It was fifty years ago on April 3, 1973, when Dr. Marty Cooper made the first public cell phone call from his clunky, personal, handheld, portable prototype as he stood on a busy New York City sidewalk. The 44-year-old Motorola engineer thought it would be amusing to make that first call to his company’s chief competitor at Bell Labs, Dr. Joel Engel. He punched in his rival’s number on a DynaT-A-C device that was roughly the size of a brick.

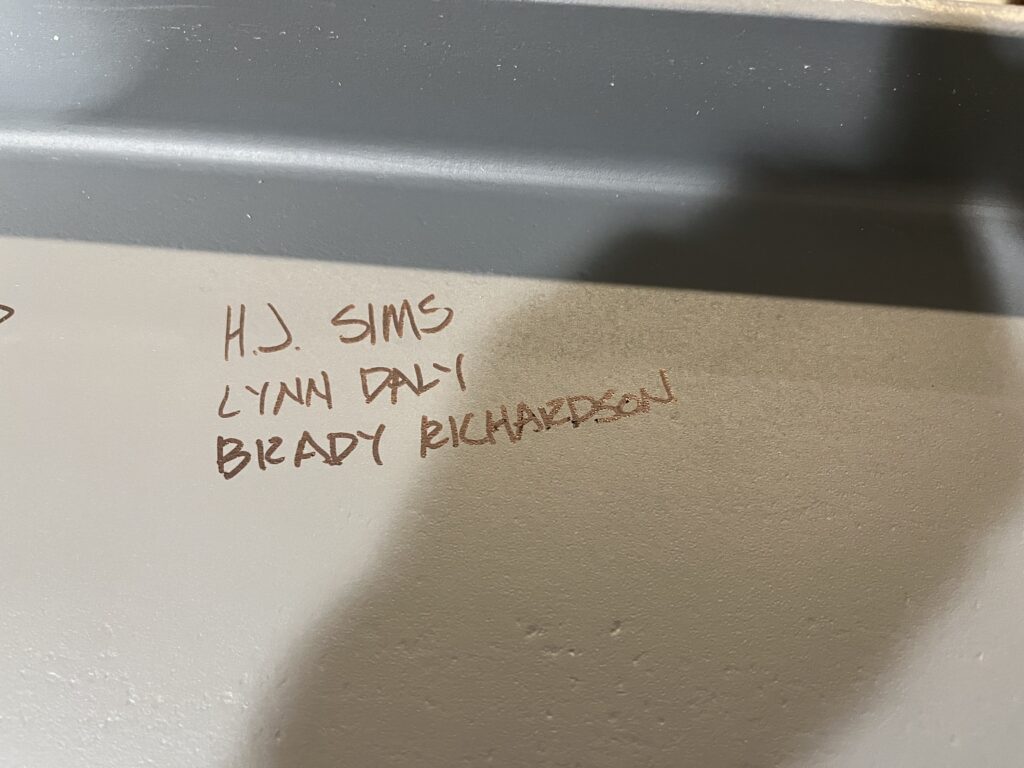

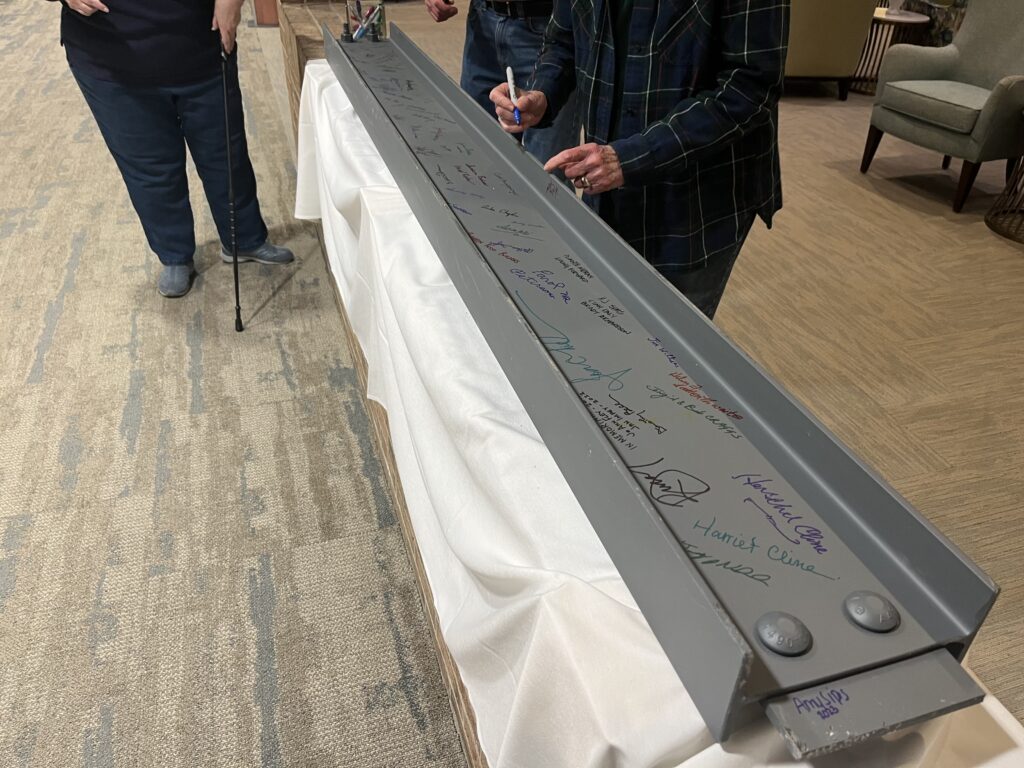

Continue readingClark-Lindsey Village Celebrates the Addition of their Assisted Living Apartment Building with Beam-Signing Event

10 Things to Consider About Using HUD Financing for Active Adult Communities

Who is an active adult? The industry definition is someone 55 years of age and older. But HUD’s version is someone 62 years of age and older. Sims Mortgage Funding looks at the 10 things to consider about using HUD financing for the development or refinancing of active adult communities.

Continue readingMarket Commentary: Sense-Making

The Cynefin framework was created as a tool to be used in “sense-making”, a term broadly incorporating common sense into decision-making, something that we and all of our policymakers in Washington should certainly do more often. Fifteen years ago, David Snowden and a team at IBM came up with this new framework for looking at problems and assessing situations accurately so as to arrive at solutions and respond appropriately. They began by identifying four types of problems: simple, complicated, complex and chaotic, and moved on from there.

Continue readingMarket Commentary: Consistency

Edgerton “Ketchie” Welch, a lifelong resident of Chillicothe, Missouri began his career at his family’s Edge-Mar Dairy but later came to run the local Citizens Bank & Trust Co., serving for a total of 55 years. At various points in his role as CEO, he reported an investment performance that beat the nation’s biggest banks and insurance companies. When interviewed by Forbes on his exceptional success, he admitted that he was not smart enough to play the stock market and never even heard of modern portfolio theory.

Continue readingSearstone (March 2023)

HJ Sims Completes 3-Step finance plan for North Carolina life plan community, Searstone, including nearly seventeen-month forward refunding.

Continue readingMarket Commentary: Banking On It

Recency bias is a term used in behavioral economics that describes the tendency of people to believe that recent events will occur again soon, that the current state of being will continue indefinitely, that headlines which feel ominous and immediate necessitate urgent action. Lacking the wider-angle lenses of history and mathematical probability, this type of bias affects trading and other short-term decisions that people make — panic selling, bubble buying – fueled by fear or greed in volatile moments.

Continue readingCapital College & Career Academy (February 2023)

HJ Sims successfully closes on $13.9 million Series 2023 Bonds for Sacramento, CA start-up public charter high school, Capital College & Career Academy.

Continue readingMarket Commentary: Where Everyone Knows Your Name

The Goosebumps books are written at a third to seventh grade reading level, unlike the minutes of the Federal Open Market Committee which cater to the ivory tower crowd. They feature no violence or death, unlike the trade press which has been reporting on the past year’s devastating market losses in brutal detail, and the mainstream media which has documented pandemic casualties for the past three years. A common theme in Stine’s writing is the use of wit and imagination to escape horrendous situations. This is an approach that we all cling to in this second decade of the third millennium as we wrestle with all our grown-up fears.

Continue readingSims Mortgage Funding, Inc. 2022 Year in Review

Have you ever heard the saying may you live in interesting times? That was the watchword for Sims Mortgage Funding, Inc. last year, as higher interest rates and increasing construction costs posed a significant challenge to their deal pipeline.

Continue readingHJ Sims Market Commentary: Goosebumps

The Goosebumps books are written at a third to seventh grade reading level, unlike the minutes of the Federal Open Market Committee which cater to the ivory tower crowd. They feature no violence or death, unlike the trade press which has been reporting on the past year’s devastating market losses in brutal detail, and the mainstream media which has documented pandemic casualties for the past three years. A common theme in Stine’s writing is the use of wit and imagination to escape horrendous situations. This is an approach that we all cling to in this second decade of the third millennium as we wrestle with all our grown-up fears.

Continue readingCommunity First Solutions (January 2023)

HJ Sims advises Community First Solutions, Ohio-based owner and operator of three senior living communities, on accretive independent living expansion.

Continue readingThe 20th Annual HJ Sims Late Winter Conference

The 20th Annual HJ Sims Late Winter Conference examined trends and developments critical to the success of charter schools and senior living communities.

Continue readingHJ Sims Market Commentary: Measures of Wealth

Wealth today is generally defined as the value of all assets of worth owned by a person, community, country or country. Back in the heyday of the pantheon of the Greek gods, wealth was largely measured in agricultural terms. Today, respondents in the latest annual Schwab modern wealth survey concluded that having a net worth of $1.9 million qualifies a person as wealthy. However, the top 1% of households by income lost almost 16% of their overall wealth from the fourth quarter of 2021 to the third quarter of 2022.

Continue readingBob Hope School (The Hughen Center, Inc.) (November 2022)

HJ Sims successfully closes on $26.335 million Series 2022 Bonds for Texas nonprofit corporation, The Hughen Center dba as Bob Hope School, which currently operates four charter schools on four campuses in and around Port Arthur, TX.

Continue readingHJ Sims Market Commentary: Super Roles

In January 1969, the inflation rate was 4.4% and the unemployment rate fell to 3.4%. In the decades since, inflation has frequently fallen below 4%. Federal Reserve Chair Ben Bernanke in his key role made 2% the official target in 2012. But we have not seen unemployment in the range of 3.4% in the last 54 years. Last Friday, the Bureau of Labor Statistics reported that the economy added a reported 517,000 jobs and that the number of jobless Americans as a percentage of the population fell to 3.4%.

Continue readingLifespace (November 2022)

HJ Sims steers phased repositioning through turbulent market with the closing of $85,00,000 financing for nonprofit owner/operator, Lifespace.

Continue readingHJ Sims Market Commentary: Groundhogs and Canaries

The first month of the New Year is already behind us and how fantastic it would be if we could keep the rally going at this pace for the rest of the year. Heading into Groundhog Day, we would welcome six more weeks, six more months of this performance with low volatility and strong returns. It certainly does not feel like we are about to enter into the recession that economists have threatened for more than a year.

Continue readingHJ Sims Market Commentary: Year of the Rabbit, Year of the Bond

Some Asian markets are closed all this week for the Lunar New Year holiday. Sunday marked the first day of the Year of the Rabbit, said to be a symbol of happiness, prosperity, abundance, peace, elegance, and longevity. Our colleagues at MacKay Shields have also dubbed 2023 as “The Year of the Bond”, and it has indeed begun with rallies across corporate, government, and municipal markets.

Continue readingLinks Funding III (October 2022)

HJ Sims partners with Links Healthcare to finance acquisition of West Coast community.

Continue reading