On Capitol Hill, yeoman’s work is needed to achieve consensus on the thorniest of issues, the legislative product of the most contentious of negotiations. This week, the whips on both sides of the aisle and in both chambers of Congress are hard at work trying to rapidly round up votes for a bill that will suspend the debt limit, set some new federal spending guidelines, and address other issues that have, for various reasons, suddenly fallen under the umbrella of extreme urgency. It is not unlike the annual effort to enact a budget framework and then an omnibus spending bill. The whole process is described as being like trying to put socks on an octopus.

Continue readingMarket Commentary: Semi-Sweet

On Capitol Hill, yeoman’s work is needed to achieve consensus on the thorniest of issues, the legislative product of the most contentious of negotiations. This week, the whips on both sides of the aisle and in both chambers of Congress are hard at work trying to rapidly round up votes for a bill that will suspend the debt limit, set some new federal spending guidelines, and address other issues that have, for various reasons, suddenly fallen under the umbrella of extreme urgency. It is not unlike the annual effort to enact a budget framework and then an omnibus spending bill. The whole process is described as being like trying to put socks on an octopus.

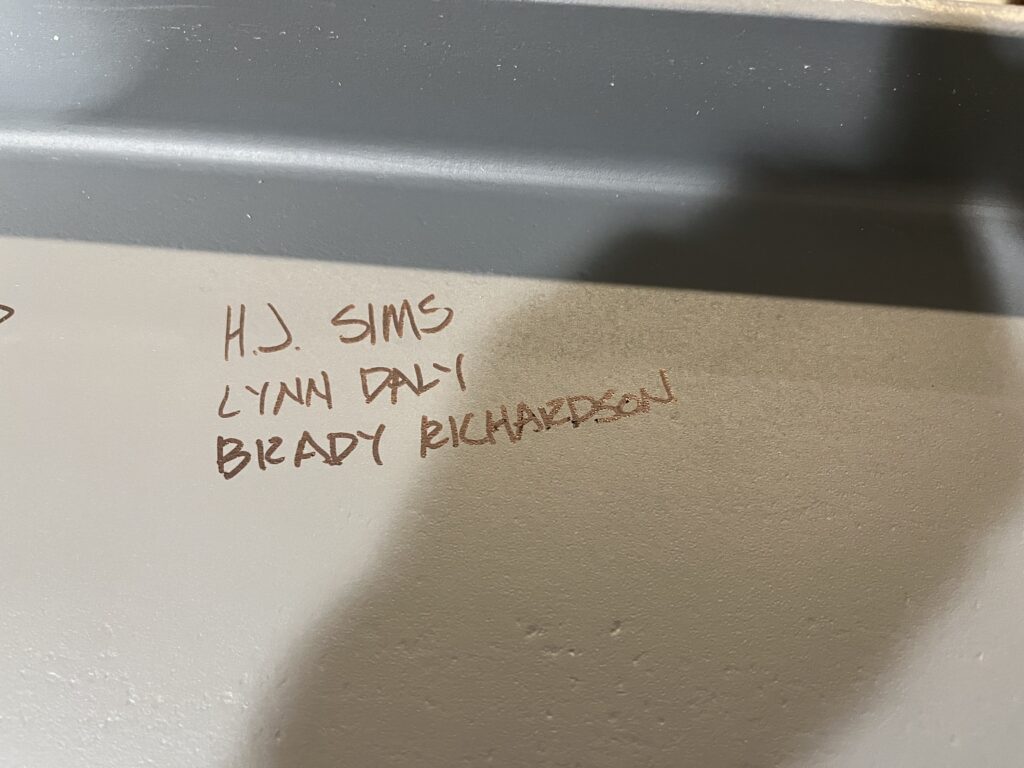

Continue readingReturning HJ Sims Client in the Southwest, Focused on Long Term Plan of Finance (June 2023)

HJ Sims closes life insurance company loan for assisted living and memory care community in the Rocky Mountains – the second in less than 30 days.

Continue readingOrenda Education (June 2023)

HJ Sims completes $37 million Bank Financing, for campus renewal and replacement projects, at attractive long-term fixed interest rates and terms for New Jersey non-profit LPC – successfully navigating volatile financing conditions.

Continue readingMarket Commentary: Smiles All Around

On Capitol Hill, yeoman’s work is needed to achieve consensus on the thorniest of issues, the legislative product of the most contentious of negotiations. This week, the whips on both sides of the aisle and in both chambers of Congress are hard at work trying to rapidly round up votes for a bill that will suspend the debt limit, set some new federal spending guidelines, and address other issues that have, for various reasons, suddenly fallen under the umbrella of extreme urgency. It is not unlike the annual effort to enact a budget framework and then an omnibus spending bill. The whole process is described as being like trying to put socks on an octopus.

Continue readingMarket Commentary: Putting Socks on an Octopus

On Capitol Hill, yeoman’s work is needed to achieve consensus on the thorniest of issues, the legislative product of the most contentious of negotiations. This week, the whips on both sides of the aisle and in both chambers of Congress are hard at work trying to rapidly round up votes for a bill that will suspend the debt limit, set some new federal spending guidelines, and address other issues that have, for various reasons, suddenly fallen under the umbrella of extreme urgency. It is not unlike the annual effort to enact a budget framework and then an omnibus spending bill. The whole process is described as being like trying to put socks on an octopus.

Continue readingMarket Commentary: Pointing Fingers

Fingers are being pointed in every direction down in the nation’s capital and there is evidently not much humor to lighten the mood. Hard-working Americans once again, through no fault of their own, face serious financial problems as a result of the pandemic, inflation and various fiscal and monetary policies. . Total consumer debt has risen past $17 trillion for the first time according to the New York Fed, and the share of current debt becoming delinquent has increased for the fifth straight quarter for most types of credit.

Continue readingMedford Leas (May 2023)

HJ Sims completes $37 million Bank Financing, for campus renewal and replacement projects, at attractive long-term fixed interest rates and terms for New Jersey non-profit LPC – successfully navigating volatile financing conditions.

Continue readingMarket Commentary: Who Wants This Job?

All great leaders are defined by how they lead during times of uncertainty and danger. Right now, in the midst of great uncertainty over when or whether our leadership will come to agreement on a new debt limit and spending priorities, we are mostly going

easy on our elected officials. There are few cries for impeachment, no major civil unrest and no major recall elections underway despite high inflation, high interest rates, sky-high federal and household debt, rampant crime, and our grim outlook for the economy.

Market Commentary: On the Brink Again

We are near the peak of another debt ceiling drama, one that will keep the world on edge for several more weeks. In the back rooms and basements of federal buildings throughout Washington, away from the principals and cameras, the proverbial frenzy of negotiations is underway. History repeats itself again with a new cast.

Continue readingThe Cliff Notes on Golden State Charter School Bonds

Director of Credit Analysis, Gayl Mileszko provides a summary of the recent S&P California Charter School Brief.

Continue readingMarket Commentary: April Showers Bring… What Next?

May has arrived with its extra hours of sunlight and the excitement of imminent graduations, reunions, weddings and summer vacations. The dark days of winter and muds of early spring are in the rearview mirror, with all around us looking green and bright. Well, not everything. We just got the taxes behind us, the school year is about to end, and it is prime time for enjoying baseball, basketball, hockey and the NFL draft. But, seemingly out of the blue, we have become seized by worry about our bank accounts now that we have seen three of the four largest bank failures in our history occur in the last two months. Our hopes for buying a new home have been dashed by mortgage rates that are right around the highs of 2003; the 30-year fixed rate is 6.98%. Our wish to sell our home is vexed by the limited pool of eligible buyers who have seen 134 straight months of home price increases.

Continue readingHJ Sims Welcomes Jenny Wade as Senior Vice President, Investment Banking

HJ Sims is pleased to announce that Jenny Wade joins the firm as Senior Vice President. With over 21 years of municipal and nonprofit finance experience, Wade is well known for her technical skills including the development of complex financial models.

Continue readingMarket Commentary: Rhymes

History doesn’t always repeat itself but, as Mark Twain reportedly once said, it often rhymes. Looking across the investment landscape, we find ourselves facing events and conditions that have been experienced before but are hardly worthy subjects for song or poetry: a debt limit standoff reminiscent of 2011 and 2013, interest rates not experienced in 16 years, inflation rates not seen in 40 years, levels of U.S. debt as a percentage of GDP that now exceed the 1945 peak, a 100-year pandemic, the 25th instance in 123 years of divided party control in Washington, a 1,000-year rainfall, and now a possible repeat of the 2020 presidential contest.

Continue readingMarket Commentary: Dangerous Words

Things are different than they were at the start of the new year. Several banks have failed, with SVB and Signature now listed among the top four U.S. largest bank failures of all time when measured by total assets. The Federal Reserve launched yet another new rescue program and Pew Research reported that 56% of Americans say banks and other financial institutions have a negative effect on the way things are going in the country these days.

Continue readingMarket Commentary: Pick and Roll

It was with a pen, not a buzzer, a 21-gun salute, a balloon drop, fireworks, or confetti parade, that the President signed congressional resolution H. J. Res. 7, ending the COVID national emergency on Monday. He signed the bill behind closed doors without ceremony, bringing no new attention to the execrable pandemic that disrupted and devastated virtually every life on the planet over the course of the last three years.

Continue readingMarket Commentary: Calling the Shots

It was fifty years ago on April 3, 1973, when Dr. Marty Cooper made the first public cell phone call from his clunky, personal, handheld, portable prototype as he stood on a busy New York City sidewalk. The 44-year-old Motorola engineer thought it would be amusing to make that first call to his company’s chief competitor at Bell Labs, Dr. Joel Engel. He punched in his rival’s number on a DynaT-A-C device that was roughly the size of a brick.

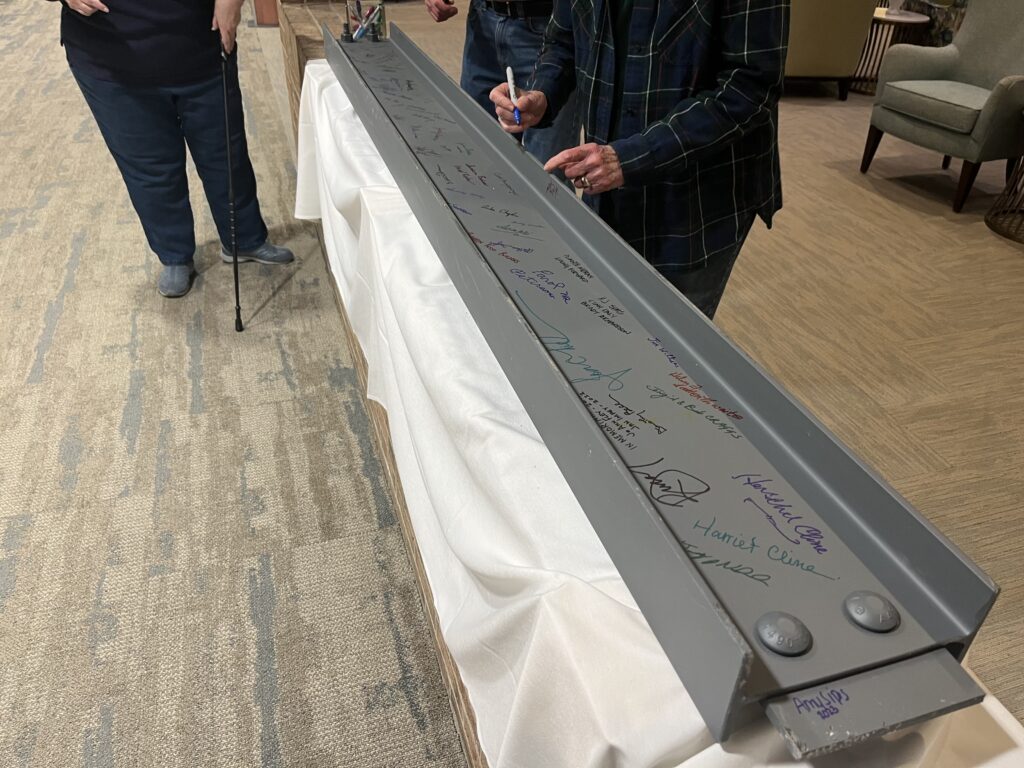

Continue readingClark-Lindsey Village Celebrates the Addition of their Assisted Living Apartment Building with Beam-Signing Event

Market Commentary: Sense-Making

The Cynefin framework was created as a tool to be used in “sense-making”, a term broadly incorporating common sense into decision-making, something that we and all of our policymakers in Washington should certainly do more often. Fifteen years ago, David Snowden and a team at IBM came up with this new framework for looking at problems and assessing situations accurately so as to arrive at solutions and respond appropriately. They began by identifying four types of problems: simple, complicated, complex and chaotic, and moved on from there.

Continue readingMarket Commentary: Consistency

Edgerton “Ketchie” Welch, a lifelong resident of Chillicothe, Missouri began his career at his family’s Edge-Mar Dairy but later came to run the local Citizens Bank & Trust Co., serving for a total of 55 years. At various points in his role as CEO, he reported an investment performance that beat the nation’s biggest banks and insurance companies. When interviewed by Forbes on his exceptional success, he admitted that he was not smart enough to play the stock market and never even heard of modern portfolio theory.

Continue reading