by Gayl Mileszko

Things are different than they were at the start of the new year. Several banks have failed, with SVB and Signature now listed among the top four U.S. largest bank failures of all time when measured by total assets. The Federal Reserve launched yet another new rescue program and Pew Research reported that 56% of Americans say banks and other financial institutions have a negative effect on the way things are going in the country these days. Federal Reserve data show that bank deposits declined by $350 billion in the four weeks ended April 5. Refinitiv Lipper reports that a net of $83.4 billion was also withdrawn from mutual funds and ETFs during this period. Where did all this money go? Well, the Investment Company Institute reports that investors have shifted $233 billion into money market funds.

So Far in 2023 Lots of Things Have Changed but the Rally Continues

Stocks and bonds have both nevertheless rallied, apparently no longer seriously concerned about the risk of contagion in bank runs or pandemic disease. Returns are back in the black after an annus horribilis in 2022. Tax Freedom Day arrived – the point at which you have spent 108 days working to pay federal, state and local taxes and can finally start taking home your income. The U.S. House returned to Republican control and policy differences over everything from the debt limit to immigration became more acrimonious. Fear of recession has been reflected in the U.S. Treasury curve, which has been inverted since last July.

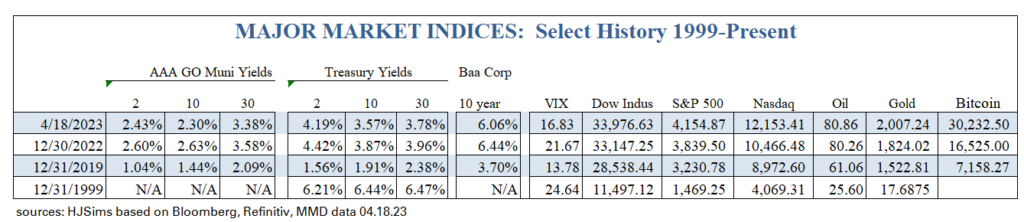

- The 3-month Treasury bill is now the highest yielding government security at 5.18%.

- The 2-year yield at 4.19% has fallen 23 basis points so far this year. The 10-year yield at 3.57% is down 30 basis points. The 30-year at 3.78% has fallen 18 basis points.

- The difference between the 3-month and 10-year yields has widened from 47 basis points at the start of 2023 to 157 basis points; every recession in the past 60 years has been preceded by upside down moves in these two specific maturities.

- For what appears to be the longest time on record, the municipal yield curve has been partially inverted since December. The 1-year AAA municipal benchmark yield at 2.62% remains higher than the 12-year yield at 2.50%; it is still below the 30-year benchmark which yields 3.38%, down 20 basis points since the start of the year

- As of April 14, the Nasdaq is up 16.13% so far this year, gold is 10% higher, the S&P is up 8.29%, taxable municipal bonds have returned 5.38%, preferreds are +4.73%, high yield corporate bonds are +4.49%, non-rated munis are +3.77%, investment grade corporate bonds are up 3.64%, Treasuries are +2.99%, and the Dow is +2.84%

Things Have Changed Since the Start of the Decade

Just about everything has changed since the start of the pandemic. Instead of the “Roaring Twenties” it feels more like the “Warring Twenties” with intense battles against an infectious disease spread worldwide, deadly fighting in Ukraine, constant sparring between political parties, ugly exchanges with Iran, North Korea, China and even some of our own U.S. allies. The word “unprecedented” has never been used so often. Neither have the words “nuclear,” “trillions,” “mandate,” “supply chain” or “default.”

Nothing is the Same Since the Start of the Millennium

The 9/11 terrorist attacks were the deadliest experienced on American soil. We waged long wars in Afghanistan and Iraq. Major corporate bankruptcies, including Enron, Lehman, and General Motors, shook the markets. The world economy was upended during the Great Recession to follow. The credit of the United States was downgraded during a debt limit standoff. Demographics have changed, technology has rapidly and radically transformed our lives, populations are shifting, there is much civil unrest, and faith in longstanding institutions has faded.

Is This Time Really Different?

Looking at all the changes that have occurred in the past two decades, at various points investors have thought: This time is REALLY different. We have to toss aside our long-term strategy because the world has permanently changed and old ways of thinking no longer apply. They say: This is the time to cash out. Or: I am afraid to miss out on what looks like a sure thing. Or: let me just mirror what the big guys are doing. Or: let’s gamble everything we have on this one oddball thing that has been skyrocketing in price. Or: we had better hold onto this non-performing asset and pray it will turn around so we don’t have to take any losses.

To quote Sir John Templeton, the Yale-educated Tennessean and contrarian investor who founded the Templeton Growth Fund in 1954 and pioneered the use of globally diversified mutual funds: “The four most dangerous words in investing are: this time it’s different.”

Professional Guidance

There is a benefit to having seasoned advisors like your HJ Sims representatives to help guide you through times that are volatile, uncertain, seemingly directionless or bordering on panic. A sound investment strategy, a strategic business plan, a periodic review and recalibration to incorporate emerging needs and revised goals. For the most part, last year’s tax season is over so it makes sense for households to start planning for the 2023 filing. Gives us a call. For borrowers who see rates just about at this cycle’s peak, this is a good time to start planning for market re-entry. Contract your HJ Sims banker to discuss options and place current rates in context.

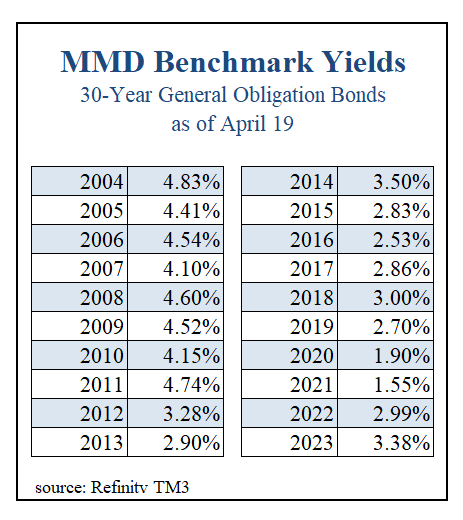

Compare and contrast the MMD municipal benchmark yields over time:

Activity in the Primary and Secondary Municipal Markets

Although the pipeline has been building since last December, there have been only five non-profit senior living tax-exempt public offerings or private placements so far this year in the primary municipal market. Four were non-rated with final maturities between 2026 and 2055 and maximum yields between 7.22% and 10%; one was state mortgage insured due in 2052 yielding 3.83%. This is well below the total of 28 financings that came to market by this time last year with combined par of $1.19 billion. We note that trading in the secondary market in this sector has been picking up, particularly in investment grade rated names. At our last count, there were 47 continuing care retirement communities with ratings from Standard & Poor’s or Fitch in the range of “A”. Your HJ Sims representative can help you find value, yield, and discounts even in higher credits in this and other muni sectors.

Recent High Yield Municipal Trades and Offerings of Interest this Week

For those who seek out the highest tax-exempt yields, the muni market has seen very little new non-rated and below investment grade issuance of late. Last week, the Florida Development Finance Corporation sold $23.5 million of non-rated revenue bonds for Parrish Charter Academy structured with a mandatory put in 2028 and priced with a coupon of 6.25% to yield 6.40%. This week, which features one of the largest calendars of the year at $12 billion, we may see a $19 million Ba2 rated Basis Texas Charter School bond issue coming through the Arlington Higher Education Finance Corporation and $11.4 million of BBB-minus rated sustainability bonds for the Camino Nuevo Charter Academy via the California School Finance Authority. There are also two interesting forward settlement transactions scheduled including a $348 million 12-month forward for A2/A-/A rated school facilities construction bonds issued by the New Jersey Economic Development Authority and a 3-month Aa3 rated forward by the Ohio Higher Education Facility Commission for Oberlin College.

For more information on offerings or questions about current market conditions, please contact your HJ Sims representative.