The global population climbed to 8 billion people on Tuesday, November 15, according to the United Nations, up from 5.3 billion in 1990. More than half of us — an estimated 5 billion — from every nation, ethnicity, faith, age range, income level and occupation will watch some or most of the FIFA World Cup games during the 29 days of competition underway in Qatar. Not billions but millions of people around the world also tune in to the monthly press conferences held by Jerome Powell, the head of the U.S. central bank. These events are shorter in duration and much less exciting than the World Cup games but produce just as much if not more wagering.

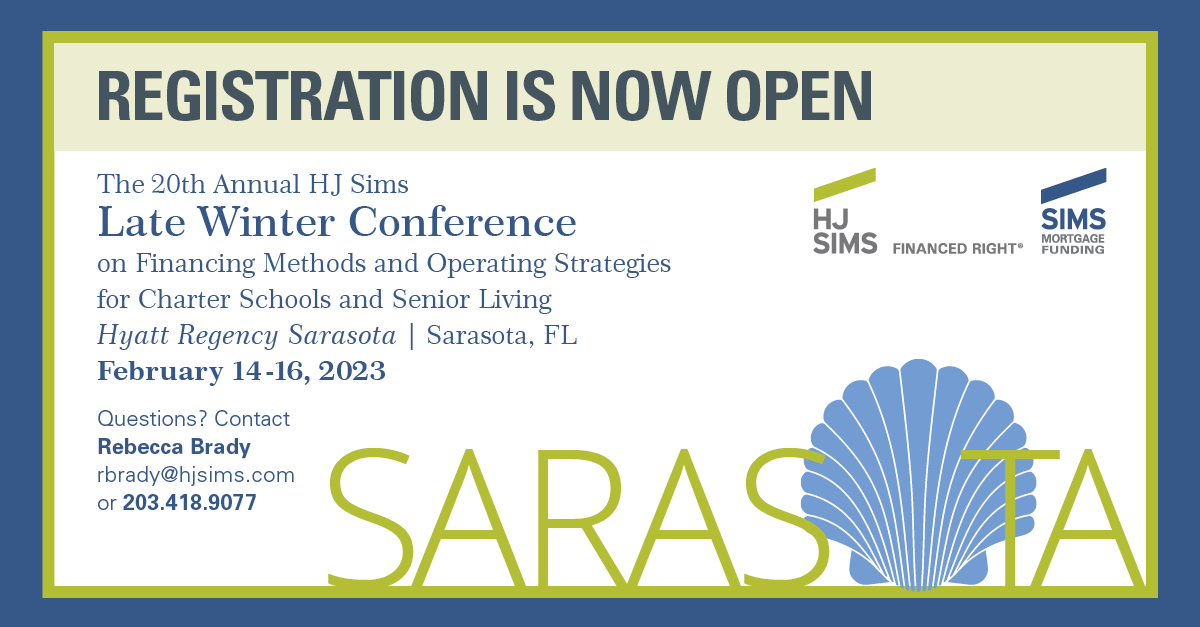

Continue readingThe 20th Annual HJ Sims Late Winter Conference

HJ Sims Market Commentary: Red, White, Black and Blue Confetti

The 2024 presidential campaign season is off to a start already with Tuesday’s announcement by former president Donald J. Trump. The launch of his third bid for the Oval Office came just one week after the mid-term elections flipped the U.S. House to Republican rule by a slim margin but left the Senate under Democratic control, likely reliant once again upon Vice President Harris to cast tie-breaking votes depending on the outcome of the December 6 runoff in Georgia.

Continue readingHJ Sims Quarter in Review – 3Q 2022

HJ Sims had a busy 3Q with financings totaling $354.7 million. Check out the highlights and our financings for clients from the quarter.

Continue readingCanyon Grove Academy (September 2022)

HJ Sims successfully closes on $15.625m Series 2022A Bonds for Utah public charter school, Canyon Grove Academy.

Continue readingWhite Horse Village (September 2022)

HJ Sims secures $38.7m of hybrid bank financing combining $28.7m tax-exempt direct bank loan renewal and $10.0m taxable revolving line of credit for new capital for PA single site Life Plan Community, White Horse Village.

Continue readingHJ Sims Market Commentary: Numbers Count

More than 18 million veterans who have served our country in the active military, naval or air service will be honored this week at parades, dinners, award ceremonies and other events commemorating their sacrifice and service. A grateful nation pauses once a year to thank all those who have defended our many freedoms — including the one we just exercised with spirit this week. An estimated 42 million early ballots were cast in the midterm elections and, by the time all the tallies are final, this could be the second midterm in a row where voters exceeded 100 million.

Continue readingMorningside Ministries (October 2022)

Refinancing led by HJ Sims locks in long-term permanent financing and provides flexibility for future growth for Texas nonprofit organization, Morningside Ministries.

Continue readingHJ Sims Market Commentary: Cracking the Code

Codes are, of course, absolutely critical to communication during times of war and, in modern military history, one that was never broken remains famous to this day. During World War II, Japanese cryptographers intercepted but were never able to decipher the messages sent by the U.S. Marine Navaho Code Talkers. The code was developed at Camp Elliott in San Diego in May 1942 by a small group of 29 Navajo men, some as young as 15, based on the complex, unwritten, verb-based Navaho (Diné) language. Although far from Window Rock, the Navajo Nation Capital, central bankers around the world have developed their own cryptic language that traders and investors struggle to decipher.

Continue readingHealthcare Communities Owner and Operator (September 2022)

HJ Sims provides healthcare communities owner and operator $4.6m Tranche B loan for acquisition of skilled nursing communities.

Continue readingHJ Sims Market Commentary: Carving Up the Markets

In one old Irish folktale, one night on All Hallows’ Eve, Stingy Jack was quenching his thirst at a pub when he ran out of money to pay his tab. The Devil, seeing an opportunity, suddenly appeared. But wily Jack managed to turn the tables and trap the Devil not once but twice. The price for the Devil’s release was that he would leave Jack alone and never ever lay claim to his soul. When he died, he was sentenced to roam the earth for eternity with nothing more than a lantern made from a carved-out turnip to light his way. Folks terrified by the prospect of the wandering soul that came to be known as Jack O’Lantern, began carving scary faces out of turnips, potatoes and mangelwurzels, placing them in windows or near entryways to scare him away. Irish immigrants brought the practice to America, the world’s eighth largest pumpkin grower, and soon every October called for us to start carving jack-o-lanterns out of this plump, orange, easily carve-able fruit. Pumpkins go hand in hand with Halloween and Thanksgiving, and both holidays draw near. It is the season of plenty — plenty of inflation in food, bond yields, fund outflows, bearishness and fear of missing out

Continue readingAn Exclusive Investment Opportunity: The Dogwoods @ Long Ridge Project

HJ Sims Market Commentary: Webs of Belief

The total amount of data in the world as of 2020 was estimated to be 44 zettabytes, or 44 trillion gigabytes, and every day since then we have created about 2.5 quintillion bytes more. So how do we handle this vast pool of information available to us, with more arriving constantly throughout the day and night? In order to be able to function amid all the information flow, we tend to create what some term a “web of belief”, a core logic, whether it is in fact logical or not. Many personal webs of belief have been completely altered during the pandemic. Those campaigning for public office count on many webs to be recast close to election day. It is happening again this year as voters have become laser focused on inflation, mortgage and interest rates, immigration, and crime, among other issues.

Continue readingCincinnati Classical Academy (September 2022)

HJ Sims provides Ohio-based start-up charter school with working capital funded entirely by HJ Sims’ Private Wealth Management clients.

Continue readingHJ Sims Market Commentary: Warped and Twisted

The Milky Way is vast: it may be one of trillions of galaxies in the universe, but it is about a thousand light years thick and stretching some 120,000 light years from end to end, holding every alien planet that our telescopes have ever spotted. To travel once around, it would take 250 million years. The Sun is based along one of its smaller arms about 26,000 light years from the turbulent core, which is packed with supermassive black holes. It has a thin, flat disk of gas and an unknown number of stars, some of which are believed to be 10 to 13 billion years old, in the middle. Near the edges, however, it appears rather sloppy, quite twisted and warped. In the financial markets these days, there is quite a lot that is warped, twisted and bubbly.

Continue readingHJ Sims Market Commentary: Fourth Quarter Challenges and Opportunities

There is a form of writing going back to the 17th century known as a lipogram wherein a single letter, or a number of letters, are omitted from a work. The author’s challenge is to compose a poem, article or book without using the common letter ‘e’, for example — no easy task. In the case of this short market commentary, 889 instances of the vowel ‘e’ can be found. Imagine the difficulty involved in penning, say, a 50,000-word novel without a single use of that letter. These days we do not need to conjure up new challenges. We have plenty as it is just trying to get through a trading day without another loss, passing a gas station without seeing higher prices, coughing and wondering if we have the new COVID variant, turning on the TV without having a central banker tell us about the harsher dose of rate medicine we need to swallow for the next six months – or longer.

Continue readingHJ Sims Closes Life Insurance Company Loan for Assisted Living and Memory Care Community

HJ Sims is pleased to announce that it was recently successful in bringing a new solution to a valuable client seeking to refinance and pay off construction debt of an assisted living and memory care community by employing a fixed-interest, 10-year term for a non-recourse loan.

Continue readingAssisted Living and Memory Care Community in the Rocky Mountains (July 2022)

HJ Sims closes life insurance company loan for assisted living and memory care community in the Rocky Mountains – the second in less than 30 days.

Continue readingHJ Sims Market Commentary: Bear Market Conditions

The Atlantic Hurricane season is upon us, having arrived late but with lethal force. It typically runs from June to November, but this year the first major hurricane did not arrive until September 20. The focus is currently on the Category 3 storm headed to Tampa Bay but the remnants of Fiona are still being felt in Puerto Rico and eastern Canada. For people already exhausted by the pandemic, weakened by inflation and battered by investment losses, hurricanes seem to symbolize the hazardous conditions we face in 2022. There are still three months left in the year, but we would all like to evacuate now.

Continue readingCarroll Lutheran Village (September 2022)

HJ Sims Acts as an Advisor to Place Long-Term Fixed Rate Cinderella Refinancing and Capital Expenditures Credit Facilities.

Continue reading