The Bethel Methodist Home, d/b/a The Knolls, is a non-profit Continuing Care Retirement Community located on a 29-acre campus in Valhalla, New York in Westchester County. The Knolls offers a full continuum of care with independent living, assisted living and skilled nursing services on a single campus.

Continue readingMarket Commentary: Narrowing the Distance Between Independence and Constitution Avenues and Us

by Gayl Mileszko

There is only a week to go until the Inauguration of our 46th President. The weather forecast for January 20 is for a partly cloudy day with temperatures in the mid-40s. But other conditions are not so favorable for this time of year and for these traditional American quadrennial ceremonies in which we all ask for God to bless America. The pandemic has already nixed most of the festivities that have accompanied the swearing-in since 1805, including celebratory inaugural balls and parades. But now in the wake of the storming of the U.S. Capitol on January 6, law enforcement is on the highest possible alert. The FBI is warning about armed protests at all 50 state capitals in the days leading up to the recitation of the oath of office by the Chief Justice. Fifteen thousand National Guard troops are being deployed to the historic grounds that lay between Independence and Constitution Avenues, the People’s House.

Two hundred thirty miles away on Wall Street, markets have barely flinched over these events. Many months ago, markets baked in assumptions of a peaceful transition of power. Investors and traders, as good at counting votes as any party whip, were unfazed when the House of Representatives approved articles of impeachment against the 45th President on December 18, 2019. They are again unfazed by this Wednesday’s vote in the south end of the Capitol. Dozens of major U.S. companies have responded with pronouncements that they are suspending political donations to some or all Members in the upper and lower chambers. Insiders understand that these bans are largely toothless as no one is fundraising at this part in the cycle with more than 660 days to go to the next election. Time and time again, we find that a lot not only can but does change in two years.

Since the start of the year, not a lot has changed in the financial markets. Prices on most assets are still extremely elevated, and rallies continue across most sectors on the expectation that additional fiscal stimulus will speed up our economic recovery. Although bonds have slightly weakened since the Georgia elections turned Washington “light blue”, as pundits label the razor thin Democrat majority in D.C., yields remain in historically low ranges. With expectations for even heavier federal spending. additional borrowing, and higher taxes, intermediate and long U.S. Treasury yields have jumped by about 24 basis points. This moved the 10-year past a 1% touchstone, but bear in mind that this yield exceeded 3.80% ten years ago. The 10-year yield is at 1.14% and the 30-year at 1.88%. The 2-year is relatively unchanged at 0.14% so far in 2021. It goes without saying that all these yields are producing negative real returns for investors.

The prices of all bonds are linked in some manner to Treasuries. So as government prices have dipped, BAA Corporate 10-year benchmark yields have risen by about 17 basis points to 2.82%. These rates nevertheless remain at historic lows, so corporate borrowers are still lining up for market entry. And both investment grade and high yield corporate bond issues cannot come fast enough to satisfy domestic and foreign demand. High yield sales total $13.2 billion so far this month with orders exceeding offers by more than three times, while investment grade issuance is already at $55.6 billion with recent trades more than 2.4 times covered. Corporates have clearly been buoyed by stock prices. At this writing, the Dow, S&P 500, and Nasdaq indices are each up about 1.2% this year while the Russell 200 is up nearly 6%. Oil is up more than 7%, but gold prices have fallen more than 2% and silver prices are off by nearly 5%. Among digital currencies, Bitcoin has been extremely volatile but is up nearly 15% in 2021.

Municipal bond yields have also inched higher since the start of the year, but Bloomberg is reporting that valuations are currently at record highs. The ratio of top-rated tax-exempt yields to U.S. Treasuries at 67% is the lowest since 2001, a huge drop from where it stood ten months ago at 215%. The 2-year AAA rated general obligation bond MMD benchmark at 0.15% is largely unchanged from last month. The 10-year and 30-year benchmarks have added 7 basis points and stand at 0.78% and 1.46%, respectively. Imagine that: top rated borrowers are still getting rates of under 1.50% for maturities in 2050! These are fantasy conditions still prevailing for most non-profit borrowers. For lower-rated and non-rated sectors, there are few deals so far this year to help us gauge the market. The Illinois Finance Authority brought a $26.6 million non-rated deal for the McKinley Foundation with a single 35-year maturity priced at par to yield 5.125%. The Wisconsin Public Finance Authority sold $6 million of non-rated bonds for St. Francis College in Brooklyn at par to yield 5.50% in 2024.

Investors cannot source enough tax-exempt product as many state, local and non-profit borrowers are taking advantage of low rates prevailing in the taxable and corporate bond markets to refinance higher coupon bonds. The 115th Congress removed the ability of tax-exempt borrowers to refund most long-term debt at tax-exempt rates, but many in the muni market hope that the 116th Congress will appreciate the urgent pleas from non-profits who are lobbying to restore the authorization and allow them to refinance outstanding debt at these extremely low rates. Record levels of taxable issuance would likely decline if, as some predict, tax reform legislation is enacted later this year or next with a provision restoring the exemption. This would significantly increase the supply of traditional munis for those looking to offset potentially higher individual tax rates.

We at HJ Sims are looking forward to this new year and cheer those states with the safest, most rapid and successful vaccine rollouts for health care workers, long term care residents and those greatest at risk of contracting the coronavirus. Along with our investors, we simultaneously root for those entrepreneurs and manufacturers of cost-effective air and surface cleaning and filtration technologies. While we share the concerns of millions over the civil unrest, the key but often controversial role of social media, the prospect of inflation, the status of mortgage, rent, student loan and other delinquencies, our growing federal and state debts and deficits, and the unprecedented year-long financial stress on most every non-profit and for-profit enterprise, we pause to count our many blessings and pledge to make our voices heard even louder this year.

For more than 85 years, we have worked with colleagues in our industry to improve market access for our borrowers, market intelligence for our investors, and public understanding of the key role that the municipal market has in facilitating essential purpose project financings. We are proud of our role in helping to originate the quintessential social good bonds and encourage our readers to join us in working collaboratively to provide and protect the safest living and learning options for our seniors, our disabled, and our young going forward. Please contact your HJ Sims representative to share your thoughts on how we can collectively enhance our advocacy on behalf of our country’s greatest needs in 2021.

Exclusive Opportunities For Our Clients

The 19th Annual HJ Sims Late Winter Conference

Financing Methods & Operating Strategies in the Senior Living Industry for Non-Profit and Proprietary Senior Living Providers

Our 19th Annual HJ Sims Late Winter Conference examined trends and developments critical to the success of senior living communities. An extensive and thoughtful agenda was compiled to address financing methods and operating strategies that can help alleviate existing challenges and encourage continued growth in the non-profit and proprietary sectors of our industry. Throughout the conference, we delivered a dynamic group of speakers and experts committed to sharing thought-provoking views and providing profound insight.

Help us make the next Late Winter Conference even more successful by completing our feedback survey. We very much appreciate your input.

Photos

View the many beautiful photos from our conference in the galleries below. Click on each album to see all of the photos from the event.

For attendees who updated their professional headshots at the “Headshot Hub,” please contact Rebecca Brady to access your headshot.

Conference Details

Save the Date

The 20th Annual HJ Sims Annual Conference will be held in Sarasota, Florida. Stay tuned for dates and more information coming soon. We can’t wait to see you there!

For more information, please contact Rebecca Brady.

Market Commentary: Tinkering with Time

by Gayl Mileszko

Speed is of the essence when it comes to delivering vaccines, election outcomes and aid to unemployed workers and locked down businesses. There are ways to measure baseball’s fastballs, touchdown sprints, and high-frequency trading executions. But some gauges can be a bit tricky. The speed of the Earth’s rotation, for example, varies constantly due to the motion of its molten core, oceans and atmosphere, as well as the impact of celestial bodies like our moon. Tides and the change in distance between the Earth and the moon all make for daily variations in the speed the planet rotates on its axis; even heavy mountaintop snow that melts in summertime can cause a shift. Given all the unprecedented events of 2020 around the world, it should come as no surprise that our Earth has literally been spinning unusually quickly of late. In fact, the shortest day on record was July 19, when the planet completed its rotation in 1.4602 milliseconds less than usual. Records were broken 28 times last year and the Earth in 2021 looks to be moving at an average daily pace that is 0.5 milliseconds faster than the standard 24 hours.

In recent decades, the Earth’s average rotational speed had been consistently decreasing. Scientists at the Paris-based International Earth Rotation Service who monitor the planet’s rotation inform countries six months in advance when “leap seconds” need to be added to align with solar time. And, since the 1970s, official timekeepers have made 27 adjustments to keep atomic clocks in sync with the slowing planet. Most recently this occurred on New Year’s Eve in 2016. Now, for the first time on record, a negative leap second may be needed. The World Radiocommunication Conference members will make the decision when they next meet in 2023.

A more common standard measure of time, the Gregorian calendar, has been in use since 1582 and has just flipped into 2021. But for some, the new year began on December 14 when the first health care workers and nursing home residents were administered the Pfizer-BioNTech COVID-19 vaccine. Four days later, the U.S. Food and Drug Administration authorized a second vaccine from Moderna for emergency use. The two mRNA vaccines have shown remarkable effectiveness of about 95% in preventing COVID-19 disease in adults when given in two doses at 21 days and 28 day intervals, respectively. At this writing, 4.56 million Americans have received injections. All of us on Main Street and Wall Street are closely monitoring the rollout of this historic mass vaccination program, fervently hoping that it puts an end to the illness and loss suffered here and around the world.

Although there is federal guidance and $8 billion of federal funds, states are responsible for running the COVID-19 vaccination campaigns and prioritizing residents. There have been issues with public information as well as with storage, handling and administration of the doses. There is also an issue of public confidence. Not everyone is anxious to get the vaccine. Many have adopted a wait-and-see approach. The sheer number of healthcare workers and long term care residents at the head of the line means that there will be many months before others become eligible. Some have objections on religious grounds. More than 20.8 million Americans have already had the coronavirus; those who have recovered may believe that they have some level of immunity. Some cite concern over the speed with which the vaccines were developed and are worried about potential side effects. Those who look in the rearview mirror can find mis-steps on the part of the federal, state and local officials and may distrust the ability of elected and unelected government workers to handle anything having to do with the pandemic. Some find the matter political, others are skeptical of the big pharmaceutical companies who are benefiting financially from the rush to market. For those with cognitive issues, consent procedures can prove vexing.

As the majority await evidence of the effectiveness and safety of the vaccines, entrepreneurs are hard at work on other approaches. Some nursing homes, hospitals, restaurants and cruise ships are installing air purifying systems using needlepoint bipolar ionization technology to disrupt surface proteins of viruses and bacteria, and de-activate harmful pathogens. Hotels, schools and offices are installing ultraviolet light emitting diodes in heating and cooling systems to disinfect surfaces, ventilation and water systems. These technologies, or others yet to come, may also help to generate public confidence and resurrect businesses and institutions severely damaged by the pandemic and related lockdown policies.

Long-term care facilities have experienced significant drops in occupancy as a result of the deadly toll that the coronavirus has taken on the frail elderly population. Some 40% of all reported COVID-19 deaths are said to have occurred in nursing homes. Rebuilding public confidence in the safety of these care communities is critical to the industry and will, in many cases, require considerable time and plenty of documentation and testimonials. Providers are exploring the expanded use of infection preventionists, recommending changes to Medicaid reimbursement rates to boost the salaries of their health and personal care workers, and working to develop improved regulatory reporting procedures.

While nursing homes, assisted living, and memory care facilities may take longer to return to pre-coronavirus levels, other battered sectors of the economy are primed to reverse if not soar once herd immunity appears imminent, federal and state efforts meet with widespread support, and vaccines and technologies are proven successful. When does that happen? There is a colloquial expression attributed to Supreme Court Justice Potter Stewart: “I know it when I see it” that described his threshold test for obscenity. This is the type of test we will apply to determine in our own non- epidemiological ways when the end to this hideous pandemic is near. It will involve a combination of federal and state pronouncements, toned down and redirected media coverage, personal anecdotal experience, and the emergence of green shoots in our respective neighborhoods.

Industries most impacted by the pandemic stand to gain the most in a world about to be restored to something akin to the 2019 version of “normal”. In the interim, and for the foreseeable future, rallies are unlikely to abate in markets for industries proven essential to day-to-day, stay-at-home life in the past year: grocery stores, pharmacies, home improvement, on-line retail sites with rapid home delivery service contracts, information technology, household durables, fast food restaurants, agriculture, farm equipment, personal and health care supplies, key ports serving cargo ships, vacation rentals, recreational vehicles, golf-related products, testing services, cybersecurity, defense and other key domestic manufacturing, utilities, water and sewer, solid waste, affordable housing, technical schools, alcohol and tobacco.

Investors with cash and foresight will look to position portfolios for a post-COVID-19 economy. We will look to capitalize on the slow but sure rebound in oil and gas exploration and storage, steel, energy equipment and services, larger hospital systems, health care technology, banks, life and health insurance, property and casualty insurance, and toll roads with steady commercial traffic. In addition, steady reversals over time should occur in homebuilding, automobiles, aerospace, public colleges and universities. Among the sectors likely to take the longest to improve as there have been major and perhaps irreversible shifts in remote work and recreational choices. Our lives have changed in major ways since March and therefore partial rebounds will likely lag for airlines, hotels and resorts, rental cars, textiles and apparel, beauty products, mass transit, parking, casinos, gyms, cinemas and theaters, convention and sports venues, finer dining restaurants, jails, small private colleges, student housing, and commercial real estate.

Scrutinizing the relative differences in fundamentals including governance, geography, balance sheets, and COVID-19 case and death statistics, will take time but will pay off for well-advised investors. Regular and transparent reporting by for-profit and non-profit entities is required. Few of the old precedents apply; last year brought dozens and dozens of new pre-packaged bankruptcy cases with unexpected outcomes for senior bondholders having less than majority votes. Changing consumer preferences and potential new regulations are bound to adversely impact holdings, including certain media. Population shifts are underway. Some entities have significantly diluted equity and incurred strangling debt loads. Governments at every level will need to re-prioritize budgets given the costs of debt service and urgent social and infrastructure needs. Underfunded pensions and other post-employment benefits may threaten future general obligation bond debt service as well as interest and principal on state and local revenue bonds with weak security protections.

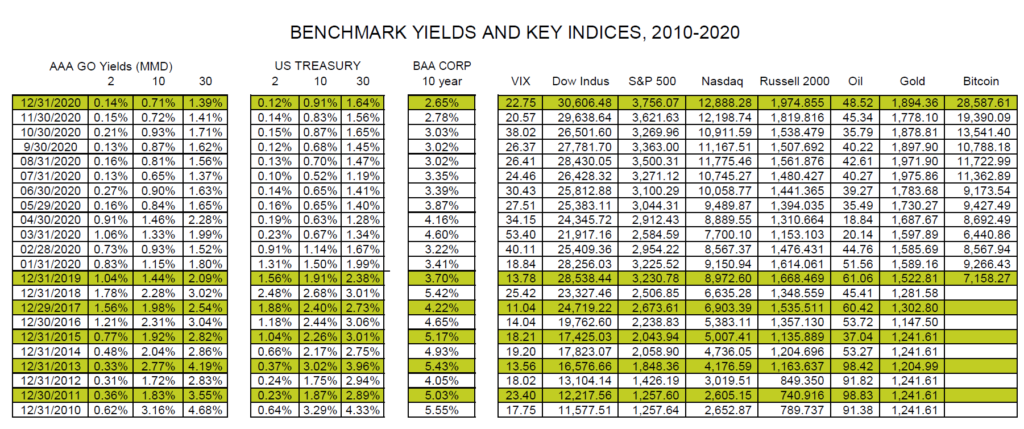

For bondholders, 2020 was a year in which fixed income was largely redefined as lacking income. Top-rated 30-year yields dipped well below 1.40% for tax-exempts and 3% for corporates. Even below investment grade and non-rated municipal and corporate securities sold at premium prices producing yields well below 5%. The chart below depicts 12 months of declining yields and illustrates the decade long decline in benchmark bond yields. It also reflects the significant volatility and gains in the stock and commodity markets, and the growing acceptance and risky participation in digital cryptocurrency markets.

Source: Bloomberg; Thomson Reuters Refinitiv

At the start of the new trading year, starting valuation levels for stocks and bonds are extremely high. Traders have been expecting prices to normalize for years and years; seasoned ones understand that this is bound to happen at some point. But our Federal Reserve has intervened in the markets for the past 12 years now and it is unclear when we should expect them to back away from hyper-accommodative policies. Central banks were the quickest to respond to the pandemic by creating and supporting liquidity facilities for every domestic market and some foreign ones as well. Their balance sheets have exploded. Few can argue with the value and timing of their tinkering. How and when they unwind, and with what impacts, are questions not faced before in our history. How our fiscal leaders respond after the past rounds of stimulus at a time when the debt and deficit are at levels not before seen is another question that investors, domestic and foreign, pose.

Gauges of sentiment from organizations including the American Association of Individual Investors, show bearishness at multiyear lows despite the global surges in COVID-19 cases, questions over the origins of the virus, and uncertainty over U.S. elections and various national policies. The major near-term risks to the financial markets include larger-than-anticipated increases in inflation rates, increases or decreases in zero-range and negative interest rates, downgrades in sovereign credits, a lower dollar, increased regulatory action, and any unexpectedly large defaults in the corporate, mortgage, and muni space.

2020 will go down in multiple record books. We saw the first president to be impeached and then run for reelection. Both the presidential candidates won more popular votes than any other in our history. We suffered the largest GDP quarterly decline followed by the largest quarterly increase, and witnessed a record-breaking single year increase in the national debt and market swings we could barely stomach. A quarter of U.S. adults say they or someone in their household has been laid off or lost a job because of the coronavirus outbreak, and 32% say they or someone else in their household has taken a pay cut due to reduced hours or demand for their work.

The $3.97 trillion muni market saw $474.05 billion of issuance in 12,940 deals in 2020 compared to $426.35 billion in 11,596 transactions in 2019 and setting a new record. Add to that private placements, corporate CUSIPs, and direct bank lines of credit which took so much tax-exempt paper out of the market and failed to satisfy a relentless demand. Corporate CUSIPs grew 223% over 2019 and landed at $40 billion for the year. The general muni market returned 5.26%, a seventh straight year of gains. High yield munis ended higher by 4.8%. Taxable munis with $140 billion of primary market sales closed up 11.82%. Zero coupon bonds were up 8.88%. Investors added about $33 billion to municipal bond mutual funds and the oldest gauge of municipal yields, the Bond Buyer 20 General Obligation Bond Index, which tracks yields on 20-year munis, touched 2% on Aug. 6, the lowest since 1952.

A record $1.75 trillion of investment grade corporate bonds was sold in 2020. High yield corporate issuance ended the year with approximately $432 billion of record issuance. The U.S. High Yield ICE BoAML Index ended the year up 6.17% and at all-time low yields of 4.18%. The U.S. Investment Grade corporate bond Index ended 2020 with returns of + 9.81%, a record; $1.75 trillion of new debt was sold in 2020.

A new year has begun and it is time to tinker with your portfolio. We at HJ Sims hope that 2021 brings only happy, healthy and prosperous days for you and your family. To that end, we encourage you to be in regular contact with your HJ Sims financial professional, to carefully add individual high yield credits we recommend to select income portfolios, to limit exposure to certain bond funds and ETFs, to consider preferreds, convertibles, zeroes and and taxable munis for retirement accounts, to prepare to take best advantage of the re-opening of our economy, to build up your emergency funds, to ensure that all your affairs are in order, to revise your monthly budgets, and to appreciate all the people, moments and little things that we took for granted at this time just one year ago.

Exclusive Opportunities For Our Clients

Market Commentary: Tidings of Comfort and Joy

by Gayl Mileszko

The holidays are upon us so this is the last full trading week of December and our last market commentary of 2020. We sigh because this year on the trading desks there is none of the usual cheerful talk about travel plans, baby gifts, and family gatherings. In fact, the trading desks are vacant as they have been for the last 10 months. Like others in so many industries, our fixed income traders have been hard at work in home offices in New Jersey, Massachusetts, Florida, North Carolina and Virginia, communicating by Skype and cell phone, email and Bloomberg, Webex and landlines for most of the year. Like our banking, sales, and operations teams in Connecticut, Texas, Pennsylvania, Maryland, Illinois, Minnesota, California and Puerto Rico, they have juggled busy work and home lives without missing a beat in serving our valued clients thanks to their professionalism and our marvelous tech staff. And, like the rest of us, they are united in their desire for the next two weeks to be joyful and peaceful ones, grateful for the opportunity to count blessings with loved ones and count down to a brand new year, a turnaround year for our economy and the people, businesses, schools, institutions so badly hurt by the pandemic.

In Washington, these are the final days of the 116th Congress, a lame duck session. As is typical for this time of year, lawmakers are late in trying to hammer out the details of the $1.4 trillion omnibus government spending bill for the fiscal year that began on October 1. They are also moving toward an agreement on that frustratingly elusive second stimulus to bring relief and some measure of comfort to small businesses and non-profits, the unemployed, those in health care and education, and all in need of vaccinations. Main Streets are quiet, pedestrians and decorations are sparse. Households are advised to limit holiday celebrations, order gifts on-line, reinvent caroling, and Zoom with Santa. It is only on Wall Street where things jingle as the Fed-fabricated Santa Claus rally which began in late March is still underway.

This has been a year like no other. The world experienced its first deliberate policy-induced recession in a concerted effort to suppress the spread of a virus. Governments took control over almost every aspect of life and corner of the world. There have been tragic losses. As the brightest minds, the largest dollars, and highest priorities have been devoted to finding treatments and vaccines, negative rates continue to dominate global markets, and government borrowing has risen to mind-numbing levels. But U.S. stocks and bonds have had a wonderful life. The usual correlations are askew and returns disconnected from the reality experienced by billions around the globe. Central banks have opened wide all the money spigots. Their massive asset purchases have created some artificial markets. The Bank of Japan, for example, has become that country’s largest single owner of equities. Here, the target federal funds rate was lowered from the target of 1.50-1.75% at the start of the year to 0.00-0.25% on March 16 and appears likely to remain in that range for several more years. Our Fed has been buying $80 billion a month in Treasuries and $40 billion in mortgage securities since June. Within a very short period, they created and ran 11 new funding, credit, liquidity and loan facilities supporting everything from commercial paper to corporate and municipal bonds to foreign monetary authorities. As a result, market confidence has soared and new issuance and performance records have been set and re-set.

At this writing, the Dow has risen more than 4.6% this year to surpass 30.000. The S&P 500 is up nearly 13% to 3,647. The Russell 2000 has gained almost 15% and stands at 1,913. The Nasdaq has been the biggest winner at 12,440 with gains of more than 38%. More than $140 billion has been raised in nearly 400 initial public offerings this year, exceeding the last full-year high in 1999 during the dot-com boom. Volatility has flared and abated throughout 2020 on lockdown, vaccine, election, Fed, and stimulus news. The VIX currently stands at 24.72 after starting the year at 13.78 and hitting a high of 82.69 on March 16. In the commodity markets, oil prices have fallen 23% from early January but have now steadied in the $47 range after sinking to the unheard of negative $37.63 on April 20. Gold prices are up 20% this year to $1,828 but rose as high as $2,060 on August 6. Bitcoin is among the year’s biggest winners, having advanced 167% to $19,135.

In the bond markets, debt issuance has surpassed expectations and smashed records. With interest rates at historic lows and liquidity needs at all-time highs, issuance has soared. Investment grade companies have sold about $1.7 trillion in the primary market, a new record. High yield corporate debt sales have exceeded $428 billion. Municipal bond issuance at roughly $425 billion will likely exceed the records set in 2007 and 2016. In the global flight to safety, investor demand for short Treasuries brought yields to new lows. When adjusted for inflation, many yields turned negative. The 3-month Treasury yield stands at 0.08%. The 2-year yield has plunged 93% from 1.56% to 0.11%. The 10-year Treasury yield at 0.89% has been cut in half and since the start of the year. A new 20-year Treasury bond began trading on May 21 and currently yields 1.47%. And the 30-year yield is down 32% from 2.38% to 1.62%. In the corporate bond market, 10-year BAA rated bond yields have fallen 100 basis points to 2.70%. In the tax-exempt space, mutual funds have seen inflows of $31.1 billion and muni ETF’s have taken in $13.1 billion. AAA muni benchmarks have all toppled more than 70 basis points. The 2-year MMD has fallen by 86% to 0.14%, the 10-year is down 51% to 0.70, and the 30-year at 1.38% is 34% lower than where it began the year at 2.09%.

Years from now, when rates eventually rise, we look back and marvel at the low rates available to borrowers and the miniscule yields confounding investors from households to mutual funds, life insurers, banks and foreign buyers. Last week, the Puerto Rico Aqueduct and Sewer Authority was able to sell $1.37 billion of non-rated bonds at a premium to yield 4.15% in 2047. New York’s JFK International Airport sold BBB rated bonds for the Terminal 4 project yielding 2.11% in 2042 last week. Scholarship Prep Schools in California sold non-rated bonds at 5.00% in 2060. The University of Connecticut just issued $279 million of A1 rated bonds yielding 1.69% in 2041. HJ Sims brought a $30 million financing through the Westchester County Local Development Corporation for The Knolls continuing care retirement community in Valhalla that we structured with noon-rated bonds due in 2055 priced at a premium to yield 4.90%

Investors who have been in the market all year have done very well across asset classes. On top of all the gains in the equity market, U.S. Treasuries are up 8.28%, high yield corporates 4.2%, investment grade corporates 9.3%, convertibles 44.3% and preferreds 5.1%. Municipal bond indices are up 4.99% and within the muni sector, taxable bonds are up 11.52%, and hospital bonds are returning 6.05%. High yield munis are up 4.48% and are likely to be among the stars of 2021.

Before the year comes to a close, we have the 13th and final Federal Open Market Committee meeting of 2020, data releases on retail sales, housing starts, home sales jobless claims, inflation, spending, consumer sentiment. We approach the end of 2020 with sadness over coronavirus losses and angst over the damage wrought on our nation. There are 10.7 million unemployed, and 17 million behind on rent and mortgage payments. Just two months into the new fiscal year, our federal deficit totaled $429.3 billion. The national debt at $27.4 trillion amounts to $218,704 per taxpayer. U.S. corporations owe more than $10.5 trillion to creditors in the form of loans or bonds. Household debt stands at $14.35 trillion.

But we end on a merry note, with the hopes of millions resting in small doses as one vaccine is being delivered to hospitals and nursing homes, and another one is nearing FDA approval. We will be back in a few weeks to take a look at the some of the market-moving trends carrying us into 2021. For now, all of us at HJ Sims simply wish you and yours a joyful holiday season with all the comforts of home and family, and only healthy and successful days in the new year.

Exclusive Opportunities For Our Clients

Blakeford at Green Hills

The Blakeford at Green Hills Corporation is a non-profit, 501(c)(3) Tennessee corporation, which owns and manages The Blakeford at Green Hills (“BGH”), a Life Plan Community that offers independent living, assisted living and skilled nursing services to its residents on a single campus.

Continue readingMarket Commentary: Cascades and Stratovolcanoes

by Gayl Mileszko

The Cascade Mountain range, named for the great cascades found near the Columbia River Gorge on the Oregon-Washington border, extends for more than 700 miles from Lassen Peak in northern California through the Fraser River in southern British Columbia. The highest peaks in the range include Mount Hood and Mount Ranier. These mountains are part of the Pacific Ocean’s Ring of Fire where nearly 90% of the world’s largest volcanic eruptions occur. There are said to be 452 volcanoes in the Ring, and they fall into three main kinds: cinder cones, shield volcanoes, and composite volcanoes. The latter, also known as stratovolcanoes, have steep profiles and periodic explosive eruptions with swift, avalanche-like, ground sweeping pyroclastic flows of gas and rock, steam and water. Of the three types, stratovolcanoes pose the greatest hazard to civilizations.

Forty years ago, the most deadly and economically destructive eruption in U.S. history occurred at Mount St. Helens in Washington, a stratovolcano located 96 miles south of Seattle. On May 18, 1980, an earthquake caused the entire north face to slide away, creating the largest landslide ever recorded on Earth. An eruption column rose 15 miles into the atmosphere and deposited ash in 11 states and 2 Canadian provinces. The debris avalanche was of such proportion that it would fill all 32 NFL stadiums in the country 31 times over. In total, Mount St. Helens released 24 megatons of thermal energy. Approximately 57 people were killed, hundreds of square miles were reduced to wasteland, and damages exceeded $2.7 billion. President Carter surveyed the damage and said that the area looked more desolate than a moonscape. Two years later, President Reagan designated the area as the Mount St. Helens National Volcanic Monument, to be used for research, education and recreation. Although seismic activity continued there for the next 28 years, hundreds of thousands still visit.

In 2020, the impacts from the coronavirus pandemic continue to cascade. In the state of Washington alone, cases total 184,404 and deaths total 2,941 as of December 7. More than 24% of staffed adult acute care hospital beds there were occupied by suspected and confirmed COVID-19 patients. The Institute of Health Metrics and Evaluation at the University of Washington projects that, without a vaccine rollout or the re-imposition of social distancing mandates, global cases will peak on January 20. As we approach the end of a deadly and destructive year, one in which several entire industries have been laid to waste and nearly every sector of the economy has been damaged, we cling to more optimistic projections for 2021.

Financial markets trade on expectations and we have seen irrepressible optimism since late March lows. We do not know the exact timing, but we can visualize the return of students to campus and fans to stadiums, the rescheduling of facelifts and knee surgeries, the booking of business flights and hotel stays, the pampering at spas, celebrations at restaurants, train trips to shop in the city, and booms in Boomer generation searches for dynamic life plan communities. The city streets may be desolate right now, but we are thinking long-term, venturing out of our cocoon havens, and willing to assume some investment risk because we know there will be a massive recovery, an economic and ecological regeneration such as the one that occurred at Mount St. Helens after the big blast. During the first week of trading in December, the Dow is up 1.5%, having broken through the 30,000 level, the S&P is up nearly 2% to 3,691 and the Nasdaq has gained 2.6% to 12,519. Oil is up 1% to $45.76 a barrel and gold prices have risen 5% to $1,865. So far this month, 10- and 30-year Treasury yields have climbed 10 basis points to 0.92% and 1.67%, respectively, while 10-year BAA rated corporate bond yields have dropped 6 basis points to 2.72%. Top-rated municipal bond yields have held steady at 0.72% for 10-year maturities and 1.42% for the 30-year primarily due to the lack of supply and demand for tax-exemption.

HJ Sims is in the market this week with a $30 million financing for The Bethel Methodist Home, better known as The Knolls, an entrance fee community with assisted living and skilled nursing in Valhalla, New York. The non-rated transaction is structured with a tax-exempt and taxable series and has a 35-year final maturity. Market demand for higher yielding maturities is exceptionally strong, supply has been light, and borrowers have been rare beneficiaries. Last week, three muni deals with Baa3 or BBB-minus rating came to market with 5% coupon bonds due in 35 years: the Glendale Industrial Development Authority brought a $90.7 million issue for Inspirata Pointe at Royal Oaks in Sun City, Arizona that priced to yield 3.58%; the Maryland Economic Development Corporation had an $80.8 million deal for student housing at Morgan State University yielding 4.09%; and the California Enterprise Development Authority sold $55.9 million of student housing revenue bonds for San Diego State University that yielded 3.02%. The Public Finance Authority of Wisconsin issued $37 million of Ba1 rated bonds for Charter Day School in Leland, North Carolina yielding 3.81% in 2055. And the Utah State Charter School Finance Authority sold $8.2 million of non-rated bonds for Paradigm High School structured with a 2051 maturity that priced at par to yield 5.125%.

There are technically three weeks remaining for issuers to access the markets, but one week from Friday trading and sales will wind down for the year. As you finalize your 2020 tax planning and plan your strategies for next year, we invite you to contact your HJ Sims partner today for guidance and recommendations tailored to your specific profile and needs. In the meantime, for all those celebrating the Festival of Lights, we wish you and your families the warmth of joy, the sparkle of health, and the glow of happiness and prosperity.

Exclusive Opportunities For Our Clients

Jefferson’s Ferry

HJ Sims has been privileged to work Jefferson’s Ferry since we underwrote its initial bond financing in 1999 followed by a refunding of the construction financing in 2006. We have also worked with members of the executive management team prior to them joining Jefferson’s Ferry.

Continue readingMarket Commentary: Shell Shock

by Gayl Mileszko

Ecdysis, commonly called shedding, occurs when a lobster extrudes itself from its old shell. Unlike animals that are soft-bodied and have skin, a lobster’s shell, once hard, will not grow much more. But all forty species of lobster continue to grow throughout their lives, so when the shells become hard and inelastic they must be shed. This happens periodically. As a result, lobsters spend much of their time preparing for, or undergoing ecdysis and arranging safe burrows for the time it takes for the new shell to harden. The overall process of preparing for, performing, and recovering from ecdysis is known as molting. Lobsters molt five or six times in the first season, but the length of time between molts increases as the lobster ages such that an adult will molt only once or twice a year and females may go two years between molts when they are carrying eggs. Many factors including water temperature, food supply, and availability of shelter control when and where a lobster will molt. The actual shedding process only takes the lobster twenty or thirty minutes, depending on environmental conditions and the size of the animal, but this is when it is most vulnerable to predators.

The start to a new decade has made clear our vulnerabilities as well as our adaptability. The predator, a pandemic, has caused us to shed our plans, routines and ways of thinking. Many of us have experienced a sea change in how and where we live, work, travel, learn and communicate. The only constant is change and, in 2020, it has been sudden and massive. The impacts have certainly varied. Some individuals, institutions, communities and systems are well along in the recovery process while others have been shell shocked and suffered painful losses, or still remain in the burrow. There are less than thirty days left in the year and yet we cannot be sure how it will end and what comes next. There are still so many variables – including political, social, scientific and economic ones — at our local, state, national, regional, and global levels.

The financial markets have enjoyed favorable environmental conditions and year-long shelter from central banks. This in and of itself is shocking as is our expectation that it rallies will continue ad infinitum. In spite of global upheavals and tectonic shifts in demand, manufacturing, distribution, and technology, stock and bond markets have been in rally mode for all but about five weeks this year. Stock market volatility as measured by the VIX CBOE Index has risen from 13.78 to 20.57, but it is down 83% from the peak level of 82 in mid-March. So far in 2020, the Nasdaq is up 36%, the S&P 500 is more than 12% higher, the Russell 2000 is up 9%, and the Dow has gained nearly 4%. More than $140 billion has been raised in approximately 383 initial public offerings, exceeding the full-year record high set during the peak of the dot-com boom in 1999. The BAA corporate benchmark yield has dropped 92 basis points to 2.78%. Investment grade corporate issuance is well over $1.7 trillion and high yield corporate bond issuance exceeds $400 billion so far this year. After rising to record highs and dipping again, gold prices are still up 17%.

On the bond market side, the 2-year Treasury yield has fallen from 1.56% to 0.14%. The 10-year yield has dropped from 1.91% to 0.83%. The 30-year yield is down 82 basis points to 1.56%. The AAA municipal tax-exempt benchmark yield has fallen from 1.04% to 0.15%, the 10-year from 1.44% to 0.72%, and the 30-year from 2.09% to 1.41%. Municipal volume is on track to smash all records this year as borrowers have clawed or rolled their way to market to secure funds to undertake new, renovation and expansion projects, bolster liquidity, and refinance outstanding debt at low rates, often including low corporate and taxable rates.

Although the municipal calendar shrank to the smallest of the year at $18.8 billion in November as issuers elected to avoid possible volatility surrounding the elections, year-to-date issuance exceeded $440.8 billion as of November 30. Muni price performance has recently been the best in three decades. Among non-rated senior living deals priced in the past few weeks, Wesley Communities of Ohio brought a $69.5 million transaction with a final maturity in 2055 priced at 5.25% to yield 5.09%. St. Andrews’s at Francis Place in St. Louis had a $37 million deal structured with 2053 term bonds priced at 5.25% to yield 5.75%, Vivera Senior Living of Jeffersonville brought a $20.4 million deal that had 20-year term bonds priced at 5.25% to yield 5.20%, and Morningside Senior Living (TX) had a $15.3 million financing with 30-year bonds priced at par to yield 5.125%. In the non-rated education sector, Crossroads Christian Schools sold $20.5 million of bonds due in 2056 priced with a coupon of 5% to yield 4.75%, Columbia College in South Carolina had a $16 million issue structured with 2045 term bonds priced at par to yield 5.75%, and Blinn College had a student housing bond sale that included a 2057 maturity priced at par to yield 5.00%.

At HJ Sims, we welcome our investing clients to contact us for our thoughts on how to re-invest the $51 billion of muni bonds maturing or being called in December and January, how to prepare for year end, and how to position for 2021. We are always available to our banking clients and prospective borrowers looking for guidance on market rates and access. As we look to bring the best possible conclusion to a year that no one ever envisioned, we welcome your input, comments and questions.

Exclusive Opportunities For Our Clients

Giving Tuesday

Join the Movement– It’s GivingTuesday, the global day of giving. Please consider contributing to HJ Sims’ Corporate Social Responsibility partner, Gift of Life, to help find stem cell donors like Sterling who flew 5,000 miles mid-pandemic to save the life of someone she never met! Help Gift of Life reach their goal. Thank you.

HJ Sims arranges $78M refinancing package for John Knox Village

HJ Sims closed on a $77.6 million refinancing and capital project package on behalf of John Knox Village, a life plan community for age- and income-qualified residents in Pompano Beach, Florida. Read more in Senior Housing News.

Some Changes Made for COVID Will Stick Around, Say Seniors Housing Executives

There are two vaccines for COVID-19 awaiting approval by the U.S. Food and Drug Administration, signaling that there is an end to the pandemic on the distant horizon. However, the impact of the outbreak on the seniors housing industry may be long-lasting.

A group of the industry’s top brass recently suggested that many of the changes made to adapt to the virus may in fact be permanent, and operators should prepare for this.

Read more in Seniors Housing Business.

HJ Sims Successfully Underwrites Pavilion Project and Refinancing for John Knox Village in Pompano Beach

FOR IMMEDIATE RELEASE

November 23, 2020

CONTACT: Tara Perkins, AVP | 203-418-9049 | [email protected]

HJ Sims Successfully Underwrites Pavilion Project and Refinancing for John Knox Village in Pompano Beach

FAIRFIELD, CT– HJ Sims (Sims), a privately held investment bank and wealth management firm founded in 1935, is pleased to announce the successful closing of an October 2020 refinancing and capital projects financing in the amount of $77,605,000 for John Knox Village (JKV), a life plan community for age- and income-qualified residents in Pompano Beach, FL.

JKV sought assistance in restructuring its capital stack while issuing additional debt to develop amenity spaces to serve existing and attract new residents to the potential Westlake Tower expansion. JKV was seeking financing options for a new community pavilion, including dining facilities and related amenities, a new lake, various parking spaces and a new central energy plant (Pavilion Project). Sims was ultimately engaged by JKV as the COVID-19 pandemic was declared.

Sims provided multiple financing scenarios to analyze considering the volatility of the bond market and bank lending environment, which ultimately led to the selection of long-term fixed rate bonds for the 2020 financing. Working alongside JKV’s board, management and financial advisor, Sims prepared JKV for the Fitch-review process as they sought a material increase in their debt, ultimately retaining their Fitch A- credit rating with a negative outlook.

Sims priced the JKV Series 2020 Bonds during a week of near record volume, surpassing expectations and executing on a majority 4.000% or lower coupon structure to minimize the debt service burden. Sims also worked alongside JKV and its legal counsel to modernize certain aspects of JKV’s existing master trust indenture, providing additional flexibility for JKV in anticipation of the potential Westlake Tower expansion. The final pricing increased maximum annual debt service by just over $2.5 million for over $58 million in new long-term debt. The Series 2020 Bond issuance, as underwritten by Sims, is expected to provide a stable platform upon which JKV may continue to grow as it nears its fifth decade of service.

“Modernizing a Life Plan Community is a stressful endeavor on its own. Adding the stress of financial markets, budgets, forecasting and legal documents can be overwhelming for governance, management and residents. A good financing team is the key to wading through these waters. HJ Sims built a strong financing team, and broke down a complicated process into easily understood digestible parts. The results left this Community the ability to afford the facility, which will position John Knox Village as continued market leaders of senior lifestyle for generations. Working with Aaron and Melissa has been a pleasure; they are part of my team and I expect to continue to use their counsel in the future. I would recommend this firm highly,” said Bruce Chittenden, CFO, JKV.

Financed Right® Solutions—Aaron Rulnick: 301-424-9135, [email protected] |

Melissa Messina: 203.418.9014, [email protected].

ABOUT HJ SIMS: Founded in 1935, HJ Sims is a privately held investment bank and wealth management firm. Headquartered in Fairfield, CT, Sims has nationwide investment banking, private wealth management and trading locations. Member FINRA, SIPC. Testimonials may not be representative of another client’s experience. Past performance is no guarantee of future results. Facebook, LinkedIn, Twitter, Instagram.

###

Jewish Federation of South Palm Beach County Presents Sports Night In

John Knox Village Case Study

HJ Sims successfully underwrites pavilion project and refinancing for John Knox Village in Pompano Beach, Florida.

Continue readingMarket Commentary: Over the River

by Gayl Mileszko

Our seasonal favorite, “Over the River and Through the Wood” was originally published in 1844 as a poem written by Lydia Maria Child and later set to music by a composer still unknown. Over the years, many of us have grown up singing this joyful song en route to celebrate Thanksgiving with family, sometimes changing the lyrics but never the melody:

Over the river, and through the wood, to Grandfather’s house we go;

the horse knows the way to carry the sleigh through the white and drifted snow.

Over the river, and through the wood, to Grandfather’s house away!

We would not stop for doll or top, for ’tis Thanksgiving Day.

Over the river, and through the wood— oh, how the wind does blow!

It stings the toes and bites the nose as over the ground we go.

Over the river, and through the wood— and straight through the barnyard gate,

We seem to go extremely slow, it is so hard to wait!

Over the river, and through the wood— When Grandmother sees us come,

She will say, “O, dear, the children are here, bring a pie for everyone.”

Over the river, and through the wood— now Grandmother’s cap I spy!

Hurrah for the fun! Is the pudding done? Hurrah for the pumpkin pie!

This year, AAA predicts that only 47.8 million Americans, about 15% of us, will travel for this Thanksgiving holiday, with 95% of us planning to go by car, 2.4 million flying, and 353,000 traveling by bus, train or cruise. This would be the greatest year-over-year drop since 2008 and it could be the biggest on record, all as a result of COVID-related concerns. There are quarantine policies, public transit fears, and government advisories or restrictions on activities, the size gatherings, business hours and configurations. Many argue that, after eight months of unprecedented pandemic-induced separations and deprivations, this year — more than any other — is the time for us to gather and give thanks for all we have endured. But there are also many sound justifications for pause, for distance, for establishing what may be new traditions for virtual celebrations. There are also plenty of great new excuses for avoiding angry dinner time political arguments, awkward moments with crazy Uncle Harry, and Aunt Edna’s mincemeat tarts.

The average age of a first-time grandparent is 50 and, at AARP’s last count, there were more than 70 million grandparents in the United States. For those who long to travel, families will think long and hard about the wisdom of descending on grandmother and grandfather’s house so as to significantly limit the risk of spreading a virus that poses such a fatal risk to those in their age group. Recent studies show that the infection fatality rate for COVID-19 increases from 0.4% at age 55 to as high as 15% at age 85. The CDC reports that, through the 12th of November, 92 percent of COVID-19 deaths nationwide have occurred among those ages 55 or older.

One in ten grandparents lives in the same household with their grandchildren, and 5 percent of those are primary caregivers, so for these families no travel through the woods would be necessary this Thanksgiving anyway. But for the six or seven percent who live in assisted living communities or skilled nursing facilities, it has not been possible for family to get through the barnyard gates to visit or share a pie for eight long months. It has been so hard to wait … and yet the wait goes on.

Financial markets will slow next week, fewer new deals with come to market as traders and buyers pause for the all-American holiday. The pace of issuance, of initial public offerings, of horse trading, has been frenetic this year. The investment community is exhausted by the recession induced by the pandemic, the market volatility, the uncertainty, the months of living with the devastating impacts on schoolchildren and small businesses, the toppling of industry titans and explosive shift in demand for technology, the massive central bank interventions and staggering levels of stimulus during a polarized election season that seems never ending. We have lived with fear and the fear of missing out, yearning for yield and vaccines, with new perspectives on the differences in how our states operate, with varying degrees of loathing and respect for our branches of government. We have forged many rivers and are taking the best paths we know, but are not yet out of the woods.

At HJ Sims, our veteran banking, underwriting, sales and trading professionals are working with our clients on year-end strategies, income needs, refinancing options, and planning for 2021. Our base assumption is that we will be in a low rate environment for several more years, so we are structuring financings for our borrowers at the lowest competitive rates while finding the highest yielding, income-producing instruments most suitable for our loyal investors. We will be working through the holidays as we have a number of new issues scheduled through year-end and into the new year, and our trading, advisory and sales teams are always active.

In response to preliminary election results, economic data, fizzled stimulus hopes, promising vaccine developments, and news reports of surging case counts, the equity, bond and commodity markets have all generally rallied this month. Historic correlations remain askew. Since the end of March when pandemic lockdowns began and market turmoil peaked, the Dow is up 36% and the S&P 500 40% while the Nasdaq and Russell 200 have soared by 55%. Ten-year Baa-rated corporate bonds yields have fallen 174 basis points to 2.86%. Oil prices are up more than 104% a barrel to $41.21. Gold prices have gained 18% an ounce to $1,886. Although 10- and 30-year Treasury yields are up, 2-year yields have dropped 26% to 0.17%. Top-rated municipal bond yields have plummeted across the curve: the 2-year is down 90 basis points to 0.16%, the 10-year is down 56 basis points to 0.77% and the 30-year is down 48 basis points to 1.51%. Non-rated bonds priced last week came with yields in the range of 5.50% in 2050.

Back in the fall of 1621 in Plymouth, Massachusetts, there was a bountiful harvest after a year of sickness and scarcity. Pilgrims celebrated a tradition called the Harvest Home. Massasoit, a leader of the Wampanoag People, along with 90 of his men joined the English for three days of entertainment and feasting. No one knew what the coming days, months or years would bring. Three hundred and ninety nine years later, we are still unsure of what the future has in store. But we know that having somewhere to go is home, having someone to love is family, and having both is a true blessing. To all our valued staff, loyal clients, industry colleagues, to all the grandparents among the thousands of residents living in communities that we have been privileged to finance, we at HJ Sims wish you a very happy Thanksgiving.

Exclusive Opportunities For Our Clients

Market Commentary: Tallies and Rallies

by Gayl Mileszko

Preston Edward Buckley, 103, of Perrytown, North Carolina drove himself to his local board of elections five miles away in Warrenton and, for the first time in his 82 years of voting, cast his general election ballot curbside. A native of Carroll County, Tennessee, Mr. Buckley is a World War II veteran who became one of the first African-Americans to serve on the New Jersey Highway Patrol. After retirement, he moved to North Carolina and became an investigator for a law firm. A proud citizen, born three years before the 19th Amendment gave women the right to vote, he served as a poll watcher and even conducted voting workshops well into his 90’s. Mr. Buckley along with the rest of his neighbors in the Tar Heel State are still waiting for the final tallies. More than one million absentee ballots were cast there and those postmarked on or before November 4th with the proper signatures will be accepted up until this Thursday, November 12th. Results are expected to be certified on Friday.

The Associated Press (“AP”) has been counting the vote for 170 years, tabulating results, and declaring unofficial winners on Election Night or soon thereafter. This year, the AP has again called most of the 7,000 races it followed, starting with the two state results first declared at 7 p.m. on Election Night, culminating with the presidential race on November 7 at 11:26 a.m. The pandemic altered the method of voting for millions of Americans and turnout was well above average. Our patience in an era which generally affords us instant gratification has been tested this time by the closeness of the vote in key areas, the markedly different procedures and deadlines adopted by individual states, the slowness of mail-in vote tallies, and polling that proved to be way off base. Several recounts will soon occur and more than the usual number of lawsuits are being filed to, among other things, halt the count, disqualify tranches of ballots, and compel closer observation of the counting process.

Wall-to-wall media coverage of all the twists and turns began well ahead of the first absentee votes which began arriving a month and a half before Election Day. Estimates vary, but a fair number of the 157.6 million registered voters have new questions about the integrity of the process. Debate on reforms at the local, state and federal level will no doubt ensue, shaped by this year’s post-mortems as well as promising new technologies. In the meantime, our republic awaits official election results in the form of individual state certifications in the coming days and weeks, the official votes of the Electoral College on December 14th, and the final count by Congress on January 6th.

Wall Street has already conducted its own tallies, digested results which appear to confirm a divided federal government, lessened regulatory and tax hike risks, GOP control of state houses and legislatures, and no earth-shattering referendum outcomes. Stocks had their biggest post-election rally in over a century. Treasuries also staged a massive rally, propelling municipal and corporate bonds. On the heels of the investor relief rally came the news that Pfizer and BioNTech reported that their Covid-19 vaccine is more than 90% effective. The Dow and S&P 500 indices jumped again, hitting record highs, as investors cheered the prospect of controlling the disease that has derailed our economy for most of the year and killed more than 239,000 of our citizens.

Since the start of the month, the CBOE Volatility Index, dubbed the Fear Index, has dropped 35% to 24.80. The Dow is up 11% to 29,420. The S&P 500 has gained 275 points or more than 8% to 3,545. The Nasdaq is up 642 points to 11,553. The Russell 2000 has gained 198 points or 13%. Oil is 16% higher at $41.36. Gold prices have increased $3 an ounce. As investors turn to risk assets in the twin relief rallies, pundits might expect bonds to have sunk. Treasuries have, in fact, weakened over these past 10 days. The 2-year yield is 3 basis points higher at 0.18%, the 10-year has added 8 basis points to sit at 0.95% and the 30-year yield has increased 9 basis points to 1.74%. However, the 10-year Baa corporate bond yield has dropped 12 basis points to 2.91%. The 2-year AAA benchmark municipal yield has fallen 1 basis point to 0.20, the 10-year yield dropped 7 basis points to 0.86% and the 30-year yield has fallen 10 basis points to 1.61%.,

Since Election Day 2016, the Dow has gained 61%, the S&P is up 66%, the Russell 2000 has increased by 45% and the Nasdaq by 123%. Oil prices are 8% lower and gold is 47% higher. Ten-year Treasury yields are 35% lower. The lowest investment grade corporate yields have dropped 41%. 10-year tax-exempt yields have been reduced by half from where they stood at 1.71%.

The past two weeks have seen blockbuster corporate issuance but a light municipal calendar. The 30-day visible supply of municipal bonds only totals $7.9 billion. Ahead of the elections, state, local and non-profit borrowers came to market at a fast and furious pace. Mid-October saw the second largest competitive sale week on record. The volume was easily absorbed by a market with unrelenting demand for tax-exempt bonds and newfound demand for taxable and corporate CUSIP supply bolstered in part by foreign demand which has doubled year-over-year. Overseas buyers are discovering new diversification within rating categories, a notable pickup in spread, additional value, less credit risk than with investment grade corporate bonds, and a lot more yield than in their own sovereign debt.

High yield municipal bonds and longer maturities have been outperforming shorter investment grade counterparts in the latest risk-on environment. This class has been stressed throughout the pandemic as investors feared the pandemic’s long-term impact on airlines, airports, mass transit, toll roads, smaller universities, rural hospitals, and nursing homes. But buyers tired of seeing months of negative real returns on short investment grade holdings and mutual funds, and recognizing the essentiality of these institutions, facilities and services in their own communities are buying individual bonds again. In the past two weeks, we have seen Edkey Charter Schools come to market with an $87 million non-rated deal structured with 35-year term bonds priced at 5.00% to yield 5.125%. Judson Park, Judson Manor, and South Franklin Circle life plan communities in Ohio, borrowed $83.8 million in a BBB-minus financing that featured a 2050 term bond priced at 5.00% to yield 4.19%. The Tahoe-Douglas Visitors Authority sold $112 million of non-rated revenue bonds including a 2051 maturity priced at 5.00% to yield 4.47%. And Missouri Slope Lutheran Care Center in Bismarck, North Dakota had a $78 million non-rated transaction with a final maturity in 2056 priced with a coupon of 6.625% to yield 6.85%.

Bond markets closed on Wednesday in observance of Veterans Day. We at HJ Sims thank Preston Buckley of Perrytown, North Carolina and all the veterans who have sacrificed much to defend our precious freedoms, namely: those of speech, religion, press, assembly, and the right to petition the government for a redress of grievances.

Exclusive Opportunities For Our Clients

Merrill Gardens VI Series IV

HJ Sims raises additional capital for investment in development fund for Merrill Gardens. HJ Sims secured the capital for the Series IV and issued $6.85 million of securities in October 2020.

Continue readingMarket Commentary: Unforgettable

by Gayl Mileszko

Many presidential election years are unforgettable: when candidates are “firsts”, when there is a true upset, when it takes weeks or months for voters to know the outcome. 2020 was already guaranteed an indelible spot in our memory banks. It will be unforgettable – but not in the sweet Nat King Cole way. It began with an impeachment, then came the pandemic, the polemics, the huge number of Democratic primary contenders, the Federal Reserve Bank interventions, the record levels of federal and campaign spending, the protests and riots and talk of police defunding, the debate over social media’s effort at content moderation, the postponement of the Olympics, the chasm over the third Supreme Court appointment. It has been a nasty, brutish year and has not always revealed America at its best. And 2020 is not over yet. At this writing, all the election year winners have not yet been declared but we know that, no matter what, the results will upset about half of the American populus. Financial markets, heads of state, and cable news anchors may take some time to adjust to the situation. Fortunately, this unforgettable year is almost behind us. But there are still 60 days until the new Congress is sworn in and 76 days until the inaugural ball. The one constant for us is the Fed and its monetary policy, and that is elevating our markets.

In the week leading into Election Day 2016, the Chicago Board Options Exchange Volatility Index (VIX), a measure of stock market anxiety that is often called the fear gauge, rose 40%. This past week, the gauge has only risen from 32.46 to 35.08. On Election Day in 2012, the VIX stood at 17.58, and in 2008 it was at 47.73. On the bond side, the performance of Treasuries, municipal and corporate bonds is more often driven by Federal Reserve activity, and Fed Fund futures prices currently indicate a 100% likelihood no change in rates when the Open Market Committee meeting concludes on Thursday. The markets have already priced in no changes for the next three years. The Dow at 27,480 and the S&P 500 are right where they were back in late February; the Nasdaq at 11,160 is not far off all-time highs. Oil prices at $37.66 have been relatively stable for five months. Gold prices at $1,909 an ounce are off the all-time highs of three months ago, but rising. The 10-year Treasury yield closed on Tuesday at 0.88%, and the 30-year at 1.65%, both roughly where they stood in early June. The 30-year tax-exempt benchmark at 1.71% is also the same yield as it was in early June. The 10-year AAA municipal general obligation bond yield last closed at 0.94%, where it stood at the end of February.

Municipal bond fund investors added another $582 million to mutual funds last week while U.S. and global equity funds faced $6.6 billion of withdrawals. State and local borrowers brought $11.6 billion of deals to market last week, raising municipal issuance totals for October to $65.2 billion, the second highest level on record. HJ Sims was in the market with two senior living financings. We underwrote an $89 million non-rated issue for Jefferson’s Ferry that was structured with a final maturity in 2055 and sold through the Town of Brookhaven Local Development Corporation with a 4.00% coupon at a premium to yield 3.75%. We also brought a $48.5 million BBB-minus rated transaction for Blakeford at Green Hills which featured a 35-year final maturity issued through the Metropolitan Government of Nashville and Davidson County Health and Educational Facilities Board with a 4.00% coupon yielding 4.40%. Among other life plan community transactions, the Henrico County Economic Development Authority issued $47.3 million of A-minus rated revenue and refunding issue for Westminster Canterbury Richmond priced at 4.00% to yield 3.19% in 2050 and the Public Finance Authority issued $50 million of A-minus rated bonds for eight Carmelite communities that had a final maturity in 2045 priced at 5.00% to yield 3.53%. In the charter school sector, the Pima County Industrial Development Authority sold $87 million of non-rated bonds for Edkey Charter Schools that had a 2055 term bond priced at 5.00% to yield 5.125%; the California Public Finance Authority issued $28.3 million of non-rated revenue bonds for California Crosspoint Academy that came with a 35-year maturity priced at par to yield 5.125%.

This week, the Federal Open Market Committee meets in Washington and the markets await the final outcomes of races where votes are still being counted. We congratulate those elected to federal, state and local offices. Public service in the age of social media in the midst of a pandemic-induced recession is extraordinarily challenging. Our newly elected leaders face harsh realities and deserve our support and best wishes. This week, voters spoke, the nation revealed its stars and stripes, the next campaigns begin, and life goes on. At HJ Sims, we are at your service, providing the right structures, financing and execution for our banking clients and outcome of income for our investors.

Exclusive Opportunities For Our Clients

HJ Sims Completes Third Financing for Client, Refinances Outstanding Debt, Generates Significant Interest Rate Savings

FOR IMMEDIATE RELEASE

October 29, 2020

CONTACT: Tara Perkins, AVP | 203-418-9049 | [email protected]

HJ Sims Completes Third Financing for Client, Refinances Outstanding Debt, Generates Significant Interest Rate Savings

FAIRFIELD, CT– HJ Sims (Sims), a privately held investment bank and wealth management firm founded in 1935, is pleased to announce the successful closing of a September 2020 financing in the amount of $77,000,000 for Casa de las Campanas (Casa), a Life Plan Community in San Diego, CA. Casa is managed by Life Care Services, and LCS Development serves as the developer.

Casa has worked with Sims to secure financing for its multi-phased Master Plan, which included renovation and expansion of its facilities, including new skilled nursing facilities, independent living apartments and memory care beds.

In 2014, Sims secured bank financing through City National Bank (CNB) for Casa’s Phase I. Sims negotiated the Phase II financing terms with CNB in 2017. Structuring the financing with CNB and Cal Mortgage, Sims worked to secure $39 million in direct bank placement bonds from CNB for Casa’s Phase II expansion. Casa applied $7.1 million of equity and transferred $5.5 million of unused Phase I proceeds towards Phase II. Sims and Casa then explored refinancing options for the outstanding Series 2010 bonds and its outstanding bank debt to reduce Casa’s overall cost of capital.

In 2017, the passage of the Tax Cuts and Jobs Act eliminated the ability for Casa to advance refund its outstanding Series 2010 bonds. Sims and CNB considered pricing a forward starting tax-exempt refinancing, helping Casa to lock in an interest rate to refinance its outstanding Series 2010 bonds, 2014 Bank Debt, the outstanding portion of the 2017 bonds and fund the remaining undrawn portion of the 2017 bonds. COVID-19 roiled markets and bank financing, therefore the financing plan evolved from a forward refunding to a current refunding, which was optimized at a $77 million credit commitment offered by CNB, realizing significant cash flow savings.

With the closing of the refinancing, Casa refinanced outstanding legacy debt, as well as debt related to their phased expansion. Casa anticipates annual cash flow savings on existing debt of $2.45 million through 2035, with net present value savings of $12 million and 18.3% of refunded debt over the 30-year amortization.

“Once again, working with the Sims’ team provided the best solution to meet our refinancing objectives. Sims continues to be our trusted financial advisor, helping us evaluate opportunities to improve upon our current debt structure while ensuring Casa is well-positioned to access future financings related to our Master Plan. Sims provided valuable insight and guidance on the refinancing scenarios to our Management Team and Board. The refinancing was successfully structured to eliminate the previously required Cal Mortgage insurance and related debt service reserve fund. With the new low interest rate, Casa is able to save millions and drastically improve our cash flow and future debt capacity. Sims went beyond the call of duty, and presented industry guidelines and insights at our Board Retreats to ensure we accomplish our goals and maintain our mission,” said Dave Johnson, CFO, Casa de las Campanas.

Financed Right® Solutions—Aaron Rulnick: 301-424-9135, [email protected] |

Brady Johnson: 949-558-8297, [email protected].

ABOUT HJ SIMS: Founded in 1935, HJ Sims is a privately held investment bank and wealth management firm. Headquartered in Fairfield, CT, Sims has nationwide investment banking, private wealth management and trading locations. Member FINRA, SIPC. Testimonials may not be representative of another client’s experience. Past performance is no guarantee of future results. Facebook, LinkedIn, Twitter, Instagram.

###