Market Commentary: Silver Bells Ring

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingHÓZHÓ ACADEMY Case Study (May 2025)

HJ Sims Partners with Hózhó

Academy to Finance Campus

Expansion and Facility

Enhancements

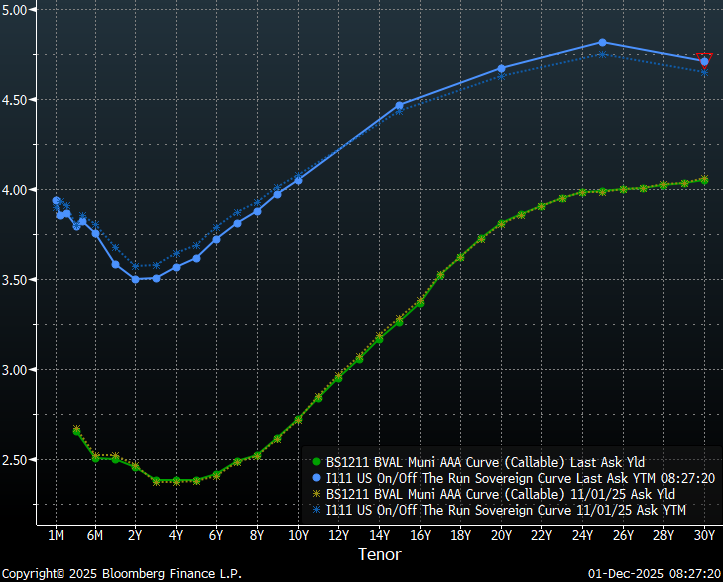

Curve Commentary: December 15, 2025

Overview

Last week, the Fed held its final meeting of 2025, with officials voting to cut its policy interest rate by a quarter-point for a third consecutive meeting. A lack of economic data, stemming from the longest-ever government closure, combined with a weakening labor market and lingering inflation has led to policy uncertainty. As a result, the Fed’s decision was not unanimous, with two regional Fed bank presidents voting to hold rates steady with one Fed governor voting for a half-point cut and nine members voting for a quarter-point cut. The market’s response to the decision has been relatively muted, with Treasuries rallying six to nine-basis points on the short-end of the curve and selling-off around four basis points on the long-end while munis were largely unchanged out to around 10-years and selling-off around two basis points on the long-end.

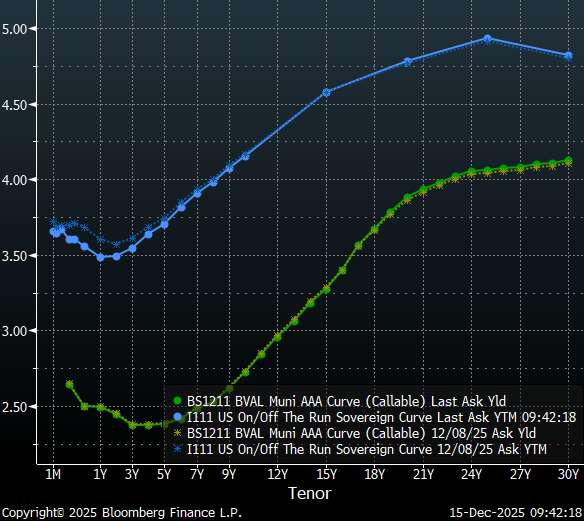

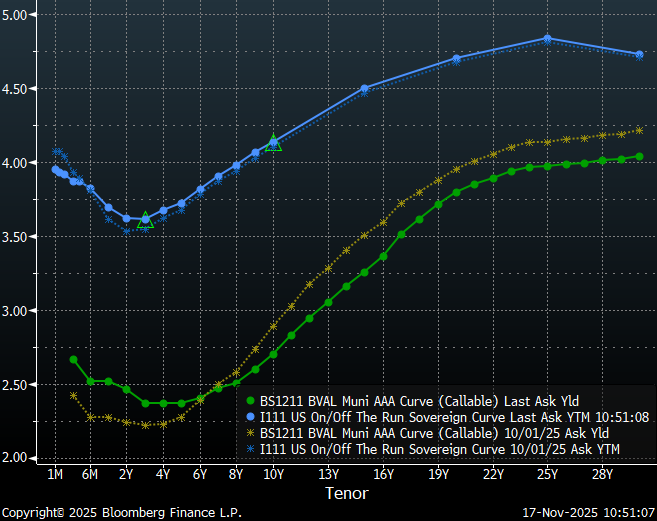

The markets continue to be responsive to comments from the Fed. The prospect of additional rate cuts next year supports lower short-term Treasury yields, while long-maturity tenors are supported by elevated inflation expectations. However, on the long-end, rate cuts into a relatively strong economy have the potential to ignite inflation to the detriment of long-duration assets. As shown in the graph below, slopes for municipals from both two to ten-years and from ten to twenty-years have steepened significantly in recent months relative to Treasuries.

Insights and Strategy

Slopes along the municipal yield curve are currently steepest around the 16-year tenor, with over 100 bps in slope from 10 to 19-years. As a result, the municipal yield curve currently rewards investors for extending from the 10-year range to the 15-20-year range. Investors also benefit from a steep roll-down over time. Although the municipal yield curve is currently rewarding duration, investors should be cautious when extending to maturities past 20-years, where the long-end becomes very flat. As a result of this flat tail, municipal bond investors can buy maturities under 20-years that yield over 90% of the 30-year curve.

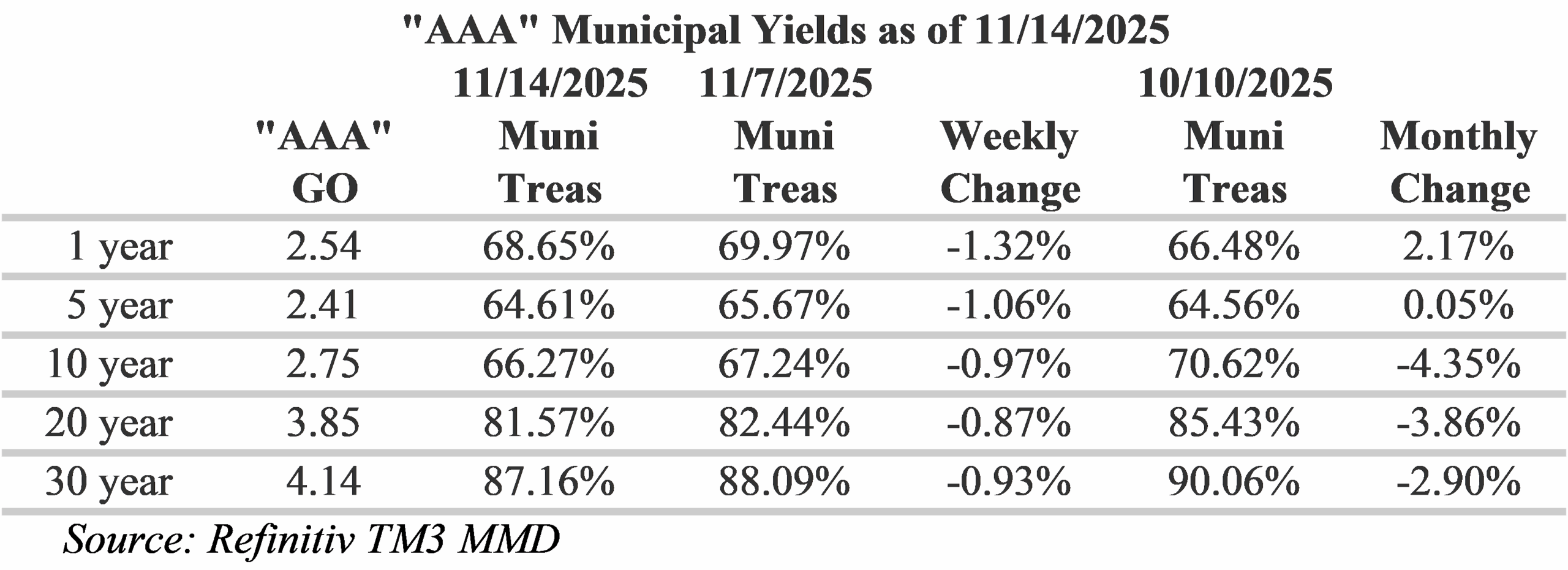

Muni/Treasury ratios generally dropped over the past week. However, the biggest moves were around the 1-year maturity where ratios actually increased to just above 70%. This move was not a surprise since the extreme short-end of the curve is where the Fed exerts its greatest influence. However, this is a remarkable change from September, when ratios in this tenor dropped to as low as 56%. Nevertheless, for investors seeking to maximize curve positioning with relative value, extending to the 19-year part of the municipal yield curve provides 90% of the 30-year municipal maturity and 80% of equivalent Treasury yields.

This week, there is a busy economic calendar with the November jobs report along with an estimate of October payrolls due on Tuesday and the consumer price index scheduled for release on Thursday. Although bond traders are betting the Fed cuts rates twice next year, the Fed’s “dot plot” is currently indicating just one reduction in 2026. Therefore, we could see some volatility this week in response to the new data due to the mis-match of expectations. The markets are likely to embrace softer labor data as an indication of a more-dovish Fed. In addition, there is a seasonal push for borrowers to complete transactions before year-end. This week, the municipal bond market is expected to offer more than $6 billion in new issues. Notable deals this week include: New York Transitional Finance Authority with $2 billion and Ohio State University with $562 million.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Market Commentary: Palace Intrigue

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingCurve Commentary: December 8, 2025

Overview

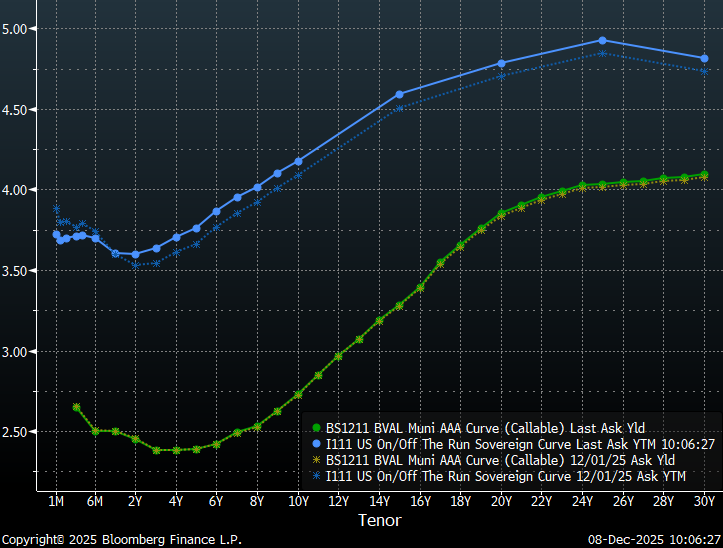

This past week, the Treasury curve shifted up eight to nine basis points in a parallel fashion from two years out while municipal yields remain essentially unchanged with the long end only about a basis point higher. The result is a steeper Treasury curve with municipal bonds generally outperforming Treasuries. Perhaps the most meaningful developments occurred in Treasuries on the extreme short-end with one-month and two-month yields rallying 10 to 20 basis points in anticipation of a Fed rate cut this week. However, following last Friday’s release of the delayed core personal consumption expenditures price index form the Bureau of Economic Analysis, inflation concerns were reinforced with prices up 0.2% from August and 2.8% from the prior year. As a result, the rate cut expected at the Fed’s final 2025 meeting later this week could potentially accelerate inflation concerns on the long-end.

Moreover, the balance of the year has the potential to be more dynamic than previous years for the fixed income markets. As a result of the shutdown, the traditional data-release schedules have been pushed-back this year. November payroll data will not be published until next Tuesday on December 16, November’s CPI is scheduled for release two days later on December 18 and third quarter GDP is scheduled to be released just two days before Christmas. In addition, the Supreme Court could release their decision on the IEEPA tariff case later this month.

Insights and Strategy

Slopes along the municipal yield curve continue to be steepest around the 16-year tenor, with over 100 bps in slope from 10 to 19-years. This is a significant change from earlier last month, when the steepest slopes were around the 10-year tenor. This shift has increased the reward to investors for extending from the 10-year range to the 15-20-year range. In addition, investors benefit from a steep roll-down over time. Although the municipal yield curve is currently rewarding duration, investors should be cautious when extending to maturities past 20-years, where the long-end becomes very flat. As a result of this flat tail, municipal bond investors can buy maturities under 20-years that yield over 90% of the 30-year curve.

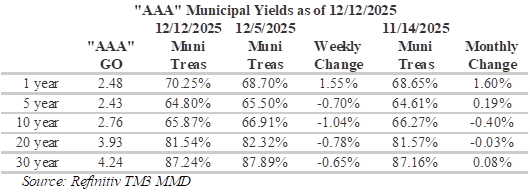

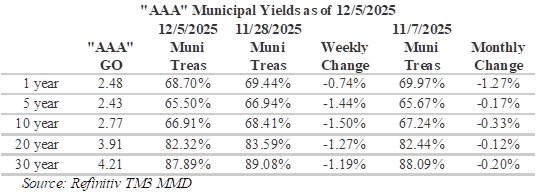

Elevated municipal tax-equivalent yields on the long-end continue to reward investors, although not by as much as they did last week. Muni/Treasury ratios have generally dropped a bit over the past week, with the biggest moves around the 10-year maturity where ratios have declined 1.5% to 66.91%. Ratios of this level are historically rich and primarily appeal to individuals investors in the top tax brackets. Not surprisingly, over the past month, the biggest moves have been on the extreme short-end of the curve where the Fed exerts its greatest influence. One-year ratios are now 1.27% richer as ratios have dropped to 68.70%. For investors seeking to maximize curve positioning with relative value, extending to the 18-year part of the municipal yield curve provides 88% of the 30-year maturity and 77.5% of equivalent Treasury yields.

This week, the municipal bond market is expected to offer more than $10 billion in new issues following a $15 billion calendar last week. Notable deals this week include: $2 billion Regents of the University of California Revenue Bonds, $1 billion Chicago O’Hare International Airport and New York Housing Development Corp. with $753 million. Fund flows have generally been supportive over the past month. LSEG Lipper Global Fund Flows reported that intermediate-maturity municipal bond funds saw inflows of $133 million last week while high-yield municipal bond funds experienced inflows of about $253 million and long-term muni funds saw inflows of about $320 million.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Market Commentary: Trotting Out the Turkeys

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue reading2025 Ohio Masonic Groundbreaking Ceremony

HJ Sims is proud to be attending the 2025 Ohio Masonic Groundbreaking Ceremony.

Attending: Lynn Daly, Executive Vice President

The 23rd Annual HJ Sims Late Winter Conference

Financing Methods and Operating Strategies for Charter Schools and Senior Living

Planning is underway for the 2026 HJ Sims Late Winter Conference, and it’s already shaping up to be an unforgettable experience. Join us for an energizing program featuring dynamic speakers, timely insights, and meaningful opportunities to connect with peers and industry leaders.

We’re thrilled to host our 23rd annual conference at the stunning Marriott Sanibel Harbour Resort & Spa in Fort Myers, Florida. Nestled along the waterfront with sweeping views of Sanibel and Captiva Islands in the upscale Punta Rassa community, this premier destination offers the perfect setting for learning, collaboration, and inspiration.

For conference attendance, follow our Safety Protocol.

Registration is now open! Visit our conference website to explore the full agenda, reserve your hotel accommodations, review event logistics, and access everything you need to plan your experience. We look forward to welcoming you to an exceptional conference in an unbeatable setting.

For more information, please contact Kat Dymond.

Academics of Math and Science Case Study (October 2025)

$18,405,000 | October 2025 | Avondale & Mesa, AZ

“We knew that long-term rates made expansion to highneed Arizona communities challenging. But our program is designed for this mission and it is our calling to serve students in need. In partnership with Sims, we were able to offer investors an opportunity to challenge the customary structure with an innovative offering, and also to equip us to make a very positive impact in the communities we serve. The result was a win for students, a win for investors, and a win for AMS.”

-Katie Determan, CFO of AMS Tweet

Partnered Right®

Academies of Math & Science (“AMS”) is a school network that operates 10 charter schools; 8 are located in metro-Phoenix and 2 are located in

Tucson. Together, the campuses serve 8,646 students from grades K-8. Sims collaborated closely with school management aligning on goals

to build out AMS Mesa, while optimizing financing for its existing operations.

Structured Right®

The $18.405 million financing proceeds were designed to support the construction of the new AMS Mesa campus and the expansion of the

existing Avondale campus. This structure featured a unique approach -a 10 year mandatory tender, the first of its kind in the charter school sector,

which Sims believes lowered the yield by ~100bps. The bonds also included capitalized interest to support the school through the initial enrollment ramp-up.

Executed Right®

Despite a challenging market backdrop during pricing, HJ Sims successfully brought the transaction to the market. The offering received indications of interest from 15 institutional investors, 6 of which were new investors to AMS, and bonds were ultimately allotted across all 15 of them – a massive success for the school.

Financed Right®

In August 2025, HJ Sims successfully placed $18.405 million in unrated, tax-exempt revenue bonds with institutional investors. The transaction

enables AMS to expand capacity and continue serving a growing student population across the metro-Phoenix and Tucson area.

2025 NFMA Advanced Seminar on High Yield Bonds

HJ Sims is proud to be attending and speaking at the 2025 NFMA Advanced Seminar on High Yield Bonds.

Aaron Rulnick, Executive Vice President, HJ Sims will be participating in a panel discussion:

Date: January 23, 2026

Topic: Construction Risk in Senior Living and Beyond

Description: The aging population is creating a demand for new senior living projects. At the same time, the construction industry is currently facing a variety of pressures including tariffs, the impact of immigration policy on labor, challenges obtaining entitlements, and high interest rates. This panel will focus on how to assess construction risk, potential strategies to minimize downside risk, and the outlook for new development in the senior living sector.

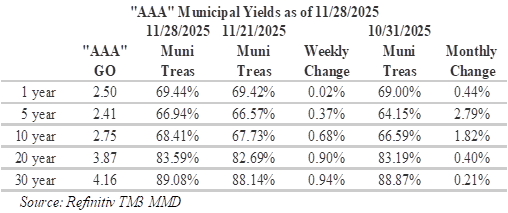

Curve Commentary: December 1, 2025

Overview

Despite uncertainty regarding the reopening of the U.S. government, conflicting information from Fed policymakers and the wild swings in market sentiment regarding the prospects of another rate cut, yields on municipal bonds and Treasuries have changed relatively little over the past month. Municipal yields for all tenors were generally within a basis point or less of their yields from the beginning of November and Treasuries were also relatively unchanged with a slight steepening as rates rallied modestly from 6-weeks to 5-years and sold off 7 to 10-basis points in tenors past 15-years. The stability in the fixed income markets can partially be attributed to the lack of key economic data during the shutdown and the continuation of long-term trends with structural labor market concerns and continued stubbornly high inflation.

This morning the Fed funds futures market was pricing-in the probability of a third rate cut this year at over 100%, which is a dramatic shift from just a few weeks ago when the probability was in the high 20% range. Although recent economic data has been largely supportive of a rate cut, should the Fed maintain current rates we will likely see some turbulence given implied rates. Lately business activity has been slowing. Today’s ISM Manufacturing Index contracted for the 9th straight month with activity shrinking by the most in four months. However, the employment picture is still not clear. The BLS will not be publishing the October employment report until after the Fed issues its decision, which is also when it will be releasing November data.

Insights and Strategy

Slopes along the municipal yield curve are currently steepest around the 16-year tenor, with over 100 bps in slope from 10 to 19-years. This is a significant change from earlier last month, when the steepest slopes were around the 10-year tenor. This shift has increased the reward to investors for extending from the 10-year range to the 15-20-year range. In addition, investors benefit from a steep roll-down over time. Although the municipal yield curve is currently rewarding duration, the long-end has become very flat with steadily declining slopes from 20 to 30-years and only a basis point or so per year past 25-years. As a result of this flat tail, municipal bond investors can buy maturities under 20-years that yield over 90% of the 30-year curve.

Elevated municipal tax-equivalent yields on the long-end continue to reward investors, with ratios generally cheapening over the past week. The muni/Treasury ratio is a widely watched measure that provides a sense of how tax-exempt munis fare against taxable fixed-income options. Crossover investors, which seek to identify the best opportunities in the fixed income universe on an after-tax basis, closely follow this ratio. Over the past week, the biggest moves have been on the long-end of the curve, where ratios are approaching 90%. Over the past month, the biggest moves have been around the 5-year maturity where ratios are approaching 3% richer. For investors seeking to maximize curve positioning with relative value, extending to the 18-year part of the municipal yield curve provides almost 90% of the 30-year maturity and almost 80% of equivalent Treasury yields.

This week, the municipal bond market is expected to price more than $14.6 billion in new issues. Notable deals this week include: State of Connecticut Special Tax Revenue Bonds with $1.56 billion, Long Island Lighting Company with $1.02 billion and City of San Antonio TX Electric & Gas Systems Revenue with $599.8 million. Fund flows have also generally been supportive over the past month. ICI data reported that exchange-traded funds saw inflows of $366 million during the holiday week Last week following a staggering $2.735 billion of inflows the week prior.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

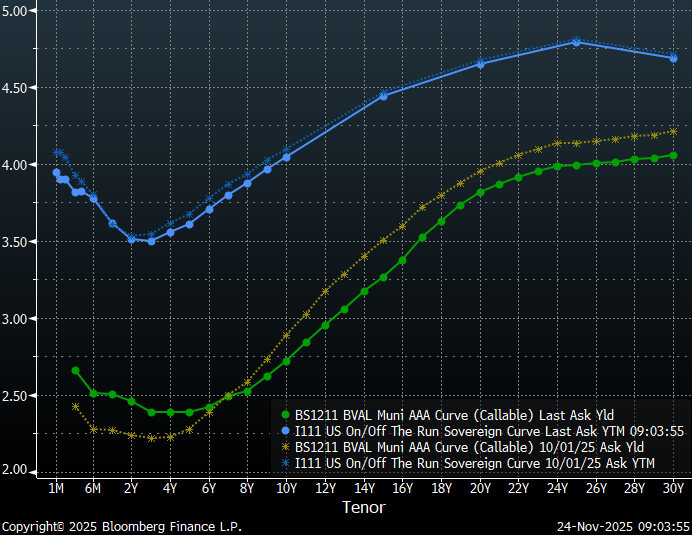

Curve Commentary: November 24, 2025

Overview

Economic data releases resumed last Thursday with the U.S. Department of Labor’s (BLS) release of the long-delayed September employment report. The BLS report did not deliver the clarity that markets are seeking regarding the central bank’s likely path. Although nonfarm payroll employment came in stronger than expected with 119,000 jobs added in September, the report also showed the jobless rate edging-up to the highest level in nearly four years to 4.4%. The increase in the jobless rate is not all that surprising, given the widely reported agency-by-agency filings showing the administration attempted to terminate a total of 3,605 employees during the shutdown. Employment gains were driven by health care, food services and drinking places, and social assistance. To add to the market’s uncertainty, the BLS will not be publishing the October employment report until after the Fed issues its decision on December 10 which is also when it will be releasing November data.

Rate expectations have varied widely in recent weeks due to conflicting information from Fed policymakers and a lack of clear signals on jobs and inflation. Last Wednesday, the Fed funds futures market was pricing-in the probability of a third rate cut this year in the high 20% range. Following comments from New York Fed President John Williams on Friday indicating the possibility of lower interest rates in the near-term as the labor market softens, investors boosted the odds of a rate cut to around 70%. As the Thanksgiving holiday approaches and traders look to the Federal Reserve for indications of policy easing, traders are fully pricing in a quarter-point cut at the January meeting and an additional cut by the June 2026 meeting.

Insights and Strategy

Slopes along the municipal yield curve are currently steepest around the 16-year tenor, with almost 75 bps in slope from 13 to 19-years. This is a significant change from earlier last month, when the steepest slopes were around the 10-year tenor. This shift has increased the reward to investors for extending from the 10-year range to the 15-20-year range. In addition, investors benefit from a steep roll-down over time. Although the municipal yield curve is currently rewarding duration, the long-end has become very flat with steadily declining slopes from 20 to 30-years and only a basis point or so per year past 25-years. As a result of this flat tail, municipal bond investors can buy maturities under 20-years that yield over 90% of the 30-year curve.

Elevated municipal tax-equivalent yields on the long-end continue to reward investors, with ratios generally cheapening over the past week. The muni/Treasury ratio is a widely watched measure that provides a sense of how tax-exempt munis fare against taxable fixed-income options. Crossover investors, which seek to identify the best opportunities in the fixed income universe on an after-tax basis, closely follow this ratio. Over the past week, the biggest moves have been in maturities around the 5 to 10-year mark where ratios have become almost 2% richer, with ratios now around 66.5% at 5-years. Over the past month, the biggest moves have been around the 20-year maturity where ratios are now about 2% richer. For investors seeking to maximize curve positioning with relative value, extending to the 18-year part of the municipal yield curve provides almost 90% of the 30-year maturity and almost 80% of equivalent Treasury yields.

Last week, the municipal bond market experienced uncharacteristically weak technical conditions as high deal volume was met by the largest outflows since the week ending April 16. Investors pulled $965.8 million from municipal bond mutual funds. This week, state and local governments bond issuance is expected to drop to $1.48b, due to the holiday week, with new issues expected to slow over the month. Notable deals this week include: Pennsylvania Housing Finance Agency selling $275 million and Keller Independent School District/Texas selling $99 million.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

2025 18th Annual Louisiana Charter School (LAPCS) Conference

HJ Sims is proud to be attending the 2025 Annual Louisiana Charter School Conference.

Attending:

Robert Nickell, Executive Vice President

Jimmy Rester, Executive Vice President

Tom Pitcher, Executive Vice President

2025 Annual Charter New Mexico (PCSNM) Conference

HJ Sims is proud to be attending, exhibiting and sponsoring at the 2025 Annual Charter New Mexico Conference.

Attending:

Richard Harmon, Executive Managing Director, Head of Education Banking

Akshai Patel, Executive Vice President

John Solarczyk, Executive Vice President

2025 Charter Innovation Summit

HJ Sims is proud to be attending the 2025 Charter Innovation Summit.

Attending:

Richard Harmon, Executive Managing Director, Head of Education Banking

Akshai Patel, Executive Vice President

Market Commentary: November’s Muni High Yield Feast

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue readingASBURY Case Study (October 2025)

Combining Obligated Groups

to Optimize Credit and

Refinancing Outcome

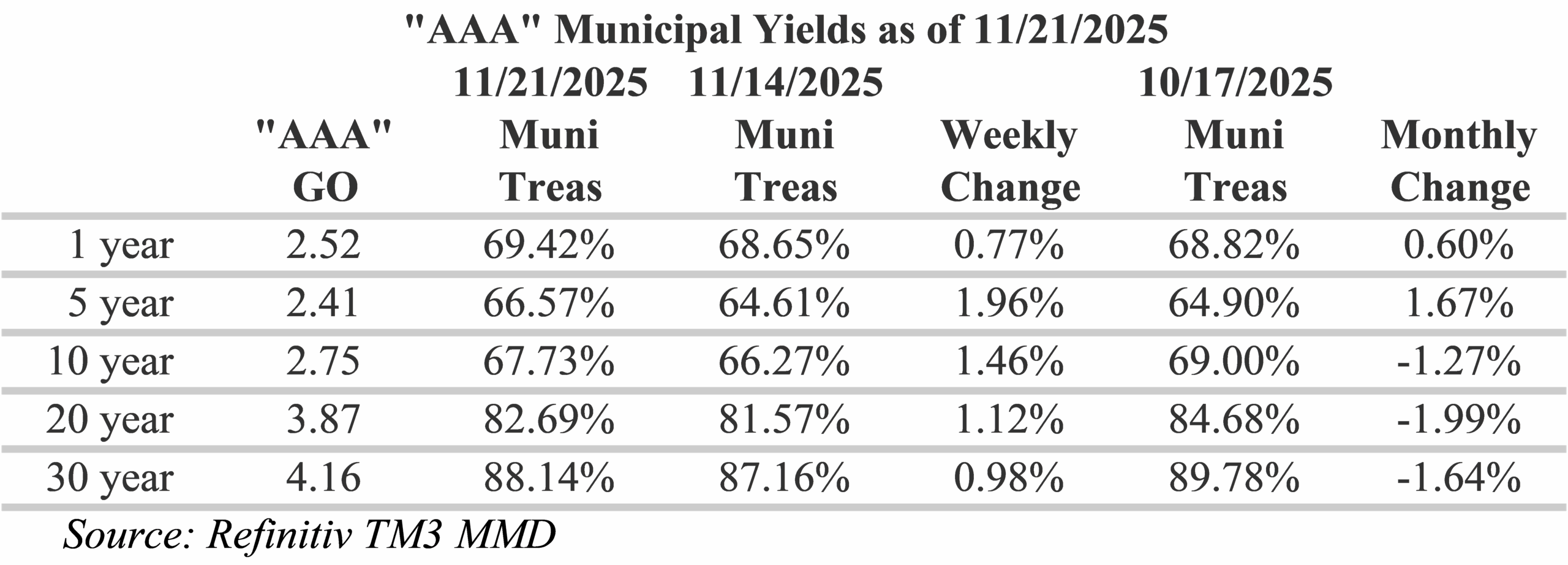

Curve Commentary: November 17, 2025

Overview

Following a record 43-day shutdown, the President signed legislation to reopen the government last Wednesday. Although the government has reopened, there is a sizable backlog of government economic data that was not available during the shutdown. The bond market is currently bracing for a flood of data as traders anxiously pare December rate cut expectations. As of this morning, the Fed funds futures market was only pricing-in a 41% chance of a 25 basis-point cut in December. Current rate expectations have declined significantly from last week, when the implied probability was in the 60’s. The tone has turned decidedly more hawkish as several FOMC members have recently cited heightened inflation concerns, which prompted a sell-off in Treasuries last Thursday.

Not surprisingly, this irresolute sentiment has resulted in Treasury yields that remain little changed from when the shut-down began on October 1. However, the municipal market has demonstrated more conviction with steady demand and appealing relative yields weighing on the long-end while shifting dynamics on the short-end have led to municipals selling-off. As a result, we have seen the municipal yield curve flatten, resulting in declining slopes and less incentive to extend duration.

Insights and Strategy

Slopes along the municipal yield curve are currently steepest around the 17-year tenor, with almost 75 bps in slope from 13 to 19-years. This is a significant change from earlier last month, when the steepest slopes were around the 10-year tenor. This shift has increased the reward to investors for extending from the 10-year range to the 15-20-year range. Although the municipal yield curve rewards duration, the long-end continues to be very flat with steadily declining slopes from 20 to 30-years and only a basis point or so per year past 25-years. However, as a result of this flat tail, municipal bond investors can buy maturities under 20-years that yield over 90% of the 30-year curve.

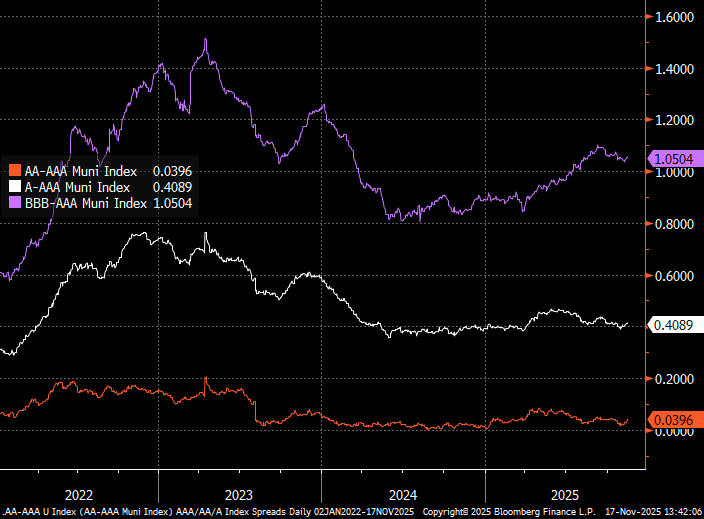

Municipal credit spreads, which are the difference in yield between the ‘AAA’ yields and riskier bonds of equivalent maturities, continue to reward risk in lower investment grade securities while ‘AA’ and ‘A’ bonds have been trading fairly tightly this year. In recent months we have seen lower investment grade credit spreads fluctuate as economic concerns have emerged prompting investors to demand more yield to compensate for the additional risk. While current credit spreads are appealing for ‘BBB’ rated bonds, caution is still warranted as these spreads can widen significantly during economic events.

The muni/Treasury ratio is a widely watched measure that provides a sense of how tax-exempt munis fare against taxable fixed-income options. Crossover investors, which seek to identify the best opportunities in the fixed income universe on an after-tax basis, closely follow this ratio. Over the past month, the biggest moves have been in maturities around the 10-year mark where ratios have become over 4% richer, with ratios now around 66%. From a historical perspective, the 10-year mean for the 10-year maturity is 82.59%, which shows how richly valued municipals have become in this art of the curve. For investors seeking to maximize curve positioning with relative value, extending to the 18-year part of the municipal yield curve provides almost 90% of the 30-year maturity and almost 80% of equivalent Treasury yields.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

Market Commentary: The Not So Grand Re-Opening

Our team of market analysts have a singular mission: to help you make better investment decisions. Read the latest market commentary.

Continue reading