by Siamac Afshar & Jim Bodine, with update provided by Andrew Nesi

The London Inter-Bank Offered Rate (LIBOR) is a benchmark rate at which major global banks make short term loans to each other.

Update: LIBOR Ends as of December 31, 2021

Effective December 31, 2021 LIBOR can no longer be used as a benchmark for new bank loans and derivatives (i.e. interest rate swaps). HJ Sims has been closely following and reporting developments on the planned termination of the index since 2017 including a discussion last spring of its likely replacement as noted in the below piece by Siamac Afshare and Jim Bodine. HJ Sims bankers are available to discuss any questions or concerns you may have regarding the transition to alternative indices and assist your organization in negotiations with your commercial banking partner.

Articles on this and many other topics may be found on the HJ Sims Perspective – HJ Sims section of our website.

Pending LIBOR Replacement – Considerations for Senior Living Organizations as of May 19, 2021

Does my community qualify?

Reflecting the ubiquity of LIBOR in the credit markets, the Alternative Reference Rates Committee (ARRC) found in 2016 over $199 trillion in market exposure to LIBOR with most of this exposure tied to derivative instruments such as interest rate swaps combined with about $10 trillion in cash exposure. LIBOR has also been the primary index upon which Senior Living Bank Loans and Swaps have been denominated. As more fully described below, LIBOR is to be discontinued and as such a replacement index is needed. On March 5, 2021, the ICE Benchmark Administration (IBA) announced the termination dates of the use of LIBOR in new and existing financings.

Newly Issued Financing: December 31, 2021

Legacy (Existing) Financing: June 30, 2023

With the announcement of the dates above, existing financings currently denominated in LIBOR will need to be remediated to another index prior to June 30, 2023. It is expected that approximately $74 trillion in LIBOR exposure will be outstanding at that time. Unlike existing financings, new LIBOR financings will not be permitted after December 31, 2021, Therefore for new financings, undertaken before December 31, 2021, borrowers should consider the use of an alternate index; while for new financings closing after December 31, 2021, borrowers will be required to utilize an alternate index.

Background

In the United States, the LIBOR is a rate set by 16 banks. On May 29, 2008, a Wall Street Journal study showed banks may have understated borrowing costs they reported for LIBOR during the 2008 credit crisis, creating the impression that banks could borrow from each other more cheaply than in reality. International investigations began in February 2012 and revealed a widespread plot by the 16 major banks, to collude to manipulate these interest rates for profit starting as far back as 2003. In addition multi-state investigations into deceptive trade practices were led by 45 state Attorneys General. Ultimately LIBOR began being described as “the rate at which banks don’t lend to each other.”

As a result, on July 17, 2017, the Financial Conduct Authority, the United Kingdom’s regulator and overseer of LIBOR, stated that all current, including US Dollar denominated, LIBOR rates, may be phased out after the end of 2021, since amended to reflect the distinction between new and existing financing and the dates referenced above. In recognition of this, the ARRC and the International Swaps and Derivatives Association (ISDA) began work to identify an alternative reference rate to take the place of LIBOR. Among the organizations involved with ARRC were the SEC, the U.S. Treasury, the Federal Housing Financing Agency, FDIC, FASB, GASB and the National Association of Bond Lawyers (NABL). In 2018, ARRC recommended the Secured Overnight Financing Rate (SOFR) as the proposed replacement rate and began publishing SOFR on a daily basis, as described in greater detail below. Since that time, ARRC has focused on encouraging the development of a SOFR-based cash and derivatives market, addressing a range of issues including those resulting from contractual fallback language used in legacy LIBOR products and establishing an infrastructure to facilitate the move from LIBOR to SOFR.

LIBOR in Senior Living

LIBOR has played an important role in financing for Senior Living Providers, having grown in conjunction with increased use of direct (tax-exempt) bank financing as an alternative to or complement to traditional tax-exempt fixed-rate bonds. Among the areas associated with LIBOR and impacted by the LIBOR-SOFR transition are:

- Variable Rate Bank Financing (Unhedged)

- Most draw-down bank financings carry an underlying variable rate, based upon a percentage of 1-Month LIBOR plus a Credit Spread.

- Synthetically Fixed/Variable Rate Financings (Hedged)

- Variable Rate Bank Loans, and, to the extent they remain outstanding, Variable Rate Demand Bonds are often Synthetically Fixed utilizing LIBOR-Based Interest Rate Swaps.

- Asset Side

- As with the Liability side of the balance sheet, some asset-side investments are also pegged to the LIBOR index.

LIBOR Alternatives

In the U.S., several indices were considered as LIBOR replacements, before the ARRCs coalescing around the Secured Overnight Financing Rate. These indices include:

- Ameribor

- Benchmark interest rate created by the American Financial Exchange

- Reflects the actual borrowing costs of thousands of small, medium and regional banks in the US

- Traded more than $550 billion since inception in 2015

- The U.S. Dollar ICE Bank Yield Index

- An index proposed by Intercontinental Exchange Benchmark Administration (IBA) in January 2019 to measure the yields at which investors are willing to lend U.S. dollar funds to large, internationally active banks on a wholesale, unsecured basis over one-month, three-month and six-month periods. Its usage is intended to be similar to how Libor is currently used.

- SIFMA Index

- 7-day high-grade municipal market index comprised of tax-exempt Variable Rate Demand Obligations (VRDOs)

- Fed Funds Index

- Target interest rate set by the FOMC at which commercial banks borrow and lend their excess reserves to each other overnight

- Bloomberg Short Term Bank Yield Index (BSBY)

- BSBY is a Bloomberg proprietary index seeking to measure the average yield at which investors are willing to invest in US Dollar denominated funds on an unsecured basis.

- Based on commercial paper and Certificate of Deposit transactional data

- Note that this index is currently being promoted by Bank of America and JP Morgan as an alternative to LIBOR and SOFR.

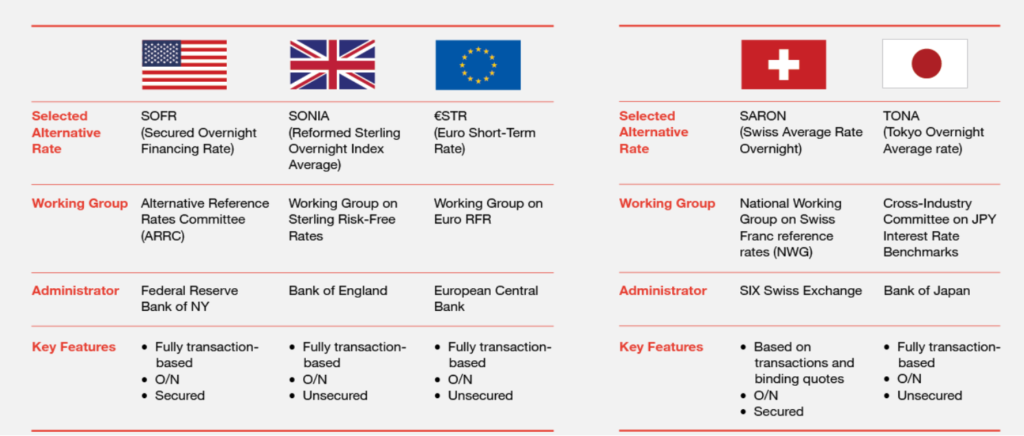

Below is a table depicting the replacement reference rate that is mostly likely to be adopted in various international markets:

Secured Overnight Financing Rate (SOFR)

In April 2018, the Federal Reserve Bank of New York began publishing SOFR, which is described as “a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities.” SOFR provides good representation of general funding conditions in the overnight Treasury repurchase (“repo”) market, reflective of the economic cost of lending and borrowing by broker-dealers, money market funds, asset managers, insurance companies, securities lenders, and pension funds. Among the differences between LIBOR and SOFR, and perhaps the most critical, are that: i) SOFR, unlike LIBOR, is a secured index reflecting financing supported by U.S. Treasury securities rather than unsecured financing, and ii) SOFR is an overnight interest rate, akin to the Fed Funds Rate in that respect, whereas LIBOR is generally quoted at 1-month or 3-month terms. It is anticipated that a term structure of interest rates (for terms/maturities longer than overnight) will be developed in the credit markets. However, for now, the lack of a term structure/yield curve for SOFR is among the reasons Bank of America and JP Morgan are promoting BSBY as an alternative to SOFR.

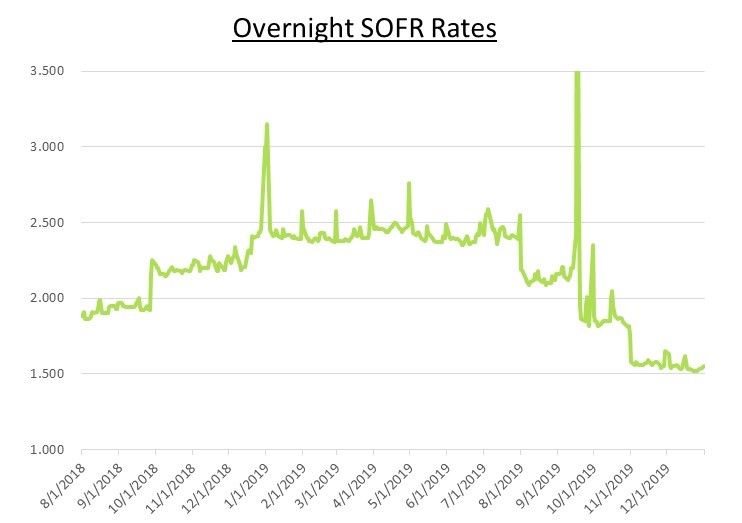

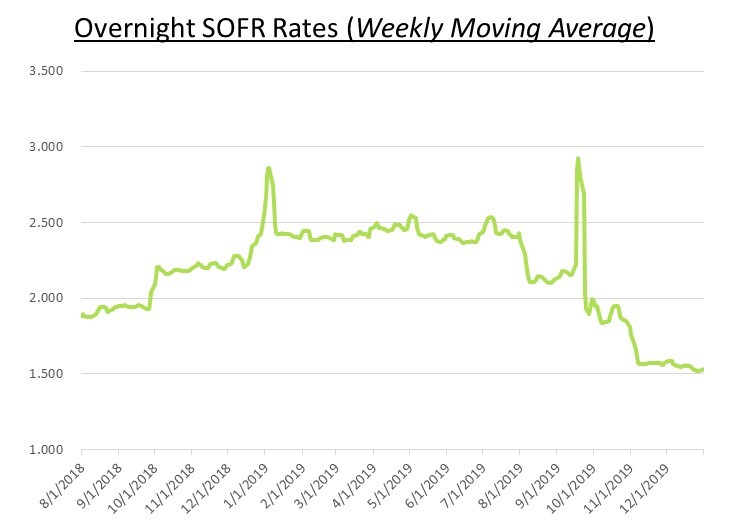

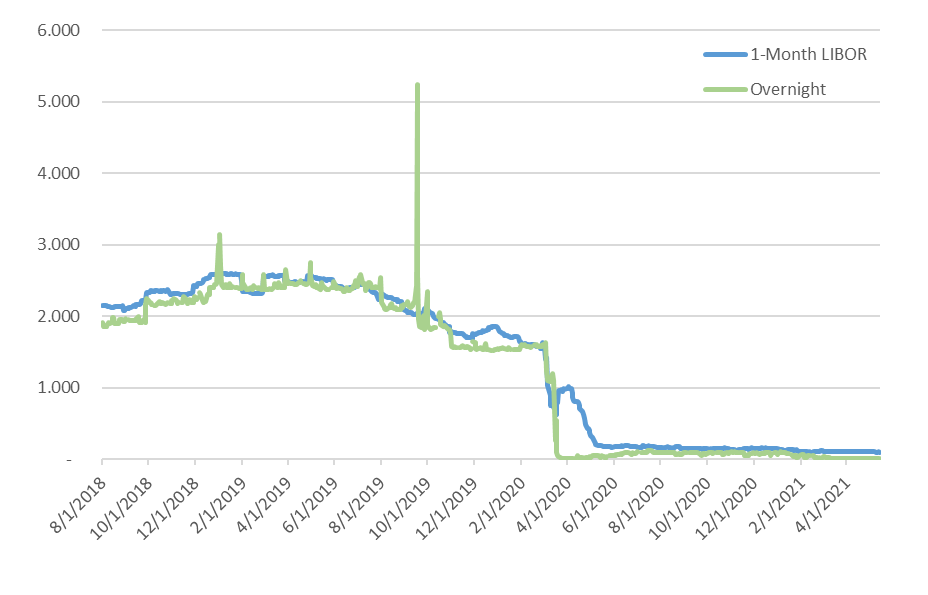

From April 2018 through 2019, SOFR, as a still developing index, saw considerable volatility at week’s and month’s end. As such, it is critical when analyzing SOFR during this time period, to utilize a moving average to more accurately depict SOFR “on average”. Illustrating this, the charts below display absolute SOFR on the left, while the chart on the right, depicts a weekly moving average of SOFR. While this method does not fully resolve the month-end spikes, it presents a more realistic picture of historic SOFR.

Data obtained from Bloomberg

Data obtained from Bloomberg

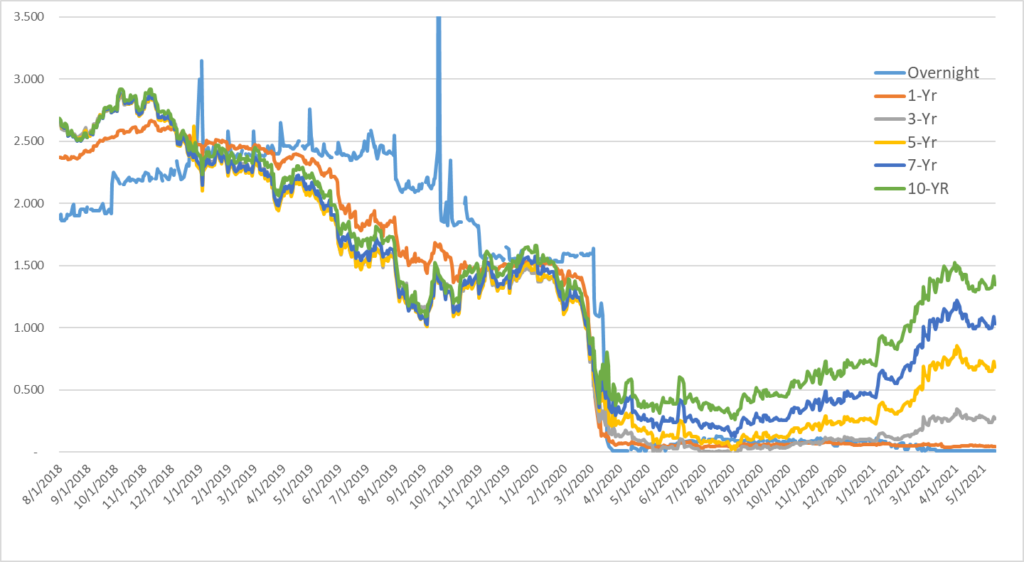

The chart below depicts various points on the SOFR Yield Curve since the index’s inception. As can be seen, the volatility, referenced above, largely resolved during 2020 and has since stabilized with the Overnight SOFR rate of 0.01% (one basis point) as of May 12, 2021. For context, Overnight SOFR has been at or below 0.10% (ten basis points) since July 2020.

Data obtained from Bloomberg

Further evidence of the relationship of SOFR as a proxy to LIBOR, albeit it usually pricing below LIBOR, due to the distinction in maturity (Overnight and 30 days) and credit (U.S. Treasury-secured vs. unsecured). As described above, SOFR has been trading at 0.01% for some time and during this period, 1-month LIBOR has been at approximately 0.11%. As a result of this spread, which has endured over the course of the last several months, banks that offer SOFR and LIBOR based loans are currently quoting credit spreads differing by approximately 10 basis points, reflecting these distinctions between LIBOR and SOFR. The banks are making this adjustment to equalize the return on their loans.

Data obtained from Bloomberg

Traction in the Market

While adoption in the municipal markets generally, and the senior living market specifically has been slow, SOFR has been gaining traction in the broader interest rate markets and there are signs of greater adoption in the municipal and senior living financing markets. ARRC reports that by the end of its first year of trading (2018), SOFR accounted for over $100 billion in daily transactions in the derivative market and $200 billion by the end of 2020. As of March 2021, there was $6 trillion in open interest in SOFR-based futures and swaps.

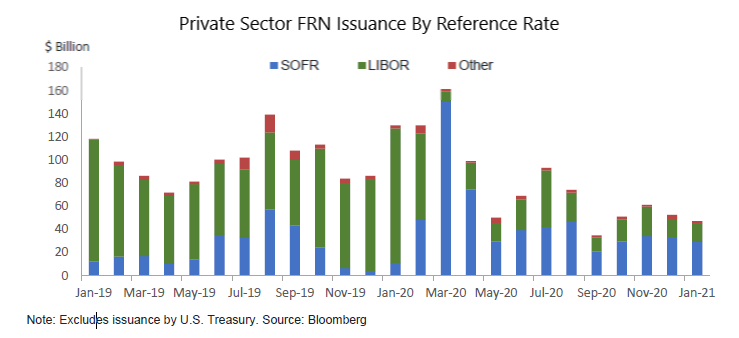

Issuance of primary market SOFR indexed financing has increased rapidly, with $36 billion in 2018, $265 billion in 2019. While LIBOR still accounted for $810 billion of new issuance in 2019, over 2020 and Year-to-Date 2021, SOFR issuance has outpaced LIBOR issuance. The increase in SOFR adoption to-date has been largely driven by U.S. Agency (Fannie Mae and Freddie Mac) directives to move from LIBOR to SOFR. For example, with regards to Fannie Mae/Freddie Mac-related derivatives, CME and LCH clearing houses moved to SOFR in the fourth quarter of 2020 and will only purchase SOFR-indexed loans going forward. Further, the Federal Home Loan Bank (FHLB) has announced they’ll no longer enter into LIBOR transactions after December 31, 2021 and the U.S. Treasury is considering issuance of a SOFR-linked floating rate Treasury instrument.

The graph on the next page reflects the growing adoption of SOFR in the Floating Rate Note market. The graph illustrates a shift from almost entirely LIBOR-based lending in January 2019, to majority SOFR-based lending in March 2020 through the present.

While adoption in the public municipal market has been slower to manifest, there have been several notable primary market issuances, these include the following Floating Rate Note transactions.

- The September 2018 New York Metropolitan Transit Authority (MTA) remarketing of its $107.3 million of Series 2001B Triborough Bridge and Tunnel Authority general revenue variable rate bonds to a SOFR-based rate, becoming the first municipal issuer to utilize SOFR.

- The Connecticut Housing Finance Authority’s $100 million Housing Mortgage Finance Program Bonds, 2019 Series C, representing the first municipal housing entity to utilize SOFR.

- The Greenville, Texas Electric Utility System issued its $20 million Series 2021 Notes on April 1, 2021.

Visibility into SOFR-based lending volume from Commercial Banks in the municipal market is limited as the majority of Commercial Bank loans are private loans and are not publicly-traded instruments.

As previously mentioned, a potential impediment to market adoption of SOFR is the lack of term-based SOFR yield curves. Currently the SOFR yield curve is based on the Overnight SOFR rate. LIBOR, however, offers both overnight rates as well as term structures based on 1-month and 3-month LIBOR, among others. To address this concern, as of October 2020, ARRC began working to implement term structures for SOFR based transactions. At this time, it is unclear when these indices will begin publication.

Impact on the Senior Living Sector

Many senior living communities have financed construction/repositioning of their communities, along with refinancing of prior debt, through the use of LIBOR-indexed bank loans and, in some cases, bonds. Further, many of these variable rate loans, have been Synthetically-Fixed from floating-to-fixed interest rate, via a LIBOR-based Interest-Rate Swap. Many financings have customarily included language related to the possible use of an alternative interest rate index, even prior to the beginning of the planned LIBOR-SOFR transition. For financing based on LIBOR, this has included more detailed “LIBOR fall-back” language to account for the possibility that LIBOR might be unavailable in the future and during the life of the financing. Most of the fall-back language that had been utilized thus far has not specified a particular alternative/fall-back index; rather, the language either indicates that the bank shall determine an appropriate fall-back index, or that the fall-back shall be the industry-accepted replacement equivalent index. Older transactions, especially those entered into before 2018, are unlikely to bear detailed LIBOR fall-back language.

In both cases described above, it is important to be aware of potential hurdles. Specifically a change in index could trigger a potential “Re-Issuance” for tax purposes, further there are potential integration/tax consequences that may be triggered by a change in index. These will be subject to a “Facts and Circumstances” review by Tax Counsel. Impacts of triggering a re-issuance could include potential loss of tax-exemption, swap integration, or changes to the financing’s “Arbitrage Yield” potentially requiring a Yield Reduction Payment to the IRS. Further, to the extent integration is lost in connection with a related swap, any termination penalty associated with such swap may be ineligible to be financed on a tax-exempt basis, as would normally be permitted with integrated swaps. Proposed regulations and a recent IRS Revenue Procedure provide some guidance and safe harbors to address these potential pitfalls; however, they failed to address whether the later establishment/implementation of non-LIBOR-based fallback rate will be shielded from triggering a reissuance. As described further below, in addition to the impact of this transition on loans, it is also important to consider the additional follow-on impact/changes to existing LIBOR-indexed swaps related to the underlying loan

Implications for Existing (LIBOR-based) Debt and/or Interest Swaps

It is important for Senior Living Providers to consult with their Investment Banker, Financial Advisor and Bond Counsel to best navigate this evolving landscape. This should be done in conjunction with proactive outreach to the organization’s commercial banking partner to discuss both the bank’s plans for the transition as well as to negotiate, as necessary, any changes to loan pricing or other terms in order to maintain interest rate equivalency, given the differential in SOFR and LIBOR. Further, any changes will likely require documentation and a Bond Counsel opinion as well as approvals from the Borrower, Issuing Authority, Commercial Bank Lender and Swap Counterparty, as applicable.

Implications for New Debt and Swap Transactions

Through the first quarter of 2021, commercial banks have been slow to adopt SOFR for senior living financing. However, since then, with the December 31, 2021 deadline approaching, an increasing number of banks have begun offering new tax-exempt SOFR-based loans. With this first deadline upcoming and the second (July 1, 2023) deadline for transitioning of all outstanding LIBOR-based debt, it is timely for all parties involved in financing (Borrower, Bank Lender and Professional Advisors) to seriously evaluate SOFR-based financing which will include alleviating any transition related concerns in the future.

Summary of Key Points

- LIBOR is expected to cease publication by December 31, 2021 for new financings and for existing financings June 30, 2023 with no further delay expected.

- SOFR is gaining traction in credit markets overall: while adoption has been slower in the public finance/senior living realm. This disparity is being eliminated and is expected to accelerate in the 2nd half of 2021 with the deadline for new issuance looming.

- Use of SOFR-based products for new issuance between now and the December 31, 2021 deadline can obviate the need, and avoid the inherent transactional costs, to modify financings when LIBOR ceases publication in 2023.

- Now is also the time to evaluate existing debt and related interest rate hedges along with considering implications for upcoming new financing needs.

- Communicate with your Commercial Banking, Investment Banking and Legal Professionals for guidance.

- BSBY, Bloomberg’s proprietary index bears monitoring as it is being promoted as an alternative to LIBOR and SOFR by two of the largest money-center banks on Wall Street.

For more information or if you have any questions regarding the content of this whitepaper, please contact:

James Bodine

267.360.6245

[email protected]

Siamac Afshar

267.360.6250

[email protected]

Any HJ Sims banker

1.800.HJS.1935