Senior Housing News

Senior housing is no longer an under-the-radar investment opportunity. It is now considered an institutional-grade asset class for real estate investors, and demand is growing with no signs of waning.

According to the 40th annual Emerging Trends in Real Estate report by PwC and the Urban Land Institute, investors identified senior housing as the top prospect for both investment and development of residential property types in 2019.

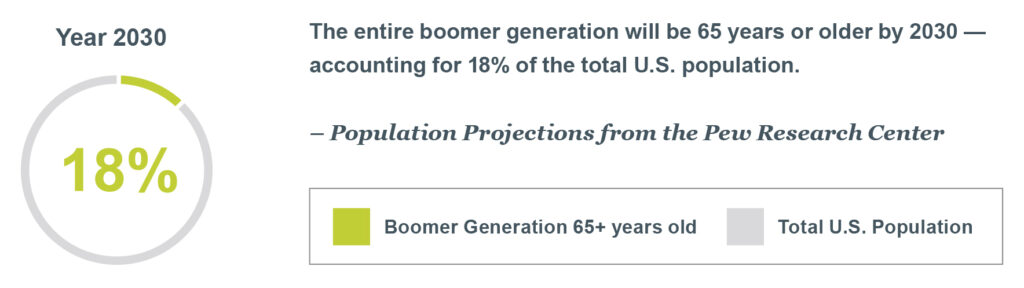

Most of this confidence is driven by favorable demographic trends. An estimated 10,000 baby boomers are retiring every day, and the entire boomer generation will be 65 years or older by 2030 — accounting for 18% of the total U.S. population, according to Pew Research Center population projections.

This positive demographic growth plays a sizable role in senior housing’s attractiveness among investors and developers. Another factor is a record run of favorable interest rates. The Federal Reserve does not anticipate hiking interest rates on 10-year Treasury bonds — which have hovered between 2.07% and 2.6%, year to date — for the remainder of 2019.

While common equity and senior debt is generally available, there is often a gap in the capital structure that can be filled by subordinate financing. These financings generally have higher rates but allow for flexible structures that can be tailored to an owner’s specific financing needs.

This white paper looks at three different types of subordinated financing, which can help developers and investors find the right package for their needs.

1. Mezzanine Financing

Definition: Mezzanine Financing

Mezzanine financing is subordinated debt in that it takes a less secure position than senior debt. It may be unsecured or, if secured, the lender may have either a second mortgage or a pledge of ownership interest of the borrower. One example of mezzanine financing is a second mortgage on a home.

Mezzanine financing carries a higher risk (and thus a higher interest rate) than some other forms of debt, but is often cheaper than equity for borrowers. It resides between the senior loan and the total amount of the project cost, Affinity Living Group CEO Charlie Trefzger says. Affinity has more than 140 communities open or under development across the southeastern U.S.

Mezzanine debt is most commonly found as a component of the financing in an acquisition situation. Senior living owners usually use short-term senior and mezzanine financing as a bridge, often securing more permanent debt when stabilizing a property.

Because of its high-risk nature, mezzanine loans typically require significantly higher interest rates than senior debt. Generally, the interest rates range between 11% and 15%. “The impact on the capital stack is significant,” Trefzger says.

“The senior loan, with its lower cost of capital, is in a much better collateral position than the mezzanine debt and its higher interest rate. In today’s world, I don’t really want to get much higher than an 8% blended interest rate. I’d rather be somewhere down in the 7% [range].”

At Affinity, Trefzger does not use mezzanine debt for long periods of time and is not too concerned about blended debt because he knows he is looking to trade out of the mezzanine debt as soon as possible. “I don’t use it for permanent solutions,” Trefzger says. “It’s a bridge between getting started in the acquisition process to securing long term financing.”

"[Mezzanine debt is] a bridge between getting started in the acquisition process to securing long term financing.”

– Charlie Trefzger

CEO, Affinity Living Group

But there are some exceptions. With HJ Sims, Affinity has done HUD-plus loans, a form of mezzanine financing which stays in place slightly longer. In such cases, the combination of very low rate HUD debt and the higher rate mezzanine financing can create a blended rate that is attractive to the borrower.

As described by Trefzger: “Then I become more concerned about the blended rate and I’m usually taking my senior debt at a 3% to 4% interest rate, blending it with the mezzanine debt and it’s still compelling.”

The effect of mezzanine debt is negligible on the total cost of capital. In a standard capital stack, senior debt accounts for between 65% and 70% of the makeup, with an interest rate in the 4% range. The higher yield mezzanine financing is a small portion of the stack, usually in the 10% to 20% range, dependent upon the senior debt, Trefzger says.

For for-profit and nonprofit senior living communities alike, mezzanine debt is a means to an end, and the status of the community will not change the characteristics of the debt structure.

In a joint venture between a for-profit community and nonprofit community, however, the latter may be able to use its tax exempt status to make the mezzanine debt more attractive for the bond purchaser.

2. Preferred Equity

Definition: Preferred Equity

Unlike mezzanine debt, where there is generally a fixed interest rate and payment, preferred equity is equity and depends more on the cash flow generated by the underlying project for its return. When preferred equity is being used as a financing tool (i.e. not meant to be a long-term part of the capital stack), the holder of the preferred equity often has the option to “put” the preferred equity back to the owners. At the same time, the owner will have an option to “call” (i.e. repay) the investment on certain terms, usually by providing the holder with a certain investment return. This gives both the owner and the preferred equity investor the ability to exit the investment on terms agreed to between the parties.

In function, preferred equity is similar to mezzanine debt, with one significant differentiator.

“It eliminates repayment guarantees,” Watermark Retirement Communities Director of Strategic Investments Bryan Schachter says. One of the largest senior housing operators in the U.S., Watermark manages 52 properties across 21 states.

Watermark’s capital stack for its acquisitions and developments normally consists of 60% to 65% senior debt, and may add a preferred equity tranche to that in order to reach the 75%-80% range, reducing the equity requirement. The firm has used HJ Sims to fill gaps in its stacks with preferred equity.

Preferred equity rates of return generally comprise current and accrued portions. The current return rates are higher than senior debt, but not as high as mezzanine financing. Schachter has seen rates usually in the 6% to 8% range. The accrued returns required by preferred equity investors result in an all-in rate in the mid-teens. Preferred equity investors might also retain a small ownership portion in the deal after the preferred return is paid off.

“While it’s more expensive than senior debt, it is much less expensive than bringing on an additional limited partner or other form of equity that will want higher returns,” Schachter says.

Preferred equity will raise a borrower’s blended cost of capital, but Schachter sees this as a good tradeoff, in order to reduce recourse requirements and ultimately retain more ownership of the asset.

As certain markets become oversaturated with supply, there has been a slight pullback in development financing over the past 2-3 years and lenders are becoming more selective with their underwriting, so as not to bring any additional risk to their portfolios.

Schachter sees no discernible differences between for-profit and nonprofit communities taking on preferred equity, as its use still depends on anticipated cash flows of the community, as well as having the confidence those revenues can service both the senior debt and the bridge lending.

"Investors identified senior housing as the top prospect for both investment and development of residential property types in 2019.”

– 40th annual Emerging Trends in Real Estate report by PwC and the Urban Land Institute

"While it’s more expensive than senior debt, it is much less expensive than bringing on an additional limited partner or other form of equity that will want higher returns.”

– Bryan Schacter

Watermark Retirement Communities Director of Strategic Investments

3. Unitranche Financing

Definition: Unitranche Financing

Unitranche financing blends a typical bank loan and a mezzanine loan into a single loan agreement, with one servicer/point of contact and one loan payment instead of the multiple parties involved in a traditional mezzanine deal. A unitranche loan provides the same leverage as a senior/mezzanine structure at a lower total interest rate.

Unitranche blends senior and subordinated debt to form a single pool of debt. It serves the same purpose as mezzanine debt in that it gives borrowers the same ability to obtain high-leverage debt at an attractive, blended rate, but in a streamlined process.

“You have one servicer, one point of contact, one payment,” Venue Capital CEO and founder Michael Goldberg says. Venue Capital is a real estate and asset management firm in New York City, focused on senior housing.

Venue Capital focuses on value-add acquisitions and repositioning opportunities, and uses unitranche financing because it is comfortable with the higher loan-to-value ratio, and leveraging its equity to create more value in the properties in moving toward the ultimate goal of a refinancing or sale.

The firm and a national senior lender most recently deployed unitranche financing through HJ Sims for the acquisition of two properties in Ohio.

The total blended interest rate in unitranche debt is very attractive to lenders.

“You’re taking a weighted average of the two [components] to come up with the blended rate,” Goldberg says.

As veteran senior living owners and operators seek new opportunities to acquire and develop communities, matching the right kind of subordinated financing with the right opportunity is essential for executing on the transaction and positioning oneself for success.