Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingCurve Commentary: December 8, 2025

Overview

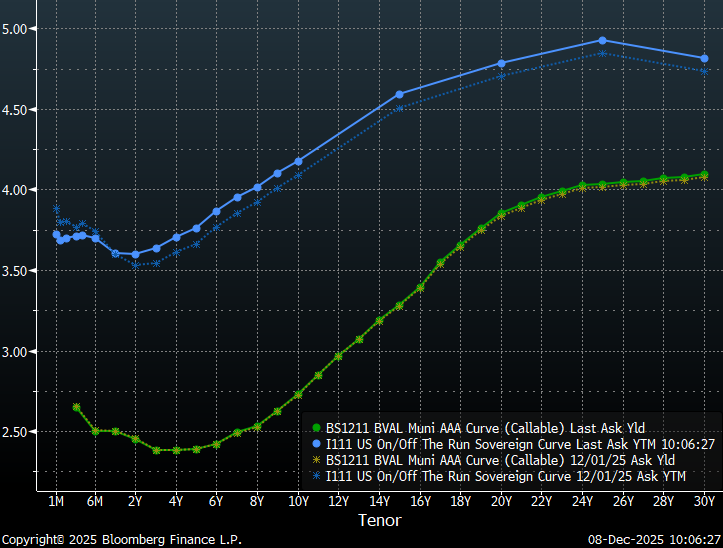

This past week, the Treasury curve shifted up eight to nine basis points in a parallel fashion from two years out while municipal yields remain essentially unchanged with the long end only about a basis point higher. The result is a steeper Treasury curve with municipal bonds generally outperforming Treasuries. Perhaps the most meaningful developments occurred in Treasuries on the extreme short-end with one-month and two-month yields rallying 10 to 20 basis points in anticipation of a Fed rate cut this week. However, following last Friday’s release of the delayed core personal consumption expenditures price index form the Bureau of Economic Analysis, inflation concerns were reinforced with prices up 0.2% from August and 2.8% from the prior year. As a result, the rate cut expected at the Fed’s final 2025 meeting later this week could potentially accelerate inflation concerns on the long-end.

Moreover, the balance of the year has the potential to be more dynamic than previous years for the fixed income markets. As a result of the shutdown, the traditional data-release schedules have been pushed-back this year. November payroll data will not be published until next Tuesday on December 16, November’s CPI is scheduled for release two days later on December 18 and third quarter GDP is scheduled to be released just two days before Christmas. In addition, the Supreme Court could release their decision on the IEEPA tariff case later this month.

Insights and Strategy

Slopes along the municipal yield curve continue to be steepest around the 16-year tenor, with over 100 bps in slope from 10 to 19-years. This is a significant change from earlier last month, when the steepest slopes were around the 10-year tenor. This shift has increased the reward to investors for extending from the 10-year range to the 15-20-year range. In addition, investors benefit from a steep roll-down over time. Although the municipal yield curve is currently rewarding duration, investors should be cautious when extending to maturities past 20-years, where the long-end becomes very flat. As a result of this flat tail, municipal bond investors can buy maturities under 20-years that yield over 90% of the 30-year curve.

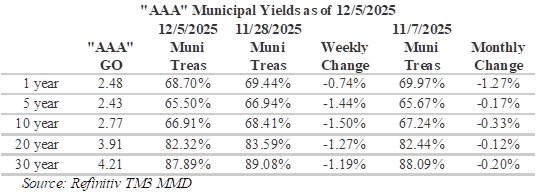

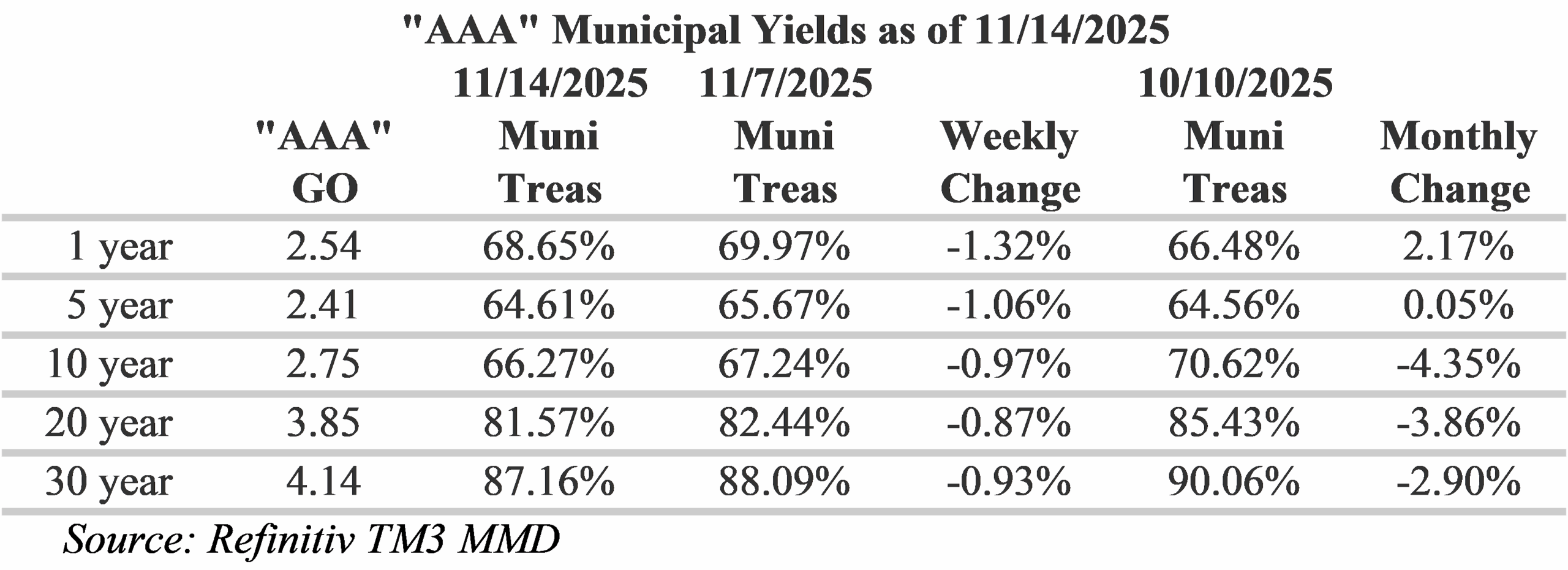

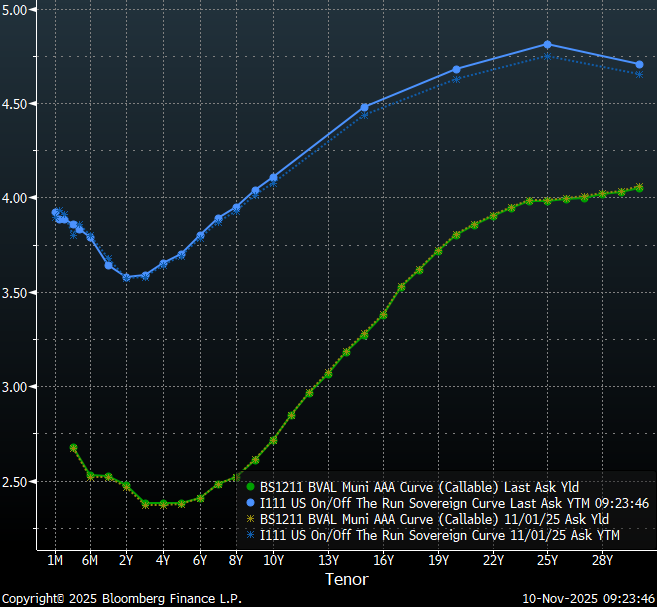

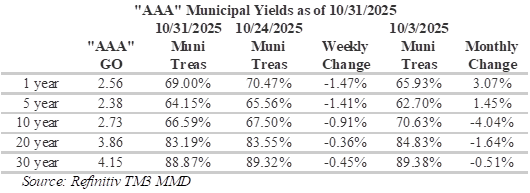

Elevated municipal tax-equivalent yields on the long-end continue to reward investors, although not by as much as they did last week. Muni/Treasury ratios have generally dropped a bit over the past week, with the biggest moves around the 10-year maturity where ratios have declined 1.5% to 66.91%. Ratios of this level are historically rich and primarily appeal to individuals investors in the top tax brackets. Not surprisingly, over the past month, the biggest moves have been on the extreme short-end of the curve where the Fed exerts its greatest influence. One-year ratios are now 1.27% richer as ratios have dropped to 68.70%. For investors seeking to maximize curve positioning with relative value, extending to the 18-year part of the municipal yield curve provides 88% of the 30-year maturity and 77.5% of equivalent Treasury yields.

This week, the municipal bond market is expected to offer more than $10 billion in new issues following a $15 billion calendar last week. Notable deals this week include: $2 billion Regents of the University of California Revenue Bonds, $1 billion Chicago O’Hare International Airport and New York Housing Development Corp. with $753 million. Fund flows have generally been supportive over the past month. LSEG Lipper Global Fund Flows reported that intermediate-maturity municipal bond funds saw inflows of $133 million last week while high-yield municipal bond funds experienced inflows of about $253 million and long-term muni funds saw inflows of about $320 million.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Market Commentary: Trotting Out the Turkeys

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingCurve Commentary: December 1, 2025

Overview

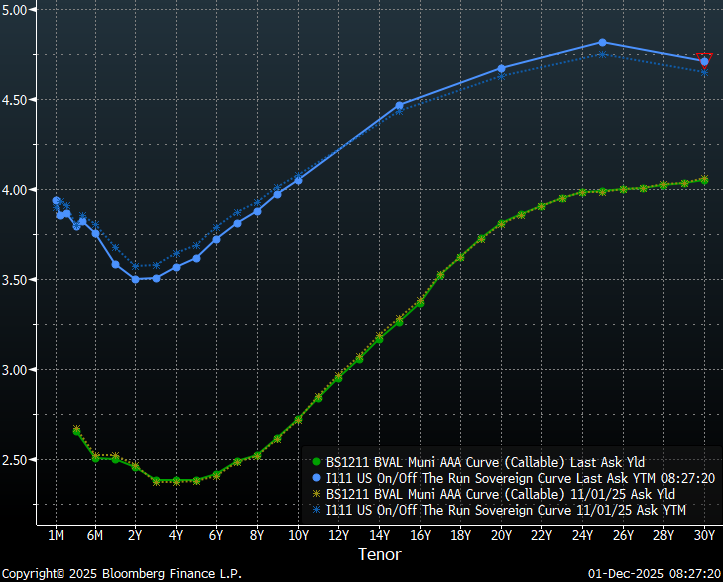

Despite uncertainty regarding the reopening of the U.S. government, conflicting information from Fed policymakers and the wild swings in market sentiment regarding the prospects of another rate cut, yields on municipal bonds and Treasuries have changed relatively little over the past month. Municipal yields for all tenors were generally within a basis point or less of their yields from the beginning of November and Treasuries were also relatively unchanged with a slight steepening as rates rallied modestly from 6-weeks to 5-years and sold off 7 to 10-basis points in tenors past 15-years. The stability in the fixed income markets can partially be attributed to the lack of key economic data during the shutdown and the continuation of long-term trends with structural labor market concerns and continued stubbornly high inflation.

This morning the Fed funds futures market was pricing-in the probability of a third rate cut this year at over 100%, which is a dramatic shift from just a few weeks ago when the probability was in the high 20% range. Although recent economic data has been largely supportive of a rate cut, should the Fed maintain current rates we will likely see some turbulence given implied rates. Lately business activity has been slowing. Today’s ISM Manufacturing Index contracted for the 9th straight month with activity shrinking by the most in four months. However, the employment picture is still not clear. The BLS will not be publishing the October employment report until after the Fed issues its decision, which is also when it will be releasing November data.

Insights and Strategy

Slopes along the municipal yield curve are currently steepest around the 16-year tenor, with over 100 bps in slope from 10 to 19-years. This is a significant change from earlier last month, when the steepest slopes were around the 10-year tenor. This shift has increased the reward to investors for extending from the 10-year range to the 15-20-year range. In addition, investors benefit from a steep roll-down over time. Although the municipal yield curve is currently rewarding duration, the long-end has become very flat with steadily declining slopes from 20 to 30-years and only a basis point or so per year past 25-years. As a result of this flat tail, municipal bond investors can buy maturities under 20-years that yield over 90% of the 30-year curve.

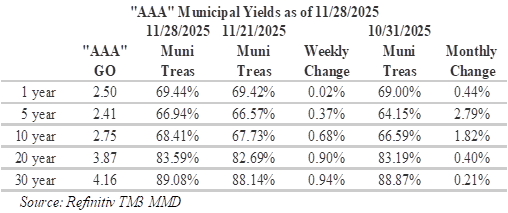

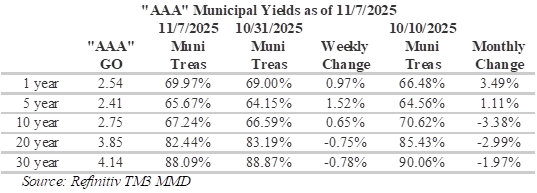

Elevated municipal tax-equivalent yields on the long-end continue to reward investors, with ratios generally cheapening over the past week. The muni/Treasury ratio is a widely watched measure that provides a sense of how tax-exempt munis fare against taxable fixed-income options. Crossover investors, which seek to identify the best opportunities in the fixed income universe on an after-tax basis, closely follow this ratio. Over the past week, the biggest moves have been on the long-end of the curve, where ratios are approaching 90%. Over the past month, the biggest moves have been around the 5-year maturity where ratios are approaching 3% richer. For investors seeking to maximize curve positioning with relative value, extending to the 18-year part of the municipal yield curve provides almost 90% of the 30-year maturity and almost 80% of equivalent Treasury yields.

This week, the municipal bond market is expected to price more than $14.6 billion in new issues. Notable deals this week include: State of Connecticut Special Tax Revenue Bonds with $1.56 billion, Long Island Lighting Company with $1.02 billion and City of San Antonio TX Electric & Gas Systems Revenue with $599.8 million. Fund flows have also generally been supportive over the past month. ICI data reported that exchange-traded funds saw inflows of $366 million during the holiday week Last week following a staggering $2.735 billion of inflows the week prior.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Curve Commentary: November 24, 2025

Overview

Economic data releases resumed last Thursday with the U.S. Department of Labor’s (BLS) release of the long-delayed September employment report. The BLS report did not deliver the clarity that markets are seeking regarding the central bank’s likely path. Although nonfarm payroll employment came in stronger than expected with 119,000 jobs added in September, the report also showed the jobless rate edging-up to the highest level in nearly four years to 4.4%. The increase in the jobless rate is not all that surprising, given the widely reported agency-by-agency filings showing the administration attempted to terminate a total of 3,605 employees during the shutdown. Employment gains were driven by health care, food services and drinking places, and social assistance. To add to the market’s uncertainty, the BLS will not be publishing the October employment report until after the Fed issues its decision on December 10 which is also when it will be releasing November data.

Rate expectations have varied widely in recent weeks due to conflicting information from Fed policymakers and a lack of clear signals on jobs and inflation. Last Wednesday, the Fed funds futures market was pricing-in the probability of a third rate cut this year in the high 20% range. Following comments from New York Fed President John Williams on Friday indicating the possibility of lower interest rates in the near-term as the labor market softens, investors boosted the odds of a rate cut to around 70%. As the Thanksgiving holiday approaches and traders look to the Federal Reserve for indications of policy easing, traders are fully pricing in a quarter-point cut at the January meeting and an additional cut by the June 2026 meeting.

Insights and Strategy

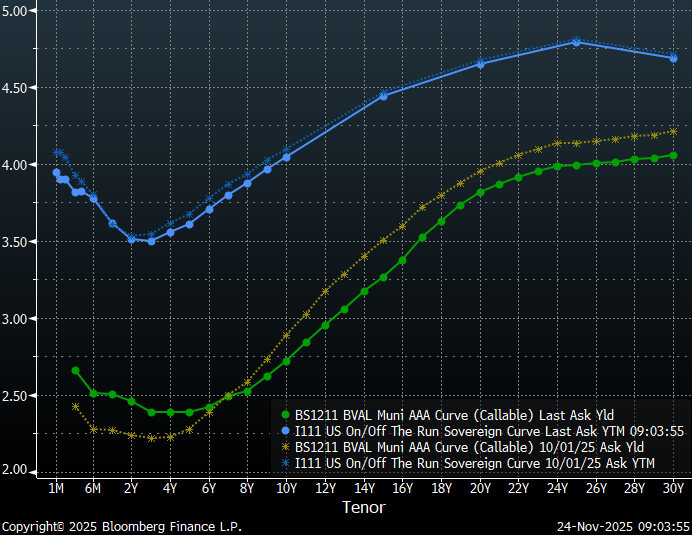

Slopes along the municipal yield curve are currently steepest around the 16-year tenor, with almost 75 bps in slope from 13 to 19-years. This is a significant change from earlier last month, when the steepest slopes were around the 10-year tenor. This shift has increased the reward to investors for extending from the 10-year range to the 15-20-year range. In addition, investors benefit from a steep roll-down over time. Although the municipal yield curve is currently rewarding duration, the long-end has become very flat with steadily declining slopes from 20 to 30-years and only a basis point or so per year past 25-years. As a result of this flat tail, municipal bond investors can buy maturities under 20-years that yield over 90% of the 30-year curve.

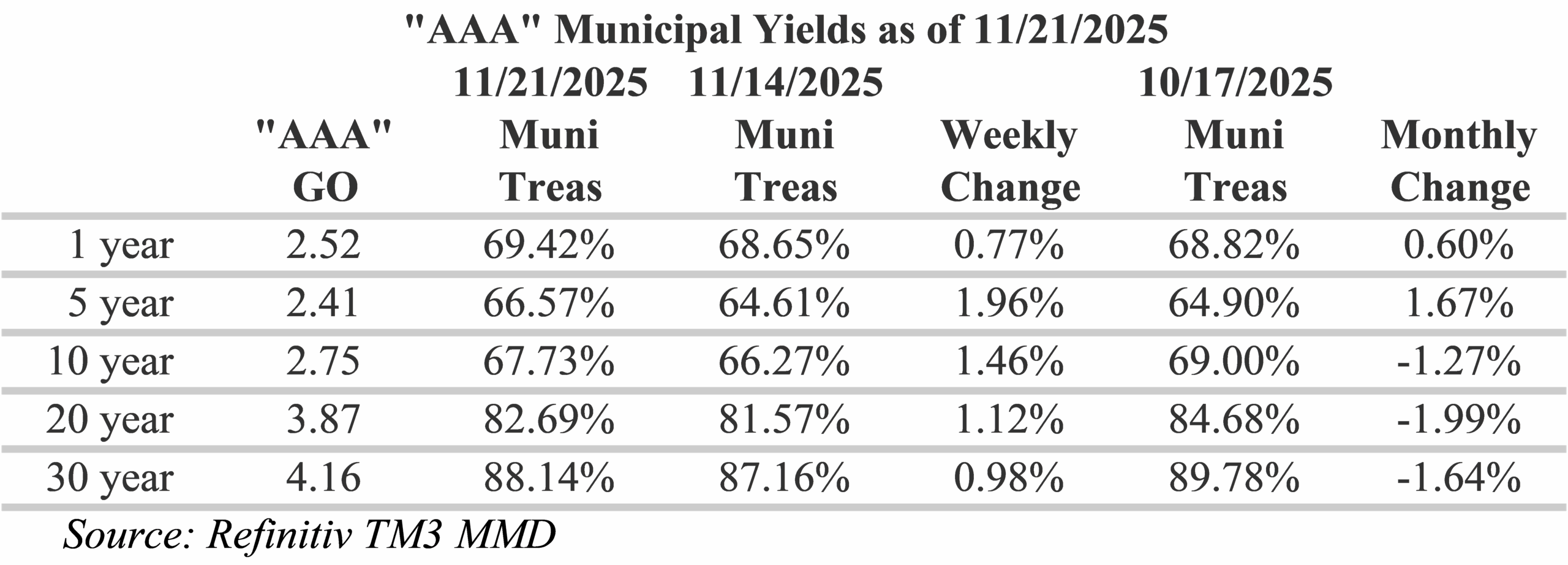

Elevated municipal tax-equivalent yields on the long-end continue to reward investors, with ratios generally cheapening over the past week. The muni/Treasury ratio is a widely watched measure that provides a sense of how tax-exempt munis fare against taxable fixed-income options. Crossover investors, which seek to identify the best opportunities in the fixed income universe on an after-tax basis, closely follow this ratio. Over the past week, the biggest moves have been in maturities around the 5 to 10-year mark where ratios have become almost 2% richer, with ratios now around 66.5% at 5-years. Over the past month, the biggest moves have been around the 20-year maturity where ratios are now about 2% richer. For investors seeking to maximize curve positioning with relative value, extending to the 18-year part of the municipal yield curve provides almost 90% of the 30-year maturity and almost 80% of equivalent Treasury yields.

Last week, the municipal bond market experienced uncharacteristically weak technical conditions as high deal volume was met by the largest outflows since the week ending April 16. Investors pulled $965.8 million from municipal bond mutual funds. This week, state and local governments bond issuance is expected to drop to $1.48b, due to the holiday week, with new issues expected to slow over the month. Notable deals this week include: Pennsylvania Housing Finance Agency selling $275 million and Keller Independent School District/Texas selling $99 million.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Market Commentary: November’s Muni High Yield Feast

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingCurve Commentary: November 17, 2025

Overview

Following a record 43-day shutdown, the President signed legislation to reopen the government last Wednesday. Although the government has reopened, there is a sizable backlog of government economic data that was not available during the shutdown. The bond market is currently bracing for a flood of data as traders anxiously pare December rate cut expectations. As of this morning, the Fed funds futures market was only pricing-in a 41% chance of a 25 basis-point cut in December. Current rate expectations have declined significantly from last week, when the implied probability was in the 60’s. The tone has turned decidedly more hawkish as several FOMC members have recently cited heightened inflation concerns, which prompted a sell-off in Treasuries last Thursday.

Not surprisingly, this irresolute sentiment has resulted in Treasury yields that remain little changed from when the shut-down began on October 1. However, the municipal market has demonstrated more conviction with steady demand and appealing relative yields weighing on the long-end while shifting dynamics on the short-end have led to municipals selling-off. As a result, we have seen the municipal yield curve flatten, resulting in declining slopes and less incentive to extend duration.

Insights and Strategy

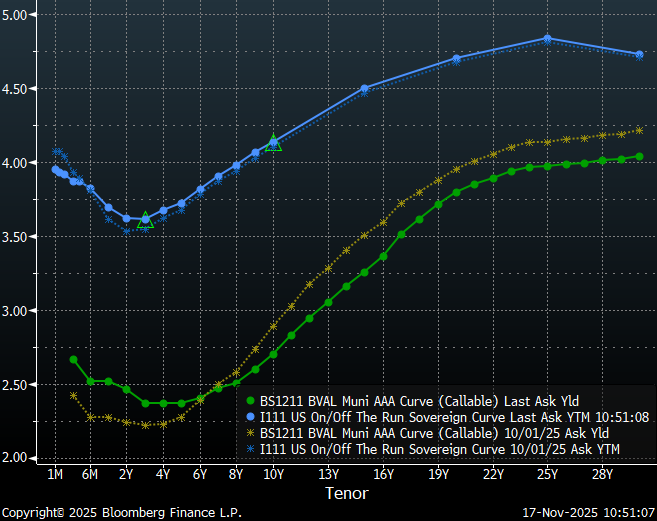

Slopes along the municipal yield curve are currently steepest around the 17-year tenor, with almost 75 bps in slope from 13 to 19-years. This is a significant change from earlier last month, when the steepest slopes were around the 10-year tenor. This shift has increased the reward to investors for extending from the 10-year range to the 15-20-year range. Although the municipal yield curve rewards duration, the long-end continues to be very flat with steadily declining slopes from 20 to 30-years and only a basis point or so per year past 25-years. However, as a result of this flat tail, municipal bond investors can buy maturities under 20-years that yield over 90% of the 30-year curve.

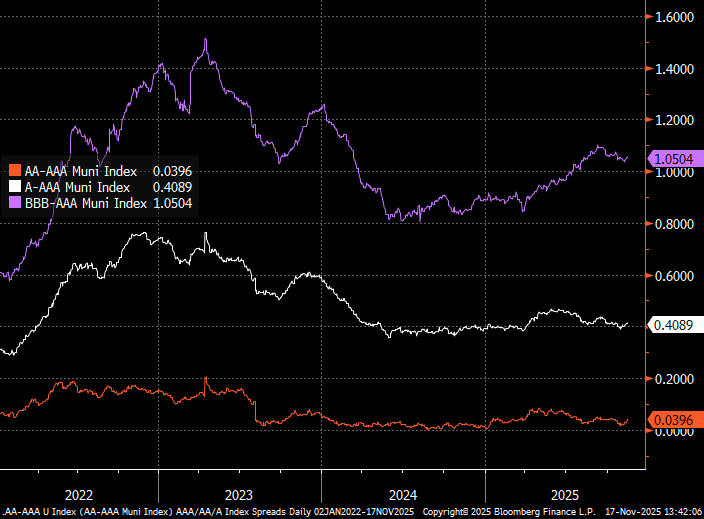

Municipal credit spreads, which are the difference in yield between the ‘AAA’ yields and riskier bonds of equivalent maturities, continue to reward risk in lower investment grade securities while ‘AA’ and ‘A’ bonds have been trading fairly tightly this year. In recent months we have seen lower investment grade credit spreads fluctuate as economic concerns have emerged prompting investors to demand more yield to compensate for the additional risk. While current credit spreads are appealing for ‘BBB’ rated bonds, caution is still warranted as these spreads can widen significantly during economic events.

The muni/Treasury ratio is a widely watched measure that provides a sense of how tax-exempt munis fare against taxable fixed-income options. Crossover investors, which seek to identify the best opportunities in the fixed income universe on an after-tax basis, closely follow this ratio. Over the past month, the biggest moves have been in maturities around the 10-year mark where ratios have become over 4% richer, with ratios now around 66%. From a historical perspective, the 10-year mean for the 10-year maturity is 82.59%, which shows how richly valued municipals have become in this art of the curve. For investors seeking to maximize curve positioning with relative value, extending to the 18-year part of the municipal yield curve provides almost 90% of the 30-year maturity and almost 80% of equivalent Treasury yields.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Market Commentary: The Not So Grand Re-Opening

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingCurve Commentary: November 10, 2025

Overview

Today marks the 41st day of the longest government shutdown in US history, and it appears a resolution is potentially close at hand. On Sunday, eight Senate Democrats joined Republicans in a push to advance a short-term funding measure that would extend government funding through January. However, the legislation still requires a final vote by the Senate and needs to pass the House before the shutdown can end. Following this news, the Treasury market has slid with 10-year Treasuries rising as much as 5 basis points to near 4.15% amid optimism . Some caution is also warranted since the re-opening may potentially trigger volatility as a surge of delayed data releases. This absence of government data has made policymakers more cautious about cutting rates, which will likely fade as data is released upon re-opening. The Fed funds futures market is currently pricing-in a 65% chance of a 25 basis-point cut in December. This is down significantly from just a few weeks ago when the implied probability was closer to 95%.

While Treasuries have generally sold-off month-to-date, particularly on the longer-end of the curve where the market has sold-off as much as 6 basis points, municipal bonds have held firmly with yields staying within a basis point of November 1 yields. Over the past week, mixed labor data has driven volatility in Treasuries with Munis being more resistant due to reinvestment demand and continued inflows from institutions. However, the one- to six-year yield municipal yield curve remains inverted, which is an important consideration for investors managing bond portfolios. However, this also creates opportunities for swaps, particularly for those investors with losses on the short-end that would like to extend duration.

Insights and Strategy

Although the municipal yield curve continues to reward duration, the long-end has become very flat with steadily declining slopes from 20 to 30-years and only a basis point or so per year past 25-years. However, as a result of this flat tail, municipal bond investors can buy maturities under 20-years that yield over 90% of the 30-year curve. Slopes along the municipal yield curve are currently steepest around the 17-year tenor, with almost 75 bps in slope from 13 to 19-years. This is a significant change from earlier last month, when the steepest slopes were around the 10-year tenor. This shift increases the reward to investors for extending from the 10-year range to the 15-20-year range. Despite recent uncertainty regarding a December rate cut, this steepness is likely to persist amid government shutdown uncertainty and demand for longer durations.

The muni/Treasury ratio is a widely watched measure that provides a sense of how tax-exempt munis fare against taxable fixed-income options. Crossover investors, which seek to identify the best opportunities in the fixed income universe on an after-tax basis, closely follow this ratio. Over the past month, the biggest moves have been in maturities under 1-year and around the 10-year mark where ratios have become over 3% richer, with ratios now around 67%. Although this part of the curve had become significantly more appealing from a relative value perspective, ratios are now less appealing. From a historical perspective, the 10-year mean for the 10-year maturity is 82.69%. On the other hand, the 1-year tenor has become over 3% more attractive with ratios now approximately 70%, but the 10-year mean for this part of the curve is 94.57%. For investors seeking to maximize curve positioning with relative value, the 18-year part of the municipal yield curve currently provides almost 90% of the 30-year maturity and over 80% of equivalent Treasury yields.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Market Commentary: Winning

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingCurve Commentary: November 3, 2025

Overview

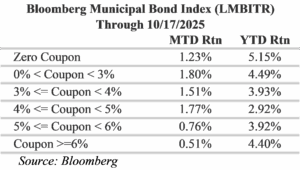

Today marks the 34th day of the US government shutdown, and despite the lack of government economic data and the continuous flow of headlines, there has been little response by the Treasury market. Yields on Treasuries are little changed over the past month with the biggest changes on tenors under 6 months and the rest of the curve virtually unchanged. Munis in tenors past 6-years have rallied as much as 20-basis points over the past month with the Bloomberg Municipal Index reporting a 1.24% return, which is the best October performance since 1995. This performance was despite $55 billion of tax-exempt issuance. Municipal tenors shorter than 6-years sold-off as demand shifted from the front end of the yield curve to the long-end as investors locked-in yields in anticipation of Fed rate cuts.

Insights and Strategy

Slopes along the municipal yield curve are currently steepest around the 17-year tenor, with almost 75 bps in slope from 13 to 19-years. This is a significant change from earlier last month, when the steepest slopes were around the 10-year tenor. This shift increases the reward to investors for extending from the 10-year range to the 15-20-year range. Although the municipal yield curve continues to reward duration, the long-end continues to be very flat with steadily declining slopes from 20 to 30-years and only a basis point or so per year past 25-years. However, as a result of this flat tail, municipal bond investors can buy maturities under 20-years that yield 93% of the 30-year curve. Despite recent uncertainty regarding a December rate cut, this steepness is likely to persist amid government shutdown uncertainty and demand for longer durations

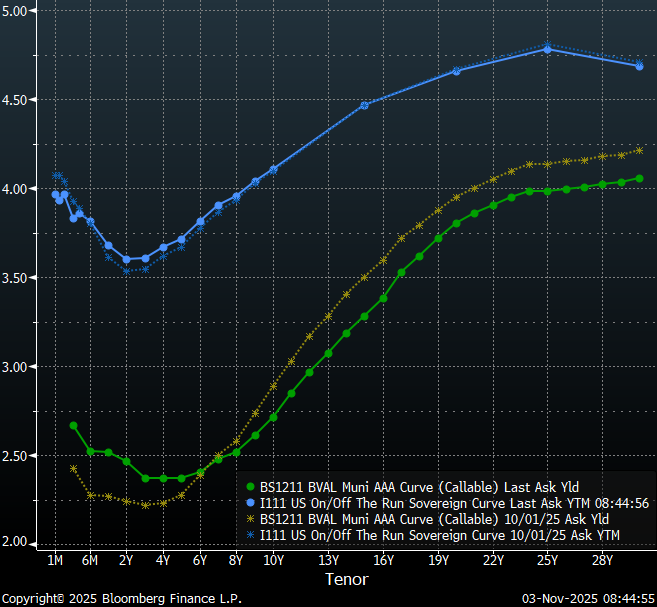

The muni/Treasury ratio is a widely watched measure that provides a sense of how tax-exempt munis fare against taxable fixed-income options. Crossover investors, which seek to identify the best opportunities in the fixed income universe on an after-tax basis, closely follow this ratio. Over the past month, the biggest moves have been around the 10-year maturity where ratios have become over 4% richer, with ratios now approaching 66%. Although this part of the curve had become significantly more appealing from a relative value perspective, ratios are now less appealing. From a historical perspective, the 10-year mean for the 10-year maturity is 82.69%. On the other hand, the 1-year tenor has become over 3% more attractive with ratios now approaching 70% but the 10-year mean for this part of the curve is 94.57%. For investors seeking to maximize curve positioning with relative value, the 18-year part of the municipal yield curve currently provides almost 90% of the 30-year maturity and almost 80% of equivalent Treasury yields.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Market Commentary: Field Day

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingMarket Commentary: Play Ball!

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingCurve Commentary: October 20, 2025

Overview

The shutdown, which is now the third longest government shutdown in U.S. history, continues to populate headlines. In addition, markets are operating without the usual government sourced economic data from the Bureau of Labor Statistics and the Bureau of Economic Analysis. Absent this data, the markets have been looking to private sources and anecdotal data from businesses for guidance. However, data from these sources is less than optimal and is typically not as broad or representative of the economy as government data sets. Due to the weakening job market and a lack of updated government data to demonstrate otherwise, the markets are operating under the assumption the Fed will make another quarter of a point cut at its meeting next week. Last week, Fed chair Jerome Powell indicated that economic concerns of the Fed had not changed during the data blackout. The Fed funds futures market is currently indicating an almost certain 94.6% chance of a 25bps rate cut at the Fed’s October 29 meeting and an additional 25bps cut in December.

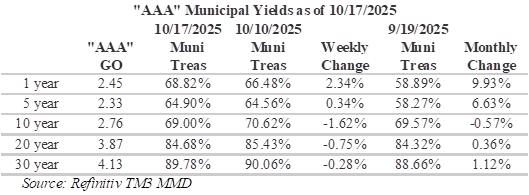

Over the past week, Treasury and municipal markets have been largely unphased by the shutdown or the regional bank distress with yields experiencing minimal change on the long end of the yield curve. Treasury yields rallied about 4.55 bps versus 5.5 bps for munis. On the more policy sensitive short tenors under 2-years, yields differed with Treasuries selling-off a little over 5 bps and munis rallying around 3 bps. Treasuries have lately been responding to haven buying, trade tensions and anxiety related to regional bank credit exposure.

Insights and Strategy

Slopes along the municipal yield curve are currently steepest around the 17-year tenor, with over 61 bps in slope from 13 to 18-years. This is a significant change from earlier this month, when the steepest slopes were around the 10-year tenor. This shift increases the reward to investors for extending from the 10-year range to the 15-20-year range. Although the municipal yield curve continues to reward duration, the long-end has become very flat with steadily declining slopes from 20 to 30-years and only a basis point or so per year past 25-years. However, as a result of this flat tail, municipal bond investors can buy maturities under 20-years that yield over 92% of the 30-year curve.

The muni/Treasury ratio is a widely watched measure that provides a sense of how tax-exempt munis fare against taxable fixed-income options. Crossover investors, which seek to identify the best opportunities in the fixed income universe on an after-tax basis, closely follow this ratio. Over the past month, the biggest moves have been around the 10-year maturity where ratios have cheapened close to 10% with ratios now approaching 70%. Although this part of the curve has become significantly more appealing from a relative value perspective, ratios are still rich from a historical perspective with a 10-year mean for this part of the curve at 94.59%. For investors seeking to maximize curve positioning with relative value, the 18-year part of the municipal yield curve currently provides almost 90% of the 30-year maturity and over 80% of equivalent Treasury yields.

Month-to-date, lower-coupon 4s have outperformed in October, benefiting from their longer duration and greater sensitivity to the rally in rates. Against the backdrop of falling yields, lower coupon bonds have recently experienced stronger price appreciation versus higher coupon bonds, which are less responsive in a declining rate environment. However, this week we are anticipating a full municipal calendar with over $15 billion in new issues. Overall, with the potential for Treasury volatility amid the government shutdown and heavy supply from the municipal calendar, continued outperformance from lower coupon bonds may prove challenging this week.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Market Commentary: Shady Pines

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingMarket Commentary: Standing By

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingCurve Commentary: October 6, 2025

Overview

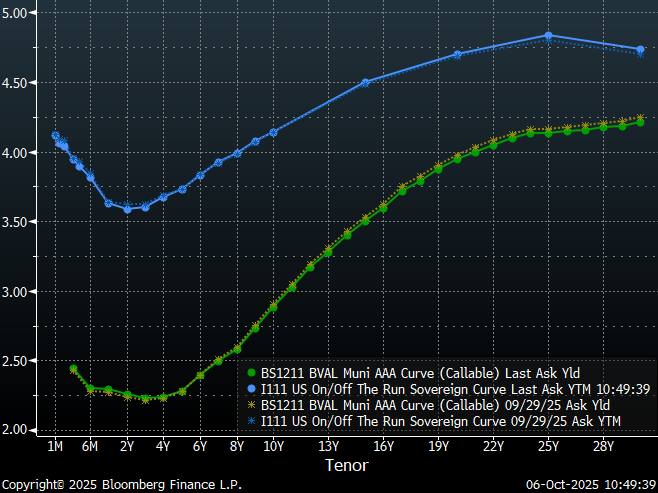

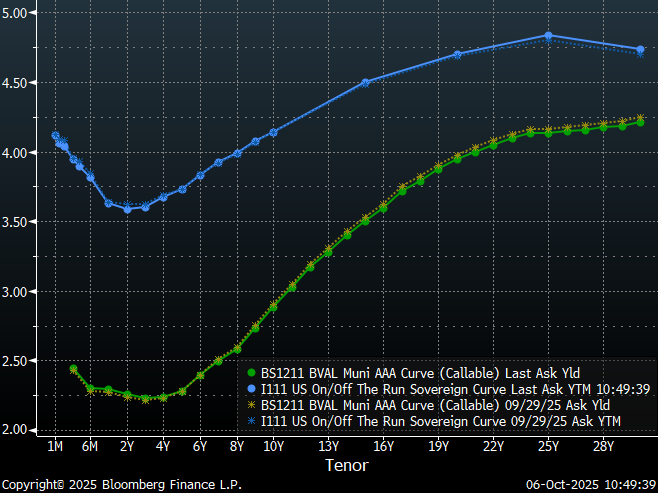

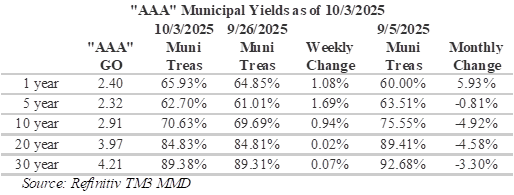

Although the U.S. government shutdown last week, Treasury and municipal markets were largely undaunted with yields experiencing only minimal change. However, the shutdown has resulted in the Bureau of Labor Statistics postponing its Employment Situation report, which is ordinarily delivered on the first Friday of the month, to report on employment levels and unemployment. Despite the lack of data, Treasury yields only moved down by about 4 bps on the short-end and up by about 5 basis points on the long-end with the 5-year tenor essentially unchanged. Muni yields moved in almost the opposite direction, with short yields climbing 2 basis points and long yields falling about 3.5 basis points and, like Treasuries, 5-year yields were essentially unchanged. Furthermore, the Fed funds futures market is currently indicating an almost certain 94.6% chance of a 25bps rate cut at the Fed’s October 29 meeting.

Overall, the Treasury curve is about 9 bps steeper over this past week and the muni curve is about 5.5 bps flatter. Slopes along the municipal yield curve are steepest around the 10-year tenor, with over 50 bps in slope from 8 to 12-years. Although the municipal yield curve continues to reward duration, the long-end has become very flat with steadily declining slopes from 15 to 30-years and only a basis point per year past 25-years. As a result of the flat tail, municipal bond investors can buy maturities under 20-years that yield over 90% of the 30-year curve.

Insights and Strategy

Muni/Treasury ratios, which provide a sense of how tax-exempt munis fare against taxable fixed-income options, have generally cheapened over the past week. Crossover investors, which seek to identify the best opportunities in the fixed income universe on an after-tax basis, closely follow this ratio. While shorter ratios have cheapened the most, they remain only narrowly appealing even to individual investors in the top tax brackets. The 10-year historical mean for the 5-year tenor is 74.71% versus 62.7% today. Ratios on the longer end of the curve continue to reward investors for extending duration with 30-year ratios approaching 90%. Although ratios in this part of the curve are meaningfully richer than they were a month ago, they continue to provide compelling value. For investors seeking to maximize curve positioning with relative value, the 12 to 18-year part of the municipal yield curve provides as much as 90% of the 30-year maturity and over 80% of equivalent Treasury yields.

This week, municipal issuers are expected to sell more $12.9 billion in new issues with year-to-date issuance levels eclipsing $436 billion, which is 13.5% more than had been issued last year at this time. Transportation issues dominate the calendar this week with the Texas Transportation Corp. selling $1.8 billion, the State of Maryland Department of Transportation selling $842.7 million and the North Texas Tollway offering 627.2 million. This supply will likely be met with strong demand with $11.8 billion in municipal bonds expected to mature in the next 30-days, $5 billion in calls announced over the next 30-days and LSEG Lipper Global Fund Flows reporting weekly inflows of $1.1 billion last week.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Market Commentary: Showdown Shutdown

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingCurve Commentary: September 29, 2025

Overview

With government funding set to expire Tuesday, the shadow of a potential government shutdown continues to loom over the bond market bringing yields down across the Treasury curve. In addition, the shutdown threatens to delay the release of key economic data, including Friday’s nonfarm payroll employment data and unemployment rate from the Bureau of Labor Statistics. This data is critical to current rate forecasts as weakening employment data was an influential factor in the Fed’s decision to cut rates earlier this month. The Fed has recently commented that labor demand, and the recent pace of job creation, appear to be running below the “breakeven” rate needed to maintain current unemployment levels. The Fed funds futures market is currently indicating an 88.7% chance of a 25bps rate cut at its October 29 meeting.

Last week, Treasuries were largely unchanged with the threat of a government shutdown drawing a haven bid while the front-end of the muni curve experienced the majority of the movement. Muni yields in this part of the curve have become quite rich with muni/Treasury ratios in the 50’s for one to five years. At these levels, yields are only narrowly appealing even to individual investors in the top tax brackets. Following last week’s moves, ratios popped-up to the low to mid-60’s on the front-end of the muni curve with significant pressure from institutional investors positioning portfolios ahead of the quarter-end.

Insights and Strategy

Although the muni curve remains steeper than the Treasury curve, last week’s sell-off resulted in considerable flattening for munis maturing within 10-years. Over the past 2-months we have experienced significant compression of spread relationships in this portion of the curve. However, it is notable that the steepest portion of the municipal yield curve is currently the 9 to 11-year stretch with a slope of 46 bps. Although the municipal yield curve remains positively sloped, investors should exercise caution to manage duration risk by buying bonds where the yield curve has sufficient slope to reward risk.

Nevertheless, long munis continue to provide compelling relative value with 20-year munis yielding almost 85% of Treasuries and 30-year munis yielding almost 90% of Treasuries. Even the 12-year tenor, which is less than half of the 30-year curve, is yielding 75% of the 30-year maturity, making this an appealing place to position new purchases. Past 20-years, the slope tapers significantly to just a basis point or two per year. For investors with longer mandates, I would consider buying shorter in the 12 to 17-year range and wait to see if the long-end steepens before extending.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Market Commentary: Falling

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue reading