Curve Commentary: May 27, 2025

Overview

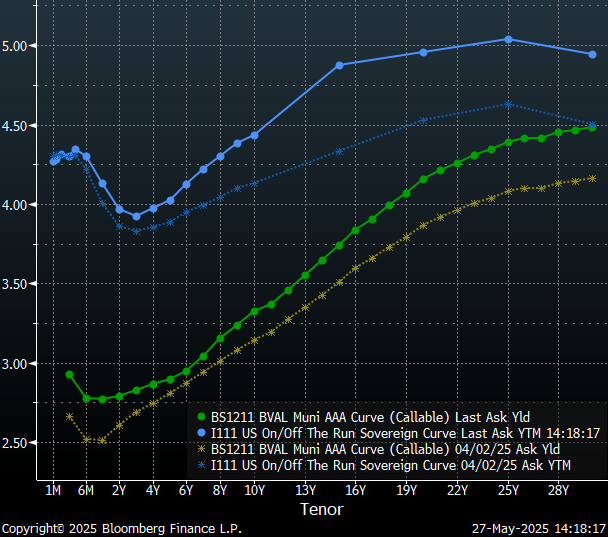

In the period following the announced tariffs on April 2nd, Municipal bonds have fared better than Treasury bonds, with 30-year Treasury bonds selling-off by 44 basis points while similar municipals sold-off by only 32 basis points. However, it is in the 15-year portion of the Treasury curve where investors are most unsettled as the Treasury bond market backed-up 54 basis points versus only 23 basis points in municipals. The result is flattening on the longer end of the Treasury curve with a slope of only 7 basis points from 15 to 30-years. Treasury bonds are responding to the long-term inflation outlook, national debt concerns and consumer anticipation of steeper price pressures with uncertainty leading to flattening on the long-end. The municipal curve has evolved to become more consistently sloped with longer duration municipals responding more to technical factors such as new issuance and fund flows.

Ratios and Strategy

Over the past week we have seen some steepening on the longer-end of the intermediate portion of the municipal curve with slopes increasing 34 basis points from 9 to 11 years. The 15 to 18 year tenor of the municipal curve also continues to offer investors reward for extension, with yields climbing 45 basis points from 2040 to 2043. This portion of the curve offers a combination of relatively steep slope and meaningful yield, allowing investors to lock-in over 93% of the yield on the 30-year municipal maturity and approximately 85% of equivalent Treasury yields.

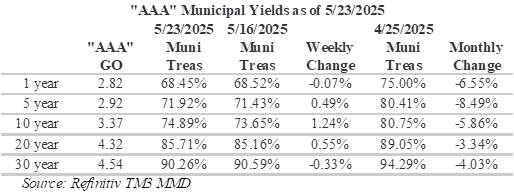

Although long-term ratios remain appealing, the yield differentials between municipals and Treasuries has tightened over the past month, with 5-year ratios declining from over 80% to just over 70%, as investors migrate to the shorter end of the curve amid rate volatility. Over the past week, ratios have tightened on both the extreme long-end and the short-end with widening in the middle with the largest moves around the 10-year mark. At the long-end, municipal bonds are still yielding over 90% of Treasury bonds, which is continues to be appealing to investors.

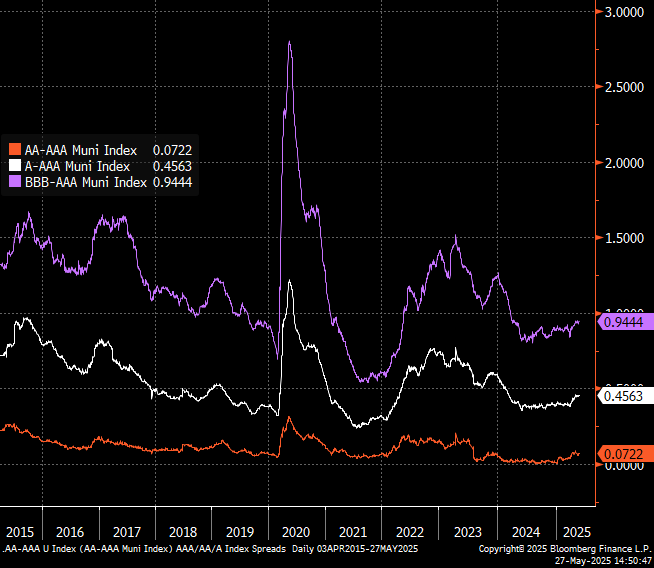

Municipal credit spreads remain relatively stable with modest widening as recession fears have been rekindled amidst day-to-day tariff and economic uncertainty and the downgrade of U.S. sovereign credit. Credit spreads measure the difference in basis points between credit ratings. This spread reflects the additional return investors demand for the credit risk associated with investing in lower rated bonds. Of the investment grade ratings, ‘BBB’ spreads have widened the most, post Liberation Day, by approximately 10 basis points while ‘A’ credit spreads have widened by 7 basis points and ‘AA’ credit spreads have widened by 3 basis points. Although credit spreads continue to reward risk, they are noticeably tighter than they were at the end of 2023, when ‘BBB’ credit spreads were 125 basis points versus their current 94 basis points.

Technical Factors

Last week LSEG Lipper Global Fund Flows reported municipal bond mutual funds saw $768 million of inflows following $769 million of inflows the prior week. The new issue calendar is a little lighter this week, due to the holiday, with an estimated $9.5 billion versus $15 billion last week. New Jersey Turnpike Authority has $1.75 billion in revenue bonds on the calendar and Omaha Public Power District is scheduled to sell $503 million in electric system revenue bonds. Year-to-date, municipal issuers have sold $210 billion, which is up 14.8% from last year at this time. However, there is speculation that issuance may slow this summer due decreased likelihood of the elimination of the tax-exemption on municipal bonds following the passage of the “Big Beautiful Bill” by the House Budget Committee last week.

Herbert J. Sims & Co. Inc. is a SEC registered broker-dealer, a member of FINRA, SIPC. The information contained herein has been prepared based upon publicly available sources believed to be reliable; however, HJ Sims does not warrant its completeness or accuracy and no independent verification has been made as to its accuracy or completeness. The information contained has been prepared and is distributed solely for informational purposes and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy, and is subject to change without notice. All investments include risks. Nothing in this message or report constitutes or should be construed to be accounting, tax, investment or legal advice.

2025 The National Charter Schools Conference (NCSC) by the National Alliance for Public Charter Schools

HJ Sims is proud to be attending and sponsoring at the 2025 The National Charter Schools Conference (NCSC) by the National Alliance for Public Charter Schools.

Attendees: Robert Nickell, Richard Harmon, Akshai Patel, John Solarczyk