“Working with Akshai Patel and Robert Nickell from HJ Sims was an amazing experience! We had been pursuing financing for the building we currently reside in for two and a half years. All paths led nowhere. Frustrated with the many barriers to finance our school building, I connected with Akshai and Robert, and they immediately gave me hope with their creative outside-the-box thinking. They worked diligently to connect their clientele to our cause. Immediately, they envisioned a way for us to finance our school building and, where other underwriters failed, they made it happen within three months. I am so grateful that they agreed to work with us to help our educational community secure a future home. Akshai and Robert are amazing at what they do! Working with them helped me to understand the financing process better, and more importantly, they delivered the hope we were looking for through the bond process. I would, without a doubt, work with them again in the future, and encourage anyone who needs assistance with financing to work with them as well.“

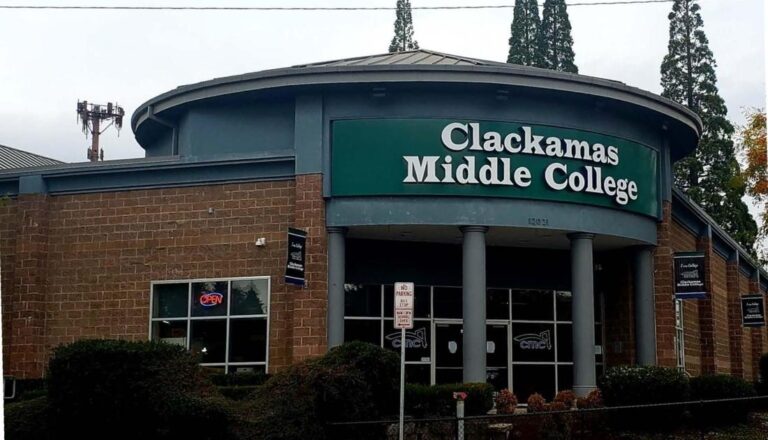

– Brian Sien, Ed. D., Principal of Clackamas Middle College (CMC)

Partnered Right®

Clackamas Middle College (CMC) is a public charter high school with about 300 students near Portland, Oregon. Originally opened in 2003, CMC’s charter is authorized by the North Clackamas School District 12, and is in effect through June 2025. Clackamas Middle College provides an inclusive, safe and supportive community of respect with high expectations in a student-centered environment that cultivates and prepares independent learners for individual pathways to the future.

Structured Right®

The Series 2024 Bond proceeds of $2.83 million were used to fund the purchase and capital upgrades to school property. The debt service reserve fund is funded to equal roughly three months of debt service. Security for bondholders included a leasehold deed of trust on the financed school facility. Principal payments were structured based off a 20-year amortization, though the bonds have a final maturity in 10 years, in order to stay within the remaining life of the existing ground lease. The bonds have a call option starting in 2026 (year 2) at 102%, declining to par by 2028 (year 4).

Executed Right®

HJ Sims succeeded in completing this transaction despite prior public marketing efforts by two other underwriters. The bonds were sold to accredited investors utilizing HJ Sims’ retail network. The tax-exempt bonds have a 6.5% coupon at par with a final maturity in 2034. The taxable bonds have a 8.5% coupon at par with a final maturity in 2031.

Financed Right®

On May 23, 2024, HJ Sims successfully closed on the $2.83 million Series 2024 Bonds on behalf of Clackamas Middle College (CMC).