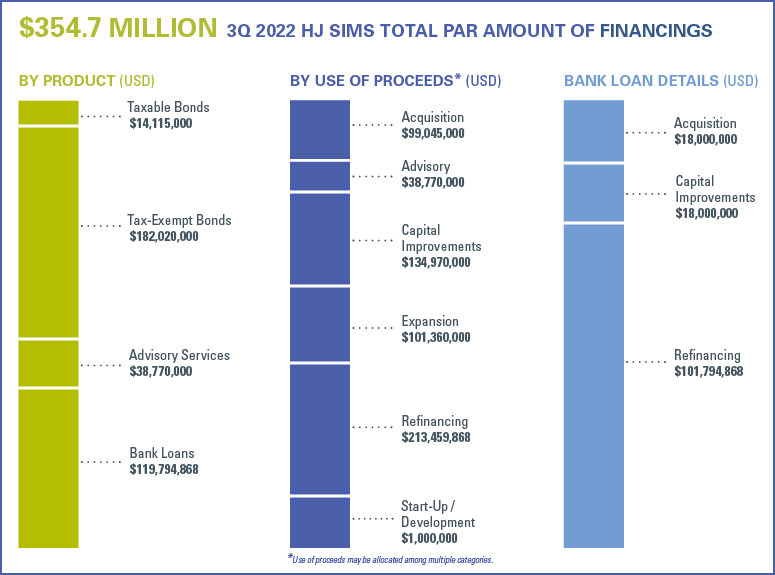

3Q 2022

Financings

HJ Sims Partners with Army Residence Community to Position the Organization for Continued Success

Army Residence Community has been serving military-affiliated seniors in Texas since January 1987. Located on 138 acres in northwest San Antonio and serving around 710 residents across more than 450 independent living units, 78 assisted living units, and 91 skilled nursing units. As part of their strategic planning, ARC sought a financing partner that would allow them to fund the first phase of their community renovation while maintaining flexibility for potential future community renovation and expansion. Read more.

HJ Sims Continues to Partner with Asbury Communities to Assist with Multiple Strategic Initiatives in Pennsylvania

Asbury Communities, Inc. owns and operates life plan communities in Maryland and Pennsylvania, as well as HUD Section 202 senior housing buildings, a foundation, and a for-profit technology consulting firm. Over the past two years, HJ Sims has assisted Asbury in several capacities to expand and fulfill its mission in Pennsylvania. Read more.

HJ Sims Acts as an Advisor to Place Long-Term Fixed Rate Cinderella Refinancing and Capital Expenditures Credit Facilities

Carroll Lutheran Village is a life plan community located outside of Westminster, MD. The community (post-renovation) will include 381 independent living units, 50 assisted living units, and a healthcare center comprised of 103 skilled nursing beds. A long-time client of HJ Sims, CLV has utilized the advice and expertise of the firm for financing solutions dating back to 2004. Read more.

HJ Sims Successfully Closes on $15.625m Series 2022A Bonds for Utah Public Charter School, Canyon Grove Academy

Quail Run Primary School Foundation, dba Canyon Grove Academy, is a public charter school educating roughly 650 students in Pleasant Grove, UT. Offers individualized learning plans for each student and offers hybrid learning through digital and non-digital, synchronous and asynchronous, both on-campus and off-campus. Read more.

HJ Sims Provides Start-Up Charter School with Working Capital Funded Entirely by HJ Sims’ Private Wealth Management Clients

Cincinnati Classical Academy (“CCA”) is a new public charter school coming to the Cincinnati, Ohio area in the fall of 2022. CCA has been granted a six-year charter to operate by St. Aloysius, an authorized sponsor in the state of Ohio. At the beginning of their first school year, CCA had over 460 students in kindergarten through 6th grade. Read more.

HJ Sims Successfully Completes $115 Million All Bank Tax-Exempt Financing for New Satellite Campus and Refinancing

High Point Academy is a public charter school educating over 1,650 students in K-12th grades spanning three campuses in the greater Fort Worth area of Texas. The school is projected to grow to serve 2,150 students in K-12 by 2026-27. The school’s charter was initially granted in 2014, and renewed in 2020 for a 10-year term through August 2030. Read more.

HJ Sims Secures $87.7M of Bank Financing for Expansion Project and Refinancing

Resthaven is a not-for-profit corporation based in Holland, Michigan that provides housing, healthcare and other related services through the operation of 145 skilled nursing beds, 116 assisted living units, and 60 independent living rental units. The organization also owns a community-based service organization. Read more.

HJ Sims Closes on $21.395 million Series 2022 Bonds for North Carolina Public Charter School, Shining Rock Classical Academy

Shining Rock Classical Academy (SRCA) is a public charter school educating 601 students in Waynesville, NC. The school seeks to develop college-ready, lifelong learners. SRCA has a curriculum based on a “whole student” with a strong emphasis on science and social studies. The initial charter was granted in 2015, and renewed in 2020 extending the charter to 2027. Read more.

HJ Sims Secures $38.7m of Hybrid Bank Financing Combining Tax-Exempt Direct Bank Loan Renewal and Taxable Revolving Line of Credit for New Capital

White Horse Village (WHV) is a strong performing single site Life Plan Community with 331 Independent Living Units, 48 Personal Care Units, 20 Memory Care Units and 59 Skilled Nursing Beds. It’s located on 97 acres, adjacent to Ridley Creek State Park, in Edgmont, PA about 20 miles west of Center City Philadelphia. Read more.

HJ Sims Closes Life Insurance Company Loan for Assisted Living and Memory Care Community

HJ Sims was recently successful in bringing a new solution for long term financing to a valuable client seeking to pay off the construction debt of a newly completed, 74 unit assisted living and memory care community located in the Mountain West. The well experienced, regional, owner/operator, currently operates more than 1,400 units across 26 communities in three different states. Read more.

HJ Sims Closes Second Life Insurance Company Loan in Less than 30 days

HJ Sims recently closed its second life insurance company loan in a 30-day period for the refinance of an assisted living and memory care community located in the Rocky Mountains. Loan proceeds were used to pay off the full recourse construction loan of the recently completed 49-unit community. The experienced Sponsor and real estate developer, along with a well-established regional, seniors housing operator, currently manages more than 25 communities across the Western U.S. Read more.

HJ Sims Provides $6.0 Million Mezzanine Loan for Nursing Home Acquisition

A national recognized owner and operator of healthcare properties and services was pursuing the acquisition of a portfolio two skilled nursing communities. The Sponsor owns a substantial portfolio of healthcare properties across several states with multiple operating partners. Outside of its healthcare portfolio, the Sponsor invests in a wide range of healthcare products and services, as well as other strategic real estate and business opportunities. Read more.

HJ Sims Provides $4.6 Million Tranche B Loan for Skilled Nursing Acquisition

A nationally recognized owner and operator of healthcare properties and services partner partnered with a regional owner and operator (collectively the “Sponsor”) to pursue the acquisition of a portfolio two skilled nursing communities (the “Portfolio”). The national sponsor owns a substantial portfolio of healthcare properties across several states with multiple operating partners. Read more.

Q3 Highlights

The HJ Sims Investment Banking Team Continues to Grow

We were thrilled to welcome three new members to the team in Q3.

Shannon Falon

Vice President

Shannon Falon serves as Vice President. She earned an undergraduate degree in public policy from the University of Southern California. After college, Shannon became a high school math teacher in Florida. Later earning a Master of Business Administration from the University of Florida, Shannon managed credit risk for a portfolio of middle market companies and then worked at Equitable Facilities Fund, where she helped the non-profit lender make facilities loans to dozens of charter schools. Throughout her career to date, Shannon has closed over $200 million in charter school loans. Consequently, her closed loans have helped serve over 6,000 students across nine networks.

Brock Bagelman

Analyst

A Texas native, Brock is based in Austin, serving as an Analyst supporting our for-profit investment banking team. Previously, Brock worked as an Assessment Management Intern at Rivendell Global Real Estate, where he prepared reports, synthesized data and uncovered inefficiencies saving the company approximately $100,000 in yearly revenue. He also worked as Leasing Agent at Housing Scout, where he closed over 30 leases. Brock holds a Bachelor of Business Administration in Finance from the University of Texas at Austin.

Greyson Harmon

Asset Management Analyst

Based in Austin, Texas, Greyson serves as an Asset Management Analyst, supporting banking operations and asset management. Previously, Greyson interned with Ice Miller, LLP as a Project Specialist, where he developed marketing material for clients and built a comprehensive client database. A former Division I baseball player, Greyson earned his Bachelor’s degree in Finance from Xavier University as well as a Master of Business Administration.