Overview

With the August 1 tariff deadline, a full economic calendar and an FOMC meeting, last week was bound to be a dynamic week. However, it was Friday’s nonfarm payroll report that proved most impactful. Total nonfarm payrolls disappointed with little change reported in July with an additional 73,000 jobs, well below Dow Jones’ expectation of 100,000. Furthermore, the unemployment rate ticked up to 4.2% alongside another decrease in the labor force participation rate. However, the revisions to May and June were more impactful, with totals revised sharply lower, by a combined 258,000 jobs from previously announced levels. Markets subsequently repriced the policy outlook for the Fed’s next rate cut with the futures market pricing in the probability of a September rate hike over 90%. The news was promptly absorbed by the municipal yield curve without prejudice of maturity, with a 7 bps bump per year from 2026 to 2055, resulting in a parallel drop lower in yields. The Treasury market also responded with yields dropping, largely in the policy sensitive 2-year note, which fell as much as 28 bps.

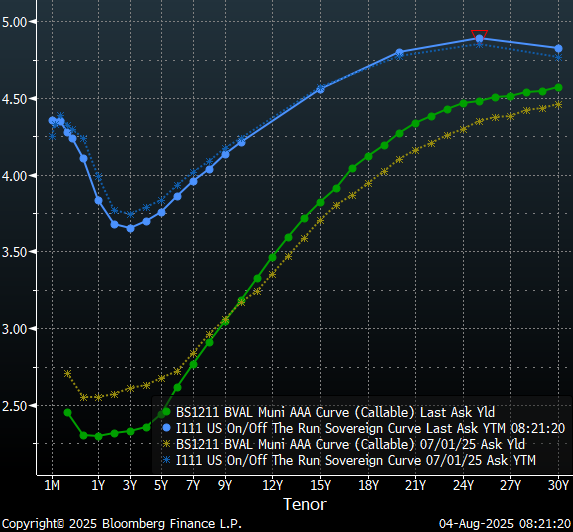

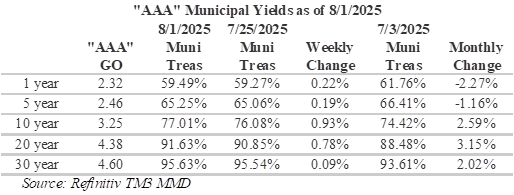

Throughout the month of July, both the Treasury and municipal yield curves experienced meaningful steepening. Munis steepened more than Treasuries, largely due to yields falling on the short-end of the curve rather than yields climbing on the long-end. For the Treasury curve, the steepening was less pronounced as 30-year yields climbed only 2.5 bps and yields around the 1-year mark dropped a significant 16bps. Currently, the municipal curve is at its steepest around the 10-year tenor with 51 bps of slope from 8 to 11-years. In addition, after this past week, the curve has steepened notably around the 5-year tenor with 33 basis points of slope from 4 to 7-years. Overall, the steepness of both curves provides significant incentive for duration extension.

Insights and Strategy

Over the past week, muni/Treasury ratios have generally cheapened, particularly around the 10-year tenor. Over the past month, ratios in the longer intermediate and on the long-end have cheapened with short to short intermediate ratios a bit richer. Over the past month, the biggest changes have occurred around the 20-year tenor, which has gone from being in the high 80’s to the low 90’s. Over the past week, the biggest changes have been around the 10-year tenor as ratios approach 80%. Overall, the 10-year and 20-year portions of the curve are strategically appealing with a combination of compelling ratios and yield curve slopes that reward extension. However, past this point the yield curve discourages extension by flattening to just a basis point or two per year. As a result, extending out to the 20-year maturity allows investors to capture over 95% of the 30-year municipal curve.

This week, the municipal bond calendar includes more than $17 billion in new issues, according to data compiled by Bloomberg. Large issues on the calendar include: the City of New York, NY, which plans to sell $1.78b of bonds, Brightline Florida Holdings LLC, which is scheduled to sell $985 million, and Beth Israel Lahey Health Obligated Group, which plans to offer $930 million. In addition, there are 34 school districts in Texas planning to sell bonds backed by the Texas Permanent School bond guarantee fund. This supply will likely be met with strong demand following last week’s addition of $937 million by municipal bond mutual funds, as reported by LSEG Lipper Global Fund Flows. In addition, municipal bond redemptions and maturities are expected to be $21.6 billion in the next 30-days.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.