By Gayl Mileszko

The Wall

Buried in the headlines marking the 100th day of President Trump’s second term were historical reports on the 50th anniversary of the Fall of Saigon, the effective end of the Vietnam War. The bloody 20-year war ended on April 30, 1975, about two years after the withdrawal of our last combat troops. More than 2.7 million America troops had been deployed there; tens of thousands were severely injured and 58,318 did not return. Three million Vietnamese and several hundred thousand Cambodians and Laotians died in this second Indochina war. In the end, all three countries became communist, the very thing that four U.S. presidents sent funds, advisors and armed forces to prevent, all without any formal declaration of war. Fifty years later, the mention of the Vietnam evokes a series of flashbacks for veterans, families, friends and all those impacted. Draft cards. Campus protests. “Dodgers.” Tonkin, Tet, Agent Orange, Ho Chi Minh, Jane Fonda, Hanoi Hilton. Hundreds of names of the fallen scrolling across TV screens every night on one of the three black-and-white news channels broadcasting. Bracelets and dog tags for those Missing in Action, still numbering 1,580. Pardons from President Carter. And Maya Lin’s striking memorial wall adjacent to the National Mall.

Fourth of July

We have lost many of the decorated heroes and prisoners of war in the Vietnam conflict over time but honor them on Memorial Day, the Fourth of July, and Veterans Day. John McCain. Roy Benavidez. Floyd Thompson. Joe Hooper. Other veterans like John Kerry continue to capture media attention for their post-war service. The Department of Veterans Affairs reports that Vietnam veterans represent the largest cohort of our veterans in terms of service era. But the U.S. Army reports that we are losing more than 500 every day. Those who served between 1955 and 1975 represented about 10% of their generation; the ones who remain have a median age of 71, with some in their mid-to late 90s. Five percent continue to report suffering from post-traumatic stress, PTSD, a condition not formally diagnosed until 1980. Almost all of those who returned from Vietnam faced hostility, isolation, and the lack of support normally afforded to veterans coming home from war. On top of that they lived through revelations of the My Lai massacre, the trial of William Calley, and an inescapable series of movies: Platoon, Apocalypse Now, The Deer Hunter, Full Metal Jacket, Born on the Fourth of July. Some now live in one of the more than 100 VA-approved state veterans’ homes, others in one our nation’s 30,600 assisted living and memory care facilities or 15,600 nursing facilities. About forty seven percent of America’s estimated 196,000 homeless veterans served during the Vietnam era.

Funding Battles

Veterans Affairs is one of the few cabinet departments that made out relatively well in the Trump Administration’s $1.7 trillion Fiscal Year 2026 discretionary funding request. The U.S. faces a wall of debt: a $140 billion trade deficit, a budget shortfall of $1.3 trillion, a $36.8 trillion national debt. The budget proposal for the fiscal year to begin on October 1 included cuts of about 22% to non-defense agencies but provided a 4% increase in funding for the VA, primarily to support healthcare services and help eradicate homelessness. The Administration’s budget would reduce Department of Education funding by $10 billion or 15% as federal activities wind down and responsibilities shift to the states; the federal charter school program would see a 14% increase. The Department of Housing and Urban Development would see its rental assistance programs converted into state-based formula grants to allow states to design their programs while funding for the Department of Agriculture’s $1.7 billion rental assistance grant contracts would be renewed. The Centers for Medicare and Medicaid budget is said to have no impact on benefits to Medicare and Medicaid beneficiaries.

Truce, Tariff and Tax Talks

Much of Wall Street’s attention is devoted to the goings-on in Washington as major news announcements are being made nearly around the clock, a pace not before experienced, and via social media such as X and Truth Social as often via live streaming and TV. The White House is keeping all on edge with tariff talks (including a 46% tariff on Vietnamese goods), truce talks, and pressures on Congress in tax cut talks. The President’s strategy and style is producing ups and downs in expectations, sentiment and, of course, the financial markets, often intraday. Since Inauguration Day, the S&P 500 Index has seen swings of 1,162 points or 23%; at 5,606 presently, it is still below the 108-day average of 5,729. Oil prices, now at $59 a barrel, have ranged between $57.13 and $75.89. Gold skyrocketed from $2,707 to $3,414 an ounce, and is currently priced at $3,384. Bitcoin prices at $120,996 have seen a peak of $133,708 as well as a drop to $95,883. The 10-year Treasury yield has swung from a low of 3.99% to a high of 4.64% and currently stands near the term average at 4.30%.

Disappointing Performances for Most So Far in 2025

Many investors have largely been disappointed in their portfolio performances this year. There have been waves of losses and recoveries. This year, as of May 2, investment grade municipal bonds are down 1.20%, high yield munis have lost 0.99%, preferred returns are down 1.17%, the prices of aluminum, zinc, iron ore and coal have all dropped, and natural gas prices are flat. The S&P 500 index return was negative 2.92%, the Dow was down 2.39%, and the Nasdaq has fallen 6.71%. On the other hand, U.S. Treasuries are returning 2.70%, mortgages have gained 2.45%, taxable munis are up 1.76%, and investment grade and high yield corporates were 1.32% and 1.60% higher, respectively. Investment grade corporates sales so far this year total a whopping $683 billion, up 5% from last year. High yield corporate issuance proceeds at a far less torrid pace: issuance so far this year totals $78.5 billion.

Bouncing Off the Walls

Municipal bond prices have been volatile as well. There are few leaks coming from the congressional tax-writing committees about the status of tax-exemption and private activity bonds, the endowment tax, and green tax credits, for example, but that uncertainty has done nothing more than bring borrowers to market faster. Some — in particular AAA rated private colleges – have elected to come even faster through the taxable corporate market. The 2-year AAA general obligation benchmark yield at 2.92% has been as high as 3.42% and as low as 2.45% since Inauguration Day. The 10-year at 3.33% has swung between 2.97% and 3.89%. The 30-year at 4.40% peaked at 4.84% but dropped to a low of 3.99%. Throughout this time, volume remains at record levels. The MSRB reports consecutive month-to-month increases in issuance: $38.6 billion in January, $42.1 billion in February, $45.1 billion in March and $53.1 billion in April. Last week, volume totaled $19.4 billion, the most since December of 2017, just ahead of the effective date of the last tax reform bill which eliminated advance refundings.

The Focus this Week: Smoke

Honing in on the focus of traders this week, most are all tuned into the Federal Open Market Committee and the press conference with Chair Jay Powell on Wednesday afternoon. No surprises were expected but tones and careful wordings will be dissected and analyzed for the next month. As expected, future Fed actions will hinge on the next economic data, any measurable impact of tariffs, and the prospect of enacting anything close to the President’s proposed budget and tax policies. Outside of news coming from the proverbial smoke-filled backrooms in the House committees drafting reconciliation language, world attention also turns from there to the Fed to the flare-up in the India-Pakistan conflict, to the latest in the war Ukraine, a possible Houthi truce, and the Vatican — where 133 Roman Catholic cardinals are sequestered in voting for the next Pope, the 267th, to lead the church with 1.4 billion followers, and what the message this next leader has for our world.

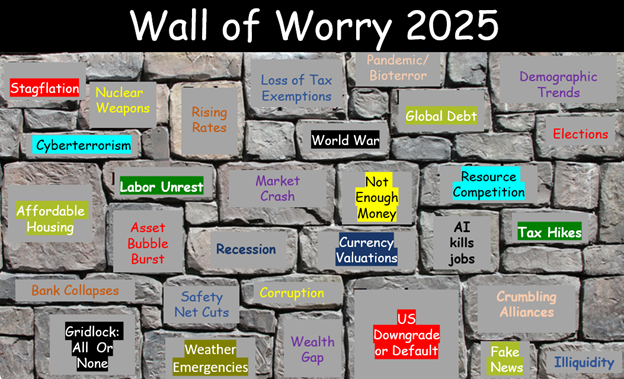

Wall of Worry for Investors

There is no doubt a pretty big “wall of worry” for savers and investors. But many fears have been with us for decades. In the muni market, these concerns often factor in less often than movements in the Treasury market, mutual fund flows, rallies in equities fueling retail fears of missing out, and heavy volume that sometimes overwhelms demand. In our HJ Sims Wall of Worry, we move the bricks around every so often to reflect what we see from polls, surveys, and indications of anxiety from our own clients. These are our latest bricks in the wall:

Lots of New Municipal Bonds for Sale

At HJ Sims, we incorporate all key factors and concerns into the timing and pricing of our negotiated sales. We also closely follow all some of the few high yield transactions and bond issues in our specialty sectors that have come this year. In the senior living sector, Twin Lakes Community in North Carolina came to market last week with a $35.3 million BBB rated financing structured with a 2055 maturity that priced with a coupon of 5.25% to yield 5.24%. In the charter school sector, we saw the Public Finance Authority place $17.3 mil of nonrated bonds for AXL Academy in Aurora, Colorado; the bonds due in 2035 priced with a coupon of 8.00% to yield 10.604%. The South Carolina Jobs-Economic Development Authority came to market with a $12.5 million non-rated deal for Cogito Academy in Lancaster; the transaction was structured with a 2032 term bond priced with a coupon of 7.50% to yield 8.283%. The Colorado Educational and Cultural Facilities Authority issued $5.4 million non-rated bonds for Global Village Academy in Aurora, selling the bonds due in 2032 with a coupon of 6.125% priced at par.

Wall to Wall Opportunity

We are bullish on munis, celebrating the latest $1.5 billion of net inflows into muni funds and the $22 billion of principal and interest that hit bondholder accounts on May 1. Another 13.4 billion will be received by the end of the month to be followed by $52.6 billion in June, $45.4 billion in July and $47 billion in August. WOW. Start working with your HJ Sims representative to scrutinize the offerings for best yields, terms and maturities. We have several new charter school issues coming to market next week and invite your contact with our sales representatives for information on exceptional opportunities that we see in the secondary market for all municipals and other fixed income products. The muni slate this week includes a $23.8 million Ba1 financing for Redmond Proficiency Academy in Redmond, Oregon, a $12.7 million non-rated Flagstaff Junior Academy sale, and a $8.9 million BB+ rated transaction for Cambridge Lakes Learning Academy in Pingree Grove, Illinois. The Florida Local Government Finance Authority has a $227.6 million non-rated deal for The Convivial Jacaranda Trace, and the Indiana Finance Authority has a $51.4 million BBB-minus rated sale planned for Indiana Masonic Home.