Curve Commentary: August 25, 2025

Overview

Jerome Powell delivered his highly anticipated keynote address at the Jackson Hole Economic Policy Symposium last Friday. Prior to the meeting, the bond market’s forecast of a 25 basis point cut at the Fed’s September 16-17 meeting had been diminishing, with Fed Funds Futures indicating the likelihood in the mid-70’s. Although Powell’s comments were largely cautious, the markets have interpreted his comments as a dovish shift with the probability of a rate cut now pricing in the low 80’s. Important takeaways from the speech include the conflicting position the Fed faces, amid mounting political pressures, with inflation pegged stubbornly above its 2% target and a languishing labor market. Perhaps more importantly, and generally ignored by the media, Powell outlined a new framework to guide future Fed decisions. The Fed’s revised framework is designed to evolve with changes in the structure of the economy and how the Fed interprets those changes. To accomplish this objective, the language in the existing framework was revised to shift focus away from the effective lower bound and remove some of the communications challenges the Fed has faced in the past with regard to the labor market.

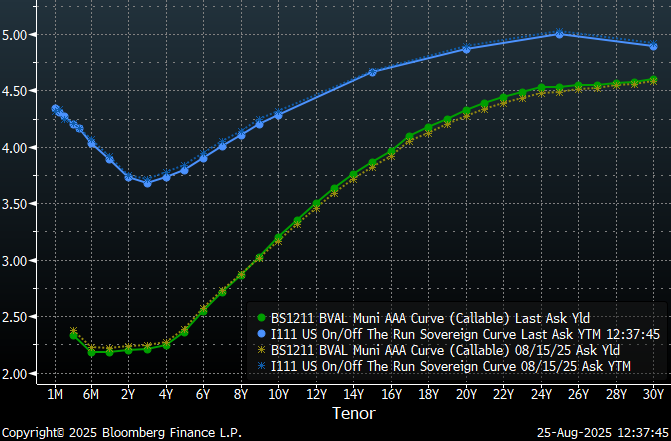

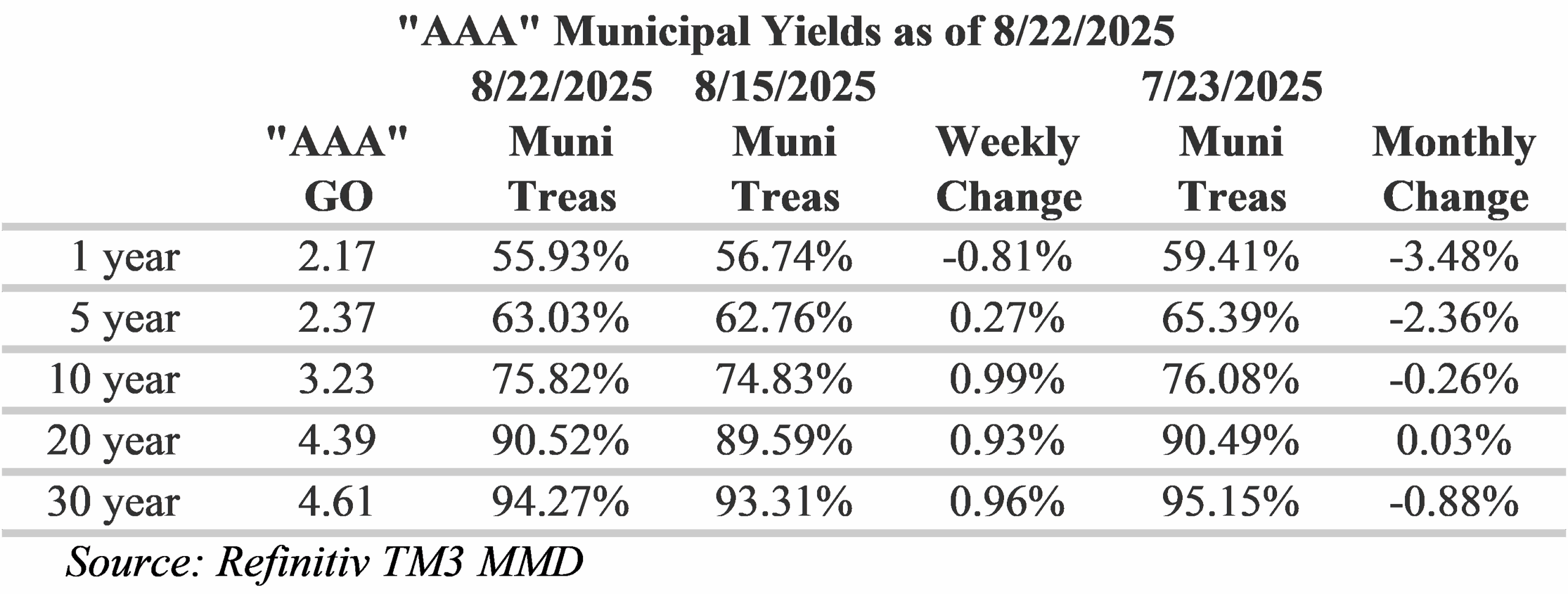

Although the anticipation leading up to the Jackson Hole speech was significant, Powell’s comments did not surprise the market and yields were largely unchanged. Over the past week, the muni yield curve has steepened a bit further with a rally on the short-end and the Treasury curve has rallied a bit in continued anticipation of a rate cut next month. However, yield adjustments on both curves were fairly modest, with the biggest moves between 15 and 20 years on the muni curve as the market sold-off around 6 bps in this range.

Insights and Strategy

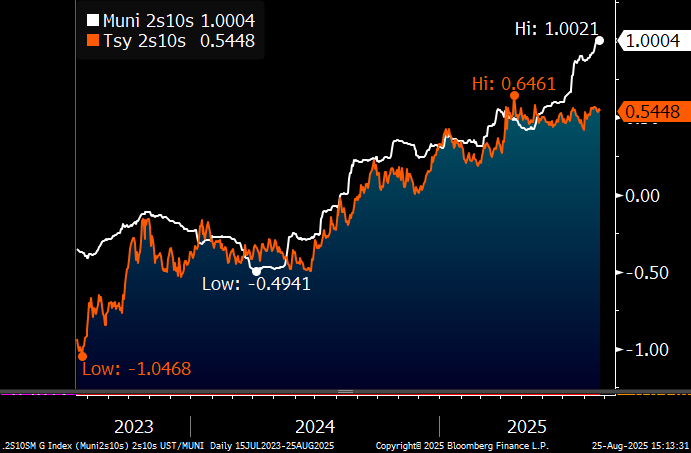

The steepening of the municipal yield curve has become particularly pronounced in the 5 to 10-year range with around 100bps of slope. This is a notable change from the beginning of the year when the muni curve had 24 bps of slope in this range. By comparison, the Treasury curve only has around 55 bps of slope in this range with munis having almost double the slope. From a strategy perspective, this is a good time to extend portfolio durations and take advantage of the additional yield offered by longer maturities. However, caution is warranted as the slope tapers-off significantly after 20-years to just a basis point or two per year. For investors with longer mandates, I would consider buying shorter in the 15 to 20-year range and wait until the long-end steepens to extend. Investors around the 20-year tenor are collecting roughly 95% of the 30-year curve, making this a very appealing place to position new purchases.

Although the markets have priced-in a September rate cut, the Fed remains concerned about tariff fueled inflation and sees its current policy stance as an appropriate guard against inflation. The yield differentials between municipals and Treasuries have cheapened a bit over this past week with Treasuries outperforming munis. One-year ratios were the exception, with muni yields a bit richer in anticipation of a Fed rate cut in September. Currently, levels are now solidly in the mid-50’s, which is a level that only narrowly appeals to individual investors in the top tax brackets. Ratios on the long-end remain relatively cheap with 20-year ratios over 90%.

This week is anticipated to be relatively light in terms of municipal issuance with around $7.4 billion in new issues on the calendar. The State of Illinois plans to sell a $1.78 billion general obligation bond and Bay Area Rapid Transit has a $929.8 million issue on the calendar. With $22.4 billion in scheduled maturities and redemptions over the next 30-days and $2.5 billion of municipal-bond fund inflows last week, this week’s new issues will likely face a strong inquiry. Recent inflows have favored long and high-yield strategies.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.