Melissa Messina

Executive Vice President & Associate General Counsel, Investment Banking

In early 2018, we issued an HJ Sims thought leadership piece discussing the changes to the tax code enacted as part of the Tax Cuts and Jobs Act. It provided guidance on how the Act would impact financings in the foreseeable future.

In the today's environment, we provide recent examples of how HJ Sims has assisted several clients in facilitating advantageous financing results, despite the elimination of advance refundings and increased corporate tax rates for their lending partners.

Recalling the Impact of the Tax Cuts and Jobs Act

First introduced by the House of Representatives on November 2, 2017, and concluding with the President signing it into law on December 22, 2017, the Tax Cuts and Jobs Act (“the Act”) was the first substantial tax overhaul since the 1986 Tax Reform Act.

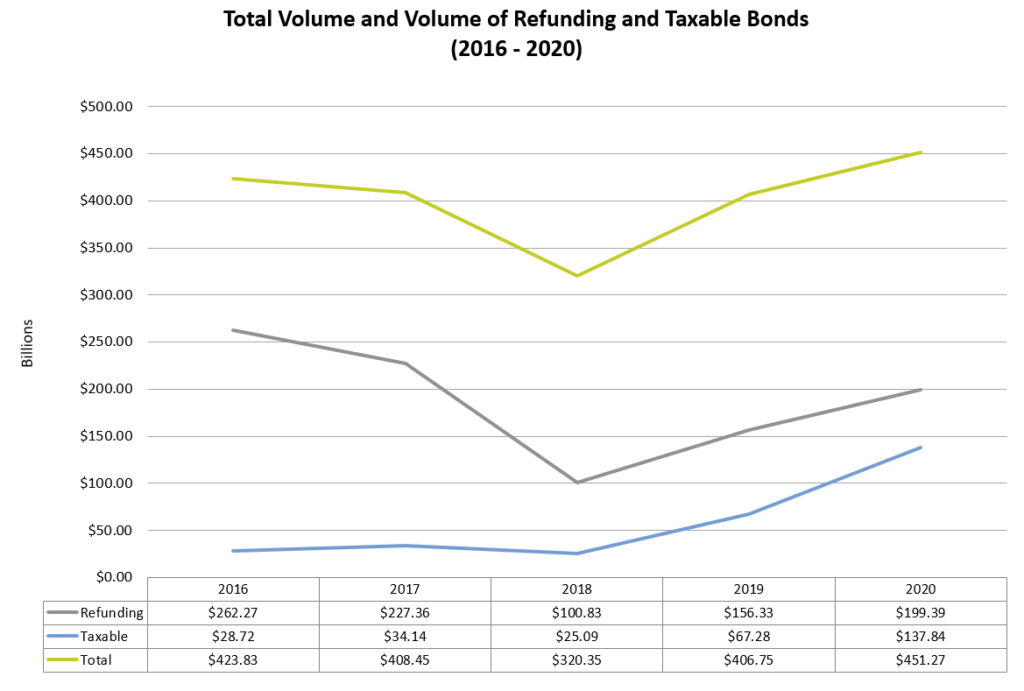

The primary impact on the municipal bond market was through the elimination of advance refundings, which represented nearly 27% of total market volume in 2016, according to Thomson Reuters. In addition, the reduction of the corporate income tax rate to 21% triggered an automatic adjustment to interest rates borne by non-profit borrowers on existing bank debt, increasing debt service as the benefit of the tax-exemption on the interest income was less valuable to bank lenders.

The graph below shows the aggregate volume of municipal bonds issued in the years 2016 through 2020, alongside bond issuance for refundings and bond issuance done on a taxable basis. In 2018, there was a significant reduction in primary market bond sales due to the glut of transactions that were brought in the end of 2017, as Congress threatened not only tax-exempt advance refundings (eventually eliminating them), but also tax-exempt private activity bonds (“PABs”), which were eventually saved. As the bond market rebounded in 2019 and 2020, and taxable rates remained at or near historic lows, the taxable bond market began to accommodate a greater volume of advance refunding debt, albeit for more highly rated borrowers. In the segments below, we discuss how we assisted clients in navigating the changing bond landscape after the Tax Cuts and Jobs Act.

Source: SIFMA, January 2021

Structured Right: How Financing Terms Changed

In 2018, we provided guidance on the projected alternatives for advance refundings and projections for changes to future bond issuances’ call provisions based upon the impact of the Tax Cuts and Jobs Act. Of those prognostications, the primary forms of alternatives utilized in the market have been (1) “Cinderella” bank-held bonds, (2) taxable fixed-rate advanced refundings, (3) forward refundings and (4) tender offers.

Advance Refunding Alternatives for Outstanding Bond Issues, In Practice

In this type of financing, the borrower enters into a financing advance refunding the outstanding tax-exempt bonds on a taxable basis, usually with a bank lender. Then the taxable refunding bonds automatically convert to tax-exempt refunding bonds at the earlier of:

- Midnight ninety days prior to the call date of the “refunded” bonds (hence the Cinderella reference); or

- The reversal of the advance refunding prohibition. This eliminates interest rate risk after the escrow period as pricing and terms for the tax- exempt refunding bonds are agreed at the time the taxable refunding bonds are executed.

Read more about this structure in our Marshes of Skidaway Island case study.

This type of financing utilizes tax-exempt fixed-rate bonds that are priced on a present-day basis, but not delivered and “closed” until ninety days prior to the call date of the refunded bonds. As supply in the bond market decreased starting in 2018, investors became more willing to make longer term forward commitments, albeit at a price of 4-5 basis points on average per month between the pricing and the closing date.

Read more about this structure in our Peconic Landing case study.

As interest rates returned to near historic lows in 2019 and 2020, the cost of taxable fixed rate bonds, especially investment-grade rated, decreased. In a number of circumstances, borrowers were able to utilize taxable municipal fixed-rate bonds to refinance tax-exempt municipal fixed rate bonds on an advance basis and still achieve material savings.

Read more about this structure in our Westminster Communities of Florida case study.

In this financing, a borrower engages HJ Sims to act as its Tender Agent and solicit existing bondholders to surrender their bonds for purchase. Bonds would be tendered at a price that is either:

- Similar to the price at which these bonds are trading; or

- Reflective of their “make-whole” value.

Read more about this structure in our Asbury Maryland Obligated Group case study.

Mitigating the Impact of Changed Corporate Tax Rate

A spate of amendments in early 2018 addressed the change to the corporate income tax rate. Tax-exempt bank debt bears interest at a rate multiplied by a percentage called the “Tax Factor.” The Tax Factor is essentially 1% minus the income tax rate of the particular bank lending institution. When corporate tax rates were in the thirtieth percentile, the Tax Factor was in the sixtieth percentile. When corporate tax rates decreased overnight to the twentieth percentile, the Tax Factor neared 80%. This had the unfortunate consequence of increasing interest expense after most entities had completed their budgeting process. Because the debt is tax-exempt, there are limited amendments that can be made without it triggering a “reissuance” of the debt. Reissuance becomes a challenge as it would require a new bond counsel opinion and may require a new Tax Equity and Fiscal Responsibility Act (“TEFRA”) hearing. It is a costly and time-consuming endeavor for all involved. HJ Sims worked closely alongside its clients and bond counsel in a number of circumstances to facilitate two types of amendments – first, ensuring that the language adjusting the Tax Factor was bilateral and second, reducing the impact of the increased Tax Factor.

In the first circumstance, we assisted clients in procuring amendments to their existing documents that would ensure that if the corporate tax rate were to be increased (as it may be under the Biden administration), the Tax Factor would see a corresponding decrease. Some bank documents only had the effect of increasing the Tax Factor in the event of a decrease in corporate tax rate and not a corresponding decrease in the Tax Factor in the event of an increase in the corporate tax rate.

In the second circumstance, we assisted some clients in negotiating with their lenders a reduction in the impact of the increase in the Tax Factor – whether by excluding from interest expense as part of the debt service coverage ratio that portion of additional interest that had not been included in the budget for that fiscal year to avoid any covenant defaults, or by amending the credit margin on the interest rate in an amount that would not trigger a reissuance, but would somewhat mitigate the increase in the Tax Factor. The latter amendments were not widely adopted by the bank lending community, but were able to be procured in some circumstances.

Financed Right: Staying Committed to our Can-do Approach

Without question, tax reform has changed the borrowing landscape for 501(c)(3) organizations. Through application of HJ Sims’ Financed Right® approach, HJ Sims demonstrates our ability to assist clients in navigating the ever-changing bond market landscape.

As we look toward the next two years of a Democratically-controlled Congress and White House, the question will remain whether tax-exempt advance refundings will be resurrected and to what extent the corporate tax rate may increase. In any event, we also expect to see the taxable primary market begin to dip its toes into the lower-rated and non-rated, high-quality bond issuances as investors search for yield and investment opportunities.

In the weeks and months ahead, HJ Sims will continue to monitor the agenda of Congress and the Biden administration and update the industry of new developments and trends as they unfold.