by Gayl Mileszko

Speed is of the essence when it comes to delivering vaccines, election outcomes and aid to unemployed workers and locked down businesses. There are ways to measure baseball’s fastballs, touchdown sprints, and high-frequency trading executions. But some gauges can be a bit tricky. The speed of the Earth’s rotation, for example, varies constantly due to the motion of its molten core, oceans and atmosphere, as well as the impact of celestial bodies like our moon. Tides and the change in distance between the Earth and the moon all make for daily variations in the speed the planet rotates on its axis; even heavy mountaintop snow that melts in summertime can cause a shift. Given all the unprecedented events of 2020 around the world, it should come as no surprise that our Earth has literally been spinning unusually quickly of late. In fact, the shortest day on record was July 19, when the planet completed its rotation in 1.4602 milliseconds less than usual. Records were broken 28 times last year and the Earth in 2021 looks to be moving at an average daily pace that is 0.5 milliseconds faster than the standard 24 hours.

In recent decades, the Earth’s average rotational speed had been consistently decreasing. Scientists at the Paris-based International Earth Rotation Service who monitor the planet’s rotation inform countries six months in advance when “leap seconds” need to be added to align with solar time. And, since the 1970s, official timekeepers have made 27 adjustments to keep atomic clocks in sync with the slowing planet. Most recently this occurred on New Year’s Eve in 2016. Now, for the first time on record, a negative leap second may be needed. The World Radiocommunication Conference members will make the decision when they next meet in 2023.

A more common standard measure of time, the Gregorian calendar, has been in use since 1582 and has just flipped into 2021. But for some, the new year began on December 14 when the first health care workers and nursing home residents were administered the Pfizer-BioNTech COVID-19 vaccine. Four days later, the U.S. Food and Drug Administration authorized a second vaccine from Moderna for emergency use. The two mRNA vaccines have shown remarkable effectiveness of about 95% in preventing COVID-19 disease in adults when given in two doses at 21 days and 28 day intervals, respectively. At this writing, 4.56 million Americans have received injections. All of us on Main Street and Wall Street are closely monitoring the rollout of this historic mass vaccination program, fervently hoping that it puts an end to the illness and loss suffered here and around the world.

Although there is federal guidance and $8 billion of federal funds, states are responsible for running the COVID-19 vaccination campaigns and prioritizing residents. There have been issues with public information as well as with storage, handling and administration of the doses. There is also an issue of public confidence. Not everyone is anxious to get the vaccine. Many have adopted a wait-and-see approach. The sheer number of healthcare workers and long term care residents at the head of the line means that there will be many months before others become eligible. Some have objections on religious grounds. More than 20.8 million Americans have already had the coronavirus; those who have recovered may believe that they have some level of immunity. Some cite concern over the speed with which the vaccines were developed and are worried about potential side effects. Those who look in the rearview mirror can find mis-steps on the part of the federal, state and local officials and may distrust the ability of elected and unelected government workers to handle anything having to do with the pandemic. Some find the matter political, others are skeptical of the big pharmaceutical companies who are benefiting financially from the rush to market. For those with cognitive issues, consent procedures can prove vexing.

As the majority await evidence of the effectiveness and safety of the vaccines, entrepreneurs are hard at work on other approaches. Some nursing homes, hospitals, restaurants and cruise ships are installing air purifying systems using needlepoint bipolar ionization technology to disrupt surface proteins of viruses and bacteria, and de-activate harmful pathogens. Hotels, schools and offices are installing ultraviolet light emitting diodes in heating and cooling systems to disinfect surfaces, ventilation and water systems. These technologies, or others yet to come, may also help to generate public confidence and resurrect businesses and institutions severely damaged by the pandemic and related lockdown policies.

Long-term care facilities have experienced significant drops in occupancy as a result of the deadly toll that the coronavirus has taken on the frail elderly population. Some 40% of all reported COVID-19 deaths are said to have occurred in nursing homes. Rebuilding public confidence in the safety of these care communities is critical to the industry and will, in many cases, require considerable time and plenty of documentation and testimonials. Providers are exploring the expanded use of infection preventionists, recommending changes to Medicaid reimbursement rates to boost the salaries of their health and personal care workers, and working to develop improved regulatory reporting procedures.

While nursing homes, assisted living, and memory care facilities may take longer to return to pre-coronavirus levels, other battered sectors of the economy are primed to reverse if not soar once herd immunity appears imminent, federal and state efforts meet with widespread support, and vaccines and technologies are proven successful. When does that happen? There is a colloquial expression attributed to Supreme Court Justice Potter Stewart: “I know it when I see it” that described his threshold test for obscenity. This is the type of test we will apply to determine in our own non- epidemiological ways when the end to this hideous pandemic is near. It will involve a combination of federal and state pronouncements, toned down and redirected media coverage, personal anecdotal experience, and the emergence of green shoots in our respective neighborhoods.

Industries most impacted by the pandemic stand to gain the most in a world about to be restored to something akin to the 2019 version of “normal”. In the interim, and for the foreseeable future, rallies are unlikely to abate in markets for industries proven essential to day-to-day, stay-at-home life in the past year: grocery stores, pharmacies, home improvement, on-line retail sites with rapid home delivery service contracts, information technology, household durables, fast food restaurants, agriculture, farm equipment, personal and health care supplies, key ports serving cargo ships, vacation rentals, recreational vehicles, golf-related products, testing services, cybersecurity, defense and other key domestic manufacturing, utilities, water and sewer, solid waste, affordable housing, technical schools, alcohol and tobacco.

Investors with cash and foresight will look to position portfolios for a post-COVID-19 economy. We will look to capitalize on the slow but sure rebound in oil and gas exploration and storage, steel, energy equipment and services, larger hospital systems, health care technology, banks, life and health insurance, property and casualty insurance, and toll roads with steady commercial traffic. In addition, steady reversals over time should occur in homebuilding, automobiles, aerospace, public colleges and universities. Among the sectors likely to take the longest to improve as there have been major and perhaps irreversible shifts in remote work and recreational choices. Our lives have changed in major ways since March and therefore partial rebounds will likely lag for airlines, hotels and resorts, rental cars, textiles and apparel, beauty products, mass transit, parking, casinos, gyms, cinemas and theaters, convention and sports venues, finer dining restaurants, jails, small private colleges, student housing, and commercial real estate.

Scrutinizing the relative differences in fundamentals including governance, geography, balance sheets, and COVID-19 case and death statistics, will take time but will pay off for well-advised investors. Regular and transparent reporting by for-profit and non-profit entities is required. Few of the old precedents apply; last year brought dozens and dozens of new pre-packaged bankruptcy cases with unexpected outcomes for senior bondholders having less than majority votes. Changing consumer preferences and potential new regulations are bound to adversely impact holdings, including certain media. Population shifts are underway. Some entities have significantly diluted equity and incurred strangling debt loads. Governments at every level will need to re-prioritize budgets given the costs of debt service and urgent social and infrastructure needs. Underfunded pensions and other post-employment benefits may threaten future general obligation bond debt service as well as interest and principal on state and local revenue bonds with weak security protections.

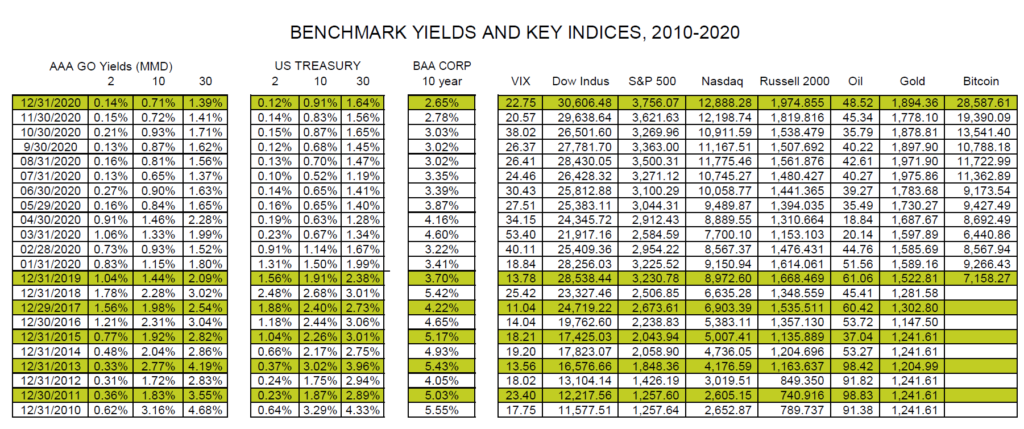

For bondholders, 2020 was a year in which fixed income was largely redefined as lacking income. Top-rated 30-year yields dipped well below 1.40% for tax-exempts and 3% for corporates. Even below investment grade and non-rated municipal and corporate securities sold at premium prices producing yields well below 5%. The chart below depicts 12 months of declining yields and illustrates the decade long decline in benchmark bond yields. It also reflects the significant volatility and gains in the stock and commodity markets, and the growing acceptance and risky participation in digital cryptocurrency markets.

Source: Bloomberg; Thomson Reuters Refinitiv

At the start of the new trading year, starting valuation levels for stocks and bonds are extremely high. Traders have been expecting prices to normalize for years and years; seasoned ones understand that this is bound to happen at some point. But our Federal Reserve has intervened in the markets for the past 12 years now and it is unclear when we should expect them to back away from hyper-accommodative policies. Central banks were the quickest to respond to the pandemic by creating and supporting liquidity facilities for every domestic market and some foreign ones as well. Their balance sheets have exploded. Few can argue with the value and timing of their tinkering. How and when they unwind, and with what impacts, are questions not faced before in our history. How our fiscal leaders respond after the past rounds of stimulus at a time when the debt and deficit are at levels not before seen is another question that investors, domestic and foreign, pose.

Gauges of sentiment from organizations including the American Association of Individual Investors, show bearishness at multiyear lows despite the global surges in COVID-19 cases, questions over the origins of the virus, and uncertainty over U.S. elections and various national policies. The major near-term risks to the financial markets include larger-than-anticipated increases in inflation rates, increases or decreases in zero-range and negative interest rates, downgrades in sovereign credits, a lower dollar, increased regulatory action, and any unexpectedly large defaults in the corporate, mortgage, and muni space.

2020 will go down in multiple record books. We saw the first president to be impeached and then run for reelection. Both the presidential candidates won more popular votes than any other in our history. We suffered the largest GDP quarterly decline followed by the largest quarterly increase, and witnessed a record-breaking single year increase in the national debt and market swings we could barely stomach. A quarter of U.S. adults say they or someone in their household has been laid off or lost a job because of the coronavirus outbreak, and 32% say they or someone else in their household has taken a pay cut due to reduced hours or demand for their work.

The $3.97 trillion muni market saw $474.05 billion of issuance in 12,940 deals in 2020 compared to $426.35 billion in 11,596 transactions in 2019 and setting a new record. Add to that private placements, corporate CUSIPs, and direct bank lines of credit which took so much tax-exempt paper out of the market and failed to satisfy a relentless demand. Corporate CUSIPs grew 223% over 2019 and landed at $40 billion for the year. The general muni market returned 5.26%, a seventh straight year of gains. High yield munis ended higher by 4.8%. Taxable munis with $140 billion of primary market sales closed up 11.82%. Zero coupon bonds were up 8.88%. Investors added about $33 billion to municipal bond mutual funds and the oldest gauge of municipal yields, the Bond Buyer 20 General Obligation Bond Index, which tracks yields on 20-year munis, touched 2% on Aug. 6, the lowest since 1952.

A record $1.75 trillion of investment grade corporate bonds was sold in 2020. High yield corporate issuance ended the year with approximately $432 billion of record issuance. The U.S. High Yield ICE BoAML Index ended the year up 6.17% and at all-time low yields of 4.18%. The U.S. Investment Grade corporate bond Index ended 2020 with returns of + 9.81%, a record; $1.75 trillion of new debt was sold in 2020.

A new year has begun and it is time to tinker with your portfolio. We at HJ Sims hope that 2021 brings only happy, healthy and prosperous days for you and your family. To that end, we encourage you to be in regular contact with your HJ Sims financial professional, to carefully add individual high yield credits we recommend to select income portfolios, to limit exposure to certain bond funds and ETFs, to consider preferreds, convertibles, zeroes and and taxable munis for retirement accounts, to prepare to take best advantage of the re-opening of our economy, to build up your emergency funds, to ensure that all your affairs are in order, to revise your monthly budgets, and to appreciate all the people, moments and little things that we took for granted at this time just one year ago.