by Gayl Mileszko

1784 was another one of those years when nothing was normal. The Treaty of Paris with Great Britain was ratified, ending the American Revolutionary War. New guidelines were being adopted for adding to the original 13 states. The New York Governor asked Congress for a declaration of war against Vermont. The first successful daily newspaper was published in Pennsylvania, and the bifocal spectacles needed by some to read it were invented by Benjamin Franklin. In Massachusetts, Governor John Hancock signed the charter for Leicester Academy, a private school initially funded by the town and its citizens, later supported for a time with state monies. Its purpose was to “promote true piety and virtue” along with the study of the English, Latin, Greek, and French languages, arithmetic and the art of speaking. Soon after its founding, the Academy broke some new ground by admitting young women. Among its earliest graduates was Eli Whitney and one of its most prominent buildings was a stop on the Underground Railroad. Over the decades, the school moved, expanded and contracted several times, adapted to new laws making education compulsory and then prohibiting public funding of private schools, and trained cadets that served in the Union Army and World Wars I and II. The Academy eventually merged with Leicester Junior College in 1954 and with Becker Business College in 1977. Becker College, as it became known, features two campuses six miles apart in Leicester and Worcester, and offers 40 undergraduate degrees including veterinary science and e-sports management along with master’s degrees in nursing and mental health counseling. It has been the home of the state-designated Massachusetts Digital Games Institute and proudly features one of nation’s the top five video game design programs.

As with many small, private colleges, however, Becker has suffered from declining enrollment in recent years and in the 2020 Fall Semester the total fell to a low of 1,500 students. Several years of hundred thousand-dollar deficits were plugged with endowment funds that have rapidly declined to $5 million. College leadership tried mightily to bolster its finances by renegotiating contracts, selling assets, consolidating departments, cutting staff and salaries, and aggressively pursuing affiliations and mergers. But the Pandemic exacerbated the revenue loss and no alliances materialized. Despite $3.31 million from the Paycheck Protection Program, and $1.6 million of CARES Act funds, the state’s Department of Higher Education concluded in early March that the school’s financial situation was such that it was unlikely to make it through the next academic year. After a weekend of agonizing discussion, the school which has boasted its status as one of the 25 oldest academic institutions in the country, just announced on Monday that it would close in August and arrange for its students, all Becker “Hawks”, to transfer to one of 18 other local schools to complete their degrees.

The closings of longstanding schools and businesses — unimaginable just one year ago — continue to make headlines, although at a rate well below the terrifying forecasts of last Spring in large part due to the $5.2 trillion of federal stimulus that has propped up income for millions. The American “can-do” spirit is, however, never to be discounted. Despite many devastating losses, more than 4.4 million new businesses have been created in the past year according to the Census Bureau, a half million this past January alone. This is an extremely hopeful sign for those of us who still remain hesitant to take public transit, sit in a crowded stadium, attend a church service, wedding or college graduation, or open or expand a dream business whether it is a restaurant, barber shop, senior living facility, charter school, mask distributor, ionizer manufacturer, entertainment venue, residential and commercial building contractor, home care provider, or reliable news source.

We join the hundreds of millions thrilled with every new report of students returning to classrooms, workers returning to offices, drivers back on toll roads, fans back in arenas, shoppers returning to brick and mortar stores, travelers booking flights and hotel rooms, seniors and their families once again scouting best places for retirement and care. The first quarter of 2021 has come to an end and the country yearns for what some call a return to normal, with hopes fueled by the widespread COVID-19 vaccinations. But the Google searches for “normal” which spiked highest last April, ebbed then rose once more with the start of the new school year and again over Thanksgiving, have since fallen off. With no disrespect to our veterans and the sacrifices that they and their families have made in time of war, this Pandemic has cost our nation in dollar terms far more than World War II and it has a death toll now counting greater than that of WWII, Korea and Vietnam combined. Our aspirations for having control over our lives once again have escalated but we are still unsure about how persistently vicious this coronavirus and its variants could be. After 14 months of the unthinkable, we are adjusting to a new normal, perhaps and hopefully on its way to a becoming better one. As the poet Maya Angelou once so aptly put it, “If you are always trying to be normal, you will never know how amazing you can be.”

In Washington, where no day is ever normal, and the cherry blossoms have peaked early this year, intelligence agencies are scouring for details of the new 25-year, $400 billion China-Iran pact. Among other threats, our military is monitoring the three Russian nuclear submarines putting on a show in the Arctic. Immigration and border patrol agents are overwhelmed with the migrant surge on the Mexican border. Health officials are studying whether new vaccines or treatments will be needed to counteract new variants in countries with low vaccination rates, if booster shots will be required in four or six months, how much value to place in the recent World Health Organization study on the origins of Covid-19. Labor and Commerce officials are exploring the implications of various policies for mandating vaccinations for certain employees, for requiring proof of vaccinations for certain activities. Education officials are addressing the myriad of issues related to in-person versus virtual instruction. NASA is focused on the Mars rover searching for signs of past life and its potential for habitation.

On Wall Street, throughout this Pandemic and indeed for the past 13 years, most normal days have involved rallies for stock and bond investors. Many are being rattled by the prospect of inflation linked to federal stimulus that may exceed $8 trillion by the end of the year if another $3 trillion of major infrastructure proposals are adopted. In response, Treasury yields have risen alongside the belief that the Federal Reserve will step in to raise rates well in advance of the 2024 target reflected in its latest dot plots. As if we have not had enough of new entries in the U.S. record books, we have just seen one of the largest margin calls of all time. Archegos Capital Management is a family office that has been employing total return swaps to amass huge stakes in major companies without having to disclose them to regulators. Archegos (Greek for “one who leads the way”) has leveraged trading partnerships with major banks including Nomura Holdings Inc., Morgan Stanley, Deutsche Bank AG and Credit Suisse Group AG, all of whom have had to liquidate huge chunks of shares in block trades at many fire sale prices. The first quarter results of these banks are now being impacted to the tune of $5 to $10 billion.

In the wake of years-long risky high yield trading and huge IPO and SPAC investment by those in desperate search of positive real yield and returns, traditional risk management tools developed in Manhattan, London, Zurich and Tokyo appear no longer appear to prevail. With respect to risk to the global supply chain, last disrupted by the shutdowns in the airline industry, the world has truly been shaken by the sight of hundreds and hundreds of ships laden with cargo blocked from entry into the Suez Canal by just one beached container vessel, the Ever Given. In the context of data privacy, hackers have reduced and revealed the little that apparently remains.

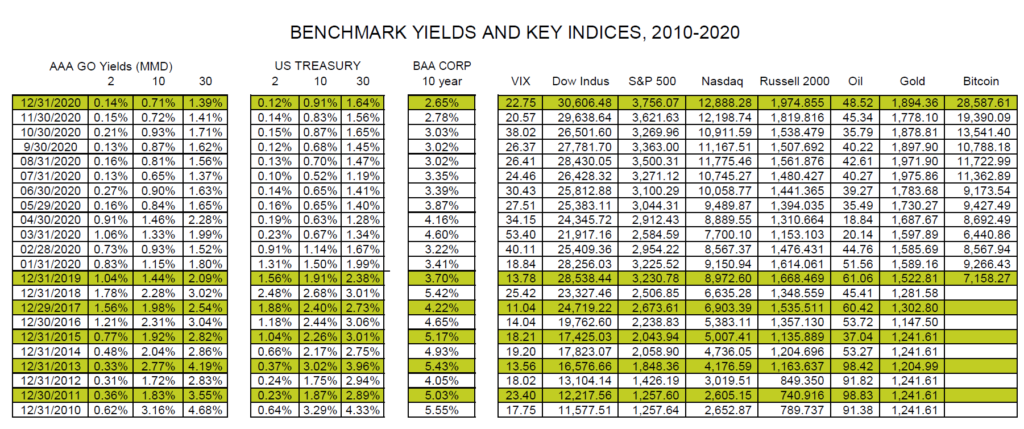

At this writing, with two days to go until the close of the first quarter in the financial markets, stocks are up across board since the start of the year. The Dow is up over 8%, the S&P 500 more than 5%, the Nasdaq over 1% and the Russell 2000 well over 9%. Oil prices at $61.56 have gained 27% while gold is down 9.6% to $1,713 per ounce and silver is down 6% to $24.75. Bitcoin has doubled in value to $57,610. In the bond markets, yields in short maturities have been stable: over the past three months, the 2-year Treasury has increased only 2 basis points to 0.14% while the tax-exempt AAA municipal general obligation bond yield has remained flat at 0.14%. The comparable Baa rated corporate bond yield has fallen 5 basis points to 1.73%. The 10-year and 30-year Treasury benchmark yields have, however, risen by more than 76 basis points to 1.70% and 2.40%, respectively. 10-year Baa corporate yields are up 61 basis points to 3.26%. Municipals have outperformed their taxable counterparts by the most of any quarter since 2009, although intermediate and long-term yields have increased by more than 34 basis points since January: the 10-year AAA muni currently yields 1.10% and the 30-year yields 1.73%. Returns in the general municipal market are expected to be in the range of negative 0.3% for the quarter, while Treasuries will end the quarter down 4.2%. High yield municipal bond returns are among the fixed income leaders, with index returns in the range of 2.11% year-to-date.

Investor demand for tax-exempt securities has been magnified by tax chatter in Washington. The Biden Administration is proposing some of the largest tax increases since 1942 and this is enhancing the perceived value of munis, even at these still relatively low historic yields. There are also several other favorable conditions prevailing for muni buyers. Investors have added $26.1 billion to muni bond funds and ETFs so far this year, reflecting retail demand for every available tax-advantaged dollar. History also shows that the muni market does well during the first 100 days of a Democratic president’s first 100 days in office. In addition, supply has been suppressed as state, local and nonprofit borrowers have awaited news of agreement on the extent of stimulus funds for more than six months. Now that federal funding has reduced the need for some deficit borrowing, volume could decline for several months to come. On top of all this, the IRS has delayed the 2020 tax filing deadline to May, which forestalls the need for some of the usual seasonal sales for another month.

This is a week in which many around the world celebrate very precious holidays. We at HJ Sims wish you and your families happy and healthy celebrations. Your HJ Sims representatives look forward to sharing the best of these moments and, based upon your investment goals and sensible risk parameters, helping you to try and improve results you have come to see as normal in your portfolios. We appreciate all that you have endured and managed during this past year and stand alongside you as you look to move forward with your investment and borrowing plans. We are dedicated to working for you and, as always, aim for amazing.