January 1 and July 1 of each year, commencing July 1, 2022

- First principal payment: July 1, 2027

- Final maturity: July 1, 2056 (multiple maturities offered)

- Series 2021B Entrance Fee Principal Redemption Bonds $23,520,000*

- Interest is exempt from Federal Income Tax, State of New York Income Tax and New York City Income Tax

- Minimum investment of $100,000 with $5,000 increments thereafter Qualified Institutional Buyers and accredited investors only

- Interest will be payable on January 1 and July 1 of each year, commencing July 1, 2022

- Sized to 85% of Entrance Fee pool

- Anticipated to be redeemed July 1, 2025

- Series 2021C Entrance Fee Principal Redemption Bonds $58,730,000*

- Interest is exempt from Federal Income Tax, State of New York Income Tax and New York City Income Tax

- Minimum investment of $100,000 with $5,000 increments thereafter Qualified Institutional Buyers and accredited investors only

- Interest will be payable on January 1 and July 1 of each year, commencing July 1, 2022

- Sized to 75% of Entrance Fee pool

- Anticipated to be redeemed July 1, 2025

- Series 2021D Entrance Fee Principal Redemption Bonds $89,525,000*

- Interest is exempt from Federal Income Tax, State of New York Income Tax and New York City Income Tax

- Minimum investment of $100,000 with $5,000 increments thereafter Qualified Institutional Buyers and accredited investors only

- Interest will be payable on January 1 and July 1 of each year, commencing July 1, 2022

- Sized to 50% of Entrance Fee pool

- Anticipated to be redeemed July 1, 2024

- Series 2021E Taxable Entrance Fee Principal Redemption Bonds $6,665,000*

- Interest is NOT exempt from Federal Income Tax, State of New York Income Tax and New York City Income Tax

- Minimum investment of $100,000 with $5,000 increments thereafter Qualified Institutional Buyers and accredited investors only

- Interest will be payable on January 1 and July 1 of each year, commencing July 1, 2022

- Sized to 12% of Entrance Fee pool

- Anticipated to be redeemed October 1, 2023

Use of Bond Proceeds

Project

- Construction of the community

- Working Capital to fund pre-opening and opening expenses

- Debt Service Reserve Funds

- Capitalized Interest during construction

- Financing costs

Security

- Secured by a sub-leasehold mortgage on the property

- Secured by a gross revenue pledge

- Secured by debt service reserve funds

- Secured by an assignment of project documents

- Secured by a $10 million liquidity support fund

Key Financial Covenants

- 1.20x Debt Service Coverage Ratio; tested annually following stabilization

- 175 Days Cash on Hand/Liquidity Covenant; tested semi-annually following stabilization

- Marketing Covenant requiring quarterly step ups beginning with 78% at 12/31/21 rising to 90% by 6/30/24 or approximately 12 months after opening

- Occupancy Covenant requiring quarterly step ups beginning one full quarter after opening and rising to 90% in 4 years

- Cumulative Cash Loss Covenant: testing to begin the full fiscal quarter following the issuance of the Certificate of Occupancy and ending the first full fiscal quarter following stabilization.

We are currently accepting indications of interest for these tax-exempt bonds with an expected pricing the week of October 25, 2021, and anticipated settlement during early November. For more information including risks, please read the Preliminary Official Statement in its entirety. If you have interest in purchasing these bonds, please contact your HJ Sims financial professional as soon as possible.

*Subject to change

No dealer, broker, salesperson, or other person has been authorized to give any information or to make any representation other than those contained in the Preliminary Official Statement and, if given or made, such other information or representation should not be relied upon as having been authorized by the Issuer, the Borrower, or the Underwriters. The information set forth herein has been obtained from the Issuer, Borrower, and other sources that are believed to be reliable, but is not guaranteed as to accuracy or completeness by, and is not construed as a representation of, the Underwriters. The information contained herein is subject to change without notice. Under no circumstances shall this constitute an offer to sell or solicitation of an offer to buy, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Any offering or solicitation will be made only to investors pursuant to the Preliminary Official Statement, which should be read in its entirety. Investments involve risk including the possible loss of principal. HJ Sims is a member of FINRA and SIPC, and is not affiliated with Purchase Senior Learning Community, Inc.

An Exclusive Investment Opportunity: Broadview at Purchase College

**This financing has been successfully closed. Please contact you advisor for any potential secondary market opportunities.**

$392,245,000*

WESTCHESTER COUNTY LOCAL DEVELOPMENT CORPORATION

Revenue Bonds

Purchase Senior Learning Community, Inc. Project

Series 2021

Series 2021A Bonds $213,805,000*

Series 2021B Entrance Fee Principal Redemption Bonds $23,520,000*

Series 2021C Entrance Fee Principal Redemption Bonds $58,730,000*

Series 2021D Entrance Fee Principal Redemption Bonds $89,525,000*

Series 2021E Taxable Entrance Fee Principal Redemption Bonds $6,665,000*

HJ Sims is pleased to serve as sole underwriter for Broadview at Purchase College, a planned senior living community consisting of 174 independent living apartments and 46 villas, 36 assisted living beds and 32 memory care beds on the campus of Purchase College in Purchase, Westchester County, New York.

Purchase College is approximately five miles from White Plains, NY and 25 miles from midtown Manhattan. It was founded in 1967 and one of the 13 comprehensive colleges of the State of New York (SUNY) system.

In 2011 legislation was passed in New York to permit SUNY to enter into a 75-year ground lease for development of Broadview, finding “provision of a senior learning community upon the grounds…is appropriate to further the objectives and purposes of [SUNY].” The legislation mandates that 100% of any rent Purchase College receives from the lease shall be used by the college for student financial aid and full-time teaching positions.

In addition to a wide variety of amenities and commons spaces, the community will include a Learning Commons consisting of classrooms, studios, a dining venue, gathering spaces, and performance spaces for use by Broadview residents and the College community and will be a place where residents, students and faculty can come together for lectures, seminars, performances, mentoring, tutoring and other educational purposes. Arts and cultural opportunities on the Purchase College campus also include the Neuberger Museum of Art, the Richard and Dolly Maass Gallery, and the Performing Arts Center, all a short walk from the Community.

Reach out and connect with Broadview.

This stunning new community will mix a vibrant college environment with senior living premium services and amenities. There will be unique opportunities for intergenerational learning & mentoring.

Broadview residents will become part of a senior living community embedded on the Purchase College campus. The Purchase College tagline ‘Think Wide Open’ will be the guiding principle for Broadview, offering opportunities to cross borders between generations, break down stereotypes and form mutually beneficial and lasting friendships.

Broadview will feature the Learning Commons (pictured above) which will be the fulcrum where students of all ages converge. Classrooms, galleries, studios, a coffeehouse and more will be housed within its expansive premises as Broadview’s hub. Meet, dine, take courses and attend lectures — each day here will present an open invitation to mingle with other residents, students and faculty in life-expanding relationships.

Market response to the new community has been strong with 83% of the independent living units reserved as of September 30, 2021.

In 2014 HJ Sims was selected as investment banker and has been actively involved in the development of the community and structuring this financing throughout the past seven years. In 2018 we raised $15 million in Bond Anticipation Notes for the initial development costs which supplemented a $5 million grant received by the Purchase College Foundation Housing Corporation. For more information about the 2018 financing, please read the full case study.

About the Bonds

- Series 2021A Bonds $213,805,000*

- Interest is exempt from Federal Income Tax, State of New York Income Tax and New York City Income Tax

- Minimum investment of $100,000 with $5,000 increments thereafter Qualified Institutional Buyers and accredited investors only

- Interest will be payable on January 1 and July 1 of each year, commencing July 1, 2022

- First principal payment: July 1, 2027

- Final maturity: July 1, 2056 (multiple maturities offered)

- Series 2021B Entrance Fee Principal Redemption Bonds $23,520,000*

- Interest is exempt from Federal Income Tax, State of New York Income Tax and New York City Income Tax

- Minimum investment of $100,000 with $5,000 increments thereafter Qualified Institutional Buyers and accredited investors only

- Interest will be payable on January 1 and July 1 of each year, commencing July 1, 2022

- Sized to 85% of Entrance Fee pool

- Anticipated to be redeemed July 1, 2025

- Series 2021C Entrance Fee Principal Redemption Bonds $58,730,000*

- Interest is exempt from Federal Income Tax, State of New York Income Tax and New York City Income Tax

- Minimum investment of $100,000 with $5,000 increments thereafter Qualified Institutional Buyers and accredited investors only

- Interest will be payable on January 1 and July 1 of each year, commencing July 1, 2022

- Sized to 75% of Entrance Fee pool

- Anticipated to be redeemed July 1, 2025

- Series 2021D Entrance Fee Principal Redemption Bonds $89,525,000*

- Interest is exempt from Federal Income Tax, State of New York Income Tax and New York City Income Tax

- Minimum investment of $100,000 with $5,000 increments thereafter Qualified Institutional Buyers and accredited investors only

- Interest will be payable on January 1 and July 1 of each year, commencing July 1, 2022

- Sized to 50% of Entrance Fee pool

- Anticipated to be redeemed July 1, 2024

- Series 2021E Taxable Entrance Fee Principal Redemption Bonds $6,665,000*

- Interest is NOT exempt from Federal Income Tax, State of New York Income Tax and New York City Income Tax

- Minimum investment of $100,000 with $5,000 increments thereafter Qualified Institutional Buyers and accredited investors only

- Interest will be payable on January 1 and July 1 of each year, commencing July 1, 2022

- Sized to 12% of Entrance Fee pool

- Anticipated to be redeemed October 1, 2023

Use of Bond Proceeds

Project

- Construction of the community

- Working Capital to fund pre-opening and opening expenses

- Debt Service Reserve Funds

- Capitalized Interest during construction

- Financing costs

Security

- Secured by a sub-leasehold mortgage on the property

- Secured by a gross revenue pledge

- Secured by debt service reserve funds

- Secured by an assignment of project documents

- Secured by a $10 million liquidity support fund

Key Financial Covenants

- 1.20x Debt Service Coverage Ratio; tested annually following stabilization

- 175 Days Cash on Hand/Liquidity Covenant; tested semi-annually following stabilization

- Marketing Covenant requiring quarterly step ups beginning with 78% at 12/31/21 rising to 90% by 6/30/24 or approximately 12 months after opening

- Occupancy Covenant requiring quarterly step ups beginning one full quarter after opening and rising to 90% in 4 years

- Cumulative Cash Loss Covenant: testing to begin the full fiscal quarter following the issuance of the Certificate of Occupancy and ending the first full fiscal quarter following stabilization.

We are currently accepting indications of interest for these tax-exempt bonds with an expected pricing the week of October 25, 2021, and anticipated settlement during early November. For more information including risks, please read the Preliminary Official Statement in its entirety. If you have interest in purchasing these bonds, please contact your HJ Sims financial professional as soon as possible.

*Subject to change

No dealer, broker, salesperson, or other person has been authorized to give any information or to make any representation other than those contained in the Preliminary Official Statement and, if given or made, such other information or representation should not be relied upon as having been authorized by the Issuer, the Borrower, or the Underwriters. The information set forth herein has been obtained from the Issuer, Borrower, and other sources that are believed to be reliable, but is not guaranteed as to accuracy or completeness by, and is not construed as a representation of, the Underwriters. The information contained herein is subject to change without notice. Under no circumstances shall this constitute an offer to sell or solicitation of an offer to buy, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Any offering or solicitation will be made only to investors pursuant to the Preliminary Official Statement, which should be read in its entirety. Investments involve risk including the possible loss of principal. HJ Sims is a member of FINRA and SIPC, and is not affiliated with Purchase Senior Learning Community, Inc.

RSVP for the HJ Sims Women’s Brunch 2021

HJ Sims Women's Brunch to kick off the LeadingAge Annual Conference

We look forward to hosting you at the Women’s Brunch. Registration is required to obtain access to the event. Please RSVP below.

In addition, if you would like more information about our special guest speaker, Kim Hoppe of United Methodist Retirement Communities and Porter Hills or to see where we will be during the conference, please visit our event webpage.

RSVP

HJ Sims Financing Catalysts for Future Growth Video

Senior living organizations may take several approaches to achieving financial success for their communities. However, there are certain strategies that can save time and money, and ultimately execute an effective, long-term and innovative financing solution for any capital needs. These strategies are focused on not only expanding capital and debt capacity, but also driving a lower cost of capital, all to support accelerated and smart growth.

For more information, watch the full six-minute video. Please reach out to our banking representatives with any questions or for assistance helping you find a Financed Right® solution.

Testimonials may not be representative of the experience of other clients and are not indictive of future performance or success.

Find the Right Structure for Your Unique Capital Needs

Advisory Services to Face Challenges or Opportunities

Risk Factors: What you need to know

Risk Factors: What you need to know about Investing in an Exclusive Financing

Investment in municipal securities inherently involves a number of risks to bondholders. Such risks relate to impacts on the following:

- Ability to collect revenues

- Bankruptcy

- Competition

- Employee relations/Labor Issues

- Federal and state regulation of the obligor’s industry

- Parity indebtedness

- Regulatory impacts on operations

- Ability to foreclose upon collateral

- Certain rights and remedies upon default

- Construction-related risks for project financings

- Factors impacting demand for the obligor’s services ɀ Impact of obligor’s 501(c)(3) status and other federal tax matters

- Risks of redemption

- Secondary market risks

For risks specific to any transaction, please refer to the Certain Bondholders’ Risks section of the Official Statement.

Risk Factors: What you need to know about investing in municipal bonds

- Credit Risk – The borrower fails to pay principal and/or interest.

- Interest Rate Risk – The market value of a bond drops when interest rates rise. While default risk is low, municipal bonds are subject to interest rate risk, or the risk that rising rates will lead to falling prices.

- Call Risk – The bonds may be redeemed prior to their maturity date depriving the investors of anticipated potential income.

- Liquidity Risk – The risk stemming from the lack of marketability of an investment that cannot be bought or sold quickly enough to prevent or minimize a loss. High yield bonds in particular are subject to more risk than investment-grade bonds and are generally less liquid and more volatile than investment-grade bonds. There is no guarantee of liquidity.

- Tax Risk – While tax-exempt municipal bonds may provide a tax advantage for some investors in that interest received on the bonds may be exempt from federal and/or state income taxes, there are certain cases where interest may be includible in income for purposes of calculating the federal alternative minimum tax applicable to a particular investor. Furthermore, certain actions or inactions taken on the part of the borrower for the bonds may result in interest paid on the bonds becoming taxable. All prospective investors should seek the advice of their own tax specialist prior to investment.

- Regulatory Risks – The underlying project is subject to various government regulation. Changes in regulatory policies could have an impact on the ability of the investment to operate, the rent they charge, staffing levels and of the expenses that could negatively affect the revenue of the investment.

In general, as for all types of investments:

- All investments involve risk and may result in a loss of principal.

- There is no guaranty of reliable, consistent, predictable income.

- Past performance is not indicative of future results.

- The purchase and sale of securities must be reviewed on an individual basis considering the risk tolerance and investment objectives specific to each investor.

LWC21 Technology Brunch Session

In this session from our 18th Annual HJ Sims Late Winter Conference, in February 2021, thought-provoking insight from an expert panel focused on the role of technological infrastructure, and integration in the flexibility and strength of an organization – important themes for fighting the COVID-19 Pandemic and the future. In this age-qualified industry, technology presents both challenges and opportunities, a few that have been highlighted in this session include:

- Tech Use among Seniors

- Organizational Technological Infrastructure

- Integration of Technology

- Emerging Technologies

Tech Use Among Seniors

The session opened with a general overview of technology usage research conducted by Pew Research Center. Included in this research were several standout statistics. As of 2016, Pew reported that smartphone adoption among surveyed seniors (people aged 65+) had nearly quadrupled from 11% to 42%; the panel echoed that the technology-adoption trend has only continued. Pew also notes affluent and better educated seniors are more likely to report smartphone ownership. However, despite the trends towards technology use amongst seniors, the Pew research points out that technology use was significantly lower amongst seniors aged 75+ compared to their younger counterparts. Transitioning from the use of technology among prospective senior living residents, the panel moved to discussions of the role of technology within senior living organizations.

Organizational Technological Infrastructure

To frame the discussion of organizational technology adoption, Nick Patel used a “Technology Maturity Model” pyramid to represent organizations’ level of technological maturity and adoption. His analysis showed that the fundamental aspect of technology adoption is a solid foundational network and data infrastructure. He defined this as the internet and data sharing networks that allow for layering of more complex data collection and distribution. For example, without reliable and accessible internet, investment in complex resident tracking software is ineffective. For most organizations, the climb to the top of this pyramid can take three to five years.

Shaun Smith noted that the pyramid prototype is the useful to his organization. In relation to Asbury, the organization was able to head off some of the technology stress of the Pandemic to buttress Albright’s technology infrastructure. Nick echoed this sentiment. Organizations which had already begun scaling the pyramid were more prepared to pivot at the onset of the Pandemic.

However, sometimes there are still unforeseen technological challenges. When Asbury staff needed to reach its LIFE Center participants (Pennsylvania’s PACE program) at the onset of the Pandemic, they quickly realized those seniors were largely without access to broadband internet or smart technology. Pivoting, the team at Asbury canvassed door-to-door with iPads. Though it was originally a challenge, the processes they developed are now used to more quickly onboard new residents.

Integration of Technology

An important theme that emerged during the discussion was the human component of technology. AJ Peterson, as a technology solution provider, discussed how their goal is to craft platforms integrating all of the technology tools into the workflow. He highlighted the importance of obtaining feedback from the end user throughout the process of developing a tool. If tools are easier to navigate, and fit the working needs of those using them, they are more likely to be adopted widely. Shaun echoed these sentiments, saying they have found that technology must be human-oriented. Adoption and integration are easier if there is a human connection element on the front-end. Residents and caregivers increasingly adopt the technology if they have human-centered training at the start. AJ also noted the ways in which these tools will continue to shift. Particularly, he discussed the role virtual care would play as part of the larger care strategy. He positioned the question: How does the entire care team engage with residents and family members? They are anticipating growth in the remote patient monitoring space and seeing a shift that emphasizes a wellness-focused model, where risk is identified sooner and mitigated.

Emerging Technologies

The session concluded with discussion related to the emerging technologies impacting the senior space. Whereas some tools, used to reward employees, may somewhat alleviate staffing and expense concerns, other tools, like VitalTech, Trueloo, Apple Watches, and Amazon Alexa, may allow more seniors to stay at home longer. Likewise, Mynd VR, Zoom, Mirror, and other technologies allow seniors new outlets to improve mental and physical health. The panelists all shared interest in how these new technologies would impact the aging space, but they unanimously voiced the need for careful adoption of the right tools versus chasing the newest technology.

For more information, please contact Melissa Messina at [email protected].

For coverage on any of our other conference sessions, please visit our events page.

Panel of Experts

Nick Patel

President

The Asbury Group – Integrated Technologies

Shaun Smith

President & Chief Executive Officer

Albright Care Services

AJ Peterson

Vice President and General Manager

Netsmart Technologies

Replay our 18th Annual Late Winter Conference

LWC21 CFO Brunch Session

In this session from our 18th Annual HJ Sims Late Winter Conference, in February 2021, thought-provoking insight from exceptional financing executives across the non-profit and proprietary segments of the senior living industry was shared in a question-and-answer format. The financial leaders focusing on COVID-19-related challenges and lessons learned during the COVID-19 Pandemic. Highlights include:

- COVID-19’s Impact on Growth Plans

- Ways to generate expense savings to offset the impacts of COVID-19

- Low Interest Rate Environment

- Lessons Learned during the Pandemic

COVID-19’s Impact on Growth Plans

Each organization noted the challenges of acquiring or affiliating with organizations during the Pandemic. However, all organizations believe there will be more acquisition opportunities in 2021, as the Pandemic begins to end. Benchmark Senior Living has seen limited acquisition opportunities throughout the Pandemic, acquiring only one CCRC in the last year. They expect to acquire more properties in the near future, as struggling communities become available for purchase.

Lifespace Communities has focused on redeveloping and/or expanding communities during the COVID Pandemic. Due to the impact of the Pandemic, they had to frequently revisit market studies and reconfigure expansions to meet the current market. Additionally, they have seen more opportunities for affiliations, especially with single-site communities that would like to be part of a strong non-profit system.

While Lifespace is not actively seeking affiliations, they typically bring in communities on a stand-alone basis. Once the community stabilizes, they then merge the community into the obligated group.

Despite the Pandemic, Voralto Senior Living is in growth mode and is actively seeking acquisitions. Voralto believes there are opportunities under all economic conditions. During the next quarter, they anticipate closing on three communities.

Where have you sought expense savings to offset the impacts of COVID-19?

To mitigate the Pandemic’s impact on census levels, senior living providers have had to find various ways to reduce expenses. Voralto has sought to lower staffing and non-resident care expenses. While Voralto has not had to lay off employees, they have seen a reduction in staffing due to a decline in census levels. To lower staffing expenses, they have focused on hiring more part-time staff, conducting cross training and sharing employees between communities. Voralto has lowered non-resident care expenses by negotiating with supply vendors and purchasing PPE in bulk.

Alexia Pozar of HJ Sims has also seen senior living providers lower expenses through reduced staffing. Additionally, she has seen cost savings in the following areas:

- Advertising: Senior living communities have reduced spending on newspaper/mail advertising and often switched to managing their own social media.

- Dining: Reduced costs have been experienced through streamlining menus and managing food waste.

- Activity/Entertainment: Due to Pandemic restrictions, activity expenses have decreased.

- Deferring Capital Improvements: If possible, communities have delayed spending funds on repair and replacement.

- Negotiating with lenders: Many communities have been able to negotiate with their banks on lower interest rates or loan forgiveness due to the Pandemic.

Low Interest Rate Environment

One of the few silver linings during the past year has been historically low interest rates. These low rates have allowed senior living communities to refinance loans, resulting in significant debt service savings. Benchmark Senior Living has benefited as actual interest rates on debt associated with its $1.8 billion portfolio recapitalization are below underwritten rates, allowing Benchmark to offset a large portion of lost revenues due to the Pandemic.

Lifespace Communities has seen its financing options increase due to low interest rates. As a non-profit senior living provider, Lifespace Communities has typically

used fixed-rate, tax-exempt bonds to finance capital improvements. Rates have reached a threshold to where typically non-viable options, such as taxable bonds, have become available. In addition, Lifespace has utilized commercial bank loans to reduce debt service, taking advantage of ultra-low bank rates.

Lessons Learned during the Pandemic

The Pandemic forced senior living providers to face unprecedented challenges, which led organizations to learn valuable lessons for the future. All panelists indicated that valuable staff and team culture often allowed their organizations to overcome the challenges of the past year. Voralto Senior Living and Benchmark Senior Living found that rewarding employees, either through premium pay or other incentives, like providing meals to staff and their families, enhanced employee retention efforts.

Further, many of the panelists gained appreciation of the importance of technology and communication. HJ Sims’ Alexia Pozar noted that the Pandemic required organizations to be transparent and communicate effectively with their staff, residents, residents’ families and vendors/lenders in order to retain staff and residents, calm fears and negotiate new lending terms.

Lifespace Communities learned about the importance of a strong balance sheet and operational results in poor economic conditions. Lifespace had a strong balance sheet coming into 2020, which has allowed the organization to “weather the storm.” Additionally, they noted the importance of strong operational results beyond entrance fees, which are often tied to economic conditions outside the control of the senior living provider.

Lastly, Voralto and Benchmark discovered that they needed the ability to adapt in the early stages of the Pandemic to ensure the operational success of their organizations. To meet new challenges, Benchmark often had management oversee processes that were outside their normal role. Voralto found that they had to quickly to new rules and regulations, ensuring that they could continue marketing efforts and visitations. Pozar found that organizations with strong internal policies and best practices were greatest equipped to effectively adapt and face unforeseen challenges.

For more information, please contact Brett Edwards at [email protected].

For coverage on any of our other conference sessions, please visit our events page.

Panel of Financial Executives

Nick Harshfield

Chief Financial Officer

Lifespace Communities

Alexia Pozar

HJ Sims

Dennis Murphy

Senior Director of Investments

Benchmark Senior Living

Toby Timmermeyer

Controller

Voralto Senior Living

Replay our 18th Annual Late Winter Conference

LWC21 Let’s Hear From the Leaders Session

In this session from our 18th Annual HJ Sims Late Winter Conference, in February 2021, thought-provoking insight from exceptional leaders across the non-profit and proprietary segments of the senior living industry was shared in an open dialogue. The leaders discussed key developments and current trends influencing their organizations. Highlights include:

- Crisis Management and Lessons Learned from the COVID-19 Pandemic

- Staffing Changes During and After COVID-19

- The Need for an Open Line of Marketing & Communications

- Social Awareness

Resilience in Crisis/Lessons Learned

The COVID-19 Pandemic has created challenges previously unseen. Suzanne highlighted the importance of adaptability, and maintaining the ability to pivot quickly to rapidly changing circumstances and state guidance. Tom shared that most communities had disaster recovery plans in place, including Pandemic plans, however had focused largely for events such as hurricanes and earthquakes, with less active preparation for a Pandemic event.

Speaking to recovery, David said that while slow, recovery has started. Beyond the vaccines, there are positive signs. For instance, leads, tours and inquiries are increasing. Both Watermark Retirement Communities and HumanGood communities have seen a significant uptick in web traffic. David acknowledged that recovery has been uneven across regions, in part because of differing local rules regarding the closing of campuses due to positive tests among residents or staff.

Staffing Changes During and After COVID

John stated that COVID exacerbated, rather than created, staffing challenges faced by senior living communities. The question facing organizations is how much of the increase in staff expenses is permanent and which will abate as the Pandemic eases. Tom added he does not expect a return to pre-COVID levels, due to the lessons around infection control, greater customer expectations and the need to increase wages to attract and certain staff. John pointed out better wages for front-line health care staff are necessary on an industry-wide basis, otherwise recruitment will become increasingly difficult. Suzanne added increased fees were previously met with strong resistance from residents. During the past budget cycle however, as the majority of fee increases were funding higher staff wages, Aldersgate encountered little to no resistance. Others also indicated their staff appreciation fundraising efforts yielded record results.

Marketing/Communications

Tom discussed Benchmark’s efforts to maintain an open line of communication with their communities, residents and families. In fact, throughout the Pandemic each community has been sending daily communications regarding the status of COVID-19 on campus. John discussed his organization’s efforts to leverage technology, such as tablets, to advance efficiency while improving resident and team member experience.

Social Awareness

Suzanne shared that socially distanced marches were organized at Aldersgate, with leadership from staff, following the death of George Floyd. These occurred on and off-campus, were attended by staff and residents, and even those in the skilled nursing facility. John offered that their internal conversations with staff showed that while good intentions were recognized, they are not enough, that people of color and LGBTQIA+ staff are looking for actions and outcomes. Further, it was understood that this is a journey, and these efforts cannot be viewed as short-term programs. Suzanne added they should not be called programs, as programs eventually terminate, and these should be permanent changes. John added that piecemeal or one-off approaches often do more harm than good. David pointed out that Watermark was able to leverage experienced gained through an art/training reach-out effort to the LGBTQIA+ community, called “Not Another Second,” to implement training around race relations.

For more information, please contact Andrew Nesi at [email protected] or Curtis King at [email protected].

For coverage on any of our other conference sessions, please visit our events page.

Panel of Industry Leaders

John Cochrane

President & CEO

HumanGood

Tom Grape

Chairman & CEO

Benchmark

David Freshwater

Chairman

Watermark Retirement Communities

Suzanne Pugh

President & CEO

Aldersgate

Replay our 18th Annual Late Winter Conference

HJ Sims Late Winter Conference Introduction Video

Read More about the 2021 HJ Sims 18th Annual Late Winter Conference

Consent for Electronic Delivery of Documents

If you would like to download and save a copy of this communication, please click here.

HJ Sims Capabilities Video

Testimonials may not be representative of the experience of other clients and are not indictive of future performance or success.

Sims Mortgage Funding is a wholly owned subsidiary of HJ Sims.

Find the Right Structure for Your Unique Capital Needs

Advisory Services to Face Challenges or Opportunities

HJ Sims LeadingAge Gulf States Exhibitor Booth Video

LeadingAge Annual Meeting Virtual Experience

Thank You to All Who Joined Us (Virtually)

Women’s Brunch to kick off the LeadingAge Annual Meeting

Thank You to All Who Joined Us (Virtually)

Women’s Brunch to kick off the LeadingAge Annual Meeting

Date: Tuesday, November 10th, 2020

Date: Tuesday, November 10th, 2020

Time: 11:30am – 12:30pm EDT

Details: We look forward to hosting you at our HJ Sims Women’s Brunch.

Registration is required to obtain access to event information, and receive a special token to make our virtual brunch memorable.

If you have not yet registered, please do so using the Registration Form below.

Where: Zoom.

As far as keynote conversations go, we are incredibly grateful for Amy Harrison, Chief Financial Officer, Kendal Corporation. Her story is inspiring, and exemplifies the glass ceilings we are breaking as women leaders. It leaves us with hope for the future. Some highlights from Amy:

- Amy shared her experiences about making career decisions based on personal values and beliefs. And, how important it is to work for an organization and with colleagues that have shared values and beliefs.

- We acknowledge that the last 8+ months have been incredibly challenging on those of us who are working from home; or more accurately…living at work. We are not alone.

- We also acknowledge that while a great number of us are working from home, a great many of the leaders at providers have been practically living at work as they combat this virus on the front lines. We thank you all for the sacrifices you have made and continue to make.

- Let’s keep the dialog going.

Keynote Speaker

Amy Harrison

Chief Financial Officer

Kendal Corporation

We are honored to welcome Amy as she shares her thoughts and perspective on her professional journey.

A certified public accountant and experienced finance executive, Amy has been an integral part of the Kendal Corporation family since 2011 as CFO for Collington, a Kendal-affiliated continuing care retirement community (CCRC) in suburban Washington, D.C. Amy was named Kendal’s CFO in 2016.

Following our dynamic keynote with Amy Harrison, we broke into smaller, more intimate group discussions to share ideas and experiences. Discussions centered around navigating life in our socially distanced times. In keeping with the theme from the LeadingAge Annual Meeting, we shared Dr. Brené Brown’s message, 10 Guideposts for Wholehearted Living, as a foundation for our discussions.