HJ Sims in December closed on a $30.03 million financing package for The Bethel Methodist Home, also known as The Knolls, a CCRC in Valhalla, New York. The campus opened in 2002 under the name Westchester Meadows; Bethel Methodist assumed ownership and management in 2016. Read more here in Senior Housing News.

Innovative Financing Strategies Create Operational Cashflow during COVID-19

CONTACT: Tara Perkins, AVP | 203-418-9049 | [email protected]

FAIRFIELD, CT– HJ Sims (Sims), a privately held investment bank and wealth management firm founded in 1935, is pleased to announce the closing of a number of financings utilizing innovative financing strategies to create operational cashflow and advantageous results for senior living organizations.

The Tax Cuts and Jobs Act of 2017 (the 2017 TCJA) had an enormous impact on the municipal bond market with the elimination of advance refundings. In 2018, Sims identified alternative strategies in the absence of advance refundings. Strategies included (1) Cinderella bank-held bonds, (2) taxable fixed rate advanced refundings, (3) forward refundings and (4) tender offers.

The use of Cinderella Bonds aims to secure an advance refunding that is at first taxable and converts to tax-exempt when permitted. It was applied to the financing of Marshes of Skidaway Island (The Marshes) in GA. In 2020, Sims approached The Marshes noting that a bank-placed Cinderella refinancing of outstanding fixed rate bonds would provide significant savings. Sims successfully closed the $47.1 million financing in December 2020, saving approximately $1.14 million annually and $15.36 million, in the aggregate, through a bank financing.

Westminster Communities of Florida, the largest provider of life plan communities in the State of FL, employed Sims to utilize a taxable fixed rate advance refunding of bonds issues to acquire Glenmoor after its successful turnaround. Sims analyzed bank-held and fixed rate bond advanced refundings, with a rapidly growing taxable fixed rate bond market. Westminster proceeded with a taxable advanced refunding and tax-exempt new money issuance to fund upcoming capital projects. Sims procured strong investor interest in the successful $107,360,000 transaction, achieving superior execution.

A Forward Refunding approach was utilized with Peconic Landing at Southold (Peconic) in NY. This strategy utilizes tax-exempt fixed rate bonds priced on a present-day basis, but not delivered and “closed” until ninety days prior to the call date of the refunded bonds. In 2019, Sims discussed potential refunding of Peconic’s bonds. The elimination of tax-exempt advance refundings meant immediate access to the tax-exempt market wasn’t possible, and the current BBB- rating made access to the taxable bond market impractical. Sims helped facilitate a forward refunding, securing pricing on a 20-year term on the refunding in late 2019 and saving Peconic $300,000+ in annual debt service with the ultimate settlement occurring in November 2020 amidst the COVID-19 pandemic.

A Tender Offer financing was implemented for the MD Obligated Group of Asbury Communities (Asbury). In 2018, Asbury MD Obligated Group’s capital stack was comprised of outstanding bonds placed directly with an institutional investor without an optional call feature and with a balloon payment. Sims negotiated an exchange of the bonds at a purchase price for a new series of bonds, extending the amortization, providing additional years of repayment and reducing the overall debt burden.

The 2017 TCJA changed the borrowing landscape for 501(c)(3) organizations. As the new administration and Congress identify and implement their fiscal policies, the Sims’ Financed Right® approach will ensure Sims will continue to assist clients in navigating the ever-changing market landscape, as we monitor market response to new laws and update the industry of developments and trends.

To learn details about each strategy, read the Sims Perspective, click here.

ABOUT HJ SIMS: Founded in 1935, HJ Sims is a privately held investment bank and wealth management firm. Headquartered in Fairfield, CT, Sims has nationwide investment banking, private wealth management and trading locations. Member FINRA, SIPC. Past performance is no guarantee of future results. Facebook, LinkedIn, Twitter, Instagram.

###

Market Commentary: No Bears in Sight

by Gayl Mileszko

NO BEAR HUGS PERMITTED, NO BEARS IN SIGHT

The Māori are the indigenous eastern Polynesian people of mainland New Zealand who came to the islands by canoe in a planned migration in the early 14th century. They developed a unique culture and language which evolved again in the late 18th century with the arrival of European settlers with written words, muskets, western agricultural methods, missionaries, smallpox and measles. Tensions between the cultures inevitably led to hostilities over time, most notably involving the sale of ancestral land. The ensuing social upheaval as well as the epidemics took a terrible toll on the Māori population; it took a century before protests for social justice and political activism stirred a significant revival movement, and it was not until 1987 that Māori was made an official language. Today, this ethnic group comprises about 17% of the country’s population but less than 200,000 still speak one of the three main dialects.

The word māori means “normal”, “natural” or “ordinary” and is said to distinguish us ordinary mortal human beings from the deities and spirits. In the Māori creation story, it was the forest god Tane who breathed life into the first woman. The story is kept alive to this day in the traditional Māori greeting which involves pressing noses together and touching foreheads in a practice called hongi. With this very personal connection, the ha (breath of life) is exchanged in a symbolic show of unity. COVID-19 has, of course, put an end to this centuries-old practice. From Auckland to Paris, Wuhan to Moscow, Toronto to Buenos Aires, non-verbal greetings from hongi to handshakes, and hugs to double cheek-kisses, once so common in our daily interactions with others are taboo under social distancing public health guidelines. What is left to us is only the awkward elbow bump, the tapping of feet, a wistful wave or spiritless salute from a distance or a two-dimensional smile on a flat screen.

We have lost a lot this past year – lives, jobs, businesses, homes, cars, freedoms, a sense of control, the sense of human touch. Neuroscientists agree that human contact is vital to health, wellness and happiness. There is a highly complex system of nerves, sensors and receptors that link our skin and brain to the people in our environment, and those deprived of a loving touch can develop severe psychological, intellectual and physical health issues. Some studies show that the pleasantness of touch is actually enhanced with age. That makes it all the more sad that senior citizens are among the most touch-deprived throughout this pandemic as so many outside of senior living communities have been self-isolating for nearly eleven months now.

The inability to shake hands, hold hands, slap backs, half hug, bear hug, huddle, and read full facial expressions has also clearly taken a toll on our politicians, elder and young alike, in Washington. While already strained by partisan divides that have been widening for 25 years, COVID guidelines have upended the tried and true methods for building coalitions, gathering for markups, conferring in cloakrooms, collecting intelligence over cocktails, commanding respect in committee hearings, enacting important legislation. Longstanding rules governing language and conduct have been waived; few leaders maintain the gold standard of civil discourse. Instead of mandates for change, recent elections have only made the extremes more apparent and inflexibility the charge. The latest Monmouth University poll finds that one-third of Americans and fully 72% of Republicans still believe that President Biden is in only office due to voter fraud. Gallup finds that 82% of Americans disapprove of the way Congress is handling its job, just off the 45-year low of 86% in 2011. The percentage of Americans citing national division and lack of unity as our top problem is the highest in Gallup’s seven decades of asking this question, dating back to 1939.

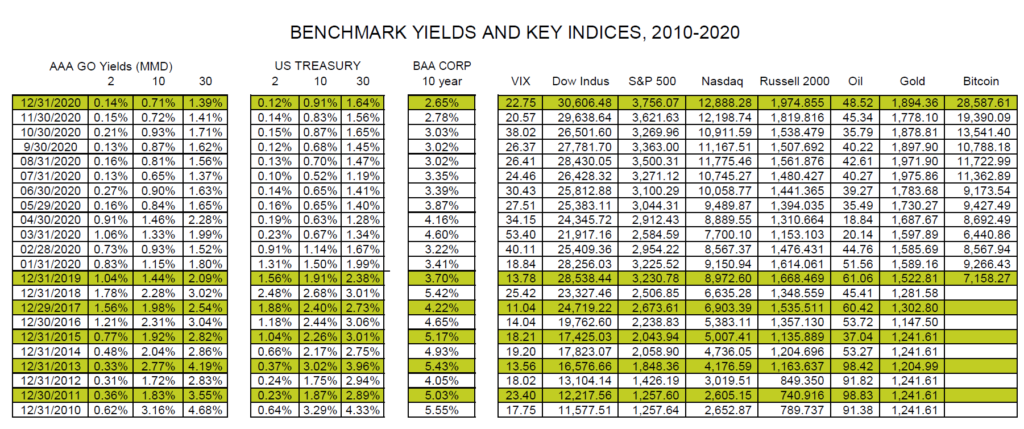

There are no bear hugs being given on the floors of any of the stock, futures, commodities, or other exchanges these days. It is not because of our civic polarization but because there are no bears. Few if any of the usual correlations between U.S. markets apply, and stocks and bonds market remains in rally mode for the twelfth consecutive year since the Great Recession, despite the Pandemic. With only a few more trading days left in this first month, the Dow at 30,960 is up nearly 10% from where it stood one year ago. The S&P at 3,855 has gained nearly 20%, the Russell 2000 at 2,163 is up more than 34% and the Nasdaq at 13,635 has increased a staggering 49%. Oil prices are up over 2% to $52.77 and gold nearly 17% to $1,858. Bitcoin at $33,770 is worth 264% more. Call-option buying on indices as well as single stocks has exploded with volumes reportedly running 20% higher than last summer. Treasury yields, despite one record auction after another to fund unprecedented stimulus, are down across the board year-over-year: the 2-year has plummeted 120 basis points year over year to 0.11%; the 10-year fell 48 basis points to 1.02% and the 30-year at 1.79% is 20 basis points lower. Tax-exempt AAA municipals have also rallied: the 2-year at 0.13% is down 70 basis points, the 10-year at 0.77% has fallen 38 basis points and the 30-year at 1.44% has decreased 36 basis points.

The Federal Open Market Committee met this week and markets once again expected reassuring words of long-term accommodation and growth on the horizon. Stock and bond investors continue to assume that COVID case counts and deaths decline with the increase in vaccinations, and we all watch and cheer the falling numbers along with the rest of the country. Economic data remains mixed, with housing strong, confidence holding, manufacturing up and some services down. With the change of party control in Washington, policies are already taking some new directions. Tax and spending measures and regulations always require more time than hoped for — or feared — but executive orders this first week will soon impact health care, energy, student loans, immigration, travel, collective bargaining, privately run prisons, certain international agreements and government procurement.

In the trade press and among the popular pundits, we are aware of some irrational exuberance and extreme fear, uncertainty and paralysis. There are indeed warning signs of bubbles in some sectors. We all know that some in the industry encourage senseless speculation based on stimulus continuing ad infinitum, many others seriously worry about inflation, and we are all frustrated by the lack of yield and difficulties in trying to hedge portfolios with all correlations so askew. For now, as one trader put it, “high yield is the paper du jour”. In bonds, high yield munis and corporate convertibles are the stars so far. We encourage our readers as always to connect and remain in close contact with your HJ Sim representatives for perspective, guidance and recommendations for your portfolio based upon your guidelines, needs, and risk tolerances.

Exclusive Opportunities For Our Clients

The Marshes of Skidaway Island

Skidaway Health and Living Services, Inc. owns the Marshes of Skidaway Island, a non-profit, 501(c)(3) corporation. The Marshes is a Life Plan Community that offers a full continuum of care with independent living, assisted living and skilled nursing services on a single campus.

Continue readingDHG 7th Annual Southeast Finance Conference

Virtual Event:

This event has been thoughtfully developed to include content designed to optimize networking and learning to look beyond the pandemic. Industry Leaders lend their expertise to provide insight on trending topics.

Date & Time: January 27-28, 2021

Thought Leadership:

Melissa Messina discusses the Relief Funding Option in FEMA.

Johnny Sears provides insight into Repurposing Aging Senior Living Facilities to Affordable Senior Housing.

Featured Speaker:

- Melissa Messina, Senior Vice President

Content Contributors:

- Melissa Messina, Senior Vice President

Contacts:

- Melissa Messina, Senior Vice President

- Tom Bowden, Senior Vice President

As we continue to experience fluctuations in our capital markets, HJ Sims is committed to Tracking the COVID-19 Impact.

Market Commentary: To Jab or Not To Jab

by Gayl Mileszko

In Act 3, Scene 1 of the Shakespeare play, Prince Hamlet asked, “To be or not to be?” bemoaning the pain and unfairness of life amid a sea of troubles, but acknowledging that the alternative might be worse. Nine months into our current global calamity, enduring the “whips and scorns” of this pandemic, so many of us have weighed our chances of contracting and surviving or spreading the coronavirus against chosen behaviors. In the United Kingdom as well as the United States, some of our most recent choices involve taking one or more of the emergency use authorized vaccines. Here, the Pfizer-BioNTech and Moderna COVID-19 rollout has been underway for about a month now and 31.1 million doses have been distributed. States are individually responsible for implementing programs but priority has been given across the board to health care workers and those in long term care facilities. CVS and Walgreens are critical to the plan and they aim to make at least initial visits to nearly all nursing homes by February. Some states are already making inoculations available to those over age 65 lest we “lose the name of Action” or momentum in our struggle.

The American Health Care Association reports that about 45% of long term care workers have already been vaccinated. But surveys indicate that 29% of those who work in health care delivery settings said they would probably not or definitely not take the vaccine even if it were free and deemed safe by scientists. Hesitancy mirrors that of the general public where as many as 40% plan to wait and see or pass for now due to worries about the lack of long-term studies on side effects compounded by the need to have two doses, concerns over the type of antigen itself or misinformation about genetic impacts that messenger RNA vaccines could have, general mistrust of government and perceived profits being made by the pharmaceutical companies, and concerns about duration and effectiveness against the new and more contagious variants of the virus that have begun spreading. Refusal rates this high can certainly jeopardize our ability to achieve what many believe is the critical need: population immunity.

Unfortunately, no one is expecting the pandemic to subside by this spring. There is talk and hope of having most American citizens vaccinated by the third quarter of this year. The new administration proposes additional stimulus to speed up the testing and vaccination process. Health care providers are offering an array of incentives to employees and requirements for prospects. The U.S. Equal Employment Opportunity Commission in December released guidance stating that employers can require proof of COVID-19 vaccination from employees — with some exceptions. Dialogue in the coming months will include various “immunity passport” initiatives affecting all of us that may be highly controversial but could prove to be a first critical step in restoring a return to air travel, hotel stays, mass transit, restaurant dining, tourism, conventions, sporting events, commercial real estate, and the entire continuum of senior care from independent living to assisted living to memory care and skilled nursing.

Some parts of the economy are being permanently altered by SARS-CoV-2 as is trust in certain institutions, notably including the media. At the federal, state, community, and business/institution levels, it is extremely challenging to communicate effectively with stakeholders who have so many diverse political, legal, medical, religious, investment, and historical views. Skepticism is rampant. One recent survey by communications firm Edelman found that we not only have a pandemic but an “infodemic,” an era of information bankruptcy and poor “information hygiene”. Communications from “my employer” have now become the most trusted source of information at 61%. CEO’s must take this message to heart and redouble efforts to be transparent and to safeguard information and product quality as well as to protect and upskill workers and inform and engage their communities and investors of these efforts.

Quarterly corporate earnings reports for the most recent period have just began and analysts are scouring the last three months of performance while peppering leadership with questions on plans and forecasts for the start of 2021. Traders and investors are also carefully listening to the statements and testimony from key incoming members of the Biden Administration on the many new policy proposals and their potential market impacts. Much has not yet been “baked in” to evaluations and certain markets as the shift in Congressional leadership is still being assessed.

Most U.S. markets nevertheless remain on fire going on three weeks into the new year, buoyed by our central bank’s policy of unprecedented accommodation for the foreseeable future. This week’s investment grade corporate new issuance is again expected to exceed $25 billion. So far this year $22 billion of high yield corporate bonds have priced and this could be the busiest months on record for this sector. Initial public offerings proceed apace. Record inflows into high yield municipal bond funds are a perfect reflection of the ongoing demand from individuals for some tax-exempt “oomph” in portfolios that may otherwise be producing nothing more than negative real returns.

Income investors are advised to contact their HJ Sims representatives for recommendations of individual bonds tailored to their risk and capital needs profiles. The general muni market, as reflected in the ICE BoAML Index is up 0.04% this year while the HY muni index has gained 1.03%. High yield corporates are up 0.37%, and convertible bonds are returning a whopping 4.84%, primarily driven by gains in TESLA. U.S Treasuries, by comparison are down 1.15%,

We live amid a raging pandemic but the season has changed and we know that many other changes lie ahead. In many ways, we have not been down this path before. A new president is being inaugurated while an article of impeachment is pending against the former president. We have an unusually close relationship between the incumbent Chair of the Federal Reserve and his predecessor, the incoming Treasury Secretary. The central bank has the greatest single impact on markets and may use yield curve control, more liquidity support, potentially set a negative interest rate policy or exploring the use of digital currency. Major policy reversals are possible, impacting everything from taxes to health care, to energy and the environment, to immigration and corporate regulation. We may face inflation, a weakening dollar, and more horse trading than usual, given the thin margins in both the House and the Senate. We at HJ Sims wish godspeed to all assuming new public office and working to speed a recovery in each and every sector while supporting our essential services and entrepreneurs and the promising economic future ahead. As Shakespeare wrote in another famous play: “Come, love and health to all. [We] drink to the general joy of the whole table.”

Exclusive Opportunities For Our Clients

HJ Sims Partners with The Bethel Methodist Home to Refinance High Interest Rate Acquisition Bonds

CONTACT: Tara Perkins, AVP | 203-418-9049 | [email protected]

HJ Sims Partners with The Bethel Methodist Home to Refinance High Interest Rate Acquisition Bonds

FAIRFIELD, CT– HJ Sims (Sims), a privately held investment bank and wealth management firm founded in 1935, is pleased to announce the successful December 2020 closing of a $30,030,000 financing for The Bethel Methodist Home, d/b/a The Knolls, a non-profit CCRC (Continuing Care Retirement Community) located in Valhalla, NY. The community, which opened in 2002 under the name Westchester Meadows, offers independent living, assisted living and skilled nursing services on one campus.

In 2008, Westchester Meadows experienced financial difficulty, which culminated in a bankruptcy filing in 2015. The community was acquired in 2016 with the proceeds of tax-exempt and taxable bonds privately placed with a single bondholder. Under new management, The Knolls began to thrive. Occupancy levels increased from 57% in 2016 to 91% pre-COVID and management has invested $12 million in renovations. Management contacted Sims to assist in refunding the existing high interest rate debt.

In addition to reducing the interest rate, a portion of the 2016 debt was to mature in 2023 and needed to be restructured. The challenge was to create a level debt service structure that would avoid the 2023 balloon payment while achieving overall savings. Additionally, a non-call provision blocked refunding the debt until 2024. Management and Sims negotiated an early exit, but it required a tight timeline for closing. Sims structured the taxable bond series to mature in 10 years. To lower debt service and create level annual payments, the tax-exempt series does not begin to amortize until the taxable series is retired, and extends 11 years beyond the prior maturity.

The new bonds needed to be issued in December 2020, but redemption could not occur until January 2021. Despite the success of The Knolls, marketing bonds for a recently financially troubled community during COVID-19 posed challenges. Sims’ team specializes in identifying and communicating the underlying strengths of every financing; this expertise was leveraged in marketing and the refunding was completed in 90 days.

On December 23, 2020, Sims closed on the $30.03 million Series 2020 Bonds for The Knolls with 20%+ of the issue purchased by Sims’ Private Wealth Management clients. The yield on the 10-year taxable series was 6.125% and the interest rate on the 35-year tax-exempt series was 4.90%, below the 7.00% yield on the prior debt.

“25 years ago, I worked with Sims and was waiting for the day to do another financing with their superb team of professionals. Finally, that day came, and Andrew Nesi and his team did not disappoint. During COVID-19, with a very small window dictated to us by our current lender and the holiday season upon us, we successfully met all deadlines and refinanced The Knolls through a combination of tax-exempt and taxable bonds, saving close to a $1,000,000 per year in interest and fees. Andrew recognized the strength of this community in the mere four years this campus has been part of Bethel, and now through this refinancing, strengthened our position. I look forward to many future endeavors with HJ Sims” – Beth Goldstein, CEO, The Bethel Methodist Home.

Financed Right® Solutions—Andrew Nesi: 203.418.9057 | [email protected]

ABOUT HJ SIMS: Founded in 1935, HJ Sims is a privately held investment bank and wealth management firm. Headquartered in Fairfield, CT, Sims has nationwide investment banking, private wealth management and trading locations. Member FINRA, SIPC. Testimonials may not be representative of another client’s experience. Past performance is no guarantee of future results. Facebook, LinkedIn, Twitter, Instagram.

###

The Bethel Methodist Home

The Bethel Methodist Home, d/b/a The Knolls, is a non-profit Continuing Care Retirement Community located on a 29-acre campus in Valhalla, New York in Westchester County. The Knolls offers a full continuum of care with independent living, assisted living and skilled nursing services on a single campus.

Continue readingMarket Commentary: Narrowing the Distance Between Independence and Constitution Avenues and Us

by Gayl Mileszko

There is only a week to go until the Inauguration of our 46th President. The weather forecast for January 20 is for a partly cloudy day with temperatures in the mid-40s. But other conditions are not so favorable for this time of year and for these traditional American quadrennial ceremonies in which we all ask for God to bless America. The pandemic has already nixed most of the festivities that have accompanied the swearing-in since 1805, including celebratory inaugural balls and parades. But now in the wake of the storming of the U.S. Capitol on January 6, law enforcement is on the highest possible alert. The FBI is warning about armed protests at all 50 state capitals in the days leading up to the recitation of the oath of office by the Chief Justice. Fifteen thousand National Guard troops are being deployed to the historic grounds that lay between Independence and Constitution Avenues, the People’s House.

Two hundred thirty miles away on Wall Street, markets have barely flinched over these events. Many months ago, markets baked in assumptions of a peaceful transition of power. Investors and traders, as good at counting votes as any party whip, were unfazed when the House of Representatives approved articles of impeachment against the 45th President on December 18, 2019. They are again unfazed by this Wednesday’s vote in the south end of the Capitol. Dozens of major U.S. companies have responded with pronouncements that they are suspending political donations to some or all Members in the upper and lower chambers. Insiders understand that these bans are largely toothless as no one is fundraising at this part in the cycle with more than 660 days to go to the next election. Time and time again, we find that a lot not only can but does change in two years.

Since the start of the year, not a lot has changed in the financial markets. Prices on most assets are still extremely elevated, and rallies continue across most sectors on the expectation that additional fiscal stimulus will speed up our economic recovery. Although bonds have slightly weakened since the Georgia elections turned Washington “light blue”, as pundits label the razor thin Democrat majority in D.C., yields remain in historically low ranges. With expectations for even heavier federal spending. additional borrowing, and higher taxes, intermediate and long U.S. Treasury yields have jumped by about 24 basis points. This moved the 10-year past a 1% touchstone, but bear in mind that this yield exceeded 3.80% ten years ago. The 10-year yield is at 1.14% and the 30-year at 1.88%. The 2-year is relatively unchanged at 0.14% so far in 2021. It goes without saying that all these yields are producing negative real returns for investors.

The prices of all bonds are linked in some manner to Treasuries. So as government prices have dipped, BAA Corporate 10-year benchmark yields have risen by about 17 basis points to 2.82%. These rates nevertheless remain at historic lows, so corporate borrowers are still lining up for market entry. And both investment grade and high yield corporate bond issues cannot come fast enough to satisfy domestic and foreign demand. High yield sales total $13.2 billion so far this month with orders exceeding offers by more than three times, while investment grade issuance is already at $55.6 billion with recent trades more than 2.4 times covered. Corporates have clearly been buoyed by stock prices. At this writing, the Dow, S&P 500, and Nasdaq indices are each up about 1.2% this year while the Russell 200 is up nearly 6%. Oil is up more than 7%, but gold prices have fallen more than 2% and silver prices are off by nearly 5%. Among digital currencies, Bitcoin has been extremely volatile but is up nearly 15% in 2021.

Municipal bond yields have also inched higher since the start of the year, but Bloomberg is reporting that valuations are currently at record highs. The ratio of top-rated tax-exempt yields to U.S. Treasuries at 67% is the lowest since 2001, a huge drop from where it stood ten months ago at 215%. The 2-year AAA rated general obligation bond MMD benchmark at 0.15% is largely unchanged from last month. The 10-year and 30-year benchmarks have added 7 basis points and stand at 0.78% and 1.46%, respectively. Imagine that: top rated borrowers are still getting rates of under 1.50% for maturities in 2050! These are fantasy conditions still prevailing for most non-profit borrowers. For lower-rated and non-rated sectors, there are few deals so far this year to help us gauge the market. The Illinois Finance Authority brought a $26.6 million non-rated deal for the McKinley Foundation with a single 35-year maturity priced at par to yield 5.125%. The Wisconsin Public Finance Authority sold $6 million of non-rated bonds for St. Francis College in Brooklyn at par to yield 5.50% in 2024.

Investors cannot source enough tax-exempt product as many state, local and non-profit borrowers are taking advantage of low rates prevailing in the taxable and corporate bond markets to refinance higher coupon bonds. The 115th Congress removed the ability of tax-exempt borrowers to refund most long-term debt at tax-exempt rates, but many in the muni market hope that the 116th Congress will appreciate the urgent pleas from non-profits who are lobbying to restore the authorization and allow them to refinance outstanding debt at these extremely low rates. Record levels of taxable issuance would likely decline if, as some predict, tax reform legislation is enacted later this year or next with a provision restoring the exemption. This would significantly increase the supply of traditional munis for those looking to offset potentially higher individual tax rates.

We at HJ Sims are looking forward to this new year and cheer those states with the safest, most rapid and successful vaccine rollouts for health care workers, long term care residents and those greatest at risk of contracting the coronavirus. Along with our investors, we simultaneously root for those entrepreneurs and manufacturers of cost-effective air and surface cleaning and filtration technologies. While we share the concerns of millions over the civil unrest, the key but often controversial role of social media, the prospect of inflation, the status of mortgage, rent, student loan and other delinquencies, our growing federal and state debts and deficits, and the unprecedented year-long financial stress on most every non-profit and for-profit enterprise, we pause to count our many blessings and pledge to make our voices heard even louder this year.

For more than 85 years, we have worked with colleagues in our industry to improve market access for our borrowers, market intelligence for our investors, and public understanding of the key role that the municipal market has in facilitating essential purpose project financings. We are proud of our role in helping to originate the quintessential social good bonds and encourage our readers to join us in working collaboratively to provide and protect the safest living and learning options for our seniors, our disabled, and our young going forward. Please contact your HJ Sims representative to share your thoughts on how we can collectively enhance our advocacy on behalf of our country’s greatest needs in 2021.

Exclusive Opportunities For Our Clients

Green House Development Workshop

Education Workshop:

This comprehensive workshop provides an overview of how and why you should build a Green House community. Leaders from Green House organizations and strategic partners will explore key cornerstones of developing Green House homes.

Date & Time: February 4, 2021 from 10:00am – 4:30pm

Session Description:

Financing Panel Discussion – Industry experts discuss innovative and efficient financing structures, including tax-exempt bonds; HUD, direct bank, and USDA financing; and interim financing and seed capital.

Session Details: 3:15pm – 4:15pm

Featured Speakers:

- Aaron Rulnick, Managing Principal, HJ Sims;

- Anthony Luzzi, President, Sims Mortgage Funding, Inc.

- John Franklin, Principal, Pearl Creek Advisors

- Sharon O’Brien, Administrative VP, Healthcare & NFP, M&T Bank

- Seth Wagner, VP Public Finance, Truist Securities

As we continue to experience fluctuations in our capital markets, HJ Sims is committed to Tracking the COVID-19 Impact.

The 19th Annual HJ Sims Late Winter Conference

Financing Methods & Operating Strategies in the Senior Living Industry for Non-Profit and Proprietary Senior Living Providers

Our 19th Annual HJ Sims Late Winter Conference examined trends and developments critical to the success of senior living communities. An extensive and thoughtful agenda was compiled to address financing methods and operating strategies that can help alleviate existing challenges and encourage continued growth in the non-profit and proprietary sectors of our industry. Throughout the conference, we delivered a dynamic group of speakers and experts committed to sharing thought-provoking views and providing profound insight.

Help us make the next Late Winter Conference even more successful by completing our feedback survey. We very much appreciate your input.

Photos

View the many beautiful photos from our conference in the galleries below. Click on each album to see all of the photos from the event.

For attendees who updated their professional headshots at the “Headshot Hub,” please contact Rebecca Brady to access your headshot.

Conference Details

Save the Date

The 20th Annual HJ Sims Annual Conference will be held in Sarasota, Florida. Stay tuned for dates and more information coming soon. We can’t wait to see you there!

For more information, please contact Rebecca Brady.

LeadingAge VA Governance Webinar Series

Education Series:

Governance Webinar Series: How does a board set an organization’s strategic vision amongst the uncertainty of the times?

Session Description: HJ Sims is sponsoring this series of comprehensive virtual content geared directly toward the Governance of senior living providers. Targeting board members, leadership teams and those new to these roles, but a benefit to all leaders in our field, the sessions will tap the intellectual capital of industry experts from governance, law, finance, development, and strategic planning. The series will explore the role of the board as well as its legal responsibilities. Included will be a discussion of the financial outlook coming out of the Pandemic as well as recent and future financial trends. There will be a session dedicated to strategic planning in unprecedented times. Finally, the series will culminate with a panel discussion amongst CEOs and Board Chairs with a passion for and demonstrated excellence in not-for-profit senior living governance.

Individual Session Details:

Financial Trends and Outlooks for Providers

- This session will review the new reality of COVID expenses that are here to stay.

- February 11, 2021 from 11am to 12:15pm EST

- Facilitator: Tom Bowden, Senior Vice President – Investment Banking, HJ Sims and Gayl Mileszko, Director of Analysis & Commentary, HJ Sims

Strategic Planning in Unprecedented Times

- During unprecedented times, it is still feasible for communities to consider various repositioning

perspectives and scenario planning for the “what if’s”. - February 25, 2021 from 11am to 12:15pm EST

- Facilitators: Tom Bowden, Senior Vice President – Investment Banking, HJ Sims and Dana Wollschlager, Partner, Plante Moran Living Forward

Governing during Challenging Times

- A panel of CEOs and Board Chairs will provide best practices in governing during difficult and challenging times.

- March 11, 2021 from 11am to 12:15pm EDT

- Facilitator: Aaron Rulnick, Managing Principal, HJ Sims

As we continue to experience fluctuations in our capital markets, HJ Sims is committed to Tracking the COVID-19 Impact.

Market Commentary: Tinkering with Time

by Gayl Mileszko

Speed is of the essence when it comes to delivering vaccines, election outcomes and aid to unemployed workers and locked down businesses. There are ways to measure baseball’s fastballs, touchdown sprints, and high-frequency trading executions. But some gauges can be a bit tricky. The speed of the Earth’s rotation, for example, varies constantly due to the motion of its molten core, oceans and atmosphere, as well as the impact of celestial bodies like our moon. Tides and the change in distance between the Earth and the moon all make for daily variations in the speed the planet rotates on its axis; even heavy mountaintop snow that melts in summertime can cause a shift. Given all the unprecedented events of 2020 around the world, it should come as no surprise that our Earth has literally been spinning unusually quickly of late. In fact, the shortest day on record was July 19, when the planet completed its rotation in 1.4602 milliseconds less than usual. Records were broken 28 times last year and the Earth in 2021 looks to be moving at an average daily pace that is 0.5 milliseconds faster than the standard 24 hours.

In recent decades, the Earth’s average rotational speed had been consistently decreasing. Scientists at the Paris-based International Earth Rotation Service who monitor the planet’s rotation inform countries six months in advance when “leap seconds” need to be added to align with solar time. And, since the 1970s, official timekeepers have made 27 adjustments to keep atomic clocks in sync with the slowing planet. Most recently this occurred on New Year’s Eve in 2016. Now, for the first time on record, a negative leap second may be needed. The World Radiocommunication Conference members will make the decision when they next meet in 2023.

A more common standard measure of time, the Gregorian calendar, has been in use since 1582 and has just flipped into 2021. But for some, the new year began on December 14 when the first health care workers and nursing home residents were administered the Pfizer-BioNTech COVID-19 vaccine. Four days later, the U.S. Food and Drug Administration authorized a second vaccine from Moderna for emergency use. The two mRNA vaccines have shown remarkable effectiveness of about 95% in preventing COVID-19 disease in adults when given in two doses at 21 days and 28 day intervals, respectively. At this writing, 4.56 million Americans have received injections. All of us on Main Street and Wall Street are closely monitoring the rollout of this historic mass vaccination program, fervently hoping that it puts an end to the illness and loss suffered here and around the world.

Although there is federal guidance and $8 billion of federal funds, states are responsible for running the COVID-19 vaccination campaigns and prioritizing residents. There have been issues with public information as well as with storage, handling and administration of the doses. There is also an issue of public confidence. Not everyone is anxious to get the vaccine. Many have adopted a wait-and-see approach. The sheer number of healthcare workers and long term care residents at the head of the line means that there will be many months before others become eligible. Some have objections on religious grounds. More than 20.8 million Americans have already had the coronavirus; those who have recovered may believe that they have some level of immunity. Some cite concern over the speed with which the vaccines were developed and are worried about potential side effects. Those who look in the rearview mirror can find mis-steps on the part of the federal, state and local officials and may distrust the ability of elected and unelected government workers to handle anything having to do with the pandemic. Some find the matter political, others are skeptical of the big pharmaceutical companies who are benefiting financially from the rush to market. For those with cognitive issues, consent procedures can prove vexing.

As the majority await evidence of the effectiveness and safety of the vaccines, entrepreneurs are hard at work on other approaches. Some nursing homes, hospitals, restaurants and cruise ships are installing air purifying systems using needlepoint bipolar ionization technology to disrupt surface proteins of viruses and bacteria, and de-activate harmful pathogens. Hotels, schools and offices are installing ultraviolet light emitting diodes in heating and cooling systems to disinfect surfaces, ventilation and water systems. These technologies, or others yet to come, may also help to generate public confidence and resurrect businesses and institutions severely damaged by the pandemic and related lockdown policies.

Long-term care facilities have experienced significant drops in occupancy as a result of the deadly toll that the coronavirus has taken on the frail elderly population. Some 40% of all reported COVID-19 deaths are said to have occurred in nursing homes. Rebuilding public confidence in the safety of these care communities is critical to the industry and will, in many cases, require considerable time and plenty of documentation and testimonials. Providers are exploring the expanded use of infection preventionists, recommending changes to Medicaid reimbursement rates to boost the salaries of their health and personal care workers, and working to develop improved regulatory reporting procedures.

While nursing homes, assisted living, and memory care facilities may take longer to return to pre-coronavirus levels, other battered sectors of the economy are primed to reverse if not soar once herd immunity appears imminent, federal and state efforts meet with widespread support, and vaccines and technologies are proven successful. When does that happen? There is a colloquial expression attributed to Supreme Court Justice Potter Stewart: “I know it when I see it” that described his threshold test for obscenity. This is the type of test we will apply to determine in our own non- epidemiological ways when the end to this hideous pandemic is near. It will involve a combination of federal and state pronouncements, toned down and redirected media coverage, personal anecdotal experience, and the emergence of green shoots in our respective neighborhoods.

Industries most impacted by the pandemic stand to gain the most in a world about to be restored to something akin to the 2019 version of “normal”. In the interim, and for the foreseeable future, rallies are unlikely to abate in markets for industries proven essential to day-to-day, stay-at-home life in the past year: grocery stores, pharmacies, home improvement, on-line retail sites with rapid home delivery service contracts, information technology, household durables, fast food restaurants, agriculture, farm equipment, personal and health care supplies, key ports serving cargo ships, vacation rentals, recreational vehicles, golf-related products, testing services, cybersecurity, defense and other key domestic manufacturing, utilities, water and sewer, solid waste, affordable housing, technical schools, alcohol and tobacco.

Investors with cash and foresight will look to position portfolios for a post-COVID-19 economy. We will look to capitalize on the slow but sure rebound in oil and gas exploration and storage, steel, energy equipment and services, larger hospital systems, health care technology, banks, life and health insurance, property and casualty insurance, and toll roads with steady commercial traffic. In addition, steady reversals over time should occur in homebuilding, automobiles, aerospace, public colleges and universities. Among the sectors likely to take the longest to improve as there have been major and perhaps irreversible shifts in remote work and recreational choices. Our lives have changed in major ways since March and therefore partial rebounds will likely lag for airlines, hotels and resorts, rental cars, textiles and apparel, beauty products, mass transit, parking, casinos, gyms, cinemas and theaters, convention and sports venues, finer dining restaurants, jails, small private colleges, student housing, and commercial real estate.

Scrutinizing the relative differences in fundamentals including governance, geography, balance sheets, and COVID-19 case and death statistics, will take time but will pay off for well-advised investors. Regular and transparent reporting by for-profit and non-profit entities is required. Few of the old precedents apply; last year brought dozens and dozens of new pre-packaged bankruptcy cases with unexpected outcomes for senior bondholders having less than majority votes. Changing consumer preferences and potential new regulations are bound to adversely impact holdings, including certain media. Population shifts are underway. Some entities have significantly diluted equity and incurred strangling debt loads. Governments at every level will need to re-prioritize budgets given the costs of debt service and urgent social and infrastructure needs. Underfunded pensions and other post-employment benefits may threaten future general obligation bond debt service as well as interest and principal on state and local revenue bonds with weak security protections.

For bondholders, 2020 was a year in which fixed income was largely redefined as lacking income. Top-rated 30-year yields dipped well below 1.40% for tax-exempts and 3% for corporates. Even below investment grade and non-rated municipal and corporate securities sold at premium prices producing yields well below 5%. The chart below depicts 12 months of declining yields and illustrates the decade long decline in benchmark bond yields. It also reflects the significant volatility and gains in the stock and commodity markets, and the growing acceptance and risky participation in digital cryptocurrency markets.

Source: Bloomberg; Thomson Reuters Refinitiv

At the start of the new trading year, starting valuation levels for stocks and bonds are extremely high. Traders have been expecting prices to normalize for years and years; seasoned ones understand that this is bound to happen at some point. But our Federal Reserve has intervened in the markets for the past 12 years now and it is unclear when we should expect them to back away from hyper-accommodative policies. Central banks were the quickest to respond to the pandemic by creating and supporting liquidity facilities for every domestic market and some foreign ones as well. Their balance sheets have exploded. Few can argue with the value and timing of their tinkering. How and when they unwind, and with what impacts, are questions not faced before in our history. How our fiscal leaders respond after the past rounds of stimulus at a time when the debt and deficit are at levels not before seen is another question that investors, domestic and foreign, pose.

Gauges of sentiment from organizations including the American Association of Individual Investors, show bearishness at multiyear lows despite the global surges in COVID-19 cases, questions over the origins of the virus, and uncertainty over U.S. elections and various national policies. The major near-term risks to the financial markets include larger-than-anticipated increases in inflation rates, increases or decreases in zero-range and negative interest rates, downgrades in sovereign credits, a lower dollar, increased regulatory action, and any unexpectedly large defaults in the corporate, mortgage, and muni space.

2020 will go down in multiple record books. We saw the first president to be impeached and then run for reelection. Both the presidential candidates won more popular votes than any other in our history. We suffered the largest GDP quarterly decline followed by the largest quarterly increase, and witnessed a record-breaking single year increase in the national debt and market swings we could barely stomach. A quarter of U.S. adults say they or someone in their household has been laid off or lost a job because of the coronavirus outbreak, and 32% say they or someone else in their household has taken a pay cut due to reduced hours or demand for their work.

The $3.97 trillion muni market saw $474.05 billion of issuance in 12,940 deals in 2020 compared to $426.35 billion in 11,596 transactions in 2019 and setting a new record. Add to that private placements, corporate CUSIPs, and direct bank lines of credit which took so much tax-exempt paper out of the market and failed to satisfy a relentless demand. Corporate CUSIPs grew 223% over 2019 and landed at $40 billion for the year. The general muni market returned 5.26%, a seventh straight year of gains. High yield munis ended higher by 4.8%. Taxable munis with $140 billion of primary market sales closed up 11.82%. Zero coupon bonds were up 8.88%. Investors added about $33 billion to municipal bond mutual funds and the oldest gauge of municipal yields, the Bond Buyer 20 General Obligation Bond Index, which tracks yields on 20-year munis, touched 2% on Aug. 6, the lowest since 1952.

A record $1.75 trillion of investment grade corporate bonds was sold in 2020. High yield corporate issuance ended the year with approximately $432 billion of record issuance. The U.S. High Yield ICE BoAML Index ended the year up 6.17% and at all-time low yields of 4.18%. The U.S. Investment Grade corporate bond Index ended 2020 with returns of + 9.81%, a record; $1.75 trillion of new debt was sold in 2020.

A new year has begun and it is time to tinker with your portfolio. We at HJ Sims hope that 2021 brings only happy, healthy and prosperous days for you and your family. To that end, we encourage you to be in regular contact with your HJ Sims financial professional, to carefully add individual high yield credits we recommend to select income portfolios, to limit exposure to certain bond funds and ETFs, to consider preferreds, convertibles, zeroes and and taxable munis for retirement accounts, to prepare to take best advantage of the re-opening of our economy, to build up your emergency funds, to ensure that all your affairs are in order, to revise your monthly budgets, and to appreciate all the people, moments and little things that we took for granted at this time just one year ago.