Are you an owner/operator of an affordable senior housing community?

One who is seeking a financing solution for an acquisition or recapitalization?

If so, HJ Sims can help your community weigh the benefits of the Standard & Poor’s (S&P) Affordable Multifamily Housing program.

Here’s how it works in a nutshell:

If your senior housing community elects to offer a portion of its units to low-income residents, your organization may qualify for an S&P Rating, making a bond issuance an attractive financing option. In order to obtain the S&P Rating, there are certain guidelines you must follow – all described in this fact sheet.

Does my community qualify?

To qualify for the S&P Rating, your community must be considered an affordable, multifamily community. Your community:

- May offer independent living, assisted living, or memory care, but cannot offer skilled nursing care; and

- Must occupy either:

- a) 20% of its units with tenants whose household income does not exceed 50% of median gross income for the area; or

- b) 40% of its units with tenants whose household income does not exceed 60% of median gross income for the area.

Note: In both instances, median gross income is adjusted to account for family size. Assets of qualifying residents are not taken into consideration.

Is this financing option appropriate for my community?

This financing option may be ideal in the following circumstances:

- A for-profit owner/operator would like to sell its community(s) and capitalize their investment, but does not wish to lose management revenue;

- Note: Depending on local property tax law, acquisition by a 501(c)(3) may benefit the value of the community.

- An acquiring or recapitalizing organization displays proven management experience and financial strength, but desires higher leverage;

- An existing not-for-profit organization wishes to recapitalize its debt and reinvest in capital improvements, but does not qualify for other financing programs because of certain amenities it offers to its residents; or

- An existing not-for-profit organization wishes to simplify its capital structure and refinance its individual, community-level loans under one collective obligated group financing.

What type of organization can utilize this financing program?

While only a 501(c)(3) may issue the tax-exempt bonds discussed under this rating criteria, a forprofit organization may work with an existing 501(c)(3) that is committed to serving seniors to acquire the community(s). The for-profit organization may still act as the manager of the community and receive a management fee, while the not-for-profit sponsor may benefit from a formal agreement that allows for contributions to the sponsor.

Can an Entrance Fee Community Qualify?

Yes, an affordable senior housing community that charges an entrance fee may qualify; however, S&P will not consider entrance fees in their calculation of net operating income or cash flow. A community must have a revenueonly debt service coverage ratio that complies with the rating criteria to qualify.

S&P will also evaluate refund language in resident contracts to determine the potential negative impact on cash flow stemming from refund liabilities.

What is the rating process and criteria?

When considering a senior living community for a rating, S&P Ratings applies a thorough review to determine a credit profile of the community(s). This process is based on a framework that considers enterprise and financial risk, and allows for adjustments and/or overrides to the final rating (when certain factors are present). These adjustments may result in a final rating that is one or more notches above, or below, the indicative rating. The assessment process follows:

- Analyze enterprise risk and financial risk to determine initial risk profiles.

S&P assesses enterprise and financial risk by analyzing five components for each (please see figure below). The components weigh differently and include several variables. - Adjust or override the initial risk profiles to determine final risk profiles.

The initial enterprise risk profile may be adjusted downward, if the current U.S. country risk assessment by S&P Ratings is below a certain level. The initial financial risk profile may be overridden, if debt service coverage and loss coverage assessment are below a certain threshold. - Compare final risk profiles to arrive at indicative rating.

Utilizing a matrix, S&P Ratings will compare each final risk profile to arrive at an indicative rating that equally weighs enterprise and financial risk. - Adjust or override the indicative rating to arrive at final risk profiles.

The indicative rating may be adjusted downward one to three notches, if debt service coverage and the debt service reserve fund do not meet certain criteria. An indicative rating may be overridden and the final rating capped at certain levels, if the strategy and management assessment or debt service coverage ratio and loss coverage assessment levels do not meet certain thresholds.

Enterprise Risk Profile | Financial Risk Profile |

|---|---|

Industry Risk (10%) Risk of the affordable housing industry as a whole relative to other corporate and not-for-profit sectors | Loss Coverage (20%) Ability to cover losses in a portfolio of properties or recovery, based calculation assuming loan default |

Demand Drivers (5%) Annual population growth, average rent as a percentage of market rent | Financial Strength (30%) Cash flow and debt structure, anchored by debt service coverage ratio |

Strength of Local Housing Market (15%) Location, average rent growth, occupancy levels, absorption rates, etc. | Asset Quality (30$) Age and condition, presence of environmental risks, and relative attractiveness to target tenants |

Government Support (17.5%) Diversification of support from multiple layers of government | Operating Performance (10%) Project vacancy and delinquent rents |

Strategy and Management (52.5%) Owner/sponsor expertise and experience, property manager experience, construction risk | Financial Position and Practices (10%) Portfolio monitoring, default and delinquency remedies of owner/sponsor |

Enterprise Risk Profile |

|---|

Industry Risk (10%) Risk of the affordable housing industry as a whole relative to other corporate and not-for-profit sectors |

Demand Drivers (5%) Annual population growth, average rent as a percentage of market rent |

Strength of Local Housing Market (15%) Location, average rent growth, occupancy levels, absorption rates, etc. |

Government Support (17.5%) Diversification of support from multiple layers of government |

Strategy and Management (52.5%) Owner/sponsor expertise and experience, property manager experience, construction risk |

Financial Risk Profile |

|---|

Loss Coverage (20%) Ability to cover losses in a portfolio of properties or recovery, based calculation assuming loan default |

Financial Strength (30%) Cash flow and debt structure, anchored by debt service coverage ratio |

Asset Quality (30$) Age and condition, presence of environmental risks, and relative attractiveness to target tenants |

Operating Performance (10%) Project vacancy and delinquent rents |

Financial Position and Practices (10%) Portfolio monitoring, default and delinquency remedies of owner/sponsor |

Is there anything else I should be considering?

The bonds issued under the S&P Affordable Multifamily Housing program will be governed by documents that outline covenants with which the borrower is expected to comply. The bonds can be financed in multiple tranches based on different debt service coverage levels, allowing for additional leverage and rate savings. Typical underwriting criteria is as follows:

- Appraisal and Valuation

Total purchase price or net proceeds cannot exceed the appraised value of the communities. - Debt Service Coverage Ratio

The bonds may have different ratings, based on the debt service coverage ratio. An investment grade rating in the “A” category may require a 2.0x coverage or greater, while a “BBB” category rating will require a 1.35x coverage or greater. Non-rated tiers of bonds may be underwritten at debt service coverage ratio of approximately 1.20x. - Affordability Covenant

The community(s) must maintain the required percentage of Low Income Tenants, as described in the Qualifications section. - Financial Covenants

The borrower must achieve the minimum debt service coverage ratio and days cash-on-hand requirements. - Management Agreement

The management fee must be subordinate to debt service.

The bond issue is subject to common tax-exempt and real estate criteria, such as local governmental approvals, weighted average maturity limitations, acceptable management projections, phase 1 and physical needs reports, and continuing disclosure requirements.

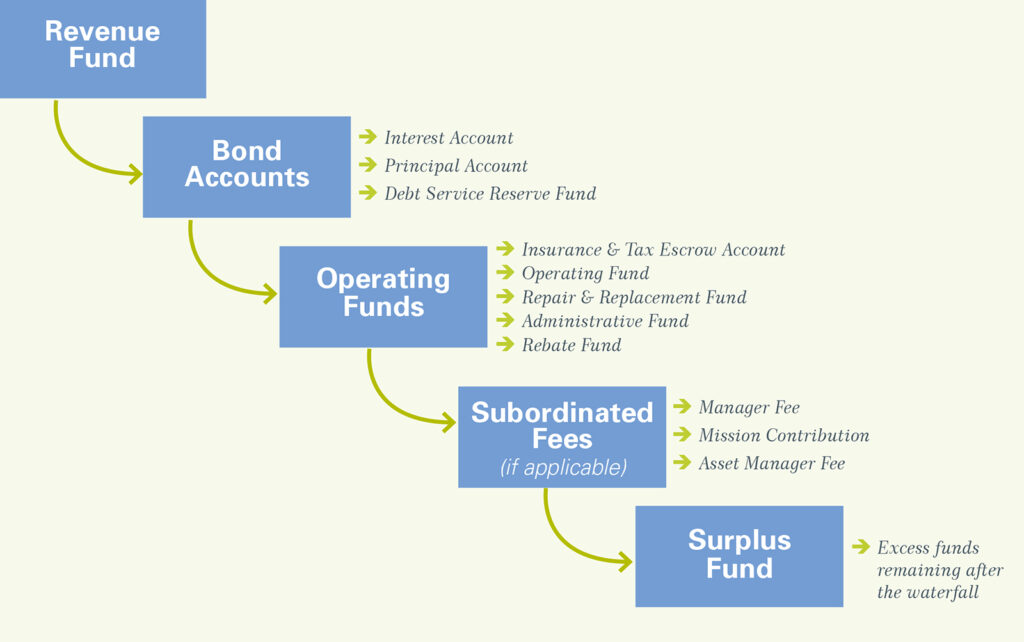

Bonds have a Bond Trustee who services the interest and principal payments, and manages the monthly cash flow of the communities. Monthly rents are deposited into a Revenue Fund, which is typically disbursed as outlined in the figure below.

Disbursement Waterfall

If you are interested in learning more about how HJ Sims can help your senior housing community weigh the benefits of the S&P Affordable Multifamily Housing program, please contact your local Sims Banker:

Connecticut

William Sims

203.418.9001

[email protected]

Jeff Sands

203.418.9002

[email protected]

Andrew Nesi

203.418.9057

[email protected]

Florida

Kerry Moynihan

407.313.1702

[email protected]

Maryland

Aaron Rulnick

301.424.9135

[email protected]

Melissa Messina

203.418.9015

[email protected]

New Jersey

Sims Mortgage Funding

A wholly owned subsidiary of HJ Sims

201.307.9383

Anthony Luzzi

[email protected]

Kerrie Tomasiewicz

[email protected]

Andrew Patykula

[email protected]

Pennsylvania

James Bodine

267.360.6245

[email protected]

Siamac Afshar

267.360.6250

[email protected]

Texas

Curtis King

512.519.5003

[email protected]

James Rester

214.559.7175

[email protected]

Brett Edwards

512.519.5001

[email protected]

Virginia

Thomas Bowden

804.398.8577

[email protected]

This overview is for informational purposes. The information set forth herein has been obtained from sources that are believed to be reliable, but is not guaranteed as to accuracy or completeness. The information contained herein is subject to change without notice. HJ Sims is a member of FINRA and SIPC.