Curve Commentary: May 19, 2025

Overview

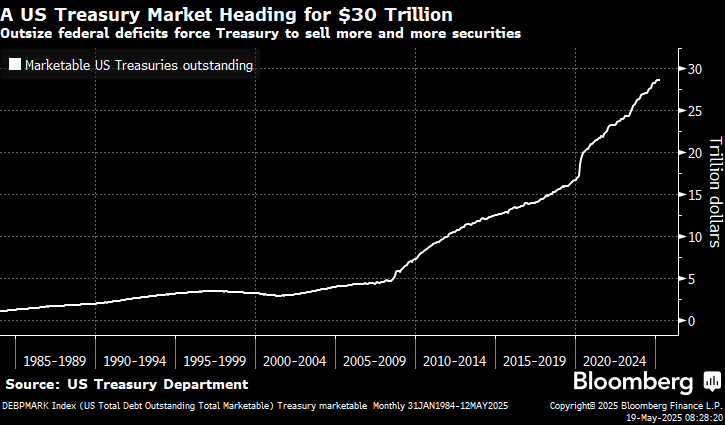

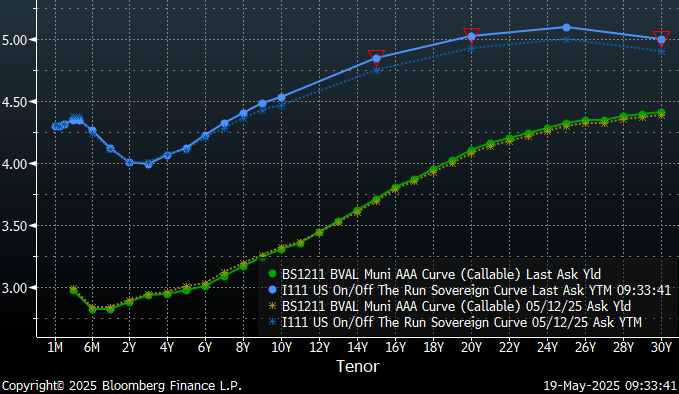

This morning municipal bonds are selling-off following Friday’s downgrade of the US Treasury by Moody’s from ‘AAA’ to ‘Aa1.’ In early trading yields extended over 5% for 20 and 30-year Treasury bonds, although yields have since settled back under 5% for both tenors. Moody’s downgrade was prompted by their concern of a decade of increasing debt and interest payments to levels significantly higher than similarly rated sovereigns and by successive US administrations that failed to agree with Congress on measures to reverse the trend. In addition, Moody’s commented the ratio of total US public debt to the size of the economy has reached 98% of GDP in 2024 and anticipates the federal debt burden will reach 134% of GDP by 2035. Moody’s also changed its outlook on the US economy from negative to stable and commented that it expects US GDP growth to slow in the short-term as the economy adjusts to higher tariffs, but that it does not expect long-term growth to be significantly affected.

Ratios and Strategy

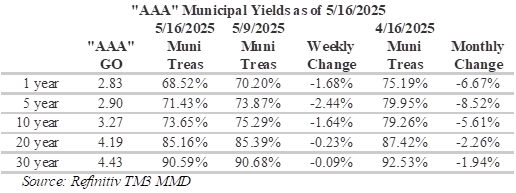

The change in Treasury ratings puts relative value with the municipal market into question with the possibility to disrupting traditional relationships between the two markets. Although the impact on municipals is far more muted than the impact on Treasury Bonds, we are still seeing municipals selling-off 2.5 bps across the 20 to 30-year tenors versus Treasury bonds selling-off 7 to 8 bps in the same range. As a result, muni/Treasury ratios continue to grind lower with ratios now in the high 60’s on the short-end of the curve.

On a relative basis, the draw to longer durations is decreasing as the justification for extension shifts to the stability of municipal credit ratings rather than improved ratios. As an asset class, municipal bonds now offer greater credit appeal versus similarly or even lower rated Treasury obligations. However, with 20-year municipals yielding 85% of their Treasury equivalents and 30-year municipals yielding over 90% of equivalent Treasury bonds, there is still a progressive benefit to the tax exemption. From the perspective of the Charlotte trading desk, tighter ratios make it more difficult to bid aggressively on secondary offerings with a narrower margin for error.

Unlike recent weeks, Treasury bonds and municipals are shifting in a similar manner with intermediate yields adjusting slightly lower while longer yields adjust higher resulting in a similar steepening in both curves. The municipal curve starts to steepen at around the 9-year maturity with steepening extending out to the 15 to 17 year portion of the curve. Overall, there is over 90 bps of steepening in this range with a slope of approximately 11bps per year, meaning that investors are rewarded for assuming duration risk in this part of the curve. In addition, the 17 year portion of the municipal curve also offers 90% of the yield on the 30-year municipal maturity and approximately 80% of 20-year Treasury bond yields. However, yields flatten-out meaningfully on the long-end with slopes of just a few basis points per year over the last 10-years.

Last week, LSEG Lipper Global Fund Flows reported that investors added $769 million to municipal bond funds. Long-term muni funds gained $337 million while intermediate funds saw inflows of $161 million and high-yield funds added $140 million. Overall, the fund flows point to less risk appetite as investors return to the safety of intermediate investment-grade bonds. In addition, municipal issuance remains brisk offering incoming money a variety of choice with $12.7 billion of new issuance over this week from issuers ranging from State of Kansas to local school districts.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

2025 LeadingAge Arizona Conference & EXPO

HJ Sims is proud to be attending the 2025 LeadingAge Arizona Conference & Expo.

Attendees: James Rester

2025 LeadingAge New York Conference & EXPO

HJ Sims is proud to be attending, sponsoring and exhibiting at the 2025 LeadingAge New York Conference & Expo.

Come visit us at Booth 46.

Attendees: Andrew Nesi, Kerri Tomasiewicz

Curve Commentary: May 12, 2025

Overview

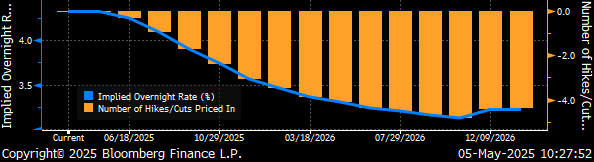

This morning’s announcement of a reprieve in the trade war between the US and China sparked a seven-basis point increase in the 10-year Treasury yield as traders pushed back the timing of possible interest-rate cuts. The trade war has been the biggest driver of rates in the capital markets this year, marking a significant shift from the previous focus on the Fed. Last week, the Fed held rates steady at 4.25% to 4.5% and cited the trade talks as a key factor amid concerns of increased unemployment and higher inflation. Volatility from the trade war has been elevated in the Treasury bond market with trading surging 25% in April to a record $1.323 trillion in average daily turnover, which almost doubled to $2.44 billion on the peak day with trade war volatility driving position unwinds.

Not surprisingly, uncertainty in the municipal bond market also remains uncharacteristically high. Last week, LSEG Lipper Global Fund Flows reported that investors added $1.1 billion to municipal bond funds. As a result, technical conditions improved in the muni market last week as robust supply was met with solid demand. Long-term muni funds gained $597 million while intermediate funds saw inflows of $96 million and high-yield funds added $348 million. Overall, the fund flows point to risk-on as investors migrate to the long-end of the curve and riskier assets. From the perspective of the Charlotte trade desk, trades this morning have been a little soft but ratios have recently compressed and inventory struggles to keep pace with demand.

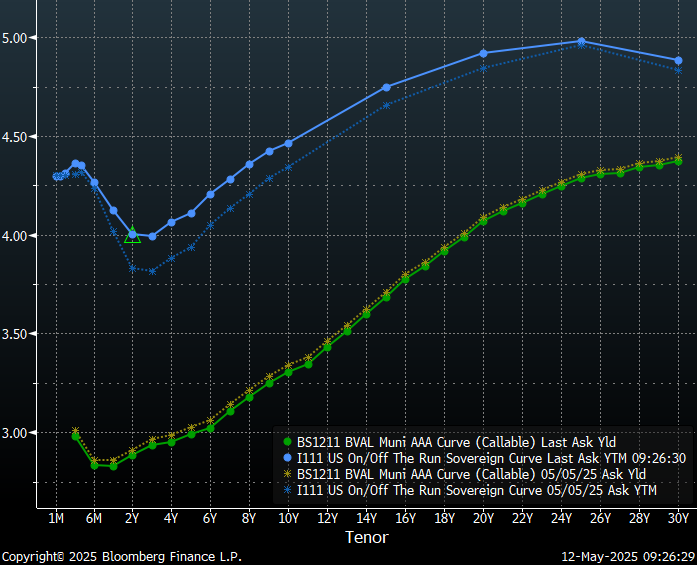

Although the Treasury bond yield curve has steepened slightly over the last week, with the long-end selling-off five basis points, the municipal bond yield curve has responded with a two to four basis point parallel shift lower. The steepening Treasury bond yield curve combined with mixed inflation signals greatly complicates the timing of future policy moves. Further adding to the uncertainty, the Treasury curve has sold-off 18-20 bps in the policy sensitive 2-4 year portion of the curve. This move points to potential flattening of Treasury bond yields as investors struggle with where to position.

Ratios and Strategy

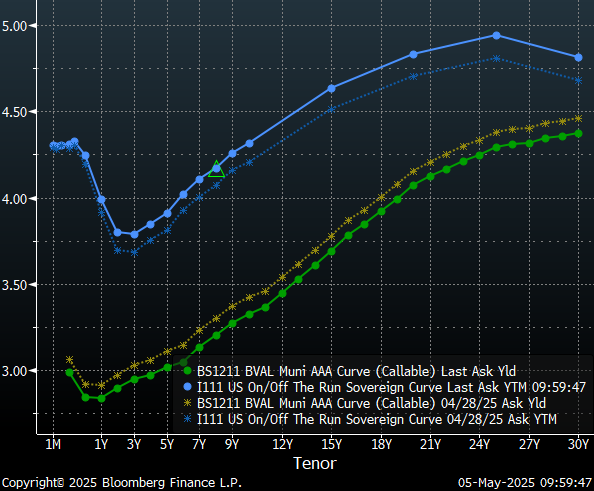

Slopes along the municipal bond yield curve progressively steepen from 6 to 17 years with the 15 to 17-year portion of the curve having the steepest slope of 11bps/year. The 15-17 year portion of the municipal curve also offers approximately 90% of the yield on the 30-year muni maturity and approximately 80% of 20-year Treasury bond yields. However, yields flatten-out meaningfully on the long-end with slopes of one to three basis points over the last nine-years.

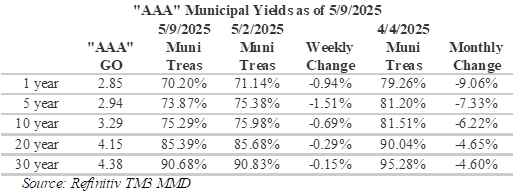

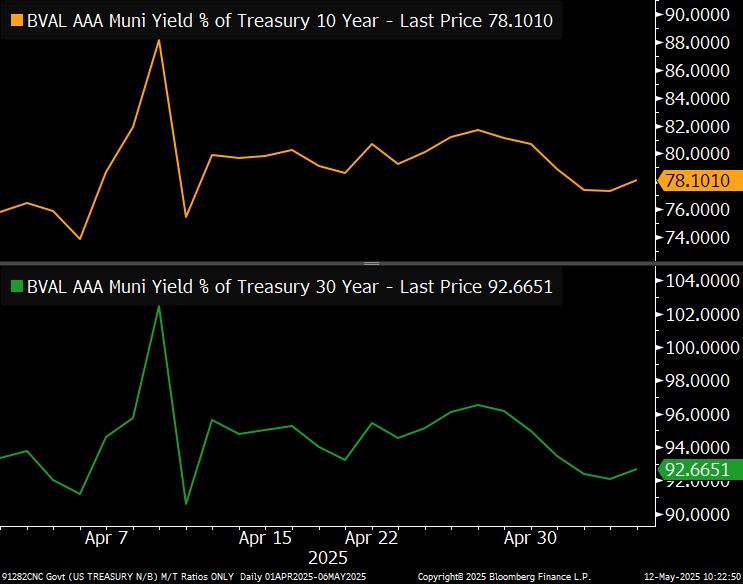

Over the past month, Muni/Treasury ratios have compressed by over nine percentage points on the short-end. Ratios have also compressed on the long-end, but at about half the rate of the short-end with 30-year ratios compressing 4.6% over the past month. Relative to 10-year historic means, ratios have once again become rich with the greatest disparity on the short-end with historic ratios of 95.72% versus 70.2% currently. As in the past, these tighter ratios will weigh on investor decisions and we may see stronger sympathies by munis to moves in the Treasury bond market.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

2025 LeadingAge Michigan Conference & Solutions EXPO

HJ Sims is proud to be attending and speaking at the 2025 LeadingAge Michigan Conference & Solutions EXPO.

Lynn Daly, Executive Vice President will be speaking. Details below:

Date: May 19, 2025

Time: 3:00pm

Subject: Maintaining flexibility while navigating challenging financial times

Attendees: Lynn Daly

Market Commentary: Big News From All Corners

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue reading2025 LeadingAge PA

HJ Sims and Sims Mortgage Funding are proud to be attending, sponsoring, and exhibiting at the 2025 LeadingAge Pennsylvania Conference.

Come see us at booth 24!

Attendees

2024 Year in Review

Check out our 2024 Year in Review below:

Case Studies

Save the Date

The 23rd Annual HJ Sims Annual Conference will be held February 24th-26th, 2026 at the Marriott Sanibel Harbour Resort & Spa in Fort Myers, FL. Stay tuned for more information soon. We can’t wait to see you there!

For more information, please contact Kat Dymond.

ISF/Ativo Senior Living (March 2025)

HJ Sims and JLL Execute on $239.68 Million of Bonds to Finance a Three Property, Rental Senior Living Portfolio, Including Two Development Projects and One Fully Stabilized Community

Continue reading2025 LeadingAge Texas Annual Conference & Solutions EXPO

HJ Sims is proud to be attending and speaking at the 2025 LeadingAge Texas Annual Conference & Solutions EXPO.

Jimmy Rester, Executive Vice President will be speaking.

Details below:

Date: Tuesday, May 20

Time: 3:45 – 4:30 pm

Session: Learn strategies to navigate financial distress as a non-profit CCRC.

This session will explore the journey of a single-site CCRC facing financial distress and highlight the strategic initiatives implemented to improve financial health. Attendees will learn about the importance of stakeholder alignment and the cost of waiting, gaining insights into how to better position their organizations for financial recovery.

Learning Objectives:

• Understand single-site financial trends

• Learn about the education and alignment of stakeholders

• Recognize the cost of waiting and its impact on financial recovery

Attendees: Jimmy Rester, Nick Roberts

Curve Commentary: May 5, 2025

Overview

Over the past week, yields in the municipal and Treasury markets have moved in opposite directions as uncertainty and volatility continue to be prominent themes in the fixed income markets. Based upon guidance from the Fed, traders are betting policymakers will remain in wait-and-see mode until there’s more clarity on tariffs. As a result, the longer policy uncertainty persists, the greater the potential economic impact. Although, the futures market is pricing in over a 98% chance the Federal Reserve will leave rates unchanged at their meeting later this week, the market is anticipating a 25 bps cut as soon as the July 30 meeting. In addition, the market is anticipating three rate cuts this year which seems questionable given job gains reported by the BLS last week and the Fed’s previous comments regarding timing. Nevertheless, the primary concern is not whether or not the fed cuts rates, but rather the specific language used by the Fed in its message and the potential volatility should the Fed indicate increased likelihood of a recession. Although we are seeing more confidence in the long-end of the yield curve, particularly in municipals, investors remain cautious amid the uncertainty.

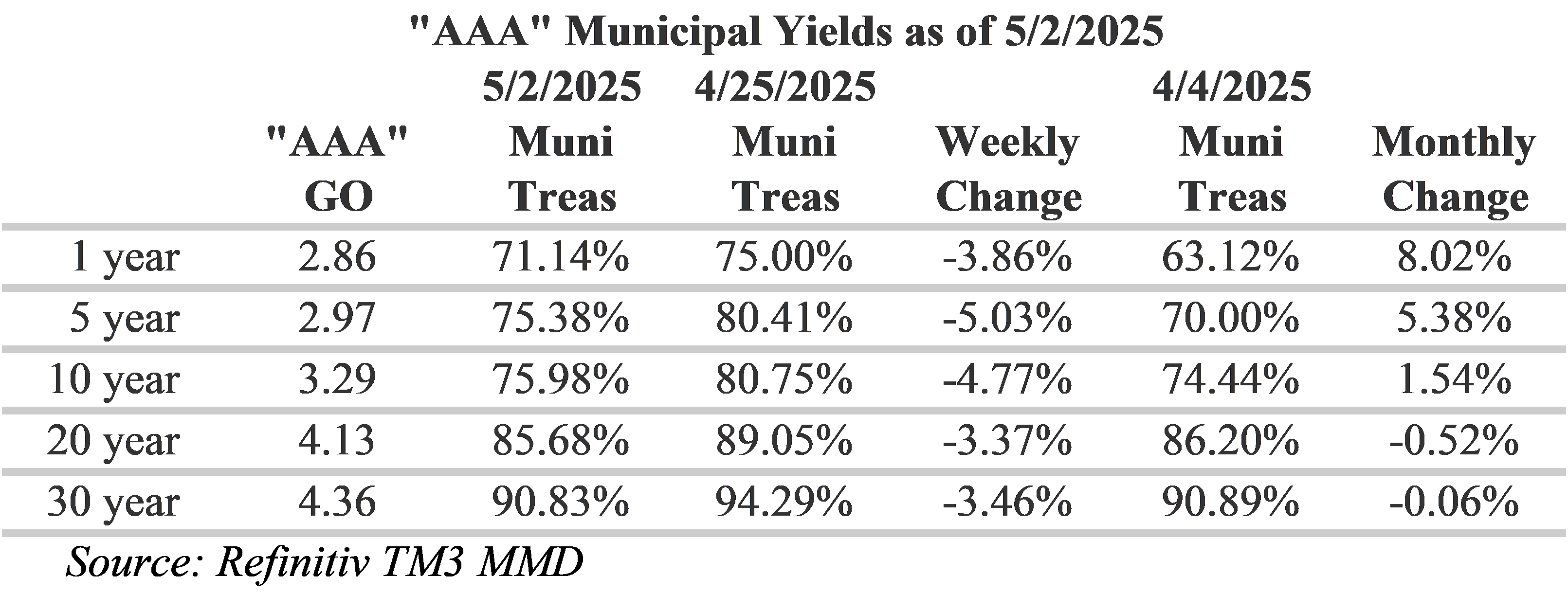

Ratios and Strategy

Treasury tenors past one-year saw yields increase over the past week while municipal yields across the curve dropped lower. The reason for this divergence can largely be attributed to market technical, with municipal bond mutual funds and ETFs recording strong inflows amid a somewhat lighter calendar. Slopes along the muni curve continue to be steepest around the 9-12-year tenor of the curve, with a slope of 24 bps over 4-years, and the 15-17-year tenor of the curve, with a slope of 33 bps over a period of just 3-years. The 15-17 year tenor of the municipal curve offers an appealing combination of a relatively steep slope and meaningful yield, allowing investors to lock-in over 90% of the yield on the 30-year municipal maturity and over 80% of equivalent Treasury yields.

Although long-term ratios remain appealing, the yield differential between long-term muni and Treasuries has widened over the past week. Although ratios dropped throughout the yield curve, they experienced their largest moves in the 5-10-year range. Despite declines experienced over the past month, ratios have become dramatically more appealing on the short-end of the curve from 65.84% last month to over 70% this past week. At the long-end, municipal bonds are still yielding over 90% of Treasury bonds, which is continues to be appealing to investors.

Last week LSEG Lipper Global Fund Flows reported municipal bond mutual funds experienced $1.567 billion of inflows following seven consecutive weeks of outflows. This is the largest inflow figure since January and is partly responsible for driving yields lower on the long-end of the municipal yield curve. The new issue calendar is a little lighter this week with an anticipated $9 billion in new supply, excluding deals considered day-to-day, with the Massachusetts Institute of Technology planning to sell $750 million, Dartmouth Health Obligated Group selling $420 million and the Indianapolis Bond Bank selling $285 million.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Market Commentary: Great Shakes

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue reading2025 LeadingAge Iowa Spring Conference & Solutions Expo

HJ Sims is proud to be attending the 2025 LeadingAge Iowa Spring Conference & Solutions Expo.

Attendees: Jenny Wade, Nick Roberts

2025 LeadingAge Maryland Annual Conference & Expo

HJ Sims is proud to be attending, sponsoring and speaking at the 2025 LeadingAge Maryland Annual Conference & Expo.

Aaron Rulnick, Managing Principal, will be speaking on the topic below:

Date: May 14, 2025

Time: 10:45am

Topic: Alternative Models for Growth

Attendees: Aaron Rulnick

2025 LeadingAge Colorado Conference

Curve Commentary: April 28, 2025

Overview

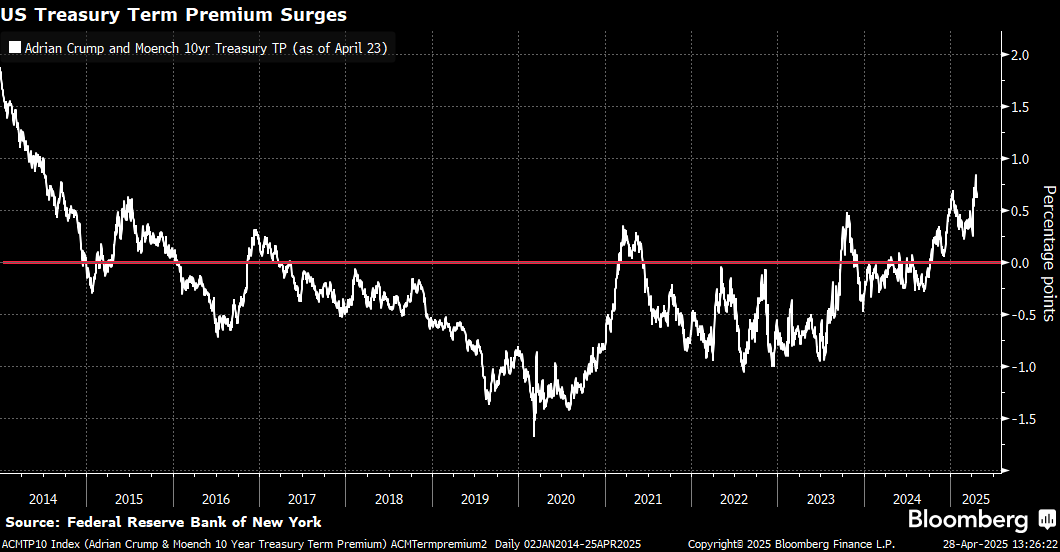

Over the past week, the fixed income markets continue to react to the uncertainty created by on-again/off-again tariff announcements and the de-escalation of tensions between the President and the Fed. Treasury bonds have outperformed municipals, particularly on the long end of the yield curve, were yields on Treasury bonds have dropped 20 bps versus a 5 bps decline on municipals. The strong moves in Treasury bonds are driven by a resurgence in risk appetite while municipals are responding to improved muni/Treasury ratios. However, last week the term premium, which is the additional yield required on longer maturities, hit 80 bps which is the highest level we have seen in over a decade. Although we are seeing more confidence in the long-end of the yield curve, investors remain cautious amid the uncertainty.

This afternoon, the yield differential between 30-year Treasury bonds and 30-year ‘AAA’ municipals compressed to just 24 basis points from 39 basis points last Monday. Inside of 2-years, municipals and Treasury bonds remain essentially unchanged. Past 2-years, Treasury yields progressively flattened as investors extended out the yield curve to take advantage of steeper slopes. Slopes along the muni curve continue to be steepest around the 9-11-year tenor of the curve, with a slope of 24 bps over 3-years, and the 14-18-year tenor of the curve, with a slope of 48 bps over 5-years. The 14-18 year tenor of the municipal curve continues to offer a combination of relatively steep slope and meaningful yield, allowing investors to lock-in over 90% of the yield on the 30-year muni maturity and over 86% of equivalent Treasury yields.

Ratios and Strategy

Muni/Treasury yields continue to converge at the long-end resulting in increasingly compelling muni/Treasury ratios. Over the past week, ratios dropped at the short-end, but steadily progressed further out the curve. However, over the past month, ratios have become dramatically more appealing on the short-end from 65.84% last month to 75% this past week. Over the past 10-years, the mean 30-year muni/Treasury ratio is 94.43%. At the long-end, municipal bonds are now yielding 94.29% of Treasury bonds, which is very appealing compared to historic averages.

Fund Flows and Calendar

Last week was the seventh consecutive week of outflows from municipal bond mutual funds. Amid the busy trading week, LSEG Lipper Global Fund Flows reported $1.1 billion migrated out of long-term muni funds and $142 million left high-yield funds while intermediate munis saw inflows of $7 million. Given the conservative nature of intermediate funds, this move is not surprising. This week the new issue calendar, excluding deals considered day-to-day, includes $14.6 billion in new supply with the District of Columbia planning to sell $1.49 billion, the East Bay Municipal Utility District selling $1.09 billion and Los Angeles Department of Water & Power selling $993.5 million.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Market Commentary: The Wall Street Haboob

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingCurve Commentary: April 21, 2025

Overview

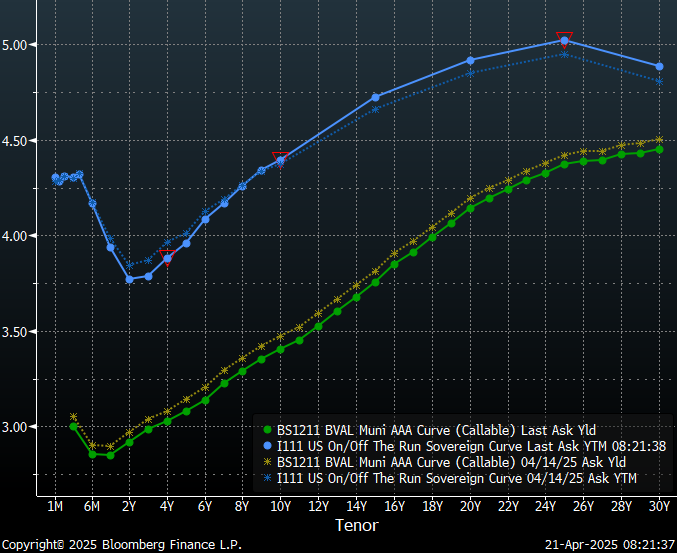

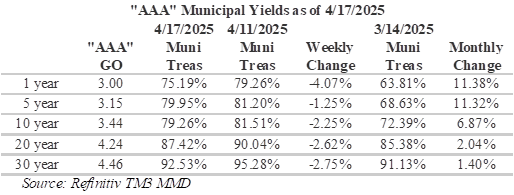

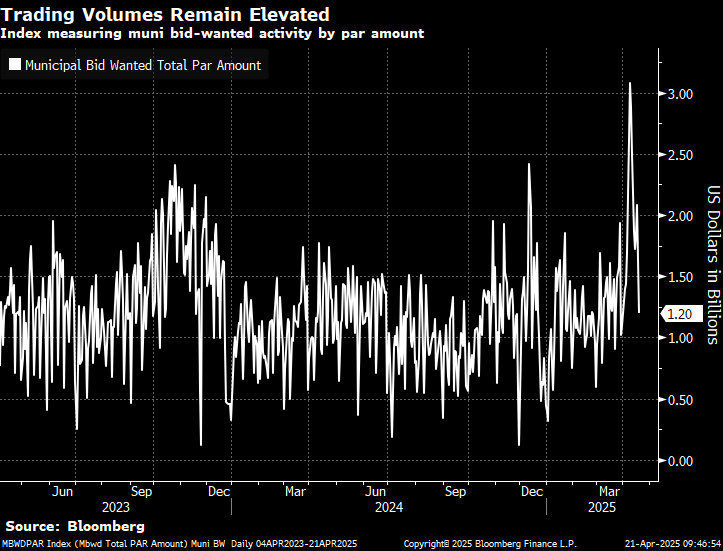

This morning, investor sentiment remains resilient with secondary trades executing at relatively tight levels. Volatility has been uncharacteristically high following Liberation Day resulting in pricing discovery as investors test MMD spreads and question evaluated prices. Current market dynamics remain challenging to manage from a trading perspective due to the combination of economic uncertainty, fund flows and the strength of recent moves.

Municipal yields and Treasury yields continue to move in opposite directions. Over the past week, Treasury bonds sold-off on the long-end of the curve as investors price-in macroeconomic concerns of mounting inflationary pressures from tariffs and economic uncertainty. In contrast, municipal bonds rallied on the long-end as investors took advantage of more appealing ratios and sentiment the sell-off the previous week was overdone. Treasury bonds on the shorter end of the curve in the two to four-year tenor, which tend to be more policy sensitive, fell by nine basis points as the market continues to struggle with on-again/off-again tariffs.

Ratios and Strategy

In aggregate, weekly yield movement at the long-end of the curve widened by approximately 12 bps with Treasury bond yields moving up by 7 basis point and municipal yields dropping by 5 basis points, almost splitting the difference. Immediately following Liberation Day, long-term muni and Treasury bond yields converged on the long-end, resulting in more appealing muni/Treasury ratios. However, over the past week, yields diverged as long-term Treasury bonds sold-off and long-term munis rallied. The 15-17 year portion of the municipal curve continues to offer a combination of relatively steep slope and meaningful yield, allowing investors to lock-in over 90% of the yield on the 30-year muni maturity and yields eclipsing 80% of equivalent Treasury bonds.

Trade Volume and Calendar

Despite being a holiday week, secondary market activity remained high. Last week was the sixth consecutive week of outflows from municipal bond mutual funds. Amid the busy trading week, LSEG Lipper Global Fund Flows reported $1.4 billion migrated out of long-term muni funds and $522 left high-yield funds while intermediate munis saw inflows of $163 million. Given the conservative nature of intermediate funds, this move is not surprising. This week the new issue calendar, excluding deals considered day-to-day, includes $14.2 billion in new supply with the State of Connecticut planning to sell $1.6 billion, the Commonwealth of Massachusetts selling $1.07 billion and Los Angeles Unified School District selling $965 million.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Market Commentary: April: Cruelest or Most Beautiful Month?

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue reading2025 PAHSA – Spring Conference & 65th Annual Meeting

HJ Sims is proud to be attending the 2025 PAHSA Spring Conference & 65th Annual Meeting.

Attendees: Tom Bowden