Overview

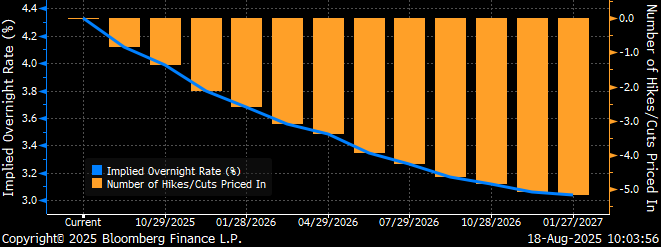

With government funding set to expire Tuesday, the shadow of a potential government shutdown continues to loom over the bond market bringing yields down across the Treasury curve. In addition, the shutdown threatens to delay the release of key economic data, including Friday’s nonfarm payroll employment data and unemployment rate from the Bureau of Labor Statistics. This data is critical to current rate forecasts as weakening employment data was an influential factor in the Fed’s decision to cut rates earlier this month. The Fed has recently commented that labor demand, and the recent pace of job creation, appear to be running below the “breakeven” rate needed to maintain current unemployment levels. The Fed funds futures market is currently indicating an 88.7% chance of a 25bps rate cut at its October 29 meeting.

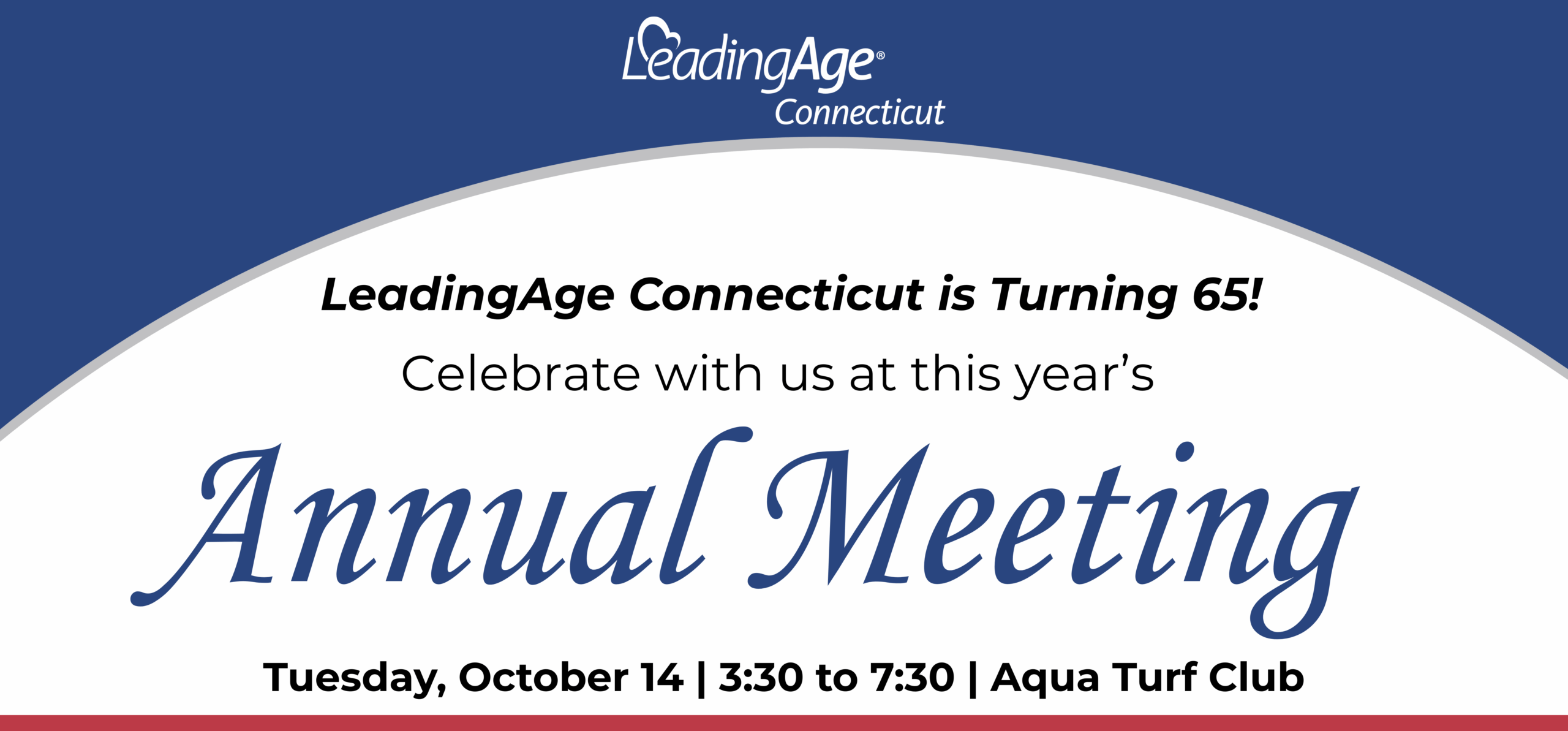

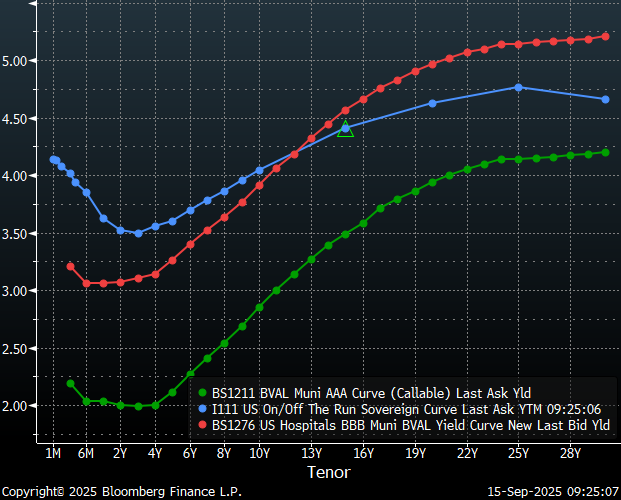

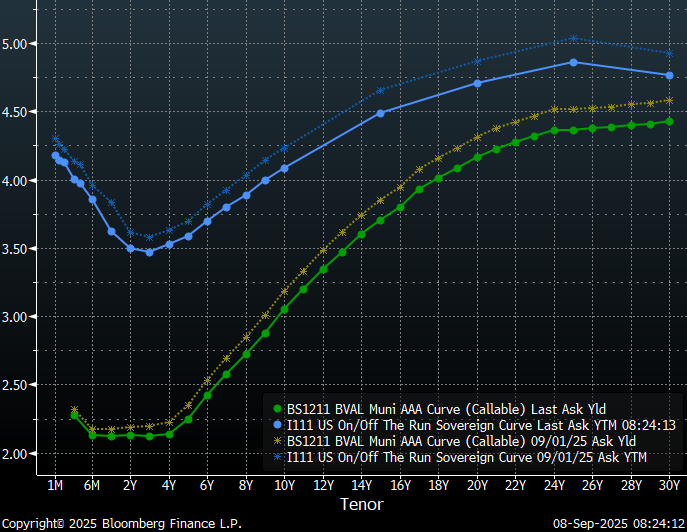

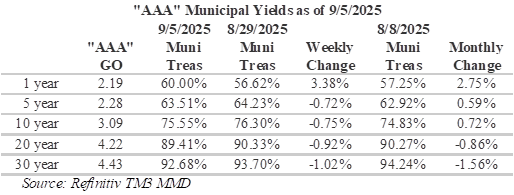

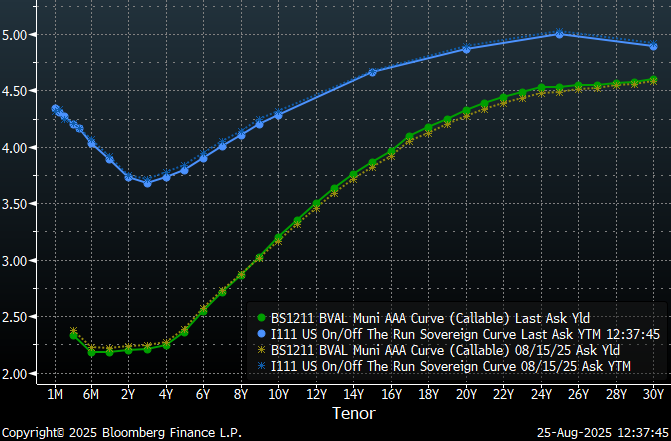

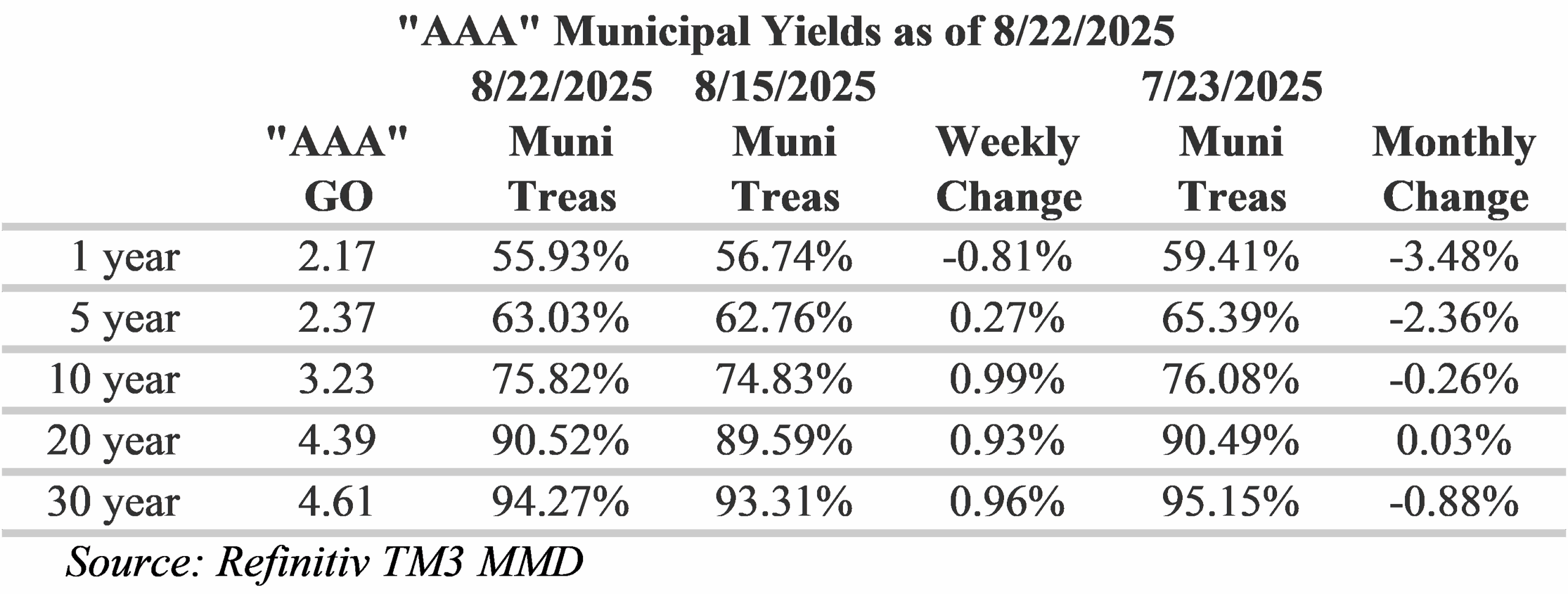

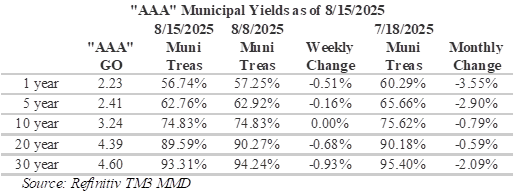

Last week, Treasuries were largely unchanged with the threat of a government shutdown drawing a haven bid while the front-end of the muni curve experienced the majority of the movement. Muni yields in this part of the curve have become quite rich with muni/Treasury ratios in the 50’s for one to five years. At these levels, yields are only narrowly appealing even to individual investors in the top tax brackets. Following last week’s moves, ratios popped-up to the low to mid-60’s on the front-end of the muni curve with significant pressure from institutional investors positioning portfolios ahead of the quarter-end.

Insights and Strategy

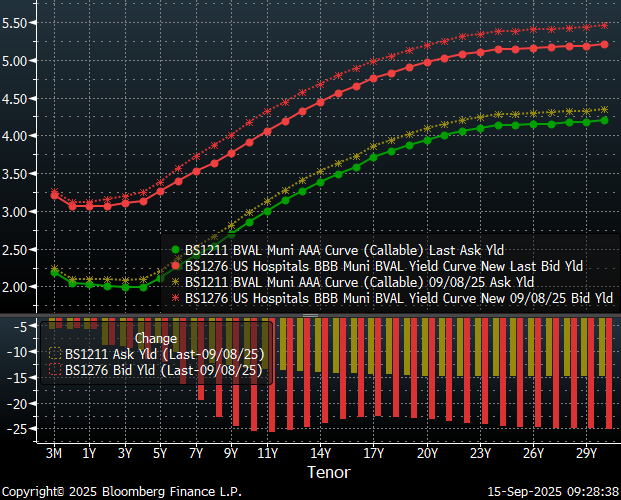

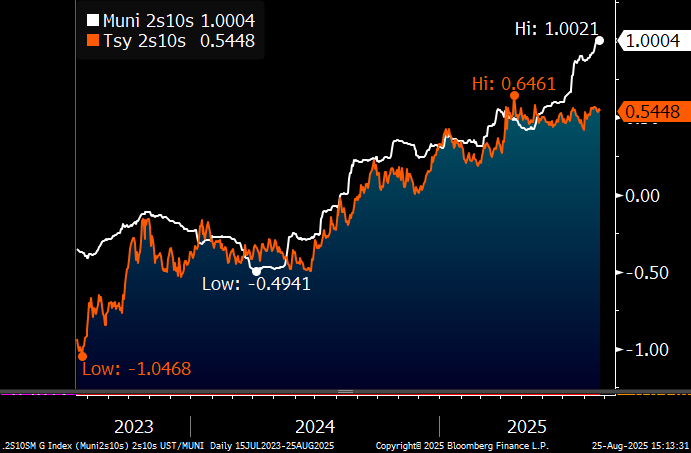

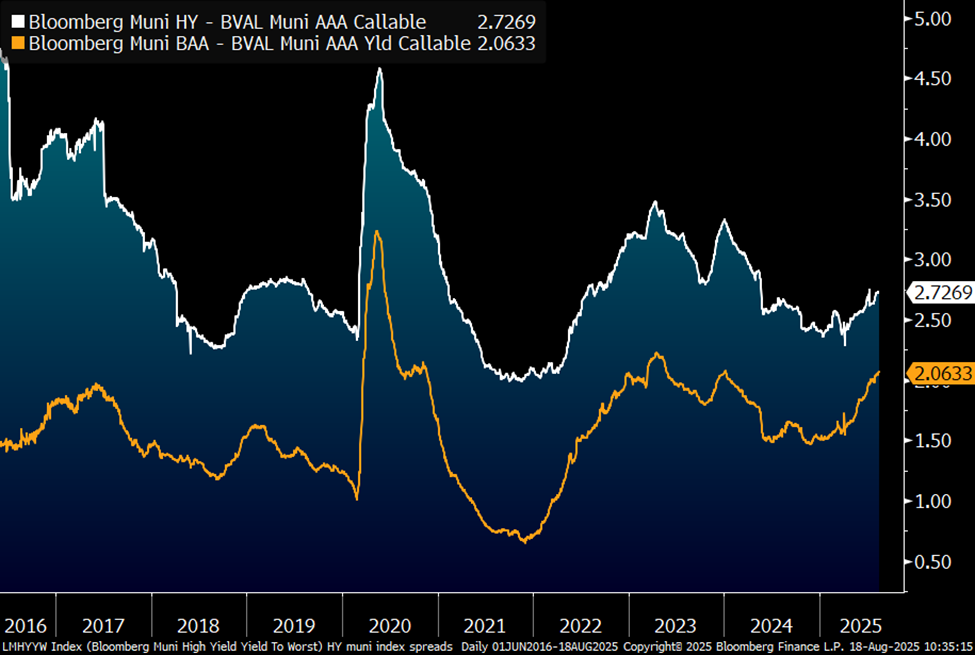

Although the muni curve remains steeper than the Treasury curve, last week’s sell-off resulted in considerable flattening for munis maturing within 10-years. Over the past 2-months we have experienced significant compression of spread relationships in this portion of the curve. However, it is notable that the steepest portion of the municipal yield curve is currently the 9 to 11-year stretch with a slope of 46 bps. Although the municipal yield curve remains positively sloped, investors should exercise caution to manage duration risk by buying bonds where the yield curve has sufficient slope to reward risk.

Nevertheless, long munis continue to provide compelling relative value with 20-year munis yielding almost 85% of Treasuries and 30-year munis yielding almost 90% of Treasuries. Even the 12-year tenor, which is less than half of the 30-year curve, is yielding 75% of the 30-year maturity, making this an appealing place to position new purchases. Past 20-years, the slope tapers significantly to just a basis point or two per year. For investors with longer mandates, I would consider buying shorter in the 12 to 17-year range and wait to see if the long-end steepens before extending.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.