by Gayl Mileszko, Senior Vice President and Director of Credit Analysis

Senior living and care operators are used to navigating in choppy waters. But in these past few years, many have felt like Odysseus, the captain of the vessel in Homer’s Greek myth who faced unthinkable maritime hazards in that narrow strait between Sicily and the Italian mainland. On one side of the sea was Scylla, a 6-headed, 12-footed sea monster with a triple row of sharp teeth who would eat six men if the ship came too close. On the opposite shore, there was Charybdis, a whirlpool who drank down and belched out the waters three times a day and could swallow the entire ship. The thought of facing these two deadly immortals terrified all sailors aboard as they knew the slightest navigational error could prove fatal. What was a captain to do? Odysseus was caught between two equally bad alternatives. His situation has later been categorized as being on the horns of multiple dilemmas, forced to choose between the lesser of two evils, stuck between a rock and a hard place.

Battling Inflation and Pandemic

Forty-year high inflation rates have impacted every aspect of communities offering independent living, assisted living, memory care, and/or skilled nursing on both the non-profit and for-profit sides. During the pandemic, many workers left their communities, requiring managers to use expensive agency staffing to fill key positions from dining room workers to registered nurses, and hire recruiters to try and fill permanent positions or leave positions unfilled. To compete with the bigger wage and benefit packages offered by retail and hospitality employers, providers have had to match or exceed them while struggling with higher prices for food, supplies, insurance, utilities, and services that are outsourced.

To comply with new regulatory requirements and meet the expectations of residents and prospects, expenditures for new or upgraded technology and trained staff have also been necessary. According to the result of a recent survey from the National Investment Center for Seniors Housing & Care, inflation has replaced staffing as a top concern for providers. The Bureau of Labor Statistics last reported that its key inflation gauge, the consumer price index, rose 8.3% year-over-year in August. The Federal Reserve’s key inflation gauge, the August personal consumption expenditures price index excluding food and energy increased 4.9% from last year.

Scrimping and Finagling

To corral escalating costs, prioritize spending, and reduce expenses, managers have held exhaustive brainstorming sessions with senior staff as well as outside consultants, slashed spending wherever possible, and delayed all but the most critical capital and repair projects. They have negotiated with vendors, outsourced services, juggled schedules, and re-designed benefit packages to include such things as workforce housing. Many have peppered every local and digital source repeatedly for referrals, launched new at-home and hospice programs, created new training programs with local colleges, and applied for every local, state, federal and philanthropic grant they could find.

After months and months of scrimping and finagling, many have found that their efforts have not been enough. Only one other option has remained: raising rates for residents.

Raising Rates Enough

Every community is different, but for those managers still unsure about what to do or how high to go, we encourage you to consider the following:

- Providers are operating in unprecedented economic conditions, battling a barrage of negative national press as well as a pandemic going into its third year, still not back to pre-pandemic occupancy but facing a more intense regulatory environment with reporting requirements such as technology upgrades and specialized staff, all designed to protect and benefit residents and patients;

- Boards and managers are committed to the best and highest health and safety protocols to benefit residents as well as staff and this requires the payment of going rates for all the necessary technology, supplies, training and labor;

- Inflation is hitting some parts of the country, some urban, rural and suburban areas harder than others as a result of the pandemic, supply shortages, wage increases offered by employers in competing industries including retail and hospitality, and demographic changes. The reality is that labor is in extremely short supply and price inflation for non-discretionary items and services has been rising all year and continues to rise. Smaller communities have less leverage in negotiating purchases and services. As always, rates need to be high enough to cover projected costs for the contracted service and meet debt service;

- Trends in real estate sales, prices, mortgage rates and demand point to a slowdown, which may have a significant impact on the pool of prospective residents seeking to enter each community to fill vacant units and provide the revenue needed to meet operating expenses and provide timely refunds. Some cushion is needed to absorb changes in housing trends and the economy in general that are beyond management’s control;

- However, many residents and prospects facing higher than expected entrance, rental and monthly fees should have some cushion based upon the nationwide annual home price growth which peaked at 20.6% in April 2022, and the long bull run in the U.S. stock and bond markets;

- More good news is that residents are expected to see a Social Security COLA increase of 8.7%, which would be the biggest raise in more than 40 years and that will help;

- Since the community was financed with debt and equity, there are hard covenants that must be met with respect to debt service, cash balances, occupancy, and sales. Operators have no intention to default, create headlines and bring in new pressures and demands forcontrol fro m outside parties;

- Some residents faced with increases may seek to terminate their contracts and move in with family or to a different community, so creating and maintaining wait lists and interested party lists is critical;

- The goal of management should be to maintain a steady, predictable annual increase for residents and avoid ever having to announce any exceptional increases again;

- FY22 and FY23 increases have necessarily been the highest on record, but there will be a time, hopefully in the very near future, when conditions turn, prices fall, fees can be lowered and any surcharges discontinued.

Expectations and Pressures

Almost every current and prospective resident understands that their contracts assume annual increases. For renters, they have the option of moving out if the increase is unacceptably high. For those with entrance fee contracts (lifetime leases), it is not so easy. For investors who financed the facilities with equity or debt, the assumption is that there will be regular, annual increases of about 3% in monthly fees and 2% to 4% in entrance fees.

Major institutional investors in this sector know that senior living facilities are able to raise fees; care providers must do so to compensate for low Medicaid, Medicare and Managed Medicare reimbursement rates. Managers can also reconfigure units or eliminate skilled nursing beds to offset some of the cost inflation and investors may pressure managers and boards to do so.

These investors also understand that communities going into the pandemic with lower occupancy, and those who continue to experience a sluggish recovery as a result of new competition, too rapid expansion, or significant demographic change, may not have the luxury of increasing fees by much, if at all.

Increases in 2022

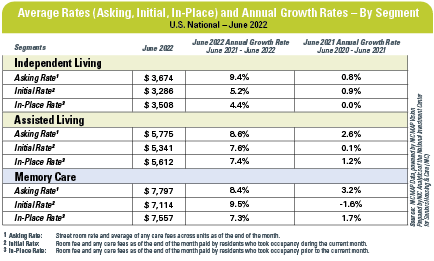

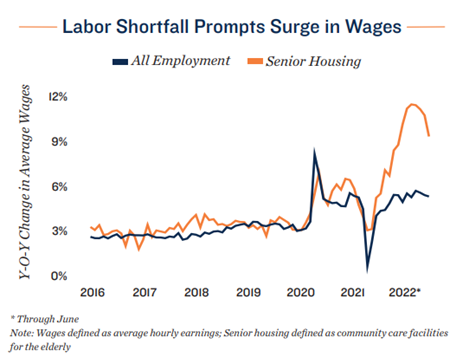

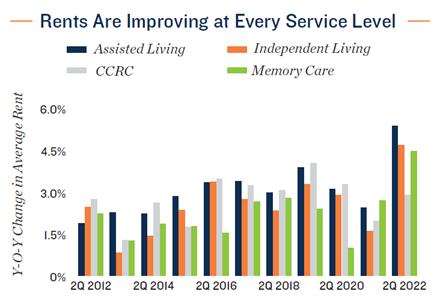

During the first year of the pandemic, not all providers were able to raise rates, given the lockdowns and loss of so many services and staff. That may have slightly skewed the 2021 Genworth Cost of Care Survey which reported that the compound 5-year annual growth rate is 4.4% for community and assisted living, and 3.25% for nursing care. In 2022, most every independent living, assisted living and memory care facility operator pushed their resident fees higher. As of June 30, the average rent across senior living rose by 4.7% year-over-year according to Marcus & Millichap, with increases well exceeding 5% in 20 different major U.S. markets. However, the average rent growth still remains below that of inflation (Chart 1) while labor costs soar (Chart 2).

Chart 1

Chart 2

Source: Marcus & Millichap 2H22 Senior Housing National Report

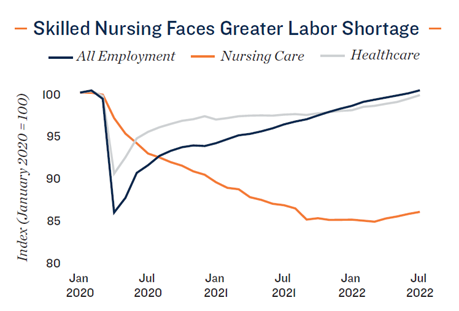

Nursing home rent growth that has averaged only 2.6% during the past 12 months ended in June. This, together with significantly shortfalls in state Medicaid reimbursements, has made it nearly impossible to boost compensation enough to restore a workforce that, according to Marcus & Millichap, remains 15% below February 2020 levels.

Source: Marcus & Millichap 2H22 Skilled Nursing National Report

The average increase in monthly fees for independent living was 4.70% according to one major industry poll, but at least 29 operators reported that they were forced to increased rates mid-year as annualized inflation surged to 7.5% in January and hit 9.2% by June.

Assisted living and memory care each posted their fastest annual rent gains in more than a decade, eclipsing 4.5%, but still not accelerating in line with inflation.

Source: Marcus & Millichap 2H22 Senior Housing National Report

Happy or Unhappy New Year

Some life plan community, independent living and assisting living resident contracts clearly limit the number of increases that can be imposed in a given year and may leave no flexibility to management on the timing (e.g., effective date of January 1, or anniversary date). In other cases, residents and families panic that sizable increases will start coming every six months. In one recent industry survey of chief financial officers, 140 saw the possibility of needing a mid-year adjustment in 2023 as a result of continuing wage and other inflationary pressures. Any further downturns in the economy would add a whole new layer of financial pressure on both senior living providers and residents, while COVID outbreaks continue, labor shortages persist, and home sales slow.

Moving Forward Amid Uncertainty

All of this is to say that we do not know how long this environment of inflation and labor shortages will exist but the bills keep coming, the cost of training and retaining key staff increases, and occupancy at about 82.2% is still well below the pre-pandemic level of 87.2% while brand new inventory may be rolling out in the area.

The latest NIC Executive Survey Insights showed that the latest 30-day pace of move-ins fell in independent living and skilled nursing; assisted living properties have been reporting declines for the past three months but memory care move-in rates have recently picked up. The families of new patients urgently requiring memory and skilled care-based services will undoubtedly seek discounts in asking rents, and managers looking across empty floors

may have no choice but to provide them. Notices on the new entrance and monthly fees to take effect on January 1 typically are sent at this time of year.

Resistance

Since the vast majority of residents or prospects are retired and living on fixed incomes, they find themselves paying more and, given the phenomenon of “shrinkflation”, getting less. This includes residents who have fewer staff to attend to them and, given the average turnover, fewer quality relationships with their caregivers. Those looking to sell their homes in order to pay entrance fees and monthly charges, are seeing sales and prices fall in most parts of the country as mortgage rates have doubled; this can delay or forestall planned moves and present the kind of

hazards for operators that they did in 2008.

Those in every bracket relying on investment income have seen the market value of their portfolios plummet this year and no doubt some worry that they will not be able to afford to stay where they are. Adult children often called upon to fill financial gaps are in the same boat. Market experts say the current household wealth losses from financial markets could total $10 trillion. Even those managers in communities with little competition and long wait lists face major resistance to significant back-to-back hikes given economic conditions and universal declines in net worth.

The Need to Educate and Engage with Residents

Of course, some providers have their hands tied by municipalities that impose caps on annual rent increases. For those not so limited, many have already held at least one educational forum with current residents on forthcoming fee increases said to be averaging 5.38% but running as high as 22%. Several more sessions may still be necessary to lay out management’s justifications to understandably angry and fearful residents.

In order to reduce the planned increase, some communities may be able to strike an agreement to cut or eliminate various services or activities. Other operators may be able to impose a surcharge for services like utilities, fine dining, housekeeping, high personal care levels, or recreational activities that residents can elect to opt out of. Many providers have had success putting the increase in rates in perspective on what is needed to keep the staff whom the residents have come to know, respect and love. That personalization may have the most impact in placing the need for increases in perspective.

Rehabilitating Public Understanding on The Cost of Living and Care

Senior living industry leaders have long been advocating for a coordinated industry focus that takes into account not only this and future pandemics but also the myriad of changing demands from residents, the evolving needs of workers, the heightened regulatory environment, construction challenges, and the new active roles that providers must assume as lobbyists for local, state and federal attention and support.

The intense kind of rehabilitation that is already a critical component of senior care now needs to apply to the education of life care residents, legislators, regulators, and the general public as our population ages and the harsh realities of how truly high the costs of living and care are for our senior population.

For more information or if you have any questions regarding the content of this white paper, please contact:

Gayl Mileszko

Senior Vice President and Director of Credit Analysis

561.620.2145

[email protected]

Any HJ Sims banker

1.800.HJS.1935