Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue reading2025 LeadingAge Connecticut – Ripples of Impact Expo & Tradeshow

2025 LeadingAge North Carolina – Ripples of Impact Conference & Expo

2025 Methodist Ministries Network Annual Meeting

2025 Longevity + Inclusion Alliance Retreat

Mozaic Concierge Living Case Study (April 2025)

Sims Underwrites $333.4 Million in

Bonds for the Development of

New Life Plan Community in

Stamford, CT

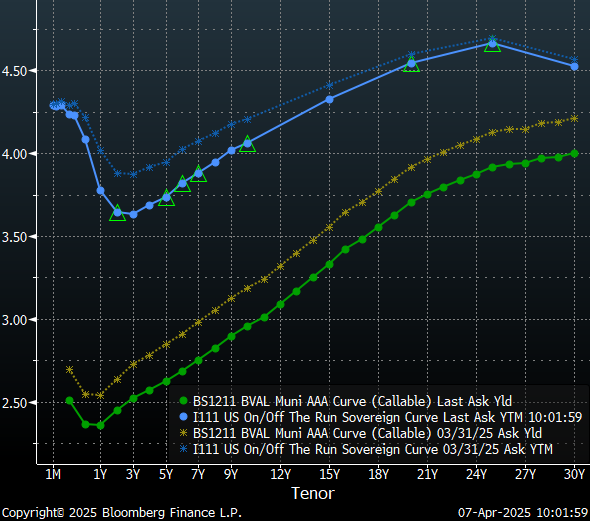

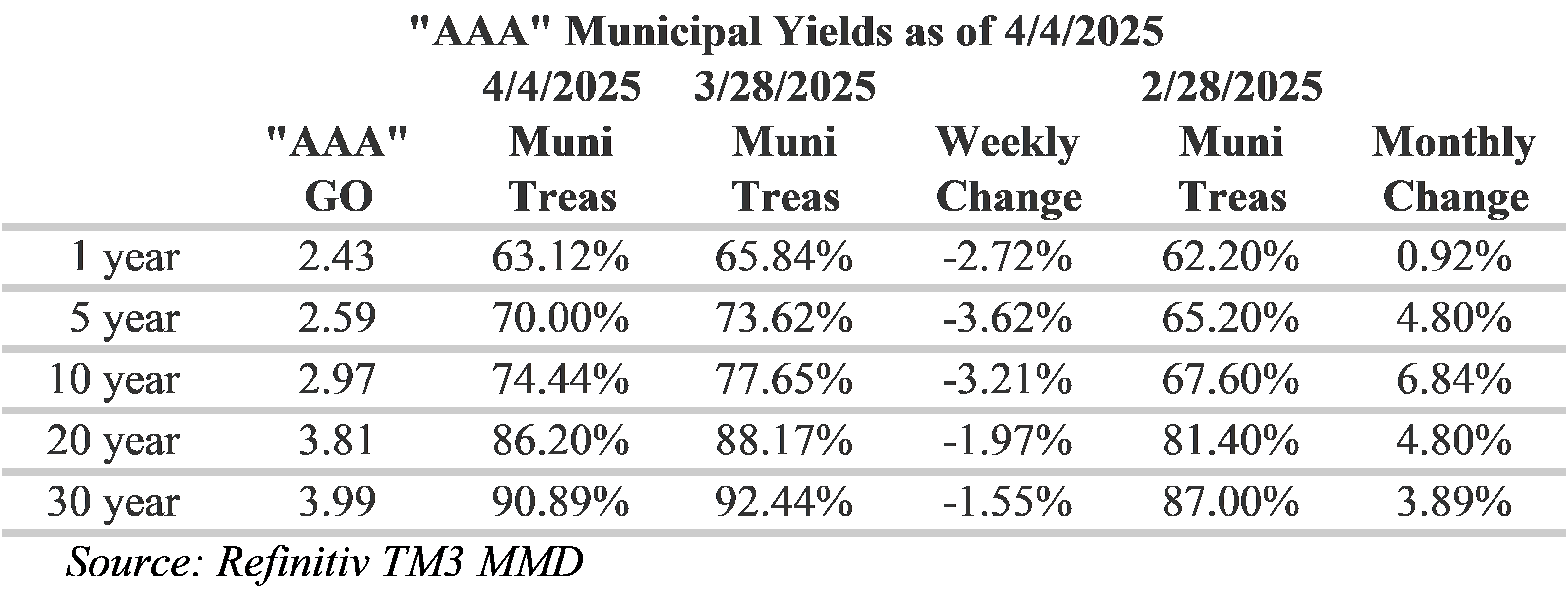

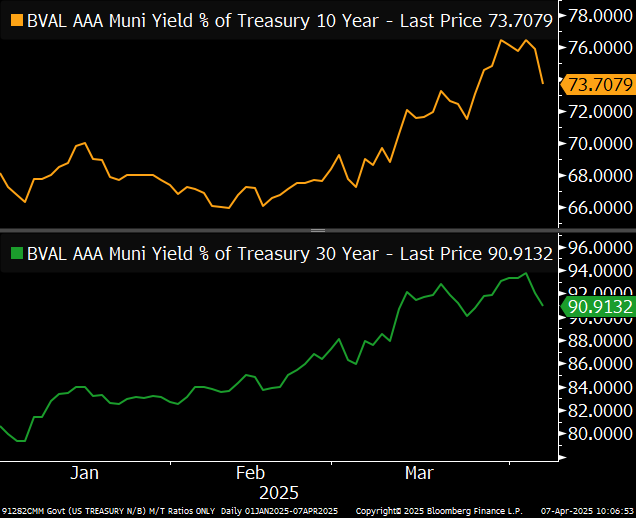

Curve Commentary: April 7, 2025

Market Commentary: Maximize Yield, Minimize Waste

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingKahala Nui Case Study (January 2025)

HJ Sims Lead Bookrunner on Kahala Nui Land Purchase Transaction to Help Secure Community’s Future

Continue readingMarket Commentary: Predictions

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue reading2025 4th Annual Building Hope Impact Summit & Awards

2025 NPL Charter School Facility & Finance Summit

2025 CAH (Critical Access Hospital) Conference

Rolling Green Village Case Study (September 2024)

Sims Advises Rolling Green Village on Strategic Pre-Development Capital

Continue readingMarket Commentary: Bug On The Wall

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue reading2025 Environments for Aging Conference

Market Commentary: If I Ran the Zoo

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingThe 22nd Annual HJ Sims Late Winter Conference

Market Commentary: Millions, Billions and Trillions

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue reading