Last week marked the ninth straight week we have seen the additional yield investors demand to own 30-year Treasuries versus two-year maturities increase. This gap reached levels last seen in 2022 and is only one of two periods of this magnitude that Bloomberg has recorded since it began collecting this data in 1992. The U.S. economy is facing considerable turbulence (including geopolitics), with the potential positives of tax reform and deregulation and the potential negatives of tariffs and trade wars, ongoing sticky inflation, high fiscal deficits and high daily volatility.

The municipal bond market has experienced uncharacteristically high volatility over the past week amid escalating tariff threats and retaliatory measures from U.S. trade partners. Daily changes in the municipal market swung wildly in both directions with almost 50 basis points of bumps on Thursday following 42 basis points of cuts on Wednesday. This is extreme for a market accustomed to days where yields finish the day unchanged. Today we are continuing to see cautious attitudes with accounts hanging-out in the safety of cash versus wading back into the market.

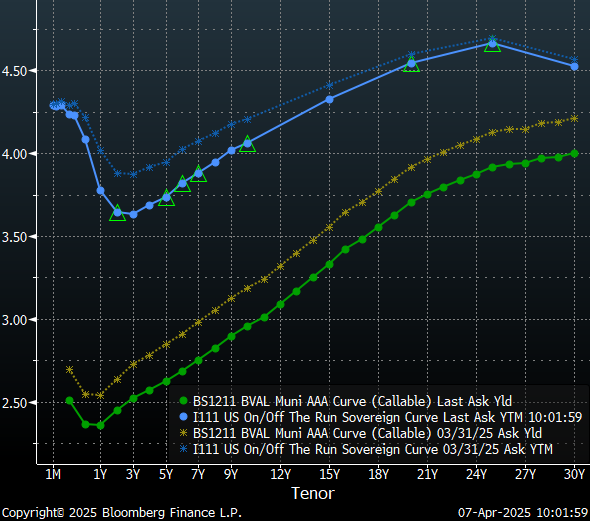

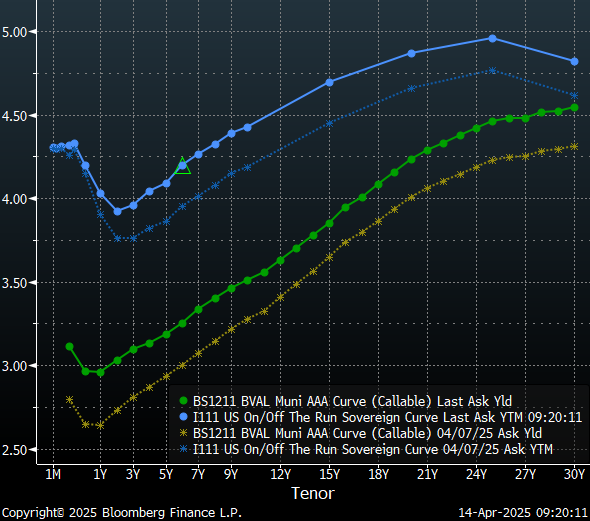

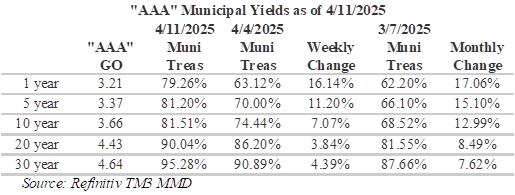

The extreme volatility from last week has resulted in a steeper Treasury curve and a parallel shift up in the municipal curve of 23 to 31 basis points. The short-end of the muni curve experienced the biggest movement in stark contrast to the Treasury curve which experienced the most movement on the long-end. Not surprisingly, the relationships along the curve have changed, with the steepest point being the 15-17 year tenor with an overall change of 30 basis points. Slopes have generally become more consistent along the municipal curve with some flattening on the long-end out past 20-years.

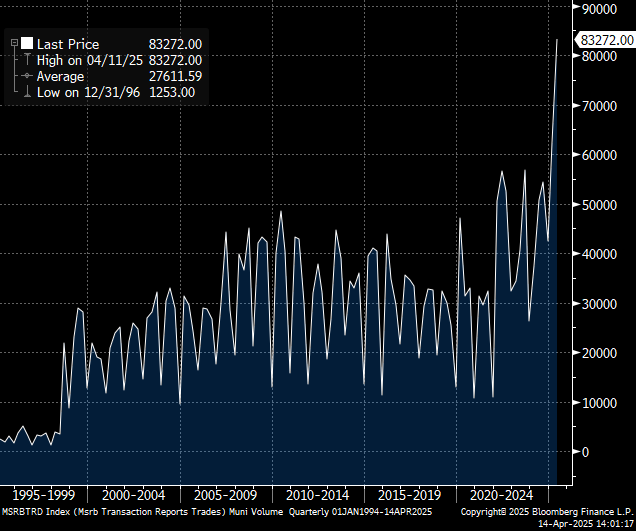

Trade Volumes

Secondary market activity surged last week, with the number of trades and total par traded nearly doubling daily averages on Wednesday. Municipal bond mutual funds experienced their largest outflows since the volatile market conditions of June 2022. According to LSEG Lipper Global Fund Flows, long-term municipal bond funds lost $2.6 billion while high-yield funds lost $759 million. Although the new issue municipal calendar is rather full at $12.1 billion this week, many of these deals are scheduled day/day.

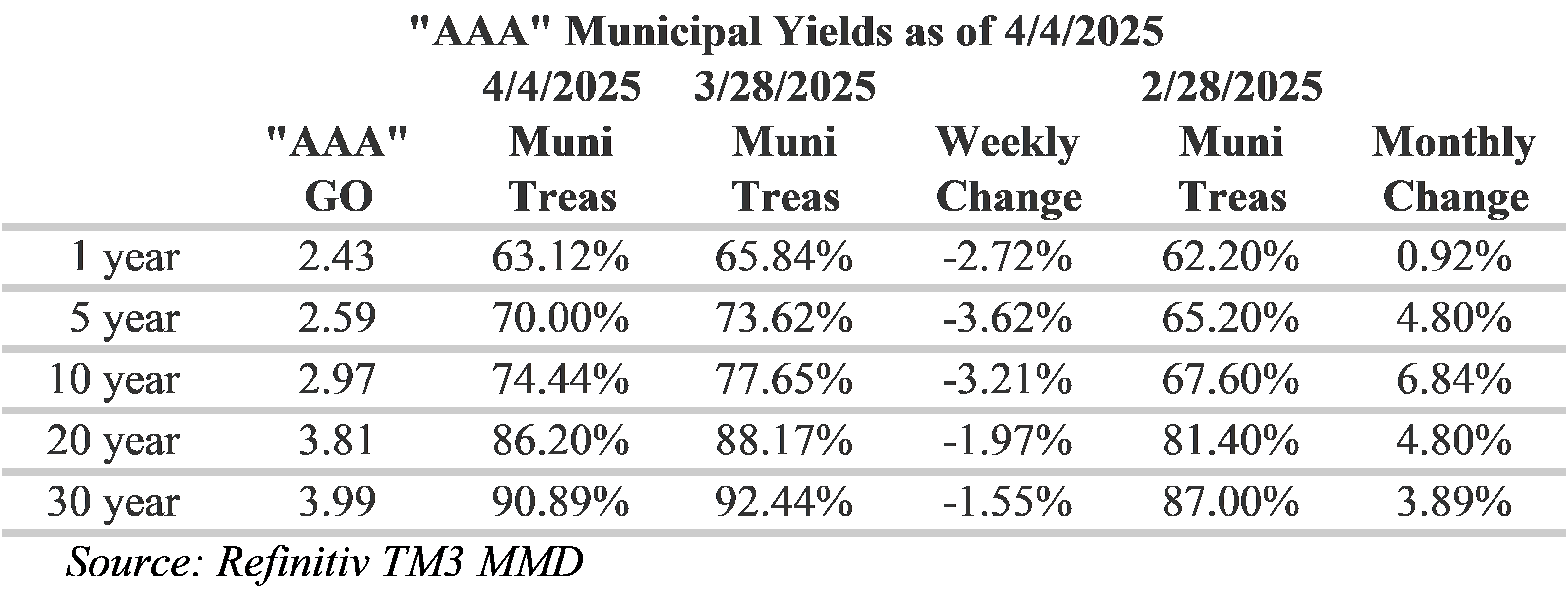

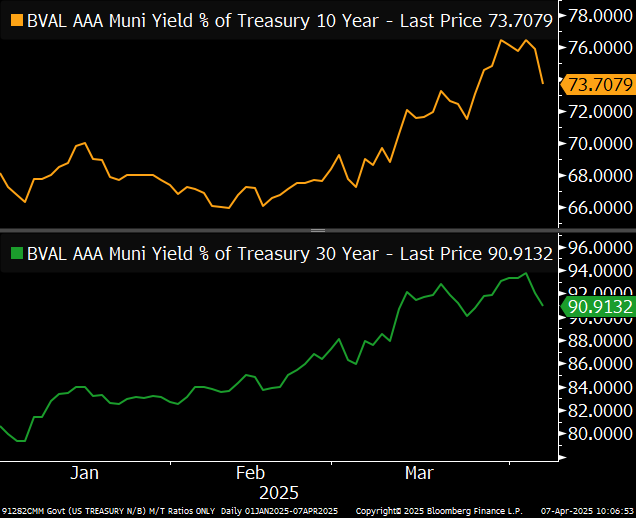

Ratios

Over the past week muni/Treasury ratios have changed dramatically as a result of diverging yield curve moves. Ratios are at the highest level we have seen in the past 12-months and present significant value when compared to Treasury bonds. The short-end of the municipal yield curve experienced the largest changes with 1-year ratios increasing 16% to 79.26% followed by the 5-year tenor with ratios improving 11% to 81%. Overall, the 17-year portion of the curve is an attractive place to position, with relatively steep slopes and yields approaching 90% of 20-year Treasury bonds.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.