Overview

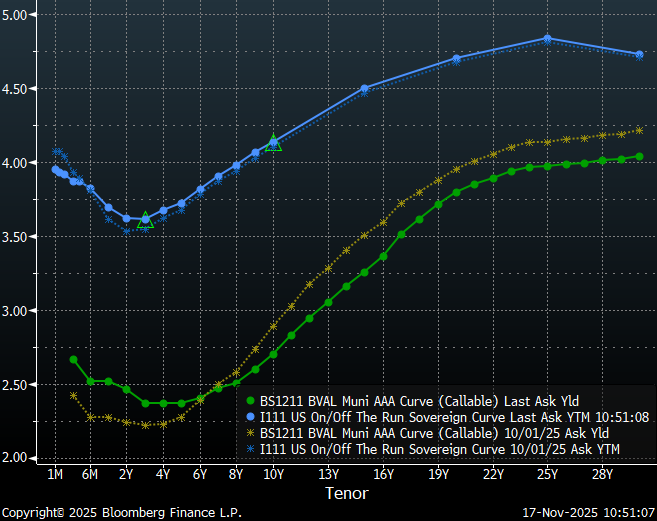

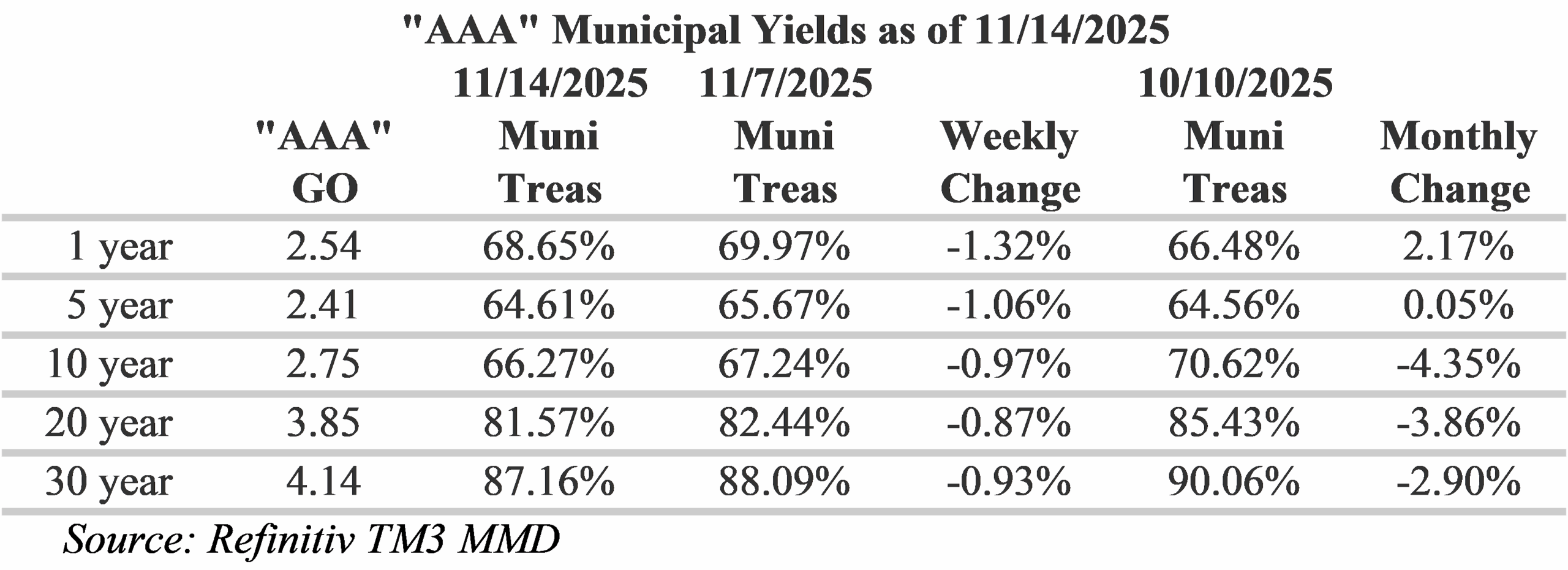

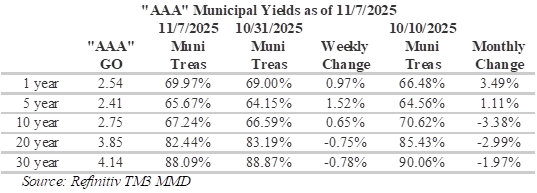

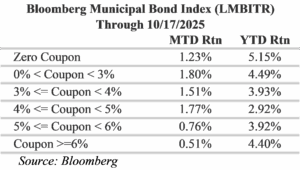

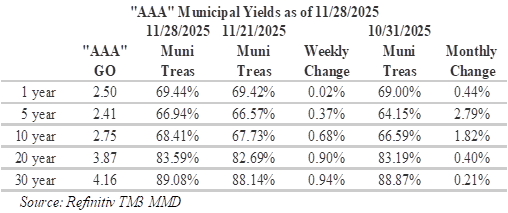

Despite uncertainty regarding the reopening of the U.S. government, conflicting information from Fed policymakers and the wild swings in market sentiment regarding the prospects of another rate cut, yields on municipal bonds and Treasuries have changed relatively little over the past month. Municipal yields for all tenors were generally within a basis point or less of their yields from the beginning of November and Treasuries were also relatively unchanged with a slight steepening as rates rallied modestly from 6-weeks to 5-years and sold off 7 to 10-basis points in tenors past 15-years. The stability in the fixed income markets can partially be attributed to the lack of key economic data during the shutdown and the continuation of long-term trends with structural labor market concerns and continued stubbornly high inflation.

This morning the Fed funds futures market was pricing-in the probability of a third rate cut this year at over 100%, which is a dramatic shift from just a few weeks ago when the probability was in the high 20% range. Although recent economic data has been largely supportive of a rate cut, should the Fed maintain current rates we will likely see some turbulence given implied rates. Lately business activity has been slowing. Today’s ISM Manufacturing Index contracted for the 9th straight month with activity shrinking by the most in four months. However, the employment picture is still not clear. The BLS will not be publishing the October employment report until after the Fed issues its decision, which is also when it will be releasing November data.

Insights and Strategy

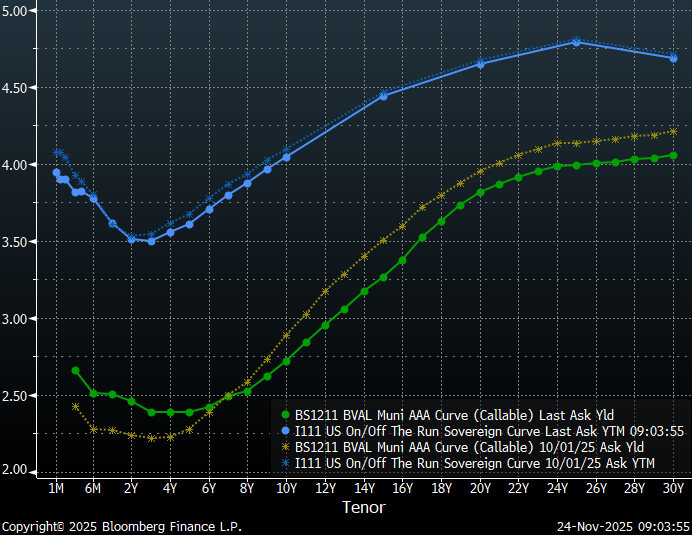

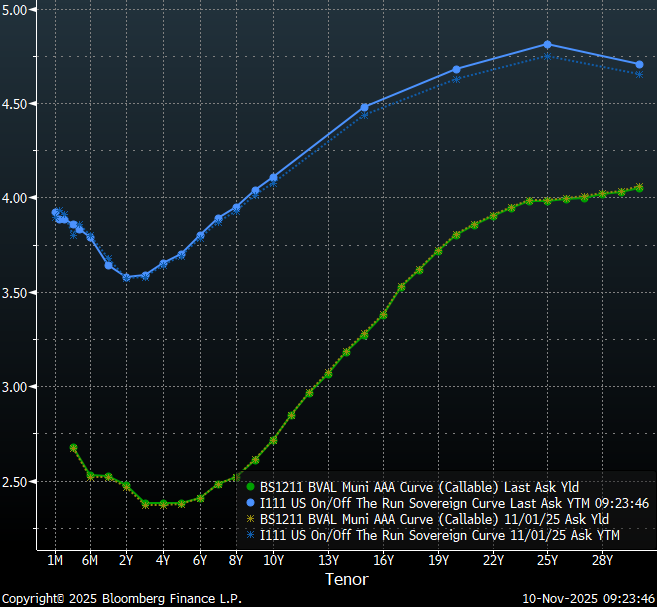

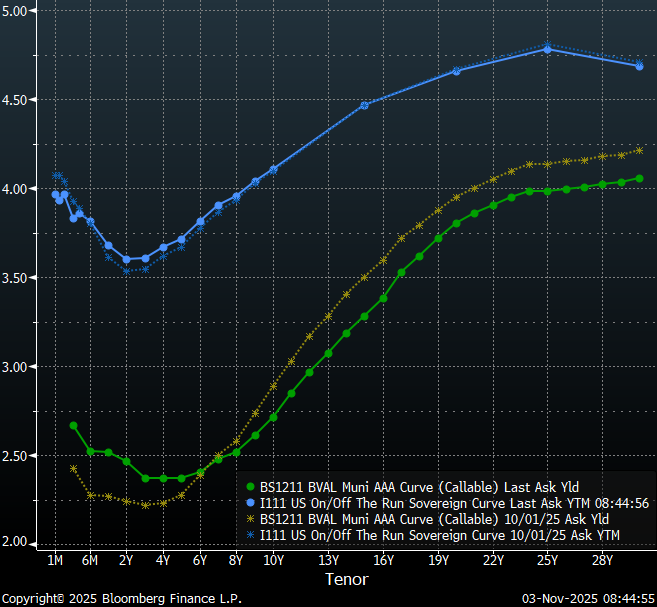

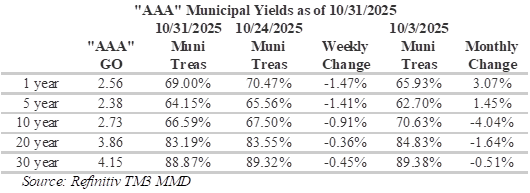

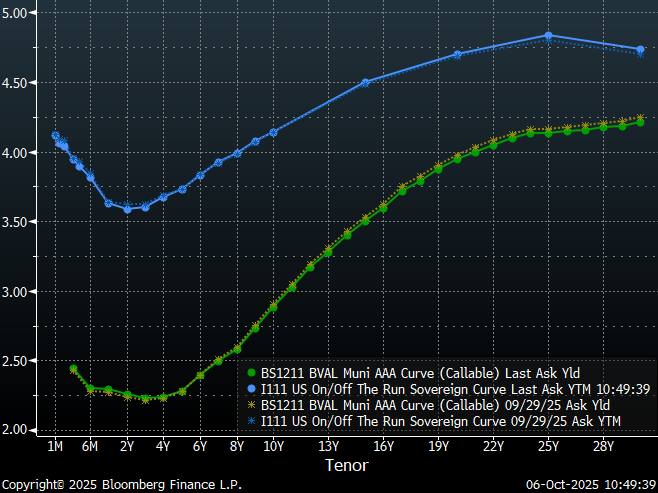

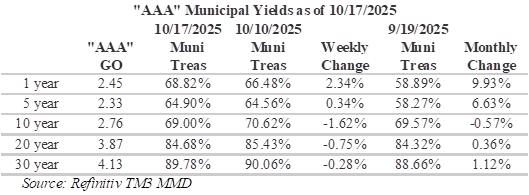

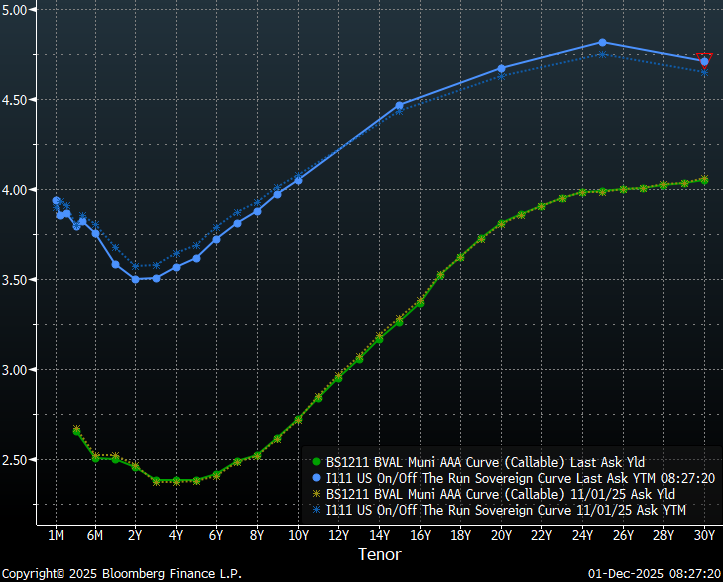

Slopes along the municipal yield curve are currently steepest around the 16-year tenor, with over 100 bps in slope from 10 to 19-years. This is a significant change from earlier last month, when the steepest slopes were around the 10-year tenor. This shift has increased the reward to investors for extending from the 10-year range to the 15-20-year range. In addition, investors benefit from a steep roll-down over time. Although the municipal yield curve is currently rewarding duration, the long-end has become very flat with steadily declining slopes from 20 to 30-years and only a basis point or so per year past 25-years. As a result of this flat tail, municipal bond investors can buy maturities under 20-years that yield over 90% of the 30-year curve.

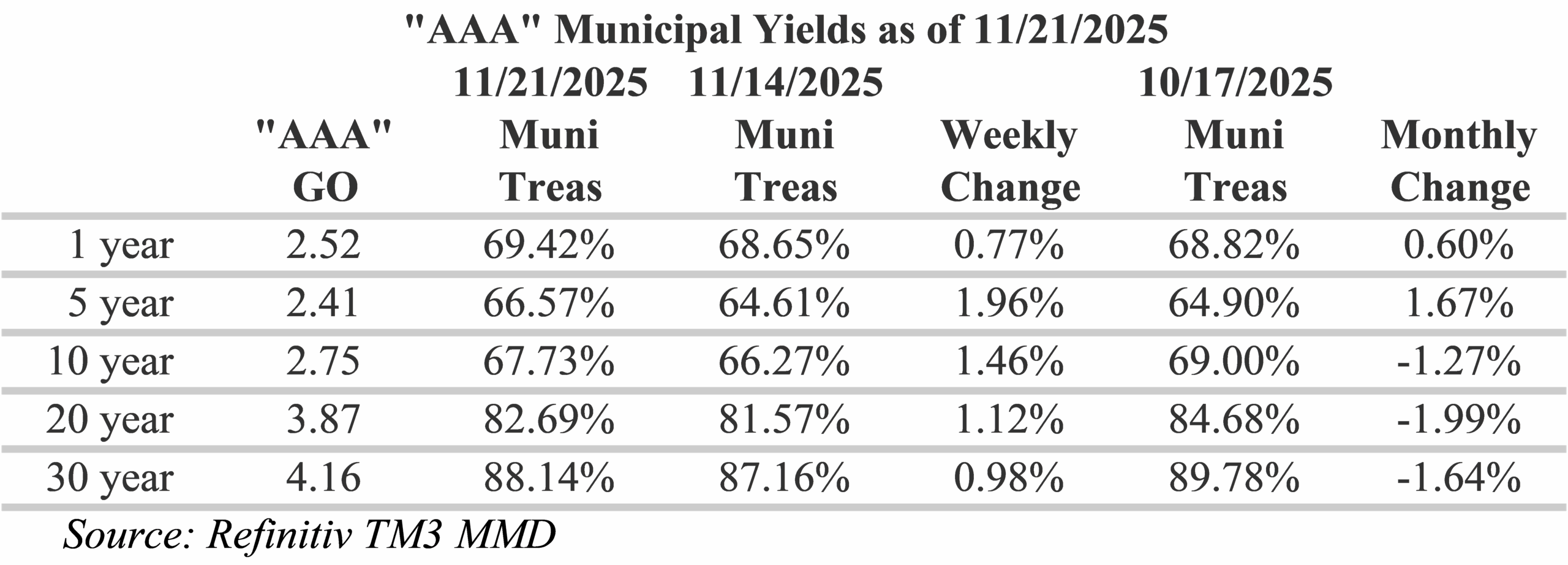

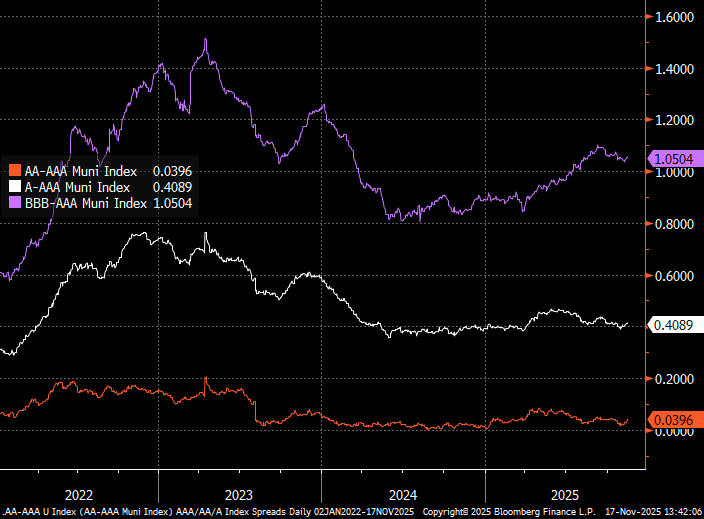

Elevated municipal tax-equivalent yields on the long-end continue to reward investors, with ratios generally cheapening over the past week. The muni/Treasury ratio is a widely watched measure that provides a sense of how tax-exempt munis fare against taxable fixed-income options. Crossover investors, which seek to identify the best opportunities in the fixed income universe on an after-tax basis, closely follow this ratio. Over the past week, the biggest moves have been on the long-end of the curve, where ratios are approaching 90%. Over the past month, the biggest moves have been around the 5-year maturity where ratios are approaching 3% richer. For investors seeking to maximize curve positioning with relative value, extending to the 18-year part of the municipal yield curve provides almost 90% of the 30-year maturity and almost 80% of equivalent Treasury yields.

This week, the municipal bond market is expected to price more than $14.6 billion in new issues. Notable deals this week include: State of Connecticut Special Tax Revenue Bonds with $1.56 billion, Long Island Lighting Company with $1.02 billion and City of San Antonio TX Electric & Gas Systems Revenue with $599.8 million. Fund flows have also generally been supportive over the past month. ICI data reported that exchange-traded funds saw inflows of $366 million during the holiday week Last week following a staggering $2.735 billion of inflows the week prior.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.