Overview

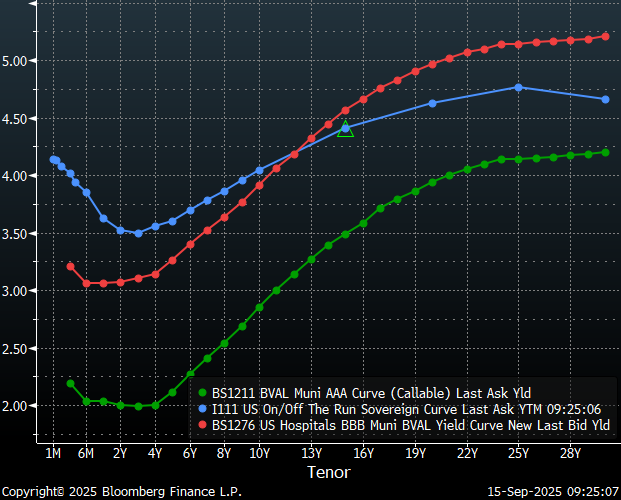

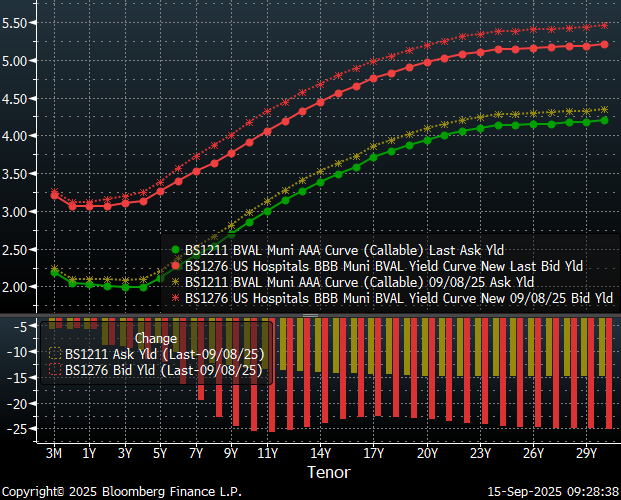

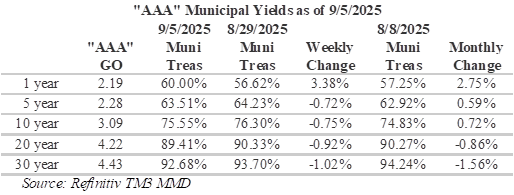

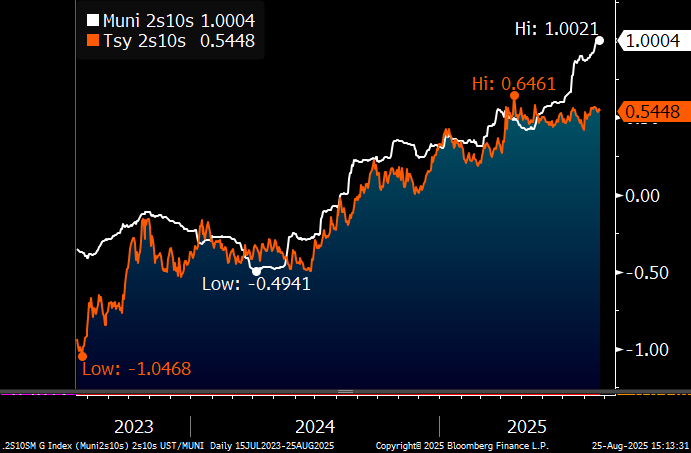

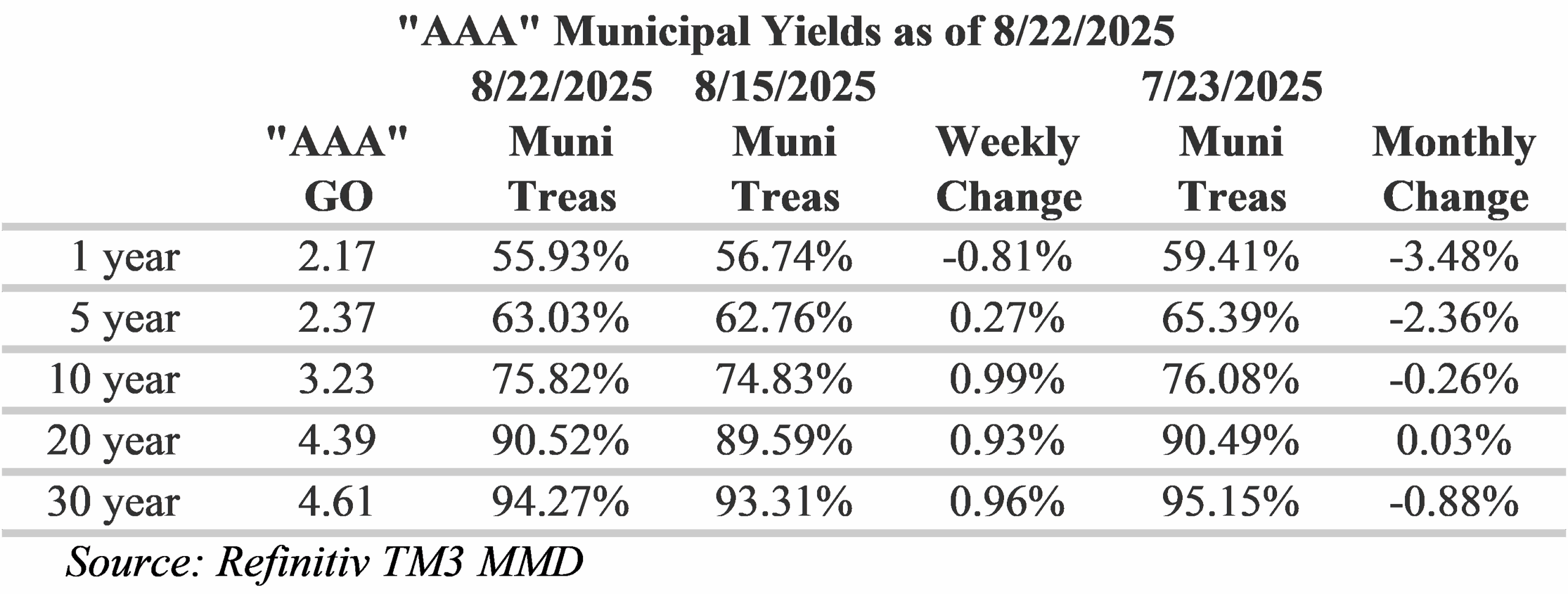

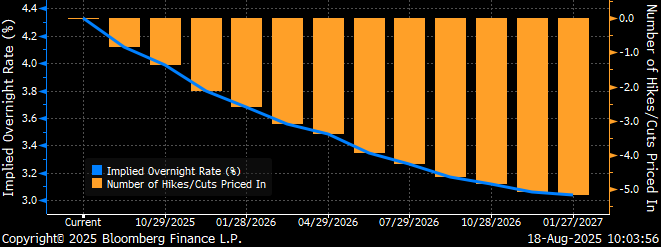

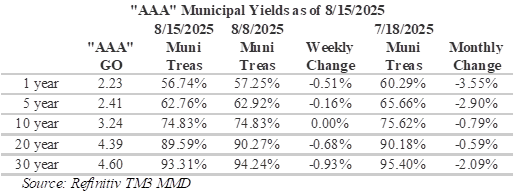

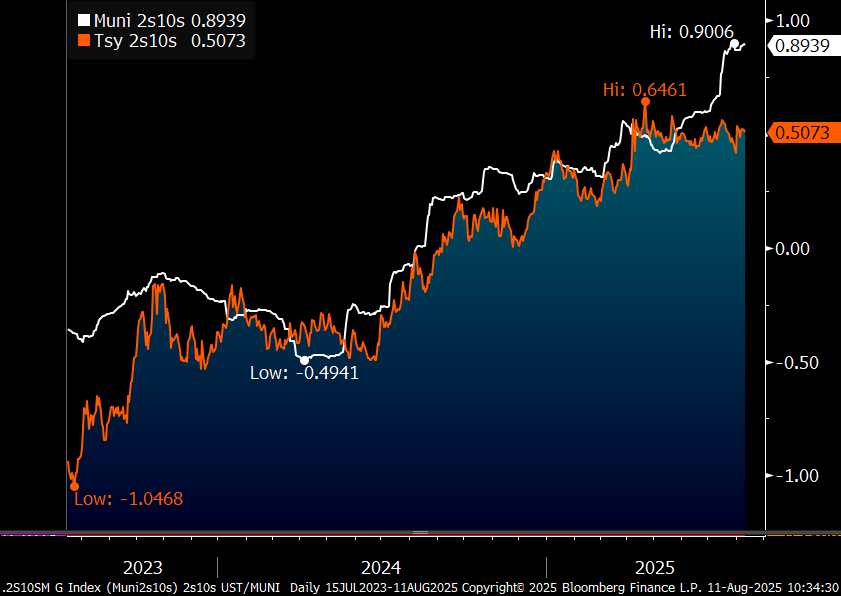

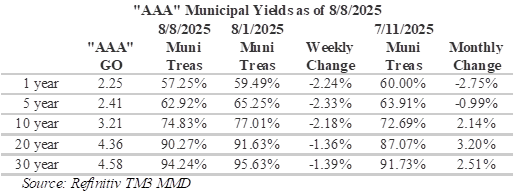

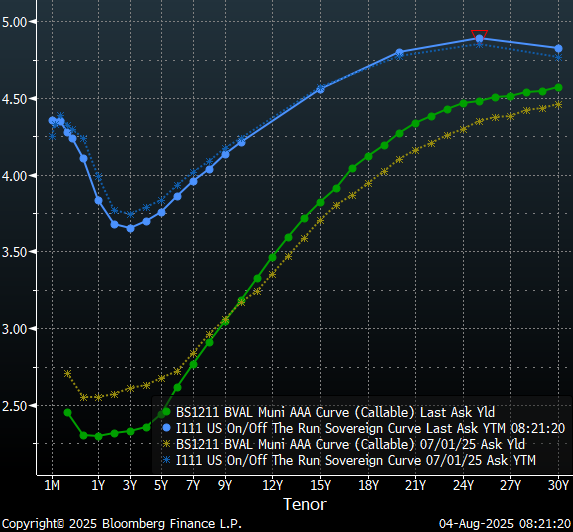

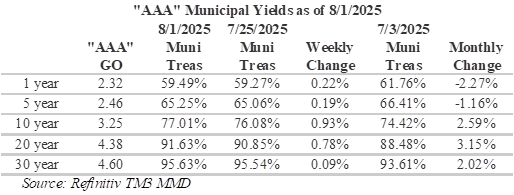

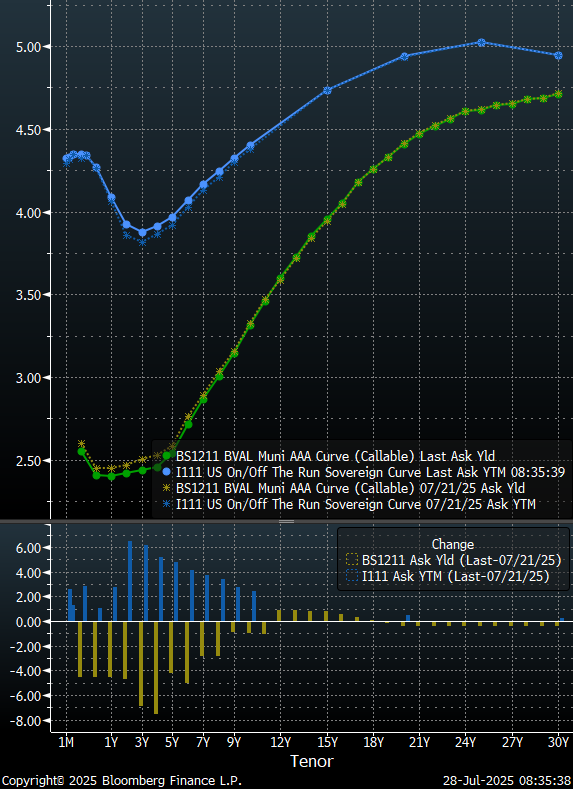

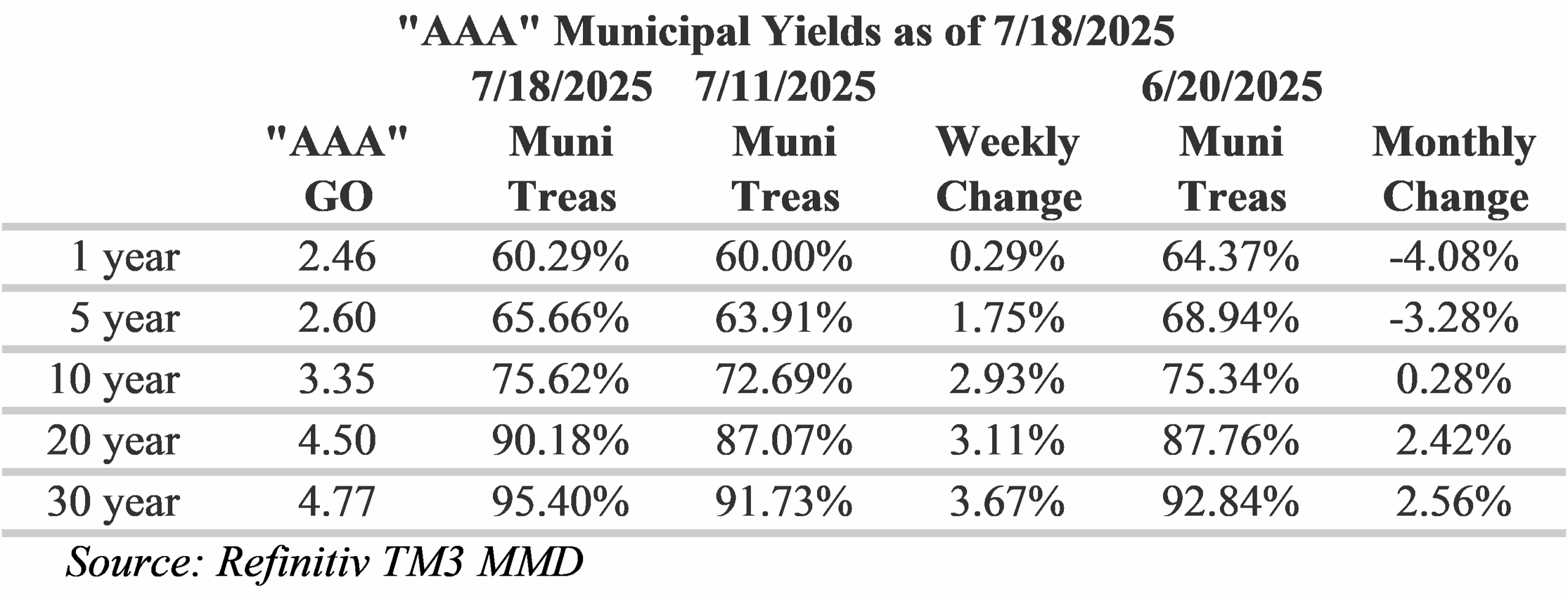

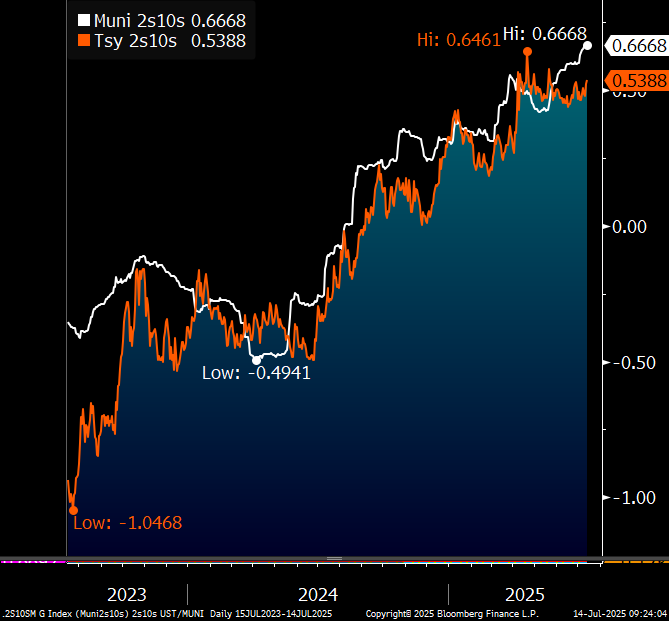

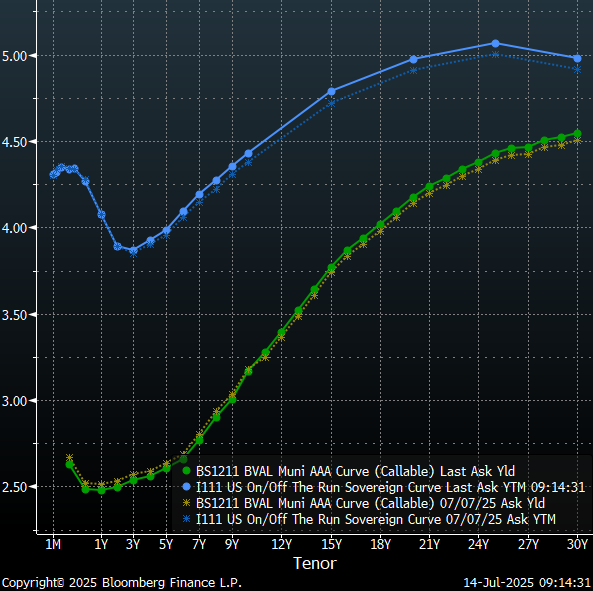

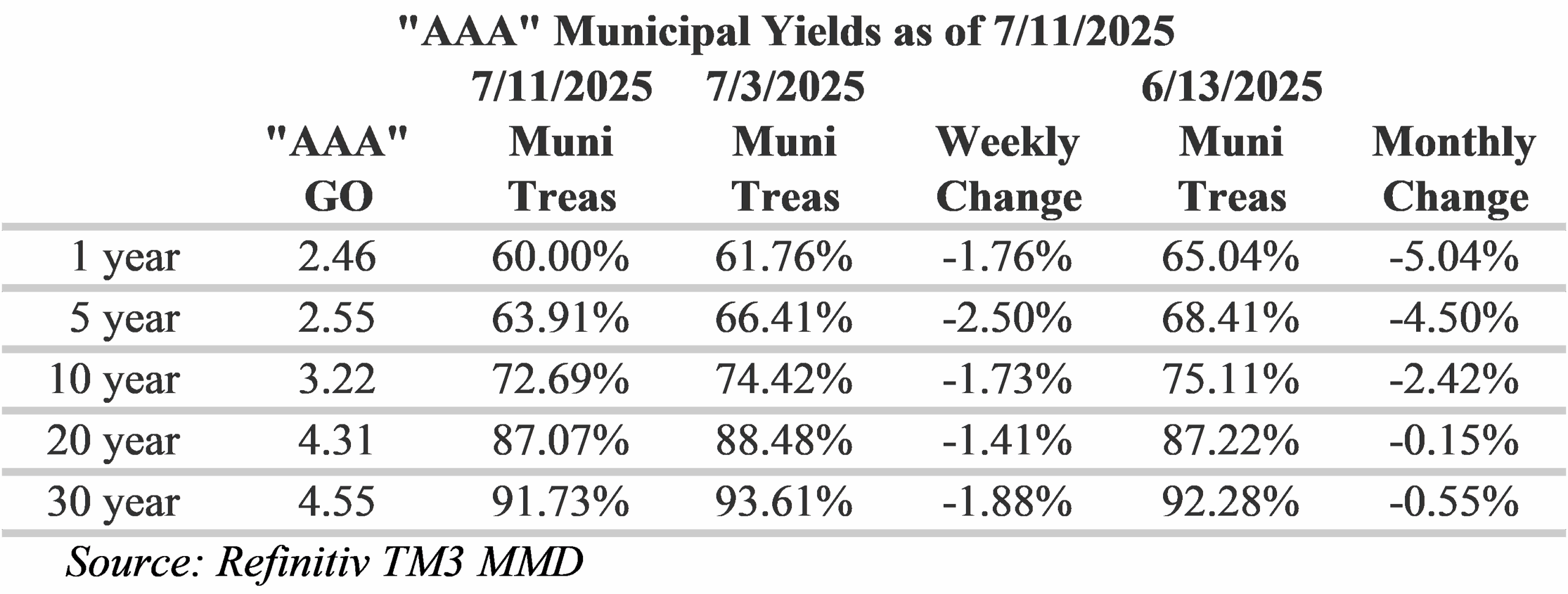

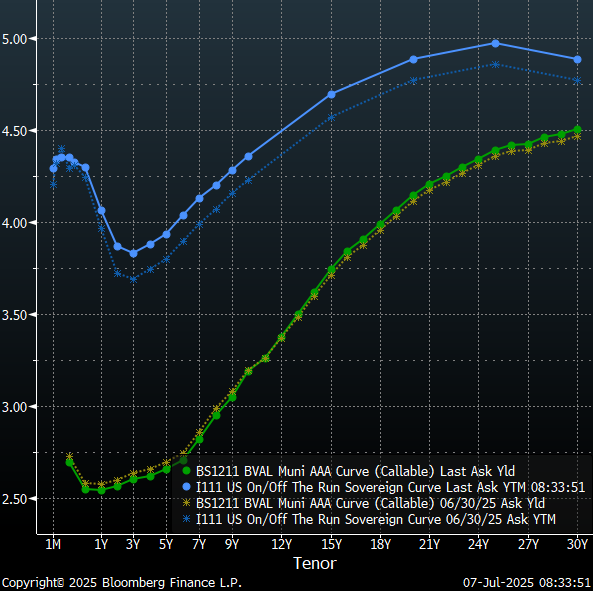

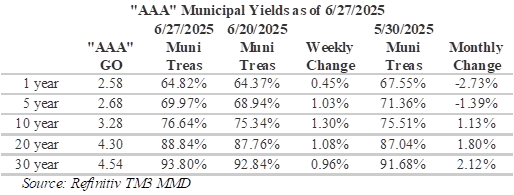

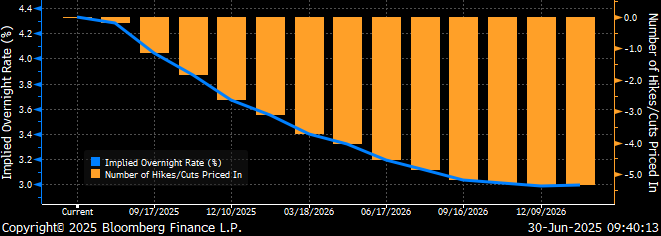

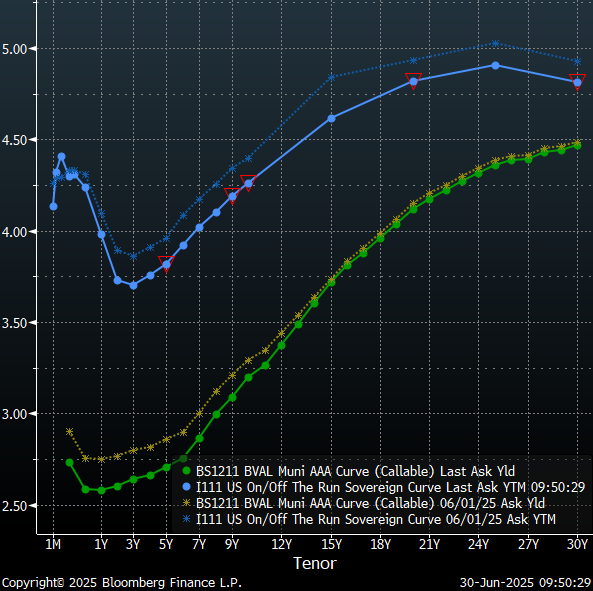

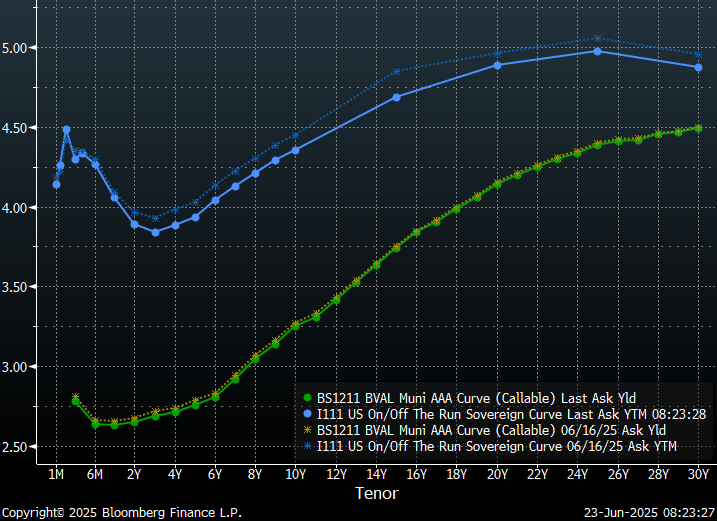

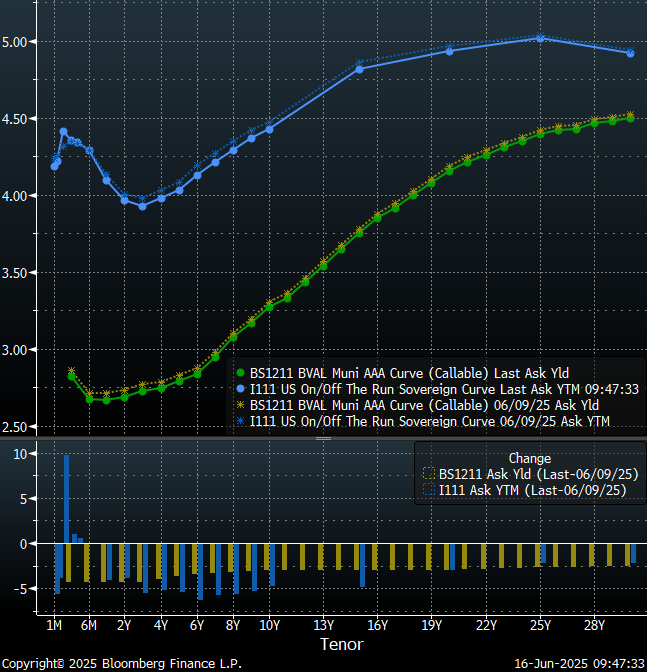

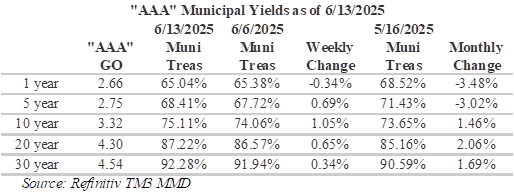

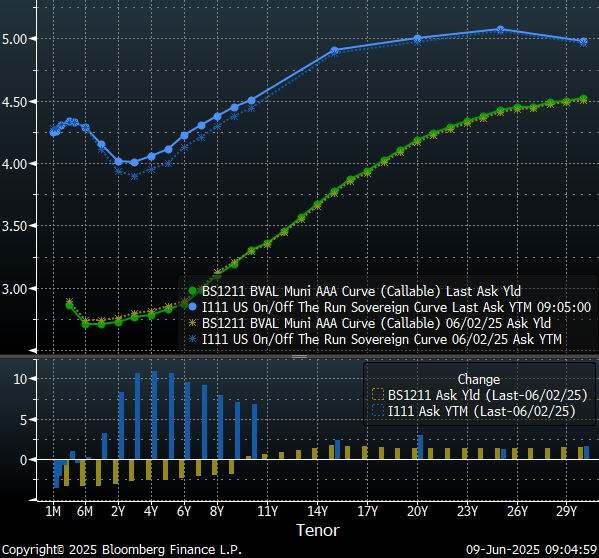

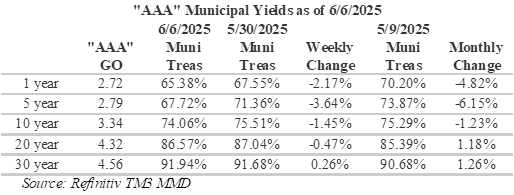

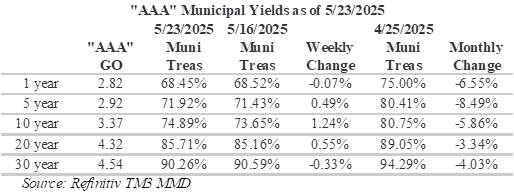

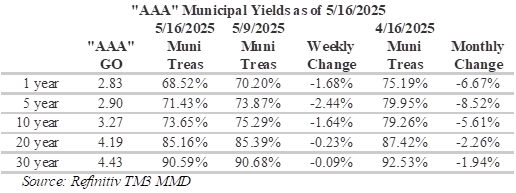

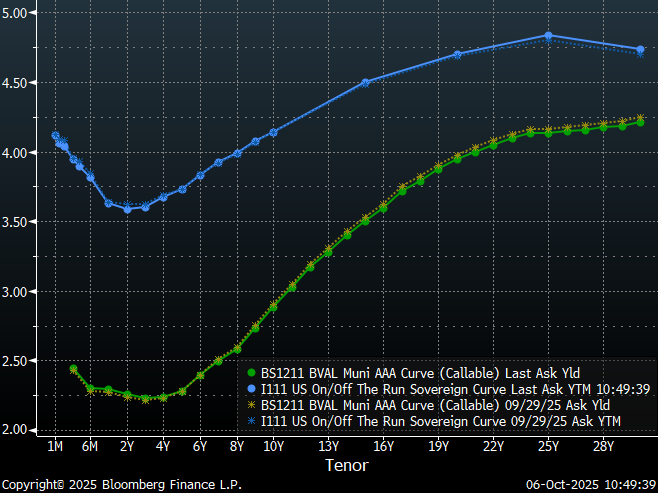

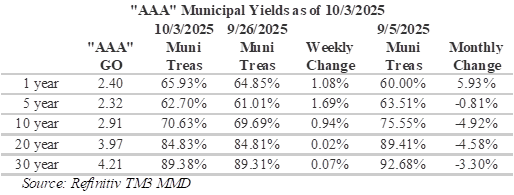

Although the U.S. government shutdown last week, Treasury and municipal markets were largely undaunted with yields experiencing only minimal change. However, the shutdown has resulted in the Bureau of Labor Statistics postponing its Employment Situation report, which is ordinarily delivered on the first Friday of the month, to report on employment levels and unemployment. Despite the lack of data, Treasury yields only moved down by about 4 bps on the short-end and up by about 5 basis points on the long-end with the 5-year tenor essentially unchanged. Muni yields moved in almost the opposite direction, with short yields climbing 2 basis points and long yields falling about 3.5 basis points and, like Treasuries, 5-year yields were essentially unchanged. Furthermore, the Fed funds futures market is currently indicating an almost certain 94.6% chance of a 25bps rate cut at the Fed’s October 29 meeting.

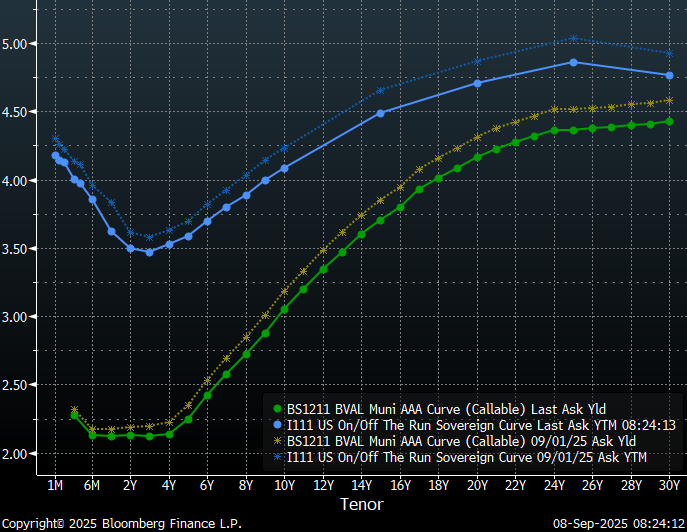

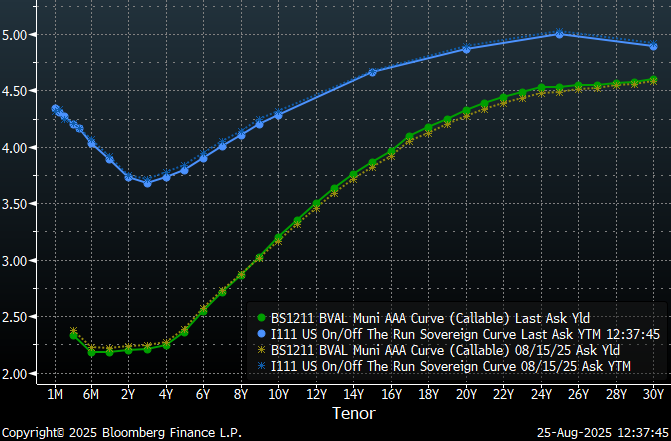

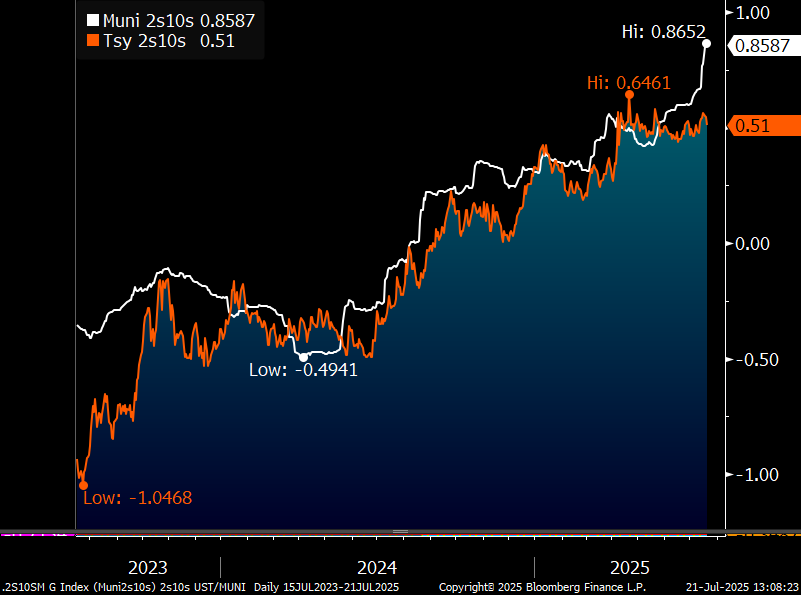

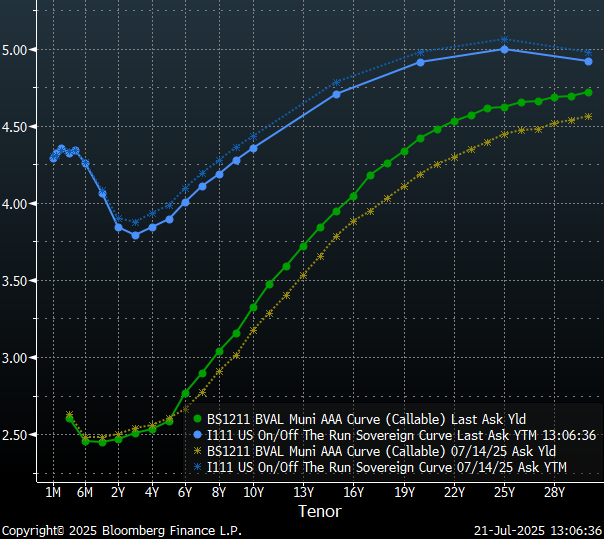

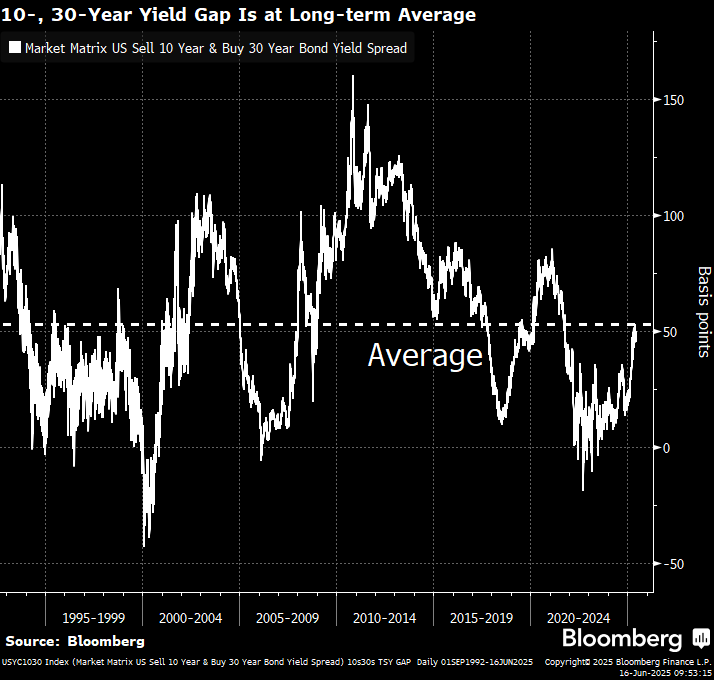

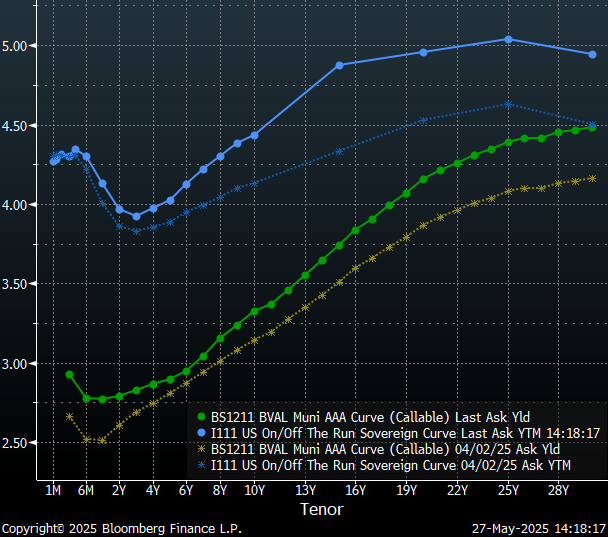

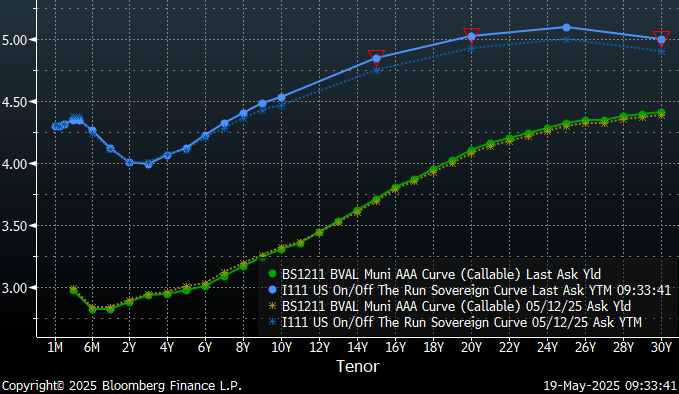

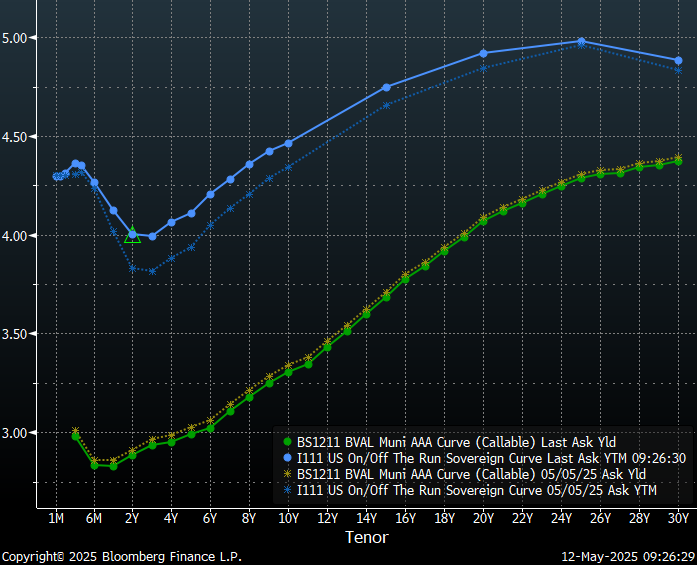

Overall, the Treasury curve is about 9 bps steeper over this past week and the muni curve is about 5.5 bps flatter. Slopes along the municipal yield curve are steepest around the 10-year tenor, with over 50 bps in slope from 8 to 12-years. Although the municipal yield curve continues to reward duration, the long-end has become very flat with steadily declining slopes from 15 to 30-years and only a basis point per year past 25-years. As a result of the flat tail, municipal bond investors can buy maturities under 20-years that yield over 90% of the 30-year curve.

Insights and Strategy

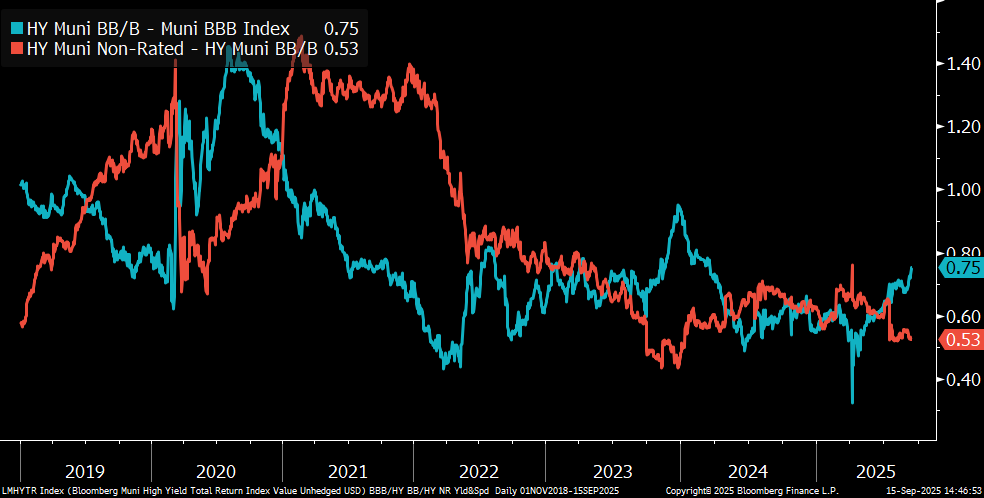

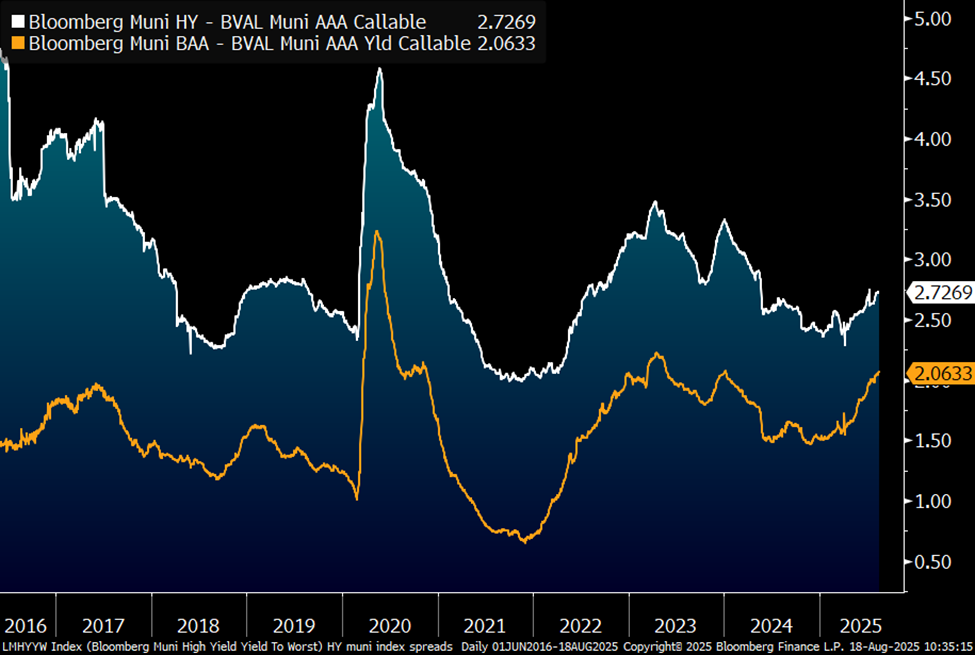

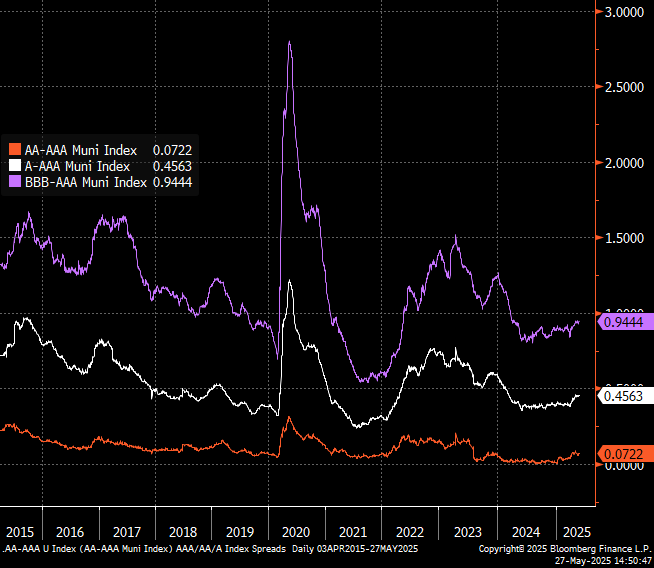

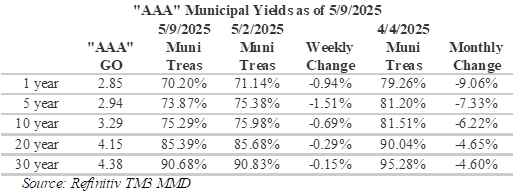

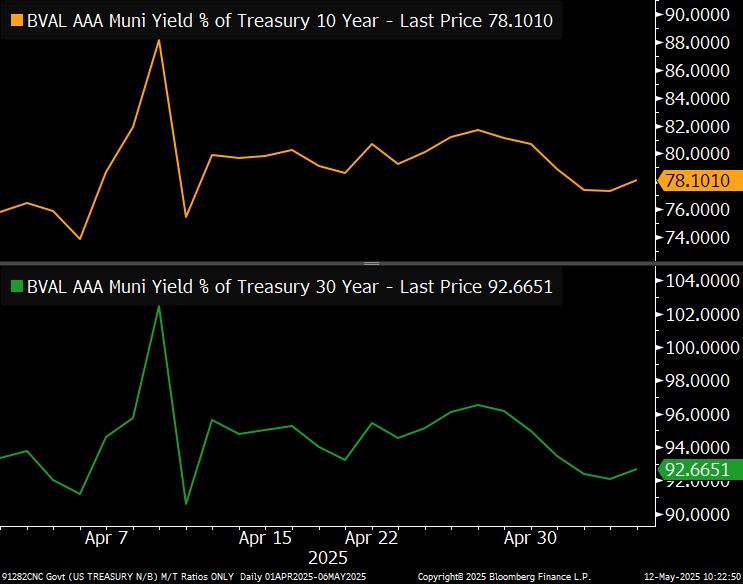

Muni/Treasury ratios, which provide a sense of how tax-exempt munis fare against taxable fixed-income options, have generally cheapened over the past week. Crossover investors, which seek to identify the best opportunities in the fixed income universe on an after-tax basis, closely follow this ratio. While shorter ratios have cheapened the most, they remain only narrowly appealing even to individual investors in the top tax brackets. The 10-year historical mean for the 5-year tenor is 74.71% versus 62.7% today. Ratios on the longer end of the curve continue to reward investors for extending duration with 30-year ratios approaching 90%. Although ratios in this part of the curve are meaningfully richer than they were a month ago, they continue to provide compelling value. For investors seeking to maximize curve positioning with relative value, the 12 to 18-year part of the municipal yield curve provides as much as 90% of the 30-year maturity and over 80% of equivalent Treasury yields.

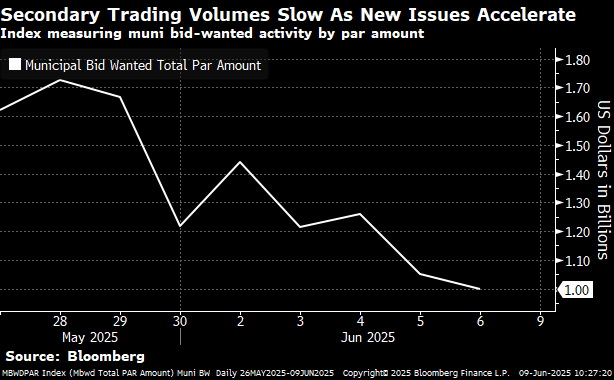

This week, municipal issuers are expected to sell more $12.9 billion in new issues with year-to-date issuance levels eclipsing $436 billion, which is 13.5% more than had been issued last year at this time. Transportation issues dominate the calendar this week with the Texas Transportation Corp. selling $1.8 billion, the State of Maryland Department of Transportation selling $842.7 million and the North Texas Tollway offering 627.2 million. This supply will likely be met with strong demand with $11.8 billion in municipal bonds expected to mature in the next 30-days, $5 billion in calls announced over the next 30-days and LSEG Lipper Global Fund Flows reporting weekly inflows of $1.1 billion last week.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.