Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingMarket Commentary: Rising Above the Noise

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingCurve Commentary: January 26, 2026

Overview

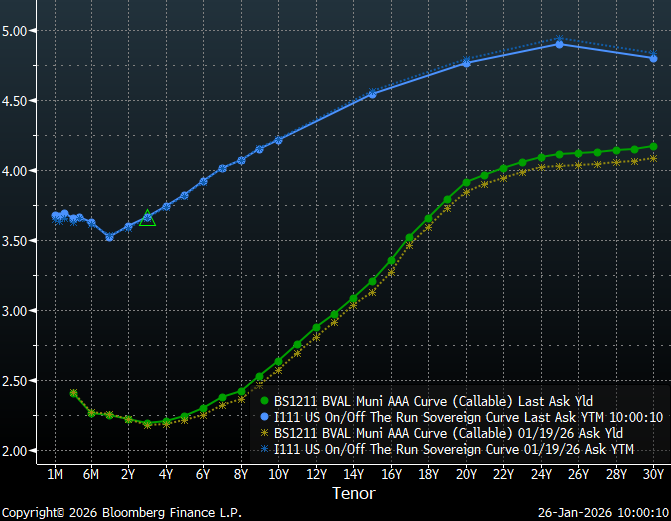

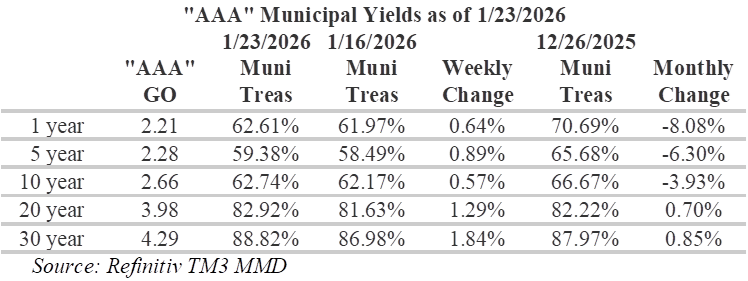

This morning on the trade desk, accounts are distracted by Winter Storm Fern, which has created havoc from Texas to Maine with 24 states declaring emergencies. In addition to widespread power outages, many roads and highways remain impassable and flight cancellations have reached levels not seen since the early days of the Pandemic. Despite the inclement weather, Treasuries rose over the five to 30-year tenors resulting in yields dropping to their lowest levels since last week’s volatility. Following a preliminary announcement by the Commerce Department of stronger than anticipated durable goods orders for November, gains were briefly pared.

Early last week, international events came into focus following instability in the Japanese bond market. Yields surged in the Japanese bond market following a pitch by Japanese Prime Minister Sanae Takaichi to cut taxes on food, which markets interpreted to mean increased government bond issuance. The result was 40-year Japanese yields jumping to the highest level of any maturity of the nation’s sovereign debt in more than three decades. In addition, escalating tensions over the control of Greenland with the threat of tariffs on European goods added to the melee. The municipal bond market responded to the uncertainty with bonds selling-off. As of the end of the day on Tuesday, MMD ultimately cut yields from 2bps in 2027-28 to 7 bps in 2041-56.

Despite the volatility early in the week, rates were relatively unchanged over the week. Treasuries outperformed munis with 30-year Treasury bonds rallying 3.3 bps while 30-year munis sold-off 8.7 bps. The overall result was a flatter Treasury curve and a steeper muni curve. Slopes along the municipal yield curve are steepest from 11 to 12 years, with 27 bps of slope and from 14 to 20-years, with 95 bps of slope. In addition, investors benefit from a steep roll-down over time. Although the municipal yield curve is currently rewarding duration, investors should be cautious when extending to maturities past 20-years, where the long-end becomes very flat. As a result of this flat tail, municipal bond investors can buy maturities under 20-years that yield over 90% of the 30-year curve.

Insights and Strategy

Muni/Treasury ratios for 10-year and shorter maturities have seen significant declines over the past month due to a concentration of retail demand at the front end of the yield curve. However, this is a still an improvement from September, when ratios in the 1-year tenor dropped to as low as 56%. Ratios further out the curve, from 20-years and longer, remain attractive relative to Treasuries due to weaker demand and wider spreads. For investors seeking to maximize curve positioning with relative value, extending to the 19-year part of the municipal yield curve provides over 90% of the 30-year maturity and over 80% of equivalent Treasury yields. In the rich belly of the curve, particularly around 5-years, we are hearing reluctance from institutional investors citing these ratios as unappealing relative to the rest of the curve.

Municipal new issuance volume is expected to be relatively quiet this week, with a just over $4 billion on the calendar. Significant deals include $750 million from the Triborough Bridge & Tunnel Authority and Florida Health Sciences Center Inc. Obligated Group with $369.3 million. Furthermore, states and local governments are planning to issue just under $9 billion in new supply over the next 30 days, according to data compiled by Bloomberg. In addition, the FOMC is scheduled to hold its press conference later this week to brief the markets. Currently, markets expect the Fed to hold rates steady following three straight cuts last year. In addition, the markets will be looking to the Fed for signals about where rates are headed.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Market Commentary: The Giant Chessboard

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingCase Study: Wesley Commons (November 2025)

Sims and Wesley Commons Execute on Tailored

Expansion and Repositioning Financing

Case Study: Rolling Green (November 2025)

HJ Sims Completes Bond-Financed Expansion

and Assisted Living Modernization for Rolling

Green Village

Market Commentary: Anniversary Years

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingCurve Commentary: January 12, 2026

Overview

Last week, the Bureau of Labor Statistics reported a drop in the unemployment rate to 4.4% in December, down from 4.5% in November. However, nonfarm payroll employment levels crept up by 50,000 workers, which was less than the downwardly revised 56,000 in November and short of analyst estimates. Overall, it was a mixed report that supports the narrative of a low hire, low fire job market and is unlikely to inspire a rate cut at the FOMC meeting later this month. Although December’s employment data did little to provide the clarity the capital markets are seeking, it was also not sufficiently weak to warrant a rate cut. Currently, fed funds futures are pricing-in only a 5% change of the Fed cutting rates in January.

The markets responded to this news with Treasuries selling-off, largely around the policy sensitive 2-year tenor with Treasury yields largely unchanged past about 10-years. Conversely, ‘AAA’ municipal yields fell across the curve, with the largest declines concentrated in the first few years. The rally in munis was largely supply driven following a modest calendar at year-end and a bit of a slow start to the new year. However, weekend news of the US central bank being subpoenaed by the Justice Department with threats of criminal indictment have markets concerned about Fed independence. In addition, this week is a heavy week for economic data with December’s Consumer Price Index scheduled to be released on Tuesday and November’s Producer Price Index scheduled to be released on Wednesday. As markets digest these events there is heightened level of risk for rate volatility over the next few days. In addition, as shown below, ACM 10-year Treasury term premium are at about the highest levels seen in over a decade. This is an indication of some nervousness about future and provides bond investors with a reward for assuming duration.

Slopes along the municipal yield curve are steepest from 14 to 19-years, with over 80 bps of slope. Like the Treasury curve, the municipal yield curve also rewards investors for extending duration. Investors benefit from a steep roll-down over time as bonds mature. Although the municipal yield curve is currently rewarding duration, investors should be cautious when extending to maturities past 20-years, where the long-end becomes very flat. As a result of this flat tail, municipal bond investors can buy maturities under 20-years that yield over 90% of the 30-year curve.

Insights and Strategy

Muni/Treasury ratios for 5-year and shorter maturities have seen significant declines over the past month due to a concentration of retail demand remains at the front end of the yield curve. However, this is a still an improvement from September, when ratios in the 1-year tenor dropped to as low as 56%. Ratios further out the curve, 20-years and longer, remain attractive due to weaker demand and wider spreads. For investors seeking to maximize curve positioning with relative value, extending to the 19-year part of the municipal yield curve provides over 90% of the 30-year maturity and over 80% of equivalent Treasury yields. In contrast to the rich belly of the curve, particularly from 5 to 10-years, we should start to see more pressure on the long-end as investors are tempted to extend duration by higher yields and relative value.

Municipal new issuance volume is expected to pick-up this week with over $11 billion in new issues on the calendar, up from approximately $7 billion last week. The New York City Transitional Finance Authority Future Tax Secured Revenue plans to sell $1.5 billion of bonds, Metropolitan Nashville Airport Authority is on the calendar with $1.28 billion, and California Community Choice Financing Authority is scheduled to offer $850 million. This past week, municipal bond mutual funds and ETF’s collectively benefitted from a little over $2 billion of inflows. Furthermore, last week was the fifth straight week that net flows topped $1 billion for municipal ETF’s. Given the strong fund flows and current relative values, this week’s larger calendar should face a receptive audience.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Market Commentary: Record Books Smashed

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingCurve Commentary: December 22, 2025

Overview

Although last week was a noteworthy week in terms of economic releases, yields for maturities past 6-months are largely unchanged. Last week’s economic releases included nonfarm payroll employment and the unemployment rate on Tuesday and the Consumer price Index on Thursday, hitting on both of the Fed’s primary goals of maximum employment and stable prices. Both the unemployment rate, at 4.6%, and the number of unemployed, at 7.8 million, were little changed from September. However, the current unemployment reading has crept up to the highest level seen in over 4-years. In addition, the all items CPI index, released on Thursday, surprised with a decrease in year-over-year inflation to 2.7%. The drop in inflation was largely attributed to a decline in the rent index and the owners’ equivalent rent index. It is important to note that we will have another payroll release prior to the Fed’s January meeting.

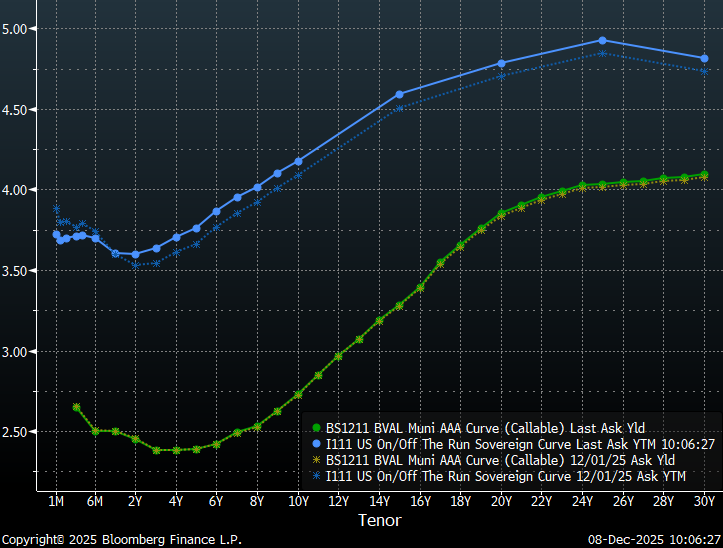

Given the mixed economic news, it is not surprising that the fixed income markets were largely unchanged over this past week. The prospect of additional rate cuts next year supports lower short-term yields, while long-maturity tenors are seeing the influence of elevated inflation expectations. But it is not just the past week that yields have held steady, even looking back two months to late October yields have been surprisingly steady. In the graph above, Treasury yields show the greatest change with modest steepening while municipals experienced relatively little change, particularly in the 5 to 20-year tenors.

Insights and Strategy

Slopes along the municipal yield curve are currently steepest around the 16-year tenor, with over 100 bps in slope from 10 to 19-years. This slope of the municipal yield curve currently rewards investors for extending from the 10-year range to the 15-20-year range. In addition, investors benefit from a steep roll-down over time. Although the municipal yield curve is currently rewarding duration, investors should be cautious when extending to maturities past 20-years, where the long-end becomes very flat. As a result of this flat tail, municipal bond investors can buy maturities under 20-years that yield over 90% of the 30-year curve.

Muni/Treasury ratios have generally cheapened/increased over the past week, except around the 1-year maturity, where ratios actually decreased to just above 70%. However, this is a remarkable change from September, when ratios in the 1-year tenor dropped to as low as 56%. When combined with modest inversion over the first 5-years of the curve and more appealing ratios at the short-end, investors hiding-out in cash or spooked by inflation may be tempted by short municipals. Nevertheless, for investors seeking to maximize curve positioning with relative value, extending to the 19-year part of the municipal yield curve provides 90% of the 30-year maturity and 80% of equivalent Treasury yields.

Over the next two weeks, the new issue calendar is relatively quiet for municipals. Tomorrow, the Bureau of Economic Analysis is scheduled to release its initial estimate of GDP for the third quarter. The original report was delayed due to the government shutdown. The Bureau of Labor Services is also scheduled to release updated July, August and September PCE Inflation (the Fed’s preferred gauge) data tomorrow. Following the Fed lowering rates by a quarter point on Dec. 10 and the divided opinions within the Fed, the fed funds futures are currently pricing-in only a 20% change of the Fed cutting rates in January.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

2026 SFCS’ 41st By Design Conference

HJ Sims is proud to be attending the 2026 SFCS’ 41st By Design Conference.

Attending:

Tom Bowden, Senior Vice President

David Saustad, Vice President

Market Commentary: Silver Bells Ring

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingHÓZHÓ ACADEMY Case Study (May 2025)

HJ Sims Partners with Hózhó

Academy to Finance Campus

Expansion and Facility

Enhancements

Curve Commentary: December 15, 2025

Overview

Last week, the Fed held its final meeting of 2025, with officials voting to cut its policy interest rate by a quarter-point for a third consecutive meeting. A lack of economic data, stemming from the longest-ever government closure, combined with a weakening labor market and lingering inflation has led to policy uncertainty. As a result, the Fed’s decision was not unanimous, with two regional Fed bank presidents voting to hold rates steady with one Fed governor voting for a half-point cut and nine members voting for a quarter-point cut. The market’s response to the decision has been relatively muted, with Treasuries rallying six to nine-basis points on the short-end of the curve and selling-off around four basis points on the long-end while munis were largely unchanged out to around 10-years and selling-off around two basis points on the long-end.

The markets continue to be responsive to comments from the Fed. The prospect of additional rate cuts next year supports lower short-term Treasury yields, while long-maturity tenors are supported by elevated inflation expectations. However, on the long-end, rate cuts into a relatively strong economy have the potential to ignite inflation to the detriment of long-duration assets. As shown in the graph below, slopes for municipals from both two to ten-years and from ten to twenty-years have steepened significantly in recent months relative to Treasuries.

Insights and Strategy

Slopes along the municipal yield curve are currently steepest around the 16-year tenor, with over 100 bps in slope from 10 to 19-years. As a result, the municipal yield curve currently rewards investors for extending from the 10-year range to the 15-20-year range. Investors also benefit from a steep roll-down over time. Although the municipal yield curve is currently rewarding duration, investors should be cautious when extending to maturities past 20-years, where the long-end becomes very flat. As a result of this flat tail, municipal bond investors can buy maturities under 20-years that yield over 90% of the 30-year curve.

Muni/Treasury ratios generally dropped over the past week. However, the biggest moves were around the 1-year maturity where ratios actually increased to just above 70%. This move was not a surprise since the extreme short-end of the curve is where the Fed exerts its greatest influence. However, this is a remarkable change from September, when ratios in this tenor dropped to as low as 56%. Nevertheless, for investors seeking to maximize curve positioning with relative value, extending to the 19-year part of the municipal yield curve provides 90% of the 30-year municipal maturity and 80% of equivalent Treasury yields.

This week, there is a busy economic calendar with the November jobs report along with an estimate of October payrolls due on Tuesday and the consumer price index scheduled for release on Thursday. Although bond traders are betting the Fed cuts rates twice next year, the Fed’s “dot plot” is currently indicating just one reduction in 2026. Therefore, we could see some volatility this week in response to the new data due to the mis-match of expectations. The markets are likely to embrace softer labor data as an indication of a more-dovish Fed. In addition, there is a seasonal push for borrowers to complete transactions before year-end. This week, the municipal bond market is expected to offer more than $6 billion in new issues. Notable deals this week include: New York Transitional Finance Authority with $2 billion and Ohio State University with $562 million.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Market Commentary: Palace Intrigue

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingCurve Commentary: December 8, 2025

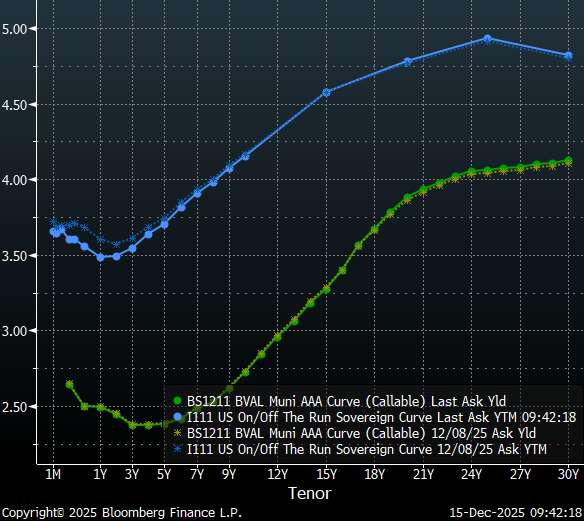

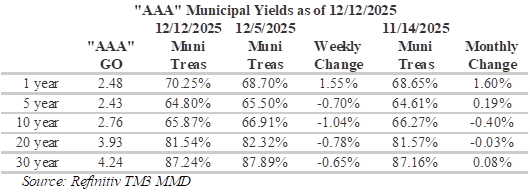

Overview

This past week, the Treasury curve shifted up eight to nine basis points in a parallel fashion from two years out while municipal yields remain essentially unchanged with the long end only about a basis point higher. The result is a steeper Treasury curve with municipal bonds generally outperforming Treasuries. Perhaps the most meaningful developments occurred in Treasuries on the extreme short-end with one-month and two-month yields rallying 10 to 20 basis points in anticipation of a Fed rate cut this week. However, following last Friday’s release of the delayed core personal consumption expenditures price index form the Bureau of Economic Analysis, inflation concerns were reinforced with prices up 0.2% from August and 2.8% from the prior year. As a result, the rate cut expected at the Fed’s final 2025 meeting later this week could potentially accelerate inflation concerns on the long-end.

Moreover, the balance of the year has the potential to be more dynamic than previous years for the fixed income markets. As a result of the shutdown, the traditional data-release schedules have been pushed-back this year. November payroll data will not be published until next Tuesday on December 16, November’s CPI is scheduled for release two days later on December 18 and third quarter GDP is scheduled to be released just two days before Christmas. In addition, the Supreme Court could release their decision on the IEEPA tariff case later this month.

Insights and Strategy

Slopes along the municipal yield curve continue to be steepest around the 16-year tenor, with over 100 bps in slope from 10 to 19-years. This is a significant change from earlier last month, when the steepest slopes were around the 10-year tenor. This shift has increased the reward to investors for extending from the 10-year range to the 15-20-year range. In addition, investors benefit from a steep roll-down over time. Although the municipal yield curve is currently rewarding duration, investors should be cautious when extending to maturities past 20-years, where the long-end becomes very flat. As a result of this flat tail, municipal bond investors can buy maturities under 20-years that yield over 90% of the 30-year curve.

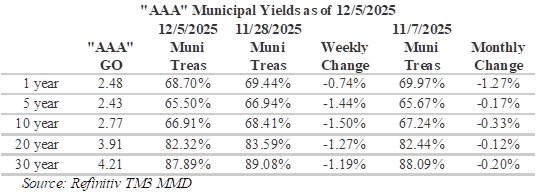

Elevated municipal tax-equivalent yields on the long-end continue to reward investors, although not by as much as they did last week. Muni/Treasury ratios have generally dropped a bit over the past week, with the biggest moves around the 10-year maturity where ratios have declined 1.5% to 66.91%. Ratios of this level are historically rich and primarily appeal to individuals investors in the top tax brackets. Not surprisingly, over the past month, the biggest moves have been on the extreme short-end of the curve where the Fed exerts its greatest influence. One-year ratios are now 1.27% richer as ratios have dropped to 68.70%. For investors seeking to maximize curve positioning with relative value, extending to the 18-year part of the municipal yield curve provides 88% of the 30-year maturity and 77.5% of equivalent Treasury yields.

This week, the municipal bond market is expected to offer more than $10 billion in new issues following a $15 billion calendar last week. Notable deals this week include: $2 billion Regents of the University of California Revenue Bonds, $1 billion Chicago O’Hare International Airport and New York Housing Development Corp. with $753 million. Fund flows have generally been supportive over the past month. LSEG Lipper Global Fund Flows reported that intermediate-maturity municipal bond funds saw inflows of $133 million last week while high-yield municipal bond funds experienced inflows of about $253 million and long-term muni funds saw inflows of about $320 million.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Market Commentary: Trotting Out the Turkeys

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue reading2025 Ohio Masonic Groundbreaking Ceremony

HJ Sims is proud to be attending the 2025 Ohio Masonic Groundbreaking Ceremony.

Attending: Lynn Daly, Executive Vice President

The 23rd Annual HJ Sims Late Winter Conference

Financing Methods and Operating Strategies for Charter Schools and Senior Living

Planning is underway for the 2026 HJ Sims Late Winter Conference, and it’s already shaping up to be an unforgettable experience. Join us for an energizing program featuring dynamic speakers, timely insights, and meaningful opportunities to connect with peers and industry leaders.

We’re thrilled to host our 23rd annual conference at the stunning Marriott Sanibel Harbour Resort & Spa in Fort Myers, Florida. Nestled along the waterfront with sweeping views of Sanibel and Captiva Islands in the upscale Punta Rassa community, this premier destination offers the perfect setting for learning, collaboration, and inspiration.

For conference attendance, follow our Safety Protocol.

Registration is now open! Visit our conference website to explore the full agenda, reserve your hotel accommodations, review event logistics, and access everything you need to plan your experience. We look forward to welcoming you to an exceptional conference in an unbeatable setting.

For more information, please contact Kat Dymond.

Academics of Math and Science Case Study (October 2025)

$18,405,000 | October 2025 | Avondale & Mesa, AZ

“We knew that long-term rates made expansion to highneed Arizona communities challenging. But our program is designed for this mission and it is our calling to serve students in need. In partnership with Sims, we were able to offer investors an opportunity to challenge the customary structure with an innovative offering, and also to equip us to make a very positive impact in the communities we serve. The result was a win for students, a win for investors, and a win for AMS.”

-Katie Determan, CFO of AMS Tweet

Partnered Right®

Academies of Math & Science (“AMS”) is a school network that operates 10 charter schools; 8 are located in metro-Phoenix and 2 are located in

Tucson. Together, the campuses serve 8,646 students from grades K-8. Sims collaborated closely with school management aligning on goals

to build out AMS Mesa, while optimizing financing for its existing operations.

Structured Right®

The $18.405 million financing proceeds were designed to support the construction of the new AMS Mesa campus and the expansion of the

existing Avondale campus. This structure featured a unique approach -a 10 year mandatory tender, the first of its kind in the charter school sector,

which Sims believes lowered the yield by ~100bps. The bonds also included capitalized interest to support the school through the initial enrollment ramp-up.

Executed Right®

Despite a challenging market backdrop during pricing, HJ Sims successfully brought the transaction to the market. The offering received indications of interest from 15 institutional investors, 6 of which were new investors to AMS, and bonds were ultimately allotted across all 15 of them – a massive success for the school.

Financed Right®

In August 2025, HJ Sims successfully placed $18.405 million in unrated, tax-exempt revenue bonds with institutional investors. The transaction

enables AMS to expand capacity and continue serving a growing student population across the metro-Phoenix and Tucson area.