To grow or not to grow is a familiar topic of conversation heard around boardroom tables, at conference sessions, and from business pundits.

HJ Sims recently surveyed LeadingAge LifePlan Community (LPC) members to uncover the motivation behind member organizations’ own growth initiatives and reveal the potential barriers impeding growth. While responses represent only a small subset of LPC members, Sims believes the results nonetheless convey an important and meaningful snapshot of what industry leaders are focused on when it comes to growth.

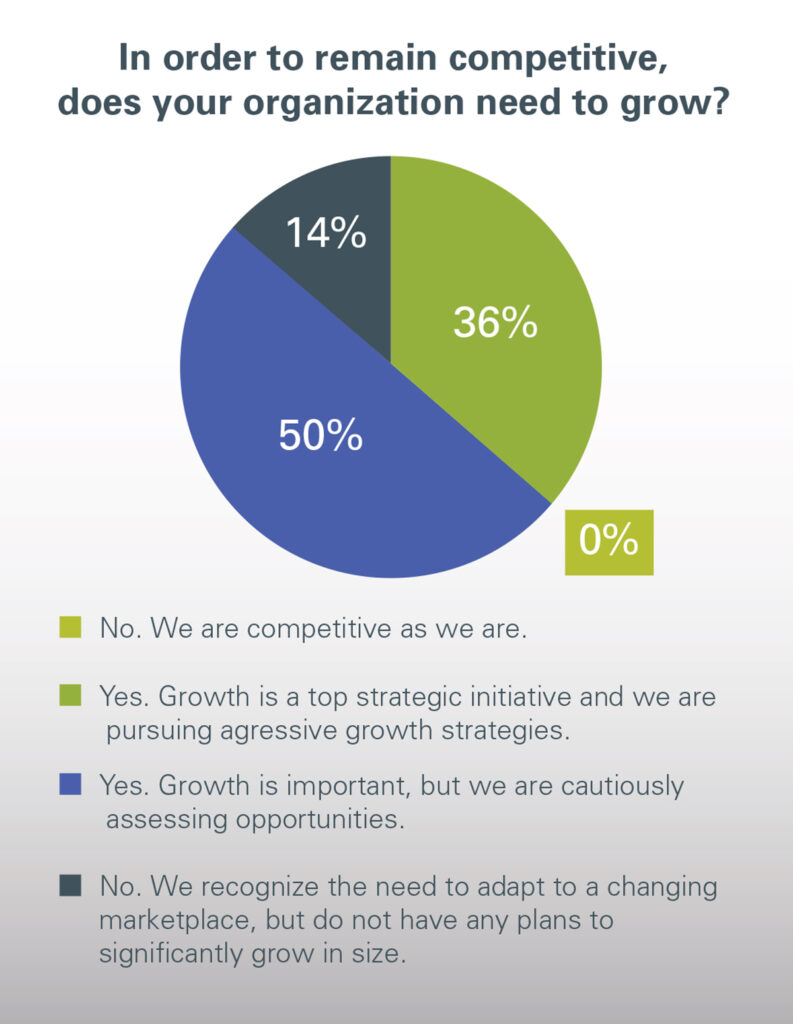

One of the most interesting facts gleaned from the survey was that, when asked if their organization needed to grow to remain competitive, not one of the respondents thought their organization was competitive as is, signaling an acceptance that remaining competitive is a constant endeavor. However not all respondents (14%) felt that growth was the key to such sustained competitiveness.

Growth Initiatives

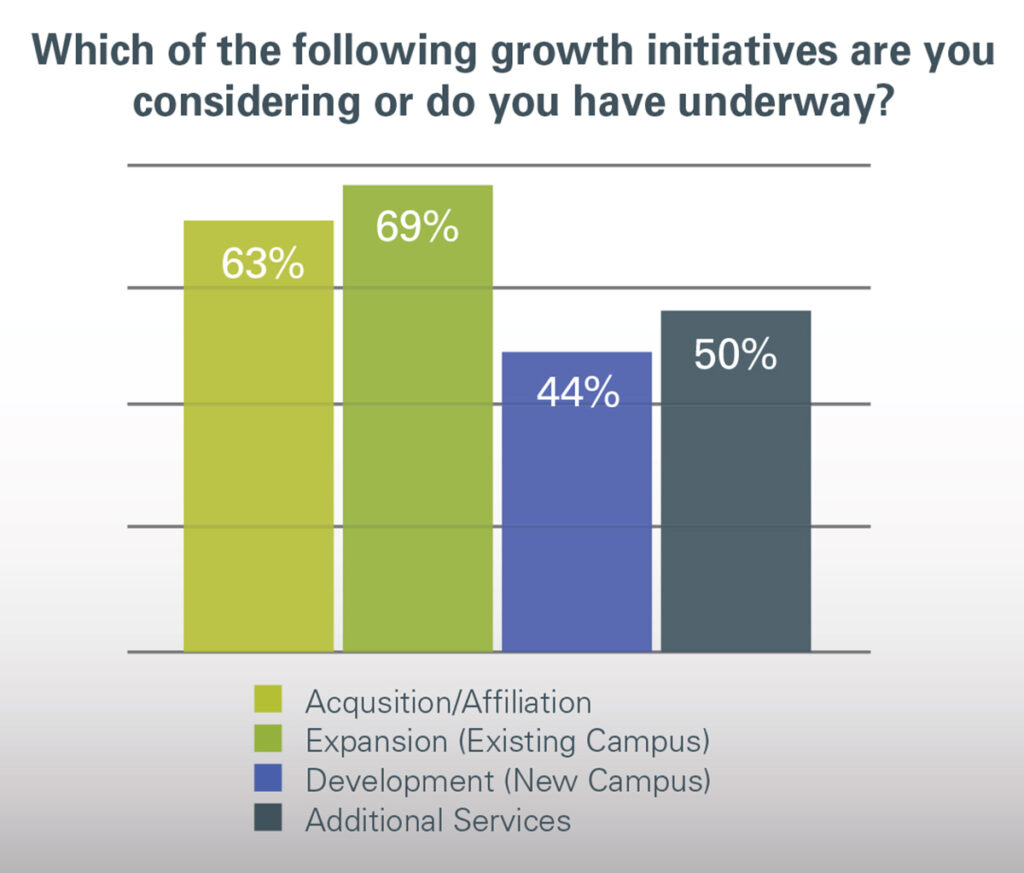

While 86% of respondents identify growth as a necessary component of competitiveness, only 74% of respondents indicated that their organization is currently underway with or considering a specific growth initiative. Of those respondents, most indicated they have more than one initiative planned or underway, with acquisitions and expansions leading the way as the most popular forms of growth.

Growth Barriers

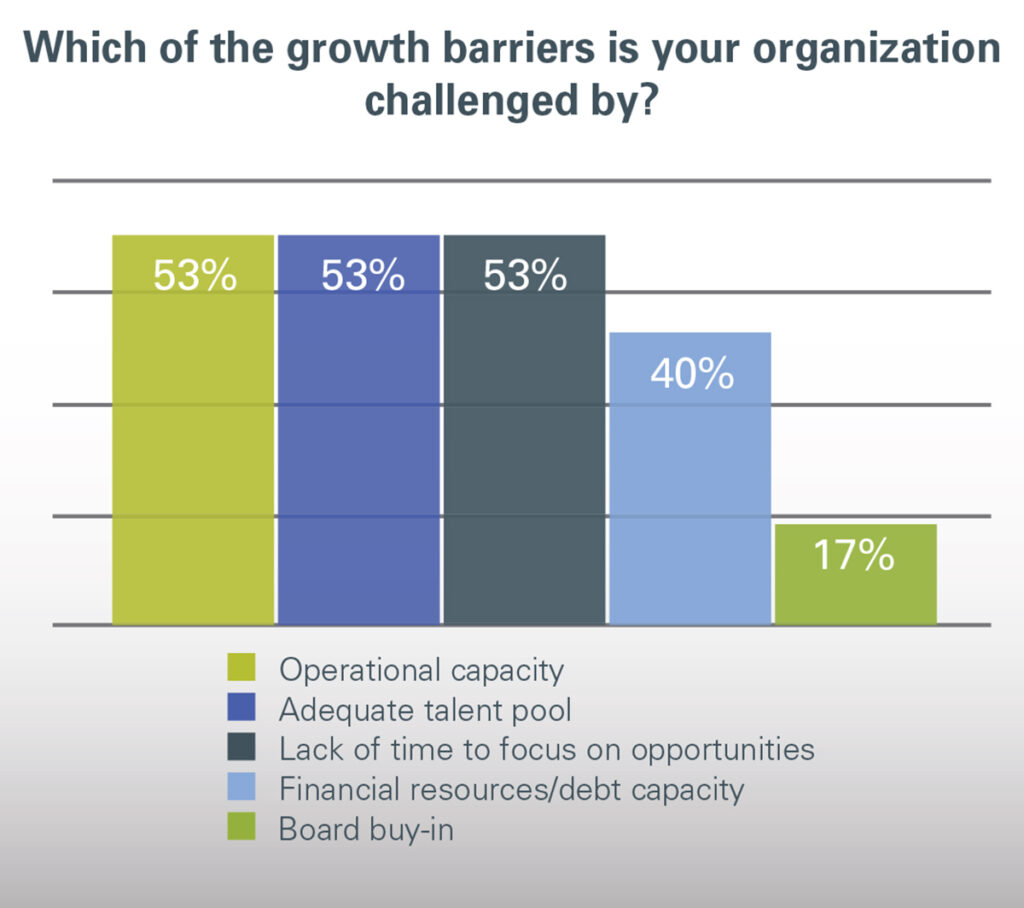

In addition to surveying respondents on the type of growth initiatives, Sims also collected feedback on key barriers to growth. Top barriers include: operational capacity, adequate talent pool, and lack of time to focus on opportunities as growth barriers. Lesser cited barriers for growth were financial resources / debt capacity and board buy-in. These responses signal that time and talent resources, in many cases, present a greater challenge than financial resources, which is understandable given the current favorable state of accessing capital markets. Other cited barriers included government bureaucracy and resident buy-in.

Criteria for Assessing Growth

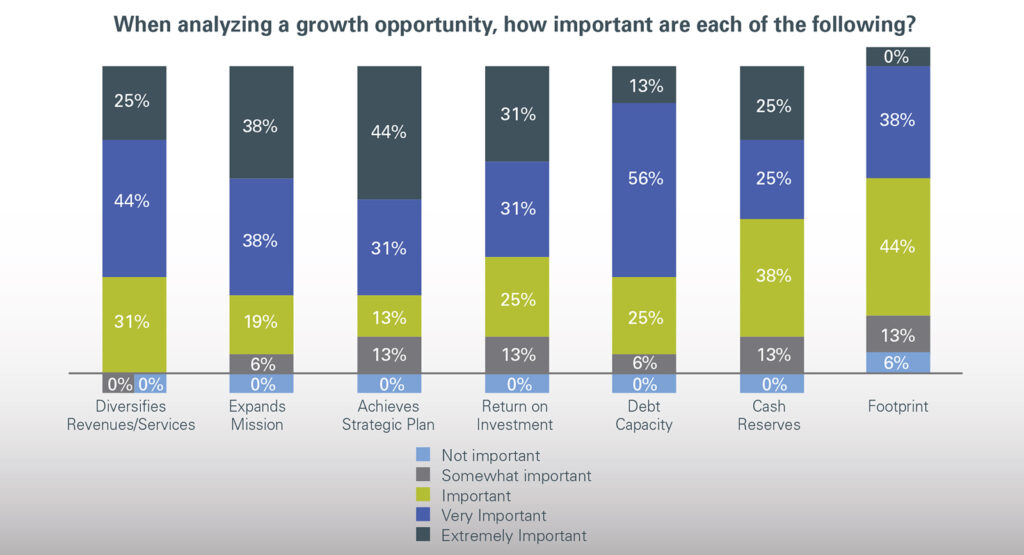

As far as examining criteria for assessing growth opportunities, all criteria presented in the survey were deemed to be important on some level by each respondent with the exception of footprint which, interestingly, some respondents felt is not important at all, and no respondent felt it was extremely important. Additionally, the criterionthat a growth opportunity achieve the strategic plan and/or expand mission were, on a weighted average, equally selected as the most important factors for assessment. Diversifying revenues and services was also widely accepted as an important assessment criteria.

Board Involvement

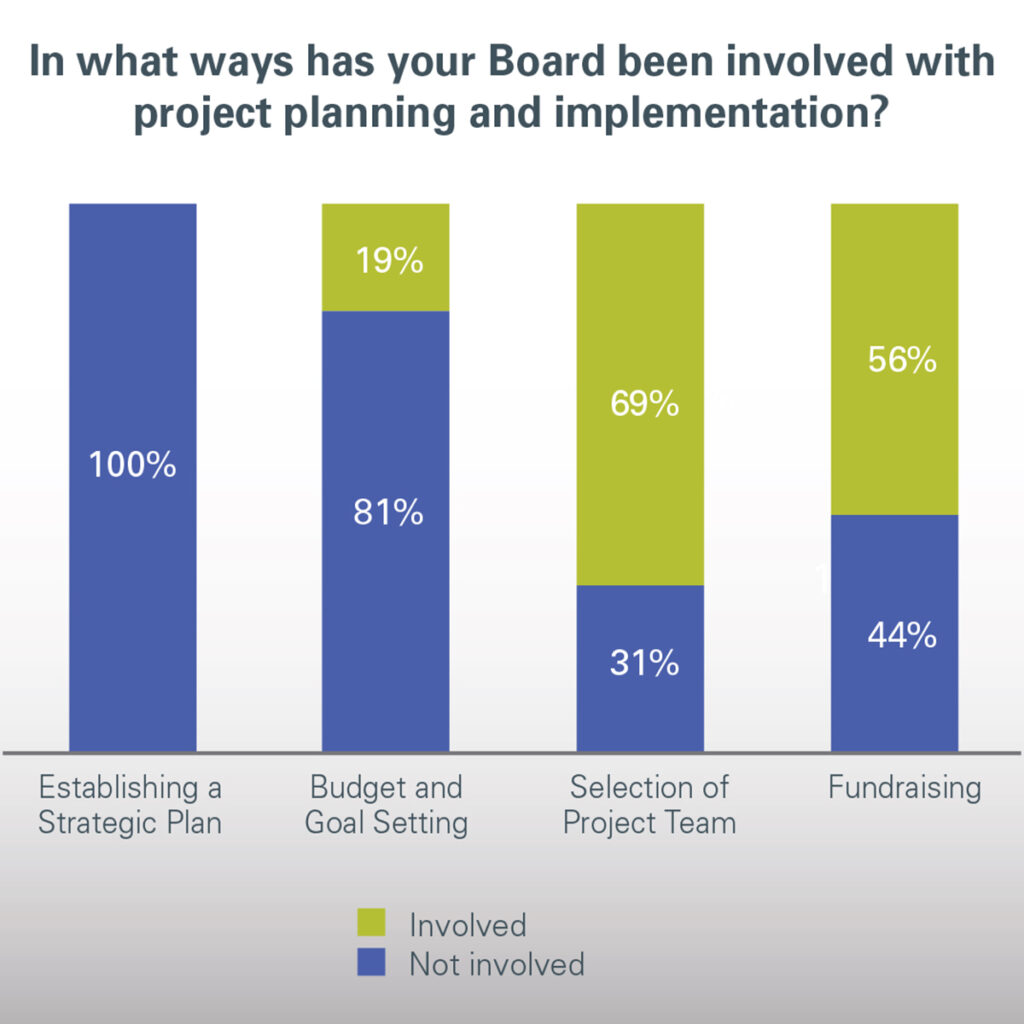

When it comes to level of board involvement, all respondents indicated that their Boards are involved in the strategic planning process, while over 80% of respondents indicated their Boards are also involved with budget and goal setting. However, less than half of the Boards from responding organizations are involved in fundraising, and less than a third get involved when selecting the project team.

Committed to Strategic Capital Plans

HJ Sims is committed to working with communities and their boards to tailor strategic capital plans, and recognizes the creative freedom that comes from knowing one size does not fit all. The results of this survey confirm there is no singular recipe or intention when it comes to achieving and assessing growth. Our goal in administering such industry surveys is to gain thorough understanding of important and relevant topics, which ultimately advances our capabilities to best serve our clients and the sector, and so we are truly grateful to those who participated in the survey.